Financial writers and gold bulls have both taken their turn at referring to a potential recession as having a positive impact on gold prices. The commentary varies somewhat, but here are a few examples…

“the price of gold would ‘benefit’ from a recession”; “the risk of recession will drive investors into gold”; “a confirmed recession is all gold needs to move higher.”

The statements above and others like them, stem from the assumption that bad economic news is good for gold. Further (they incorrectly assume), the worse the economy is, the higher the gold price.

Not true.

Nor, is the opposite true. “An overheated economy will result in higher inflation and result in higher gold prices.”

A recession is a descriptive term for a slowdown in economic activity. The term “overheated economy” refers to highly elevated economic activity.

Economic events are different from financial events. The stock market crash in October 1929 was a financial event. The Great Depression that followed was an economic event.

Recessions and depressions are terms that refer to weak and depressed economic activity. Conversely, when people use the term ‘overheated economy’, they are also referring to economic activity.

Gold is a financial asset. Its price is not determined by economic events or activity.

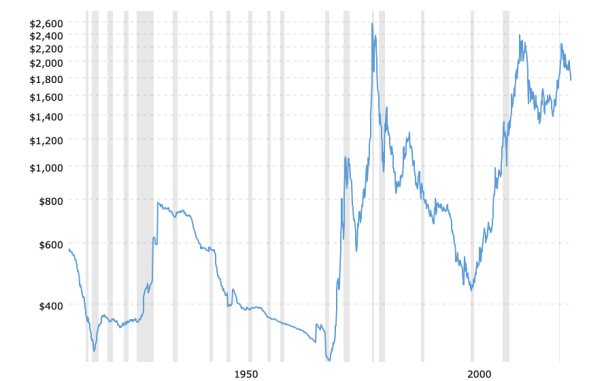

Below is a chart of gold prices for the past century. The prices are adjusted for inflation…

Gold Prices (inflation-adjusted) – 100 Year Historical Chart

During the period 1934-70, the United States and the rest of the world experienced a horrible depression, a horrific world war, and a period of new and positive economic growth.

For thirty-six years the inflation-adjusted price of gold declined steadily. This seems to contradict those who insist that things like a weak economy and geopolitical unrest are good for gold.

Then, between 1980 and 2000, the US and world economy experienced probably the most significant and lasting period of unusually strong economic growth in history. Technological advancement and business expansion powered a growth juggernaut.

Inflation, or more correctly, the effects of inflation, were little noticed. The inflation-adjusted price of gold declined by more than two-thirds. The nominal gold price declined similarly, as much as seventy percent from its intraday peak to its low point two decades later.

GOLD PRICE DURING PAST RECESSIONS

The shaded gray areas on the chart above indicate periods of time which have been classified officially as recessions. There is no apparent correlation between the gold price and the events called recessions.

Also, the recessions occurred independent of