- What Is Fair Value?

- Which of These Is Not the Same?

- Where’s Your Edge?

- Where Are We on COVID-19?

- What Do We Do About Infrastructure?

- Thoughts on the Biden Stimulus Plan

- Sic Transit Gloria Mundi Silicon Valley

- Puerto Rico and New Information on Vaccines

Readers often ask how these letters appear so regularly. The answer is we have a process. Normally, I talk to my associate Patrick Watson on Monday about the next weekend’s letter. We both go into research mode, verbally outlining a letter, and by Thursday I have an outline and some background research. This gives me plenty of time to flesh it out, so to speak.

This week was different. Patrick lives in the Texas Hill Country outside Austin, where unusual things were happening. Power failures, impassable roads, bursting water pipes, giant ice-laden tree limbs crashing, to name a few. He and his family are safe, but we didn’t have much time for collaboration this week.

However, this gives me a chance to do something I have mentally toyed with for a long time.

Rather than going deep into one theme, this week we will do a “Random Thoughts” from the Frontline. Today we will cover several topics in shorter form: valuations, infrastructure, the debacle in Texas, and a lot more.

Let’s jump in.

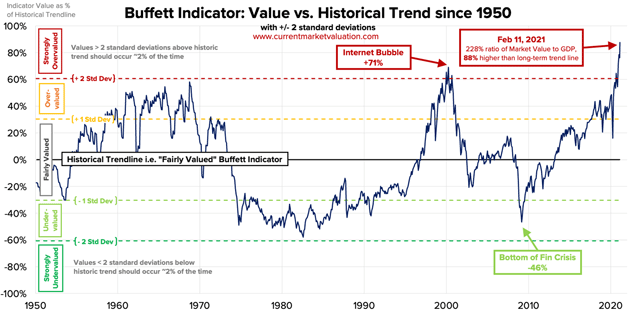

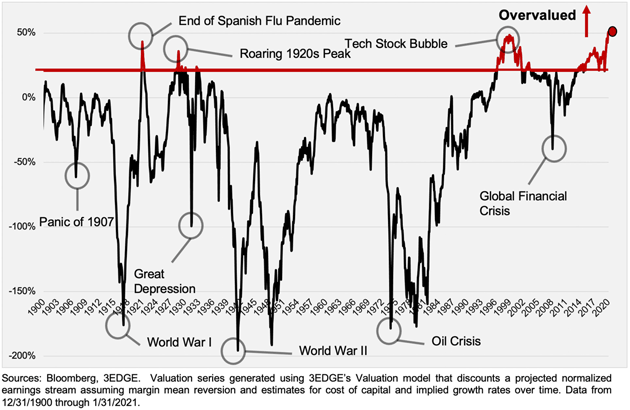

Many analysts contend that current stock valuations resemble the dot-com era. You can see it visually at Current Market Valuation. Here are just a few of the many charts on the website.

Let’s start with the classic “Buffett Indicator.” It certainly seems to be in nosebleed territory. Notice that the valuations in 1966, the beginning of a long-term bear market, were also high.

Source: CurrentMarketValuation.com

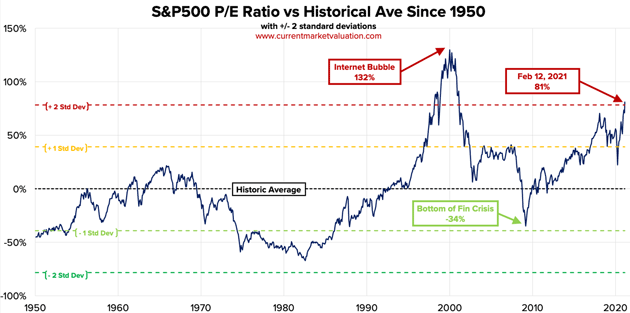

Then there is the ever-popular price-to-earnings ratio. Notice by this measure that valuations were not all that stretched in 1966. Yet there still followed a 17-year bear market, as measured from the peak back to where it started.

