That didn’t take long! Another credit downgrade just hit the US Treasury after the stock market closed, so it will be interesting to see if today’s dimwitted investors get a jolt from that after the coming weekend passes. In today’s news headlines (following this editorial for paid subscribers), it was Moody’s that just took a bite out of the Yellen’s butt by marking the quality of her Treasuries down. Her Treasury Department responded with a yelp.

Since this year’s earlier credit downgrade by Fitch, I have been warning that another downgrade was likely coming soon, whether congressional brinksmanship along the national divide caused a failure to increase the credit limit or not and whether it caused a failure to pass government funding:

On September 28th, I warned as follows in “The Comics of Bidenomics: All Revisions Go Down ... All the Time!”:

Twice in past years, I have warned that their brinksmanship would almost certainly trigger a downgrade of US credit, even though I stated the US would never actually default on the its debt AND that members of congress know they will never let it default on the US debt even as they those use the good faith and credit of the US as a bargaining chip. Still, they play the game, threatening they will. In both cases, the US government got its credit downgraded. Another step down may easily be in store.

And in a “Deeper Dive” on October 22, titled, “The US Economy is Robust Like a Dying Elephant,” I noted:

US credit is slowly being downgraded. The US debt is spinning faster, starting to wobble a little and starting to squeal and smell faintly of burning metal. In a machine the size of US debt engine (can’t even think of a real machine to compare that to) that is a dangerous situation. I won’t say it is unstable yet, but it is becoming unstable, and you sure don’t want to get to where it is unstable.

And, finally, just there days ago on November 7, I issued yet another warning in “Now That's Getting Deep!”:

Only a few more trips around the clock and we’re going to be coming up to that government funding decision again. Congress is not likely to make headway on its stalemate, so that COULD trigger another credit downgrade now that this high interest is screaming in our face, making credit agencies already a little more cautious, which could increase interest rates all on its own if it happens.

Just more of what I refer to as giving you “the news before it happens.”

How Moody’s wrecked her mood

Moody’s cut its outlook for US credit to “negative,” which is just shy of downgrading the actual credit rating but implies a downgrade of the rating could easily be forthcoming; and the reasons it gave, of course, were those screaming deficits and screaming congressman who are stuck in a stalemate because Biden wants to spend more while Republicans always only want to spend more when it is their turn to be president or when they are running both houses of congress:

Moody’s Investors Service lowered its ratings outlook on the United States’ government to negative from stable.

We’re unstable, Folks. I guess you already knew that. Moody’s also questioned the nation’s “fiscal strength.” For now, at least, we are still AAA rated with Moody’s but with a poor outlook.

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,” the agency said. “Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

This should give strength to the current Republican argument against funding Bidenomics, but it probably won’t do much to relax Democrat determination to clench their grip on everything they already passed (which is really like holding a clench on a fart):

“Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” the ratings agency said.

I suspect they are right. So, we’ll probably get to see what stalemate and a government shutdown actually achieve very soon. That, in turn, may take the recent hot air out of the stock market’s and bond market’s sails, which was all folly based on fantasy anyway.

Moody’s, however, extended a note of optimism just to maintain its popularity among officials and financial types:

“Further positive growth surprises over the medium term could at least slow the deterioration in debt affordability.”

Good luck with that! They obviously they are not regular readers of The Daily Doom, or they would know that isn’t going to happen. There are far more negative surprises that have already been waiting their turn in the cue.

Yelpin’ Yellen’s Treasury Dept., of course, took exception to Moody’s buzzkill:

We disagree with the shift to a negative outlook…. The American economy remains strong, and Treasury securities are the world’s preeminent safe and liquid asset.

There we are with the “strong and resilient” mantra I’ve said they relentlessly trot out whenever the news is bad. (One can read the “resilient” part in the word “remains.”)

One more week until the government goes unfunded or some putrid stopgap that smells of old socks and bad cheese keeps things running a few days or a week or two longer, with congress tricking itself into believing the stopgap will avert further credit downgrades. Denial works like that. Such fumbling ineptitude would more likely cause another downgrade.

Newly elected House Speaker Mike Johnson (R-La.) has indicated that he will release a Republican government funding plan on Saturday, a move that would permit members time to read it before an expected Tuesday vote on the measure.

But his plan to fund certain parts of the government through Dec. 7, and other parts through Jan. 19, known as a laddered continuing resolution, or CR, is dead on arrival in the White House and in the Democratic-controlled Senate.

