Today, I read an exasperating article on Zero Hedge. You can find it here in order to know what I’m carrying on about below:

I’m not saying that there is no chance of a big rally that becomes the defining characteristic of what happened to stocks on the way to the market in October, in spite of my own claims that said I believe we’re going to see some horrendous months for stocks this fall. As a matter of fact, things could not be looking worse so far for my “anticipation” that we’d likely see a “horrendous” October surprise to start the plunge. I could be all wrong; and, given how close we are to the end of October, that appears likely. So, this isn’t about that. It’s about some of the bases given in the article for believing in a smokin’ hot rally, which certainly came from someone smoking something hot.

It is really about the thinking exhibited throughout media analysis all year long, with just this article form ZH as a demonstrable case in point.

I begin with Uber Bullheaded Psycho Reason #1:

On top of everything we have also not really had that insane bear market rally yet in 2022

Seriously??? This to me shows how extreme bulls will be in stretching like Rubber Man to reach for a reason to rally.

The summer rally was as extreme as bear rallies typically get. So, this is pure narrative-seeking. In fact, nearly everyone was talking about how extreme the summer rally was and using its apparently indomitable strength to claim, “This is it; the bull has returned; we’re going on to new highs.” And then it broke right where most massive bear rallies break — at or near the 61.8% fibonacci retracement level — right where you would expect it to. At least, right where I said I expected a true big bear rally to break.

I described that bounce of the normal bear ceiling here. That was when the market began its latest plunge right when and where I concluded about ten days later it had, in deed, put in its high bear-market rally turn. I was able to call it as route back to a new low along the bear’s trail because it looked EXACTLY like the kind of scorching bear-market rally one would expect, even at that exactly that many days into the bear market, with the turning point right at the ideal peak.

I’ve heard it many times this summer, so I get TIRED of hearing these endless bullheads state, “But we have’t had the big melt-up rally yet.”

The melt-up this summer was, in fact, ONE OF THE STEEPEST BEAR RALLIES ever seen and went as fully high up as one ever expects a bear-market rally to climb. So, it was no surprise here that the market fell from that point to a new bear-market low and then a lower low.

Plus bear rallies are not melt-ups in the sense of the ones that come before the very top of a bull market where we make the downturn into a bear market. This one began, as all “bear rallies” do, well INTO the bear market. So, there is no basis for what is typically called a melt-up at all. The bear was FULLY established after a much earlier melt-up top.

The summertime rally was a BIG bear rally, and is all you can expect to get. That doesn’t mean another can’t happen, or that it isn’t happening now; but it is beyond absurd to claim one hasn’t already happened, so one is owed to you. You don’t get “melt-ups” in the traditional market-topping sense in the middle of an already long bear market. So, to suggest we need another melt-up before the bear goes down further is beyond Rubber-Man stretchy to say the least.

This is just PERMABULLoney, trying to game a new narrative to try to inflate a new rally out of nothing but the bull’s testosterone and endless hot air!

Uber Bullheaded Psycho Reason #2

Last time equities defied rates like this was, contrary to conventional wisdom, actually a very good time to buy equities.

No, actually, it was not. In fact, that is such a gross misrepresentation that it looks for all the world like an outright lie. I don’t know how you can even make that as a mistake. At which of all of the Fed’s rate increases would it have been a smart time to buy equities:

Well, it would have been when the first micro rate increase happened in March, if you waited about a week and then leaped back out in another week. The market bolted upward shortly after the incremental rate increase. It sure wasn’t in April and May, however, when the market continued to fall steeply for almost two months after April’s increase and more than half a month after May’s. June’s increase would have been a terrible time to jump in. It came about a week after the market had already climbed, and just a week later, the market plunged! It would have been smart in July when the aforementioned big bear rally began, but risky in August, where the increased happened shortly before the peak of that rally. All you got after August 1 was a bump followed by a long and rough decline that wasn’t much different than the kind of waterfall I was talking about for October. So, unless you’re talking only some lightning-quick day trading, defying rate hikes has proven to be a lousy strategy so far.

After such a major plunge following both of the last two rate hikes, maybe the October rate inccrease was time for another relief rally, which would be in spite of my general anticipation of an October surprise. I may likely, as it appears, prove wrong about that, but the rationale here that claims rate hikes make for good rally points is demonstrably absurd.