Source: CurrentMarketValuation.com

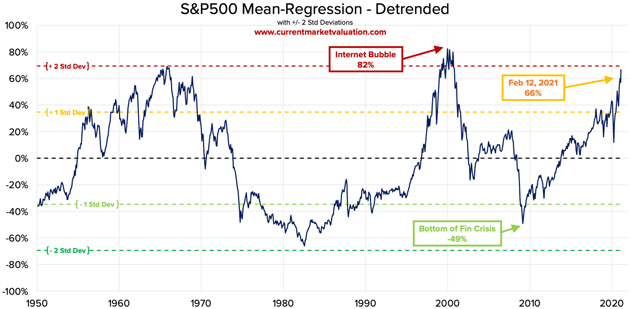

This next one is unusual: valuation as measured by mean reversion. Mean reversion is the fairly unsophisticated concept that "what goes up must come down."

While the market’s day-to-day movements are chaotic, long-term stock market returns tend to follow somewhat predictable upward trends. But they can also deviate from the trend for years or even decades.

This isn’t a trading strategy. But it's still a useful indicator of overall market valuation relative to the past.

Here, we see that in 1966 and early 2000, the S&P 500 was two standard deviations from the mean. As of last Friday, it is almost back to that level.

Source: CurrentMarketValuation.com

But this is not your father’s or your grandfather’s (if he was alive in 1929) overvalued market. There are two major differences between today and those previous periods.

First, in the dot-com era, the Federal Reserve had let loose the dogs of easy monetary policy going into the Y2K event. That was appropriate given the uncertainty, but it clearly helped send already overvalued markets to extremes.

We had day traders piling into anything that looked like an Internet stock, speculations, really easy money, and so forth. Then after January 1 passed uneventfully, Greenspan appropriately reversed the Fed’s monetary policy. Oops.

And now we have enormous federal government stimulus, soon to be about 25% of GDP in less than a year. That money ends up somewhere, but its impact is still unclear. There is no historical parallel to consider.

Which of These Is Not the Same?

For those of us with children a few decades ago, and I assume the same today, there were educational books (often coloring books) showing a series of pictures and asking which of these is not the same?

We can also ask this about our current stock market situation. Jerome Powell is not Alan Greenspan.

Powell and his colleagues have made it very clear they will keep monetary policy loose and rates low for a very long time. Inflation is well down their worry list. Their top concern is unemployment, which is indeed a real problem.

The Fed is telling us it will let inflation get to 3% or more. They are looking at the average inflation over time, which means they can justify doing anything they want.

What they want is low rates, even if it overheats the economy, until unemployment returns to where it was before the pandemic.

If they really mean that, then we are going to have low rates for a very long time, as unemployment is a bigger problem than most people think.

It also means, maybe not coincidentally, the US Treasury will find it easier to refinance an ever-increasing federal deficit.

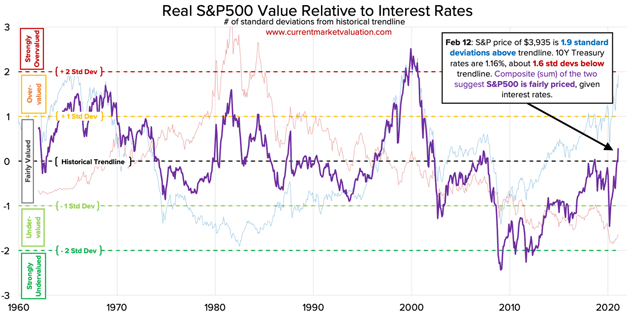

But persistent low rates might mean stock market valuations are actually in the fair value range.

Look at this next chart showing S&P 500 value relative to interest rates. Interest rates are 1.6 standard deviations below the trendline.

That suggests that the S&P 500 may not be so overpriced.

Source: CurrentMarketValuation.com

Four years ago (January 2017), I was behind the camera watching Bob Pisani on CNBC interview Steve Cucchiaro.

Bob calls Steve the most successful ETF strategist ever. His previous 20-year track record surely confirmed that.

Steve and I are quite close, and I understood his old model intimately. We talked about it a lot. He agreed with me that his old model would not carry him into the next decade.

Steve later left his firm to build a completely new model based on multiplayer game theory. I traveled to Boston more than a few times, staying at his home, discussing his new model, and looking at a flowchart of over 200 global factors.

His whiteboard looked like a bowl of colorful spaghetti. He wrote his own code for a strategy.