Of course it is. That is how the brinksmanship game is played: We’ll volley the hot potato over to your side and hope the music stops while it’s in your hand. And, of course, the other side will try to deflect the blame back as neither side actually gets things working. We saw that from the White House today:

“Moody’s decision to change the U.S. outlook is yet another consequence of Congressional Republican extremism and dysfunction,” White House press secretary Karine Jean-Pierre said in a statement.

They don’t think the trillion-dollar deficits they passed are part of the extremism?

Plenty more madness in the making

Now, Fitch, of course, has already cut the credit rating from AAA to AA+. Moody’s apparently wants to look like the good guy by not going quite that far. Don’t worry, S&P will soon step back into the game. Having been the first to downgrade US credit over a decade ago, they got slammed so hard they’ve been reluctant to stick their neck out again; but, with Moody’s jumping in with one foot, S&P will start to look cowardly if they don’t make a move soon.

As for the lunatic stock market, having no foresight in where all of this is headed but running on pure testosterone and greed, it bolted up nearly 400 points today. Its chance to respond to Moody’s will not come until Monday. That is when it can demonstrate how stupid it was today to believe everything was fine when everyone could see another credit downgrade was likely … if they aren’t thinking with their denial filter on.

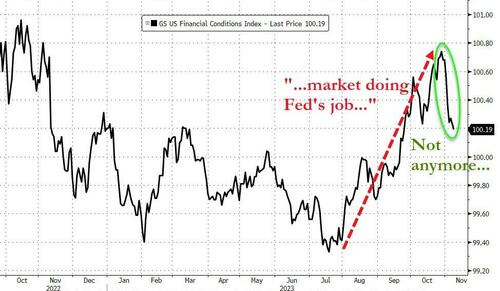

Other financial measures, however, are already not faring so well after Powell’s delightfully dovish speech regarding the FOMC meeting that failed to raise interest. (How could he not have seen that speech would cause him to lose some of the tightening “the market is doing for us.”)

As I noted yesterday, Yellen’s Treasury experienced a horrible auction on 30-year bonds, and stocks didn’t fare well yesterday either when Powell tried to tamp down his earlier excess dovishness in a speech on Thursday. As one trader said,

This is a shitshow, liquidity is disastrous and the auction is the canary in the coalmine... there's a crisis brewing under everyone's nose.

You see, Powell’s cooing after the FOMC did the following to the tightening of market conditions that had caused him to venture to say more interest hikes may not be necessary because market forces were taking over and doing the job for the Fed:

Now Moody’s has put its shoulder to the wheel to help him tighten conditions back up.

Interest rates on the 10YR didn’t have much time to respond to Moody’s blue move today, so we’ll see better later on what happens in Bond yields, too. The news only hit the mainstream press minutes before the bond market stopped ticking. Get ready for some fun ahead.

But, hey, at least banks are still busting!

