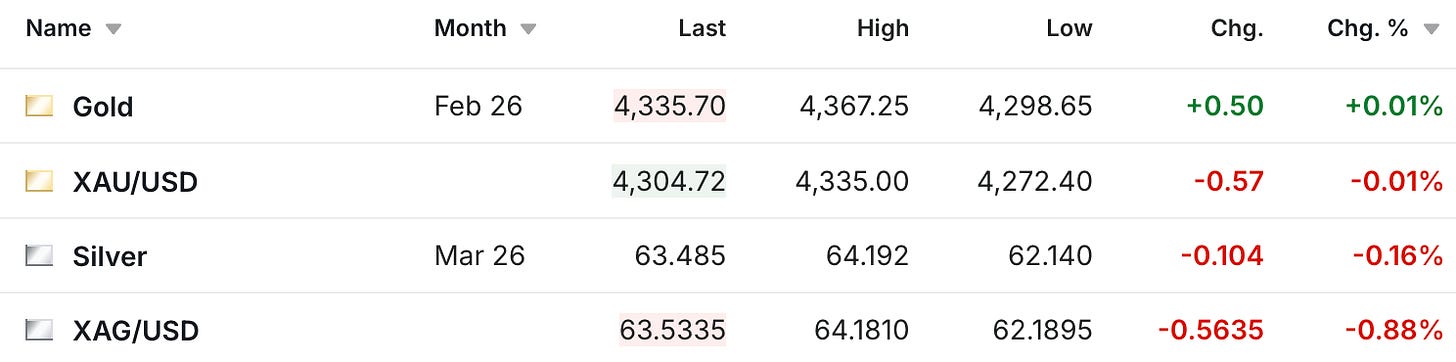

The precious metals are down slightly at midday this past Tuesday.

The gold price had a selloff recently, but rebounded higher as New York trading was starting.

We can also see a similar pattern in the silver chart.

Yet one of the latest indications that this rally could well just be getting started is that now even Warren Buffett is expressing concern about the dollar, and the other paper currencies.

Warren has been a long-time critic of gold (which I always found somewhat bizarre given how his father Howard Buffett was a staunch sound-money advocate), so it’s noteworthy that even he’s now saying the obvious out in public.

The author of the tweet mentioned that at least one of his initial responses is to buy Japanese yen, which to me seems almost as risky, but what do I know. I wouldn’t have necessarily expected him to come out and say he was loading up on gold, but you can be sure the gold dealers will be using this as another selling point soon enough.

But who knows...maybe he was even concerned by the recent liquidity issues in the bond market. While the December Fed meeting has come and gone, the evidence continues to suggest that things are not well in the plumbing of the system.

I mentioned yesterday how the Fed felt a need to respond to these liquidity concerns by purchasing $40 billion of treasury bills per month, and in Greg Crennan’s fantastic Coastal Journal he elaborated on that further.

Powell’s Unfiltered Confessions: The Plumbing Is Breaking

During the Q&A, Powell dropped the script and spoke from inside the Machine City.

He admitted the real reason the Fed was restarting T-bill purchases:

“The federal funds rate ticked up quicker than expected.”

That’s not a policy statement.

It’s a confession that QT broke the system’s calibration.

He continued:

“We are resuming reserve management purchases.”

This is Powell saying: liquidity must be injected or the plumbing fails.

Then:

“This seasonal buildup… will be front-loaded.”

Translation:

We don’t have months to fix this.

We have days.

Finally, the knockout blow:

“There’s a secular need to grow reserves $40 billion per month.”

This is the definition of life support.

A healthy system does not need permanent reserve creation.

What These Quotes Mean for Non-Experts

Reserves are the lifeblood of banks.

If Powell needs to grow reserves every month, it means the bloodstream is drying up.

This is no longer policy.

This is triage.

Obviously we’ve all been watching the debt load skyrocket for years and wondering when that becomes a problem in the bond market. And while perhaps it’s premature to say we’re on the verge of Armageddon just yet, these are the kinds of signs you would expect to see before something did happen. To be clear, sometimes the alarm bell goes off when there’s not actually a fire. But this is the bond market alarm bell going off, and we also don’t know yet that there isn’t a fire.

The Fed is also going to have to navigate this in an environment where the deficits continue to blow out even despite the additional tariff revenue, and while the US unemployment rate has been rising even according to the often generous government numbers.

This is also in addition to how layoff announcements topped 1.1 million this year, the most since the 2020 pandemic.

Given the above, perhaps it’s not all that surprising that even Warren Buffett is now concerned about the dollar. And given the number of investors who tend to follow his moves, it will be fascinating to see how he plans to respond to this dilemma.

It’s also worth noting that Buffett has already invested in silver twice, and when he described why in his 1998 Berkshire Hathaway shareholder meeting, the reasons he cited sound awfully familiar.

I suppose one of the top questions I find myself often thinking about is, now that both metals are at or near all-time highs, what do you do now? Does one still buy? Are we still just in the beginning stages of a broader rally, or has it run its course?

I’m not sure that there are ever easy answers to these questions, although when you look at the things that are happening, as well as some of the things that will have to happen going forward, it certainly lends credence to the argument that we could still be in the early innings.

Sincerely,

Chris Marcus