Today the Pivothead rally in stocks—based on nothing but fantasies—gave way; and the Dow plunged almost as deep into the red zone as it spiked on the day this blow-off rally began (down 475 points on the Dow today). The S&P, which was inches away from joining the other two major indices in putting in a record high, fell back away today, too.

Red markets

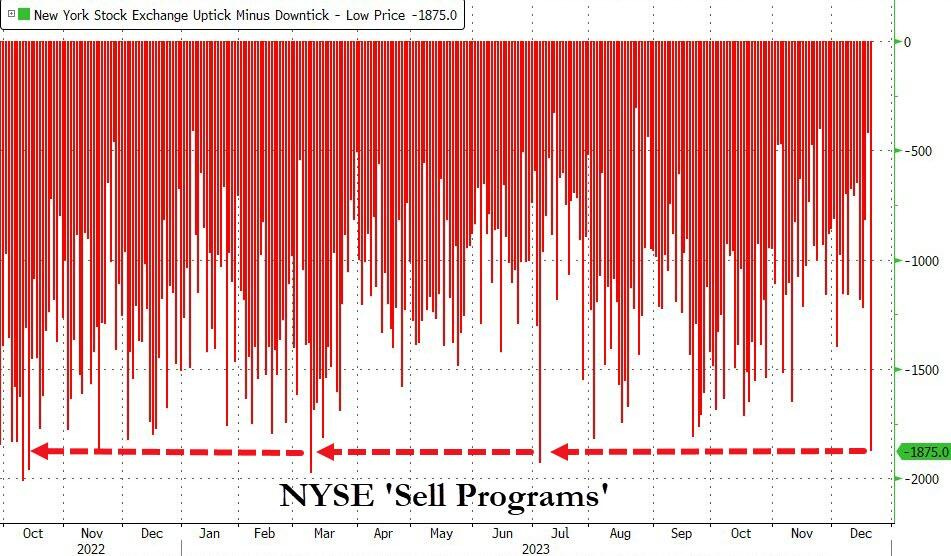

Today’s selling pressure was, as you can see, unusually deep in the red:

Zero Hedge

Zero Hedge

Zero Hedge, nevertheless, continued to falsely claim the Fed has pivoted. That is their effort to claim victory on a longtime failed prediction that a Fed pivot was imminent. By afternoon, though, even ZH was pressed to ask, “Did the Goldilocks narrative just die?”

The market’s flush emerged as the Fed, again, made another effort today to walk back the false hopes that Powell’s dovish tone conveyed to drug-addled investors. If anything should be red, it’s Powell’s face as his colleagues were pressed to let everyone know that nothing like a pivot has happened; monetary policy remains locked firmly in place where it was, and the Fed’s FOMC, which determines monetary policy, did not even talk about when to lower interest rates.

While stocks got the message, bonds did not—perhaps because the red blood of recession is also strongly in the air. So the bond market is pricing in six anticipated rate cuts for the year on the assumption that a recession will finally force the Fed to cut rates. It may when everyone wakes up to realize we are falling into recession, but it will be way too late for stocks because stocks hate recessions, and recessions hate stocks. The two display a glaring blood-shot rage when faced against each other.

All of these assurances that there are no rate cuts in sight, which the Fed has repeated many times now in the aftermath of Powell’s sugar plums full of empty calories, may be finally helping to turn down the insanity. Even so, some like Zero Hedge, who are overly zealous to claim their pivot fantasies have finally been vindicated, held strong to their rosy view until today when the market’s fever clearly began to break as the lineup of Fedheads sent out to rescue Powell appeared to bust through the stock market’s fantasy and get across the idea that rate hikes still remain far away, while fighting inflation continues to be job-one at the Fed. Dull-witted bonds, however, remain another issue.

This, you recall, is the path I’ve assured you the Fed will hold as its jobs mandate (based on how the Fed is understanding labor data) continues to give the Fed no leeway to do less on its inflation (stable currency) mandate.

Departing the Red Sea

A big part of the recent market mania over the past week came from Jerome Powell’s wistful words that supply shortages, which are half of the inflation equation, appear to be coming to an end. However, we got a flood of news this week, which I suggested was likely to emerge in my weekend “Deeper Dive,” that clearly revealed supply problems are far from behind us, and Powell was a dreamer to think they were…just like he was a dreamer to think they were soon vanishing in the early days when this inflation began. He apparently learned nothing from that red-faced mistake and, so, was quick and ready to make the same mistake again.