All in all, ignoring rate increases, which is FIGHTING THE FED, is not a good idea. That is why I want to focus on these ideas examples of peak stupidity even by the bull’s own standard logic. Stock analysts and bullhead investors long repeated a mantra “don’t fight the Fed” as their endless excuse for the market to go up; but now that the Fed is constantly tightening harder and harder, these same bullheaded people want to claim fighting the Fed is the smart action. If they had integrity in their thinking processes (I’m not necessarily talking about in their character), they would still be saying, “Don’t fight the Fed. It has told you it is tightening repeatedly and has repeatedly told you it does not intend to stop until inflation is seriously down towards its 2% target and has told you it WANTS to drive the stock market down and has even said it doesn’t see the fall of the stock market as financial breakage; plus it has consistently proven it is willing to take it down further!” That is a LOT of reason to not fight the Fed besides knowing the Fed has a legal mandate to fight inflation so long as it believes, as it claims it does, that the job market is strong.

If there were any integrity to their thinking, all of these bulls would be warning, “Unless you are an extremely agile day trader, do not challenge this market. Don’t try to stop a downhill train. Get out of its way.”

So, I call bull-something on this reason to think the market should rise. Doesn’t mean it won’t rise because the whole market is bullheaded, but it is an absurd reason to bet on a rise based on past market performance around continued rate increases.

OK, but they go on to talk about rate increases in treasury yields. I.e., is it smart for the market to be ignoring what the bond market is saying? (But the bond market is tracking with what the Fed is doing in its rate increases.)

Fighting what the bond market is telling you, as it turns out, is even dumber than ignoring the Fed:

You have to be a slower than a dead mule to think that betting against movements in bonds is any kind of good idea.

In March, when bonds started going seriously upward because the Fed was done with QE and made its first micro rate increase, stocks did take off defiantly (as they have in betting against the Fed several times) but only for half a month, and then they fell precipitously as the bonds held their path (as stocks are supposed to do when yields are rising). The wisdom of the bond market prevailed as the true trend. It is not surprising that stocks bolted up at first in their new “Defy the Fed” mentality, but bonds took the wiser more steady path, and the investors who jumped into stocks dove into an icy pond as clearly the “wisdom” of the bond market prevailed until stocks capitulated to the move in bond yields and wound up quite a bit lower, especially by the time bond yields hit a clear peak in June.

Then bond yields fell, and stocks rose … quite a lot (as they are supposed to do when bond yields are falling (bond prices rising). However, shortly after bond yields returned to rising quickly at the start of August, stocks capitulated again and fell off a cliff at the mid-August peak of that big summer bear rally (which, as you see, started clear back in mid-June when the drop in bond yields started). So, again, the greater wisdom of the bond market prevailed.

Bond yields dropped a little at the start of October, and stocks spiked up a little in response (as would be expected). As bond yields rose again, stocks fell right back off (as would be expected); but now bonds are continuing to rise, and stocks are rising right along with them, which is totally wrong; however, the writer of the article is making the case that, based on recent history, it makes sense. Clearly it does not make any sense for stocks to start rising when bond yields are still rising and rising a lot; but that is what they have done.

Will this be one of the rare times when bonds actually capitulate to stocks? Well, even if it proves to be, you cannot argue based on history that a rise in bond yields is a good time to invest in stocks. It will be an anomaly if it proves to be so. You can see that similar moves in stocks happened at the start of October and immediately failed and also did so back at start of September. Each of those times, bonds continued their almost relentless trek, and stocks got hammered back down.

This rally has gone on a little higher since the end of that graph, and bonds have put in a minor downturn, so maybe this will be the exception to the rule; but a brief reversion like that in bonds happened at the start of October, too … immediately before the next dip in the S&P to a new lower low.

Uber Bullheaded Psycho Reason #3

JPM says so.

No recession. JPM expects US growth to remain positive over 2023 – “we do not forecast a recession..” Imagine if this becomes consensus.

Oh my gosh. Just put me out of my misery. Not only is the author recommending we follow JPM, but we’re staying with the “no recession” lies that have deluged the year in nonsense.

US growth is expected by the Dimoniac of JPMorgan Chase to “remain” as “positive” as it has been in its last two quarters of falling GDP and to do so throughout 2023.

Just crush my head under the weight of surrounding ignorance!

Even if the US government, which churns out the official GDP reports, manages to arm-twist and strangle-hold the third quarter into run a positive report for the final run into elections, as the Atlanta Fed has started predicting will be reported this week, how do you get “remain positive” out of the only two known quarters that were solidly negative, even after their revisions? Talk about people endlessly selling the big lie in order to make it a fact!