You have to understand that Steve is an MIT-certified math genius, as well as Wharton. IHME, the international health data organization, asked him to join the very prestigious international board just to get his modeling insights. (More on that below.)

Steve’s new firm, called 3Edge, now runs $1.3 billion and growing. Full disclosure: He anchors my own blend of four ETF traders, and he is also separately on our CMG platform.

He released a new white paper this week. It is appropriate that he starts with a nod to the Grateful Dead, as he still plays in a very good rock band in his 60s with his childhood friends. Quoting:

“When life looks like Easy Street, there is danger at your door.”

―Grateful Dead

Signs of market euphoria are everywhere. Speculative “story” stocks, penny stocks, IPOs, SPACs, millennial “stonk” trading, margin lending, CCC junk bonds, sports trading cards and other collectibles, Dogecoins and investor sentiment surveys are all showcasing extreme market froth. Animal spirits are running hotter now than during the last market peak just before the coronavirus-induced lockdowns began.

His argument touches on the interest rate chart above. Once again, since that is what he does, he built a model on assumptions about valuations and interest rates. Quoting:

Employing an equity valuation model that discounts the S&P 500 Index’s earnings stream many years into the future, we have calculated that the only way to conclude that today’s U.S. stock market is fairly valued is to assume that today’s ultra-low corporate bond yields (among the lowest in history) remain at current levels forever. Given the unlikelihood that corporate bond yields remain at ultra-low levels forever, if we make what we believe is a more reasonable assumption that interest rates remain at ultra-low levels for the next 20 years then revert to their long-term mean, we estimate that the S&P 500 Index is about 50% overvalued today (see Figure 2 – S&P 500 Market Valuation 1900–2021).

While valuations tell us nothing about short-term markets moves, they are actually pretty good at longer-term returns.

What Steve didn’t say in the paper but told me is his model goes back 700 years, using various proxies. He says that you have to assume rates will stay low for at least 100 years to come to the conclusion that the market is fairly valued today. How likely is that?

That being said, he sees pockets of undervaluation (at least relative to the US) in more than a few places. When Steve Cucchiaro talks, you should listen.

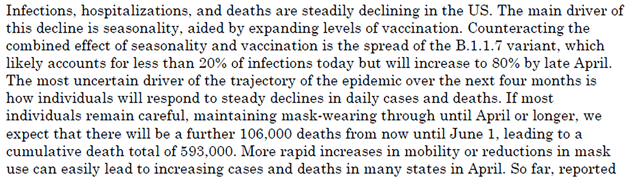

The coronavirus is today’s single most economically important factor. I have maintained for two months that, at least in the US, we are in a race between how many people can be vaccinated versus how fast the B117 variant can spread.

Last month, I was very concerned but recent data is looking more optimistic. We’re not really out of the woods until the second week of March, but we are making tremendous vaccination progress.

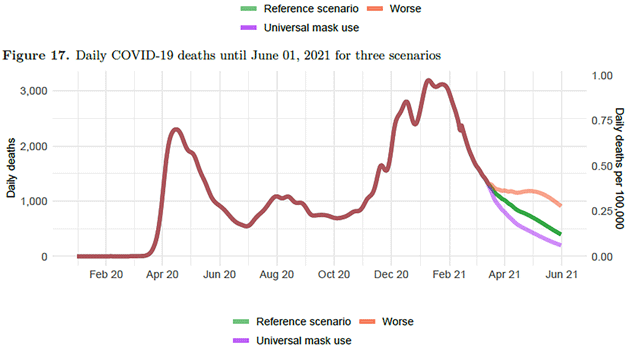

The Institute for Health Metrics and Evaluation, a go-to source for public health authorities all over the world, now projects that—absent a B117 breakout—we should see decreasing cases and deaths until flu season begins next fall. By that time, enough vaccinations will have been done to minimize another outbreak.

Now, they’ve qualified that statement with concerns about the South African variant. The vaccines we’re using may be less effective against that one. But creating a vaccine for that variant should happen faster than the last one, which was (pardon the pun) created at warp speed.

It’s too early to take a victory lap, but this would not have been possible even one or two decades ago.

