- The Case for Inflation

- No Worries?

- Necessary Conditions

- Fed Chair Jerome Powell: We Need More Stimulus and Inflation Is Not a Worry

- What’s in Your Investment Kitchen?

- Puerto Rico, New York?, and Maine

Among the many strange, unforeseen changes of the last year is a new respect for Keynesian economic theory. Practically everyone in power now agrees that deficit spending produces GDP growth. They differ only on its expected magnitude and duration. The few exceptions are mostly outside the halls of power.

This matters because deficit spending, already higher than ever, is set to grow even more when Congress passes President Biden’s pandemic relief package. I take it as given they will pass it, since Democrats have the necessary votes and look united on the major items. They may tweak some details to satisfy Manchin or Tester but the final amount will be somewhere close to the desired $1.9 trillion.

Coming on top of trillions already authorized in prior bills, a budget deficit that was already approaching $2 trillion before the pandemic, and the Federal Reserve stimulating in its own ways, people are asking whether this is too much. The answer depends on the coronavirus “Gripping Hand.” If the vaccines work well enough, and are administered widely enough, to stop the new variants and enable economic normalcy later this year, all that money might be excessive. Rising consumer demand combined with supply constraints could spark inflation.

If, however, the pandemic continues into summer, it will mean the Gripping Hand is still squeezing us. Employment won’t recover and more small businesses will fail. This relief package, as large as it is, may prove necessary and maybe even too small.

The experts I trust are split on this question, and of course no one really knows. But the debate is important philosophically. Nothing underscores this more than the comment from my personal economic bête noire, Modern Monetary Theory exponent Dr. Stephanie Kelton. Asked whether she was worried about the stimulus bill causing inflation, she said:

"Do I think the proposed $1.9 trillion puts us at risk of demand-pull inflation? No. But at least we are centering inflation risk and not talking about running out of money. The terms of the debate have shifted."

This is precisely what should concern us. No one except a few old classical economists is afraid of growing the debt. That argument is seemingly over, and its absence may be the real story here.

Today I’ll explore where all this may lead.

The concern we may overstimulate took off this month when former Treasury Secretary Larry Summers, a Democrat, pointed out that it will far exceed the “output gap” shown in the latest Congressional Budget Office economic projections.

What is an output gap? Gross Domestic Product measures (or at least tries to) economic growth. Economists also calculate “potential GDP,” which is how much the economy could grow, if every available worker and other resource were fully employed. Inflation tends to occur when actual GDP exceeds potential GDP because the economy is “running hot.” An output gap is when it goes the other way, with the economy operating well below its potential. That’s what we see in recessions.

Of course, all this involves numerous assumptions. GDP itself has problems, too, but it’s still a useful framework for analysis. Government and central bank policy should aim to keep the economy running roughly in line with its potential: not too hot, not too cold.

Larry Summers noted the Biden relief package will inject around $150 billion per month, while CBO says the monthly gap between actual and potential GDP is now around $50 billion, and will decline to $20 billion a month by year-end (because it assumes the COVID-19 virus and all its variants will be under control).

If correct, that would mean (at least to Summers and former Senator Phil Gramm, who wrote almost simultaneously a similar editorial for The Wall Street Journal) we are about to inject far more money than the economy can handle. It will have to emerge somewhere and may do so as price inflation. Here’s Summers:

[W]hile there are enormous uncertainties, there is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability. This will be manageable if monetary and fiscal policy can be rapidly adjusted to address the problem.

But given the commitments the Fed has made, administration officials’ dismissal of even the possibility of inflation, and the difficulties in mobilizing congressional support for tax increases or spending cuts, there is the risk of inflation expectations rising sharply. Stimulus measures of the magnitude contemplated are steps into the unknown. For credibility, they need to be accompanied by clear statements that the consequences will be monitored closely and, if necessary, there will be the capacity and will to adjust policy quickly.