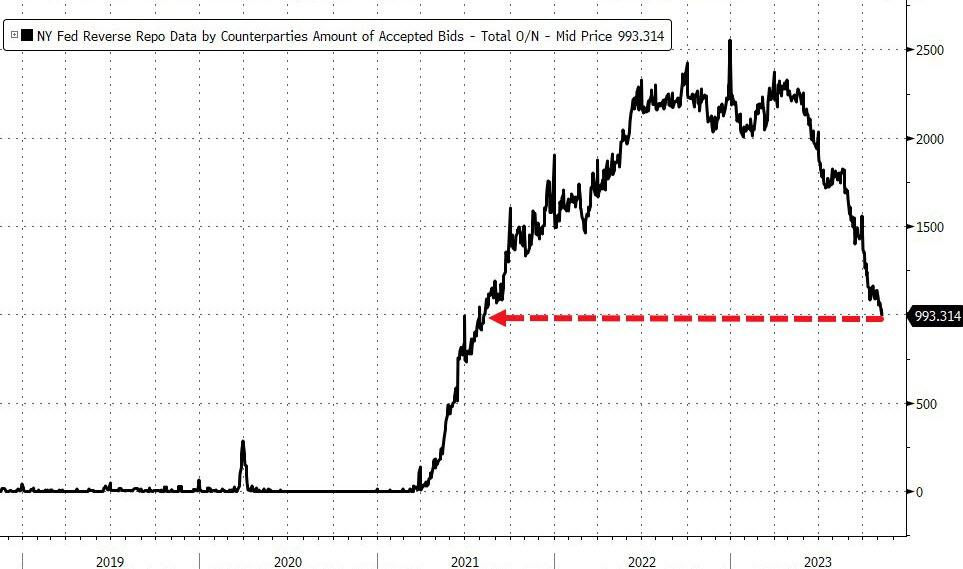

Meanwhile, bank usage of the Fed’s reverse repo facility is continuing to fall, which indicates banks are needing to get cash back into their reserves. The huge build in the reverse repo facility happened when banks got overloaded with cash in reserves during the Fed’s monetary pandemic express ride, so the banks parked their slopping excess funding with the Fed in exchange for Treasury bonds as collateral. Now they don’t want bonds as collateral because the primary dealer banks just got stuck holding a ton of brand new Treasury bonds they couldn’t immediately offload at that last 30YR Treasury auction.

In 2020, when people were asking why the Fed was creating more cash than banks could handle so that they had to get rid of the sloshy liquidity by draining it over to the Fed for holding, I said way back then that the Fed was likely clandestinely building a huge buffer for the days when it would tighten because banks could draw this money back from the Fed at will as reserves started tightening under QT.

That is what has been happening since the Spring Festival of Failures. Once the reverse repo facility hits bottom again, where it normally should be, the buffer will be gone. This has helped make QT less savage on banks, but we certainly saw in the spring that it was still ruthless for some.

As Zero Hedge said today,

The accelerating drain in reverse repo is the only thing keeping the wheels in the bond market from coming off.

So, when that buffer ends, look out.

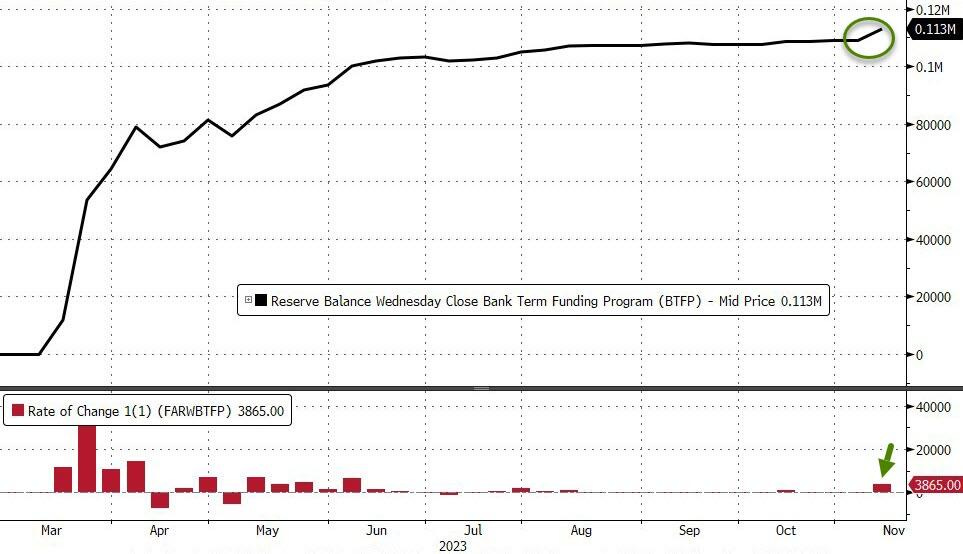

Particularly interesting to note, however, is what has just happened this month in the Federal Reserve’s emergency funding facility created to “bail out” banks during what I’ll call the “Spring Festival of Failures”:

Now that’s fun! Use of emergency programs starting to rise again. We haven’t seen a jump like this since some thought we had all of this behind us last spring. But, remember, Yammerin’ Yellen says banks are “strong and resilient” just like the economy is. She says it all the time, so it must be true. Of course, central banksters, even after they become treasurers, only say that when there is trouble that is causing concern.

Remember the fun we had when Treasurer Steven Munchkin said from his swimming pool floaty in the Caribbean back in December of ’18 that he’d called all the banks to make sure they weren’t running out of money, and everything was fine. Markets tanked overnight. Now who woulda thunk a piña-colada-lubricated announcement of “everything is fine; banks still have money” from the vacationing US Treasurer would have sparked a panic?

So, don’t worry, everything is fine!

What more can I say?