Steve sent me the latest IHME projections this morning. Here’s a screenshot from their comments:

Here are the IHME projections through June. What they call the reference scenario is roughly their base case, the reduced number of deaths if there was universal mask use; their “worse” case scenario is if B117 spreads and there is less mask use and social distancing.

I know that some think that masks are pointless and don’t help. Scientific studies say they do, but the anecdotal evidence from a conference that my good friend Peter Diamandis (medical doctor, research scientist, futurist, and founder of the X Prize) just finished showed otherwise.

They had a small group of live participants (along with hundreds of video participants) who were tested before anyone came and were tested every day during the conference. By the end, a significant portion of the attendees had acquired COVID-19, including Peter. He wrote a moving mea culpa.

Interestingly, they had 17 production staff, who all wore masks and intermingled with the unmasked participants. They were tested, too, and not one came down with the virus. This is as close to a laboratory experiment as you’re going to get.

What Do We Do About Infrastructure?

I talked last night with one of the most successful hedge fund managers in the country (in terms of returns over the last four years). He will not allow me to use his name. But I can tell you he is a raging bull.

He believes the stimulus that we already had plus what we will get—coupled with a major infrastructure bill, plus extraordinarily easy monetary policy, combined with significant new technology innovations—adds up to a new bull market.

This is someone with 5X returns over the last four years with a very diverse portfolio, so you have to pay attention. (My biggest investment mistake of the past few years was not giving him more money at the beginning.)

But let’s talk about that infrastructure. It seems there is bipartisan support to do it, so let me throw out an idea or two.

While everyone knows that I am not a fan of more debt, we clearly need to fix our ailing infrastructure here in the US. (Most recently seen in Texas, which we will discuss below.)

In my mind, there are two different categories.

One is the portion of our national infrastructure that has some type of revenue attached to it: electricity, water, airports, harbors, etc. Many older cities have terrible water systems that waste up to 20% of their supply. They need to be replaced. Cheap money amortized by a slight increase in water bills could repair all those. In fact, replacing leaky pipes might actually reduce water prices.

As for electricity, we’ve been talking about a “smart grid” for decades. It’s not that expensive and would actually reduce costs over time. Further, if we really want to convert to electric cars over time, which I would consider a good thing, not to mention the increased need for electricity to power all of our new technology, we are going to need more capacity. Solar and wind, hydroelectric and thermal, are wonderful. But it will be many years before we can rely on them for all our daily needs.

I’m as much an environmentalist as anyone. I don’t want to see the air I breathe and I don’t want anything in my water but scotch. But I also want my power to work when I flip the switch.

Those Texas wind turbines that didn’t work? Seems like they didn’t buy the heating option because they didn’t think it necessary. It would have raised the cost of electricity. Texas is the largest producer of wind energy in the country. Oops. It just cascaded from there. Nor was wind the only problem. Much of the natural gas infrastructure wasn’t sufficiently winterized, either.

Texans (like me) think they have a God-given right to cheap energy. That attitude is so 1900s and will not work in the 2020s. We must build excess capacity to handle extreme events, which means electricity will cost more. Texas power generation was geared to, as one professor put it, work 99.9% of the time. But that 0.1% can bite you in the derrière, as we all learned.

Congress should create a program to issue infrastructure bonds similar to Ginnie Mae: government-guaranteed debt that can be bought by the private market, and then even by the Fed. Thirty-year bonds yielding around 2%, as they do today, can finance a lot of self-amortizing, sorely-needed infrastructure to (finally) take us into the 21st century.

China is eating our lunch infrastructure-wise. They are building new coal plants with scrubbing technology that supposedly makes it 90% clean. We’ll see. They are also building fourth-generation thorium nuclear reactors. The difference between these and older plants like Chernobyl and Fukushima is the difference between the Model T and the Tesla.

The US needs to come to the party. Nuclear energy is the cleanest there is, in terms of carbon footprint. It takes a lot of carbon use to build wind turbines and solar panels. Yes, nuclear is more expensive than coal and natural gas. We need to get over our obsession with cheap energy.

I hear many of you asking about how we can charge the poor higher rates for energy? Why not break the income profile in the US into quintiles, charge the lowest quintile 25% less and add that cost to the highest quintile? It would be a rounding error on the highest quintile’s electric bills.