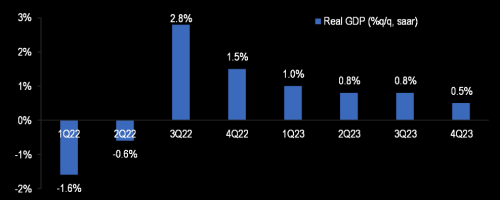

Here is JPM’s claim of where real GDP has been and is going:

JPM’s third-quarter, stand-out figure is based purely on the Atlanta Fed’s estimate, from which JPM predicts a 1.3-point decline in the rate of growth afterward with further declines after that. So, the hope of no recession — “remain positive over 2023” — is based entirely on the Atlanta Fed proving right this quarter and not distorting the numbers (which will make following quarters look worse if they do that).

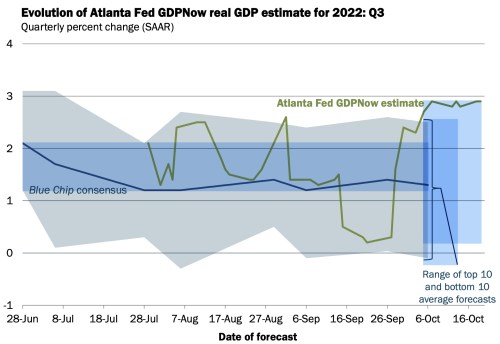

As I’ve shown before, look at how their estimate for this quarter has bounced all over the place (green line) and how it is well above consensus estimates of economists, which ran well above the Atlanta Fed’s estimates (and wrongly so) all year until now as we close in on elections:

The Fed notes the following about the typical margin of error in its forecast:

Since we started tracking GDP growth with versions of this model in 2011, the average absolute error of final GDPNow forecasts is 0.83 percentage points. The root-mean-squared error of the forecasts is 1.23 percentage points.

So, JPMs optimism is barely within the margin of error. Maybe they’ll be right for where we’re going, but I highly doubt it for all the reasons I’ve been laying out for months about the problems we are embedded in and those lurking much closer than our horizon. The margins of error given are, of course, means and averages. The GDPNow forecast has sometimes been almost as much as 2-3 points too optimistic. So JPMorgan betting the farm on a long time of positive GDP based on the Atlanta Fed’s prediction, instead of on all the terrible economic events surrounding us and what we know already of past GDP, is hyper-optimism at best, especially from the guy who predicted an economic/financial hurricane was about to assail us earlier this year. I guess all it takes is the Atlanta GDPNow forecast to turn his head from hurricanes to sunny skies for the year to come.

The Fed’s tendency is almost always to err’ on the positive side, and these average misses are based on The Atlanta Fed’s final projection a day or so before the actual report, but their tendency has been to revise down hard in the days just before the actual report and still miss by that much. If they follow that tendancy tomorrow to the extent they did in each of the previous two quarters, even their overoptimistic final projection will be close to zero.

So, this prophet of profits can bank his investing on that overoptimistic estimate if he wants and JPM’s diminishing improvements from there on out if he wants; but, seriously, JPM? The outfit that flies from hurricanes into euphoria? I think they’re selling their book.

Uber Bullheaded Psycho Reason #4

This statement to me is the worst of all them, but it follows the total brain disconnect all year created by the Fed and followers of the Fed, as the Fed has spread its outstanding lie or gross misunderstanding (whichever way you want to take it) that the economy with falling GDP all year so far is strong because the labor market has been strong all year.

It is essentially what we just saw from JPM, but it is based more on performance of markets in past quarters. Here it is:

Q3 could very well be another ‘OK’ quarter

Stock analysts are pushing the outside of the envelop on peak stupidity. This is just a vacuous parroting of the garbage spewed out by the Fed, which should already be as dead as the Fed’s claim that inflation was transitory. However, just as back then no one in the mainstream media figured out the Fed was wrong until the Fed coughed out that it was, so now no one can get their head past the Fed. They just regurgitate whatever they’re Fed.

Another OK quarter? Two quarters of declining GDP already in the books are “OK quarters?” Two quarters that, back in the days when there were still human beings with brains, would have been called “a recession” are “OK quarters?” Three quarters for certain of FALLING, CRASHING, SMASHING STOCKS AND BASHING BONDS are “OK quarters?”