I pointed, over the weekend, to problems breaking out all around the Middle East, particularly as they expand around Red Sea shipping routes, claiming the situation there was likely to explode into a new source of serious supply shortages that would push up inflation, and explode is exactly what the situation did the next day and all through this week so far, going from bad to worse each day. I said yesterday I’d try to cover some of that news in today’s editorial, and so here goes. First let me recap the headlines:

-

Red Sea Blockage Means A New Round Of Surging Cost-Push Inflation

-

Oil Hold Gains as Red Sea Attacks Cause Panic Among Shippers

-

LNG Vessels Avoid Red Sea as Tension Rises, Boosting EU Gas Prices

-

Oil Markets Are Finally Paying Attention to Red Sea Risks

-

Pentagon announces new international mission to counter attacks on commercial vessels in Red Sea

-

New Red Sea task force won't stop shipping attacks, Houthis say

-

Shipping giant Maersk to begin southern Africa reroutings due to Red Sea turmoil

-

Shippers mask positions by turning off transponders amid Red Sea attacks

-

Here’s how the Houthi attacks in the Red Sea threaten the global supply chain

-

Major Shipping Firms Halt Red Sea Routes Following Houthi Attacks

-

BP, Evergreen, Euronav Halt Sailings Through Chaotic Red Sea As Insurers Demand 'War Risk Coverage'

-

Red Sea attacks force rerouting of vessels, disrupting supply chains

-

Norwegian Chemical Tanker Is The Latest Target of Red Sea Attacks

-

How the Israel-Hamas War Could Spike Oil Prices

-

Oil Prices Poised to Bounce Back in 2024

Not bad for two days, and today’s news offers more of the same in the headlines listed below for paying subscribers. It clearly became the dominant story in economic news, possibly doing more to push back on Powell than what all of his Fedheads were accomplishing to correct the market’s misinterpretation of his dulcet tones. I’ve decided to let those headlines speak for themselves by just italicizing key phrases as they tell a clear story: Powell was dead wrong on supply shortages! There is no reason to think they are over and plenty of reason to believe they are returning with a vengeance to drive inflation back up where I’ve said it will be going.

Red repos on the run

With the Red Sea doing to supply shortages exactly what I warned was coming after Powell optimistically told the world he thought shortages were nearly over, remember who it was that also told you another metric, which Powell should know better than anyone, may be ready soon to put banks in the red like the Repo Crisis of 2019 as Powell continues his QT, which continues to rapidly peel down the Fed’s Reverse Repo lending facility, where major stashes of bank cash were banked with the Fed when money was easy in order to use that cash as a buffer if QT got too tight for them. I pointed out in my “Deeper Dive” how the tightening in the reverse repo facility had picked up quickly and said none of us know at what point that tightening breaks out in the repo loan market where banks support each other with overnight loans but indicated it could be sooner than we think.

Well, here we are … or, at least, it looks very nearly so. The Financial Times reported today,

A brief jump in US overnight lending rates this month is a likely harbinger of strains in money markets next year as the US government sells more Treasuries to cover its deficits, analysts have warned.

(Note: you cannot read this FT article without a subscription to the FT, but I included it in the headlines below anyway because it is so important, and I could find no other article carrying the news. So, I’ll quote the salient parts here for you.)

The spike …

has raised fears over the potential for broader strains in the market lending rates for banks and customers, as cash becomes scarcer after years of excess liquidity…. Joseph Abate, interest rate strategist at Barclays [says] “My sense is that it probably becomes more generalised.”

Moreover the FT attributes the emerging problem to that same glut of new US Treasuries that I said would soon start causing serious problems:

Analysts put the temporary jump down to a glut of new Treasuries, which briefly outstripped the cash available in the market for lending.