Others share Summers’ concern and add more to the list. Former New York Fed President Bill Dudley wrote a Bloomberg column back in December titled Five Reasons to Worry About Faster US Inflation. I’ll summarize them for you:

- The way prices fell abruptly last April and May will change the year-over-year comparisons this spring, making annual inflation figures jump. (Note that if you go back two years to 2019 the inflation in the annual number magically disappears.)

- As normal spending returns later this year, the leisure and hospitality industry will regain pricing power. Sharp price increases may be needed to balance demand with diminished supply. (The industry dearly hopes so.)

- Companies won’t be able to meet increased demand by simply producing more. Many expansion projects and investments were suspended in the last year and some businesses have simply disappeared.

- The Fed recently revised its policy guidelines to allow higher inflation. The target is now 2% average inflation over some undefined period. Since it is presently below 2% and has been for years, they’re saying it can run above 2% for a significant time before they change policy. (And some Fed economists and academics think it can run significantly high, with 3% or even 4% not scaring them.)

- Shifts in both political control and fiscal thinking mean the government is now more likely to spend aggressively, and less likely to remove stimulus quickly.

Again, that was Dudley talking two months ago. All still true now. But this week he added Four More Reasons to Worry About US Inflation.

- Economic slumps brought on by pandemics tend to end faster than those caused by financial crises.

- Thanks to rescue packages and a strong stock market, household finances are in far better shape now than they were after the 2008 crisis.

- Companies have plenty of cash to spend, and access to more at low interest rates.

- Inflation expectations are rising, which can lead to actual inflation.

Dudley notes the Fed’s latest projections foresee no rate hikes through 2023. This suggests they won’t be quick to tighten if inflation appears, and might have to reverse course quickly if it starts getting out of hand (though I am not sure what “out of hand” actually means today). That, in turn, could set off market fireworks.

Again, all this is premised on emerging from the pandemic. I think Summers and Dudley will both agree inflation is the least of our worries if the pandemic is still raging next fall. We have reasons for optimism but this is hard to predict—which is why we have to consider all the risks.

Not everyone fears inflation. Dave Rosenberg’s economic forecasts have been right on target over the last year, and he sees little inflation threat. In one of his morning letters last week, Dave ran through the global vaccination rates and production bottlenecks. Noting the stock market has priced in July as the month when we put the pandemic behind us, he calls that expectation “fanciful.” But more to the point, he doesn’t think the stimulus package will stimulate much.

The stimulus checks are coming. The Fed is not going to be doing anything but buying assets and pressing the funds rate to the floor. Inflation is already being widely advertised and priced into bonds. And the fact that the markets shrug off bad data means that the incoming economic information will be treated positively if the numbers are good and dismissed as old news if they are bad. That is how the markets have been positioned since the election and even more so after the Georgia Senate run-offs. And so it is.

We have till July to see how all this plays out. The market is betting that the stimulus will lead to huge spending and not saving, that the economy reopens for good in July, and that the next source of optimism will come from the “infrastructure spend.”

From my lens: That $1.9 trillion will end up being more like $160–$180 billion once (i) debt paydown, (ii) bumped up savings, (iii) rent, utilities, health care bills and (iv) import leakage are accounted for.

The timeline for herd immunity and full reopening is November, not July, and even then, the absence of this for the entire world means international travel and tourism will remain impaired. The US economy has high domestic content, indeed, but tourism in particular is a huge contributor to the retail/leisure/hospitality industry. Ask any Broadway theater owner in Manhattan about that.

Later in the week, in reacting to weak inflation data from China, Dave said it again.

China’s YoY inflation rate swung back to -0.3% in January from +0.2% in December (consensus was 0.0% so a downside surprise); the non-food index also deflated at a -0.8% YoY pace from 0.0% (the PPI was +0.3%, which was in line with the consensus view—that’s all you get with this commodity boom?).