This is truly BEYOND ULTIMATE DUMB!

Do they think the quarters were OK because stock investors lost a bundle each of the last three quarters? Is that the new goal for investors? Were all three quarters this year OK because bond funds crashed the whole time, entering a stage in the UK where they were in danger of ultimate peril of total collapse and, apparently, not far from that stage in much of the rest of the world, US included, now that Gramma Yellen has signaled her willingness to invent an entire new course of Treasury “intervention” if necessary to save the illiquid Treasury market? Were they OK because gold only fell about 10% at the worst point during that time? Were they OK because corporate earnings declined throughout that time, even though they came out above their drastically lowered expectations each quarter? Or were they “OK” because the value of your money decline about 5% over those two quarters in the US and more everywhere else?

Which part of OK were they?

I don’t even know expletives worthy of this kind of brain-stem rot. It was that statement that made me say to myself in exasperation, “OK, now I’ve had enough. I have to write a mean article about this peak of peak stupidity, for clearly we’ve found a new summit. I have to rant!”

Is this idea that the past quarters were “OK” just coming from the Fedhead/braindead idea that “the economy is strong because the labor market is strong?” That’s a fallacy I completely dispelled in my earlier articles that all other financial writers ought to be able to figure their way through on their own by now. I mean we’ve only had, at least, six months of falling GDP, if not nine, to cue them in! But now they also have the Brookings Institute report that has spelled out why the labor market is tight and shown it has NOTHING to do with a strong economy and everything to do with literal sickness and wasting away:

I was saying all year that clearly the labor market was broken and was not a sign of a strong economy even before I found those two Brookings Institute articles that explained why it was broken. Apparently no one in financial markets knows how to THINK for themselves. Or they are just disingenuously selling their book as JPM appears to be doing.

So, merrily this one also chirps what I have come to expect as another reason to rally:

4.4% earnings beat and 0.9% revenue beat for the S&P thus far.

“Yay! We got robbed blind, but it turns out the robbers forgot to take our wrist watch! Things are OK.”

“Yay, we beat some of the most steeply downgraded earnings expectations in history … so, doing great so far!”

OK. Yay for the OK.

On that basis of beating greatly lowered expectation, stocks should be rising in the month ahead, instead of just wiping their brows that things were not worse than expected.

I swear some of the articles, even on ZH, have reached new levels of euphoric exuberance we’ve never before seen. And it just keeps coming.

Where do we go from crazy?

Now, would I be totally surprised that the stock market rises for a good October, in spite of what I’ve said? No because clearly the stock market is nothing but a game of useless gambling anyway. In a market this devoid of any sense that has been trying to bet against the Fed all year, it’s even possible they will keep betting the shares up of companies that have gone out of business, like betting up the value of worse than worthless celebrity farts sold as non-fungible tokens (NFTs) … also a thing this year.

For those who remember pet rocks, at least people paying $6 bucks for one of those was getting something funny (while the joke was new), but THOUSANDS for a fart??? Are you kidding me? But, then, this is the nation where men become women in order to gain an advantage in female sports and where women become Supreme Court justices who tell you the only people capable of judging what a woman is are biologists … even though they claim they are the first Black woman to become a Supreme Court justice. I wonder how she can even be sure she is Black without a biologist to help her, since the anatomy of a woman is just as physical and obvious as the color of a Black person. If we can choose something that is as stark a divide throughout the animal kingdom as male v. female, then I certainly don’t know why we cannot choose race, which is far less significant than gender.

Stop the world. I want to get off.

Back to topic (except that peak insanity really is the topic), I don’t have faith in any of the metrics presented above as a reasonable basis for the market to rise. Might it rise on continued insanity? No doubt it could! The ability of insane people to remain insane within their asylums has no set limit. However, the likelihood of the crazies remaining happy for long and continuing to play games in the common area when the asylum ceiling is falling on them and all the walls are on fire, seems improbable. Still, crazy is as crazy does, I guess. Maybe the lunatics will celebrate and bet the stock market to the moon even as the whole asylum goes up in flames and all of them with it.

That doesn’t make it any less nauseating to watch … or listen to Bedlam.

(To stay aware of all the news about the unfolding Epocalypse, get the weekday headlines in The Daily Doom. There is no need to miss anything when The Daily Doom pulls it all together for you.)

Liked it? Take a second to support David Haggith on Patreon!