Yes, I know that is income redistribution and quasi-socialism. This libertarian boy recognizes reality when it’s coming at him. Let’s try to control it rather than having it run over us.

Then there are infrastructure needs like roads and bridges that don’t have associated revenue streams. We will just need to pony up the money to fix them, perhaps in cooperation with the states. But it has to be done or we are going to have bridges collapsing just like the Texas electric power system collapsed.

Thoughts on the Biden Stimulus Plan

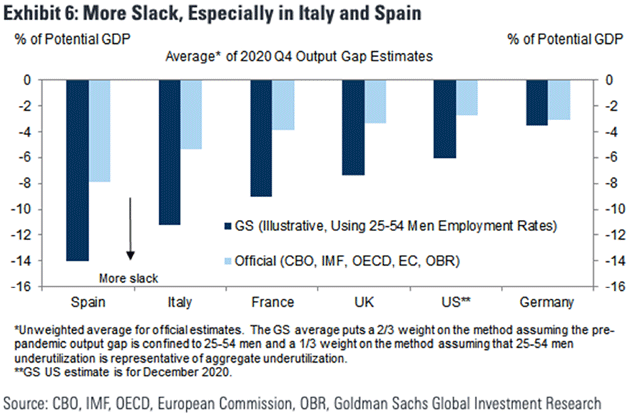

First, let me do something unusual and agree with Paul Krugman. He wrote on Twitter:

Goldman Sachs joins the campaign against nonsense output gaps, saying that there's much more slack in major economies than official estimates indicate. Obvious implications for Biden relief plan.

Here is the chart he was referring to:

This makes remarkable intuitive sense. If the official estimates of the output gap were correct, we would have been seeing inflation everywhere in 2015–2020. We didn’t, and part of the reason is the economy has more slack than the official estimates suggest.

If this is true, it means that even though I don’t like the current stimulus bill as it is structured, it is unlikely, even coupled with easy monetary policy, to produce anything other than transitory inflation.

We need a stimulus bill. Seriously. People who have lost jobs and businesses that are closing doors need help. We don’t need to load up the debt of the entire United States to help a few selected constituencies. I hope they focus on the real needs of those hit hardest in the COVID recession. Just saying…

(By the way, you should follow me on Twitter where I often share charts like the one above.)

Sic Transit Gloria Mundi Silicon Valley

I recently discovered a cool site called Investor Amnesia. The link takes you to an article on SPACs and IPOs. But about halfway down they talk about the history of Cleveland, which from the 1870s to the early 1900s was the Silicon Valley of the time. Seriously, great story.

We’ve all heard of the high-profile tech titans like Elon Musk leaving Silicon Valley. Many lower-profile companies are leaving as well. It turns out there are other places in this country that have the necessary infrastructure and collective brainpower, like Austin or Denver or Raleigh or Dallas, even Birmingham and certain parts of Florida. And they are friendlier to businesses.

No one today thinks of Cleveland as Silicon Valley, although the city fathers and the state government are actively working to change that. I am even trying to help. The point is that we as human beings project not just the current interest rates decades in the future, we also project current circumstances into the future.

Reading the history of Cleveland, it would have been hard to live there in 1900 and think it wouldn’t all continue. You can’t take success for granted. You have to constantly strive to improve… and you certainly can’t overburden the ox that is pulling the wagon.

By the way, there are 197 SPACs as of a few weeks ago. I actually like seeing private companies with great technologies get into the public marketplace.

The number of public companies has been shrinking for too long. Maybe this SPAC innovation can reverse that.

Yes, I am sure there will be some disasters, but overall I think it will be good for investors.

Puerto Rico and New Information on Vaccines

I am hoping to get my vaccine shot this afternoon. I have no idea which one is on the island. But I read this morning in The Wall Street Journal that the Pfizer vaccine is 85% effective after one shot and can be stored with regular refrigeration.

Really? That is great news but it would’ve been nice to know earlier. It certainly makes the UK’s decision to reach more people faster with the first shot seem prescient.

And with that I will hit the send button. Have a great week, call a few friends around the country, and stay safe.

Your looking forward to having dinner with friends around the world analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.