So the world’s strongest economy is deflating and everyone believes the US is on the verge of a new inflationary experience because of temporary, if large, “stimulus checks”—this isn’t actually real stimulus, it is charity, and less than 30% of it finds its way into the economy and all it does is ensure that rent payments, utilities and food bills get paid. The “New Deal,” this is not.

Dave is saying the idea that stimulus will exceed the output gap is wrong. His numbers suggest most of the $1.9 trillion will go into debt paydown, savings, or non-discretionary spending like rent. That would leave little for the kind of new spending (travel, entertainment, services, etc.) that would stretch capacity and spark inflation.

To use more technical terms, Dave is saying the “fiscal multiplier” of this spending will be pretty low. Lacy Hunt says the same. In a phone call Tuesday, he told me these sort of debt-financed stimulus programs provide only a short (a quarter or two), transitory GDP boost. He rattled off numerous examples from Japan, Europe, and here in the US. The 2018 tax cuts, for instance, pushed GDP above potential for a little while but by 2019 the effect had largely faded.

Worse, Lacy has found these programs actually have a negative multiplier once the effects play out over a few years. The new debt issued to pay for them weighs on growth, the velocity of money falls further, and the economy is worse than ever. Raising taxes wouldn’t help, either. Both taxes and government debt divert money out of the private sector.

Let’s pull all these pieces together. For inflation to be a near-term threat, several things would have to happen this year:

- Vaccines and other measures bring the pandemic under control this summer in the US and other developed countries.

- Consumers respond by using their government benefits, savings, and/or borrowing to quickly increase spending on discretionary goods and services.

- This spending is sufficiently large to exceed post-pandemic production capacity, sparking price increases.

- The Federal Reserve lets the economy “run hot” and maintains its low rates and asset purchases.

- Congress and the Biden administration leave the fiscal spigots open by not raising taxes or cutting spending.

All these are possible. Are they likely? One certainly is: I think the Fed will stay loose in almost any possible scenario, just as it did long after the last recession ended. The FOMC members don’t have the stomachs for another taper tantrum, much less the explosive reaction aggressive tightening would produce.

But the others are much harder to predict. The more we learn about the B117 and other variants, the more likely another viral surge looks. But it may be more manageable if we’ve vaccinated enough older and vulnerable people, and if the vaccines are as effective against variants. As I’ve said for the last four weeks, it is a true race. The US is now administering over 1.5 million vaccinations a day and the number is growing. By the time many of you will be reading this letter, they should have reached slightly over 15% of the population, and a much higher percentage of the vulnerable population.

If we faced only the original virus, we could actually begin to relax. Those cases are clearly dropping. But US government officials, looking at the same B117 growth rate that I am, and also the South African and Brazilian variants, are reportedly considering internal US travel restrictions to slow potential outbreaks. I applaud them for not being complacent. But if any travel restrictions are enacted, you can stick a fork in inflation. Any worries about it will be over.

It’s also hard to project how much consumer spending patterns will change, and how quickly. Even if the pandemic fear fades, people can only take so many vacations and get so many haircuts. This “pent-up demand” we hear about doesn’t apply to services the same way it does to goods, and services have suffered the most.

People are being cautious. Prior stimulus checks helped pay down debt and add to savings. Another wave of the virus will make everyone even slower to spend. That wouldn’t be inflationary.

It also matters, for both goods and services, how post-pandemic demand matches post-pandemic supply. Businesses may or may not be ready to deliver exactly what consumers want to buy. Further, when 150,000+ small businesses have closed, there may be a lot of missing supply. We should expect shortages of some things and surpluses of others. How all that will sort out, and its effect on prices and therefore inflation, is unclear.

It won’t help if the Democrats raise corporate or high-earner taxes, as Biden promised, but I’m not sure their slim majorities can do it, even if they blow up the filibuster. The size of the fiscal relief package is certainly an issue, as well as how it works. Different components will have different effects.