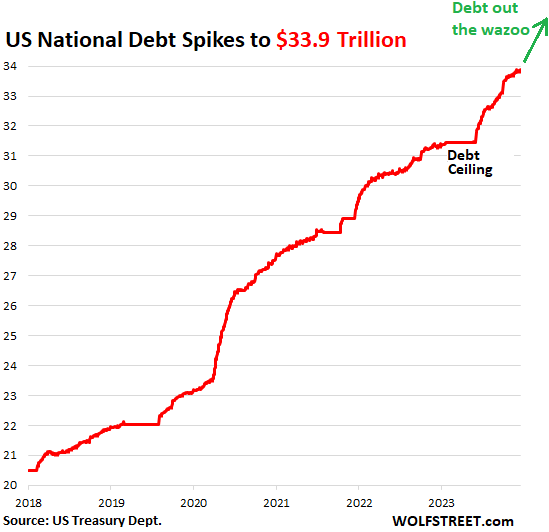

As you can see in this graph from Wolf Street (linked to in the headlines below for paid subscribers who cover the freight for everyone on this site), the US debt has grown at an astronomical pace since the debt ceiling was lifted (rising higher than the trend from before the debt ceiling, if you draw a line from the middle of 2020 through the start of the debt ceiling and extended it straight out to the present day).

US debt quickly skyrocketed through 32-trillion. 33-trillion took only another month, and I forecast (easily done) that 34-trillion wasn’t likely to take much more than another month, and now we’re almost ready to trip past that point. So, that new glut of Treasuries is going to keep coming through from the US government as the Fed continues to roll off its US Treasuries under its quantitative tightening plan—another major concern I’ve kept before you—putting a lot more stress on bank reserves.

The banks have offset this stress via the reverse repos they socked away, but those are diminishing rapidly now, as I reported a few days ago, pointing out then that we never know when those reverse repo loans made from banks to the Fed, as a way to park spare cash in Fed vaults and get interest, will completely disappear for some banks, even as they continue to be somewhat available for others that stashed more cash with the Fed for such times as these.

The repo incident reported today by the FT was a brief dislocation in what is supposed to be the most boring market in the world because repo loans between banks are how banks help each other, for minor interest, fund the clearing of checks/debits when one bank gets a lot more debits than it has cash on hand to cover at the moment. Without dragging money out of their reserves, banks take out these brief “overnight” loans with other banks to buffer their daily cashflow, using Treasuries as collateral. Reverse repos held with the Fed mean the banks can avoid those interbank loans and just get their own cash back from the Fed with interest, but when those dry up, the banks have to go to those repo loans.

The free-market rates on those loans surged and are not supposed to because a surge on such low-risk loans indicates other banks are also getting short on cash and are reluctant to make interbank overnight loans. That can become a panic between banks that freezes up the system quickly.

With one analyst saying his sense is that the problem will become more generalized (translate that metastasized in my way of putting it), this one little burst in interest for those normally boring loans, which has now gone away as quickly as it came, is seen as the mere flicker of a red light on the warning panel of a financial nuclear reactor.

The seizing up of overnight loans almost…well, overnight…is something we’ve seen happen in the past. For the banking world it is like suddenly finding there is insufficient coolant in the reactor, and the Fed has to rush in panic (that it pretends is not a panic) to supply rapid QE to stop the financial industry from melting down. In fall of 2019, we saw the Fed (back when it had no inflation to worry about) pump months worth of revolving overnight QE (which they called “not QE”) into the system to keep it from running dry until Covid gave them the excuse to go to all-out QE in the spring of 2020.

Of course, this recent flicker could just be a malfunctioning sensor for the red light:

What happened is important because it hints at what is likely to come and that is more upward funding pressure,” said Mark Cabana, head of US rates strategy at Bank of America. “Do I think that the Fed took notice? Yes. Do I think that they lost sleep? No. But I do think it probably helped advance attention on money markets.”

… or not a malfunction …

If rates are squeezed sharply higher or stay high for a prolonged period, it could send shockwaves through the financial system by raising borrowing costs and squeezing the profitability of leveraged trading positions.

I wouldn’t expect this to erupt into a full-blown repo crisis right away — well not until near the end of the month anyway when a massive number of banks and businesses and brokers all reconcile their books for the year in a flurry of transactions — but the red light is flickering right where I said to watch out for the next red light. It’s the first sign that the strains of the Fed’s QT may be about to go beyond what banks can take as the water gauge on those stashed Reverse Repo loans keeps going down. We know from experience the Fed will be last to see this coming because it is one of those areas the Fed is supposed to oversee with all of its expertise.

Nothing cures leverage like high repo rates. People funding trades are willing to accept it if they perceive it to be transitory so when you average it over, say, a month, it’s minimal,” added Abate. “It’s when the funding pressure persists that it becomes more of a deleveraging event and regulators have recollections of 2019.”

Ah, an “event.” Oh, how fun! We need more of those around Christmastime! Which fits nicely with my prediction that 2024 will be “the year of chaos”…in oh so many ways.