Fed Chair Jerome Powell: We Need More Stimulus and Inflation Is Not a Worry

The heading says it all, which is a six-inch summary of a long speech and question-and-answer session this week in New York. My friend David Bahnsen summarized it this way:

I… want to share more about Chairman Powell’s speech to the Economic Club of New York after I got to dive into it deeper last night. It is impossible to interpret really any part of the speech as anything other than hyper-dovish. All “talking up” was about the need to improve labor market conditions, and all “talking down” was concerns about inflation.

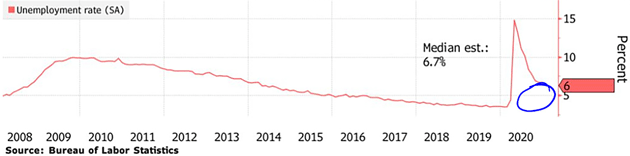

…Ultimately, what the Fed has to do is message a concern about the gap between current unemployment and pre-pandemic unemployment, as observers and actors note the significant reduction in the unemployment rolls since the pandemic began. It is this gap the Fed is talking about (circled in blue below), and rather than talk about “finishing this gap off” (getting down from 6.7% to 4%, for example), the Fed is actually talking about how even the drop from 14% to below 7% is not as good as it looks, because of the 2% decline in the labor participation force.

Source: David Bahnsen

I agree with Jerome Powell that the unemployment rate is clearly understated. I know many readers have a problem with the Labor Department’s business birth/death estimates. Of course it is aspirational. You can’t know the real number for at least a year, so they make the best estimate they can. However, the “past performance” data the estimates are based on is clearly broken when 150,000 (if not more) businesses close in less than a year. Using that estimate forces the unemployment rate artificially lower. Their models no longer apply to the world we live in.

My friend Philippa Dunne in the latest TLR describes an alternative survey by researchers working with the Dallas Fed. It pegs the January unemployment rate at 11.4%, vs. the 6.3% official number. I’ll bet you a dollar to 40 doughnuts Powell is looking at that model or something like it.

Add all this together and inflation is a risk, but I don’t see it as a major one. An output gap combined with above-10% unemployment is not the stuff inflation is made of. Yes, the latest spending plan could temporarily raise the relatively benign inflation we see today, but it will be transitory.

And if inflation does jump? It would mean we’re done with the virus. That might not be such a bad trade-off.

What’s in Your Investment Kitchen?

In a world of high valuations, zero-bound Treasury rates, and junk bonds yielding 4.1%, what does an investor do? You look for new portfolio ingredients. At CMG and our partners, we now have scores of offerings designed to help you meet your personal goals. Cash flow/income strategies in the mid-to-high single digits, absolute return strategies uncorrelated with market fluctuations, highly targeted dividend strategies and exciting growth opportunities from my network of relationships. We have begun to refer to all of the above as the Mauldin Kitchen. To show you what’s in our kitchen, whether you need an appetizer (a single idea) or a full portfolio meal, I have prepared a short special report called “What’s in Your Investment Kitchen?” Simply click on the link to get your copy. I would be very surprised if some of the ideas in my kitchen don’t tempt your investment palate. And I’ll be making a few calls myself to get a feel for what it is that you are really thinking about, what’s important to you, and what you need. So don’t be surprised if you get a call from me.

Puerto Rico, New York?, and Maine

We’ve had a lot of rain here in Puerto Rico. Everything is green. My mainland friends talk of snow and ice. I don’t miss that.

I still have not gotten my vaccination, although hopefully next week. A month or so after the second shot, I really would like to get to New York for business reasons, and of course to meet with friends. I just don’t know when that will be.

Then I have (perhaps optimistically) made a reservation for my son Trey and I to go to Maine in August for our (until last year) annual fishing trip. I hope not to postpone it again. I really do miss the friends and comradery.

I really look forward to talking with a few of you. I will learn something and it will be a lot of fun. With that, let me wish you a great week and hit the send button. Stay safe!

Your running as fast as I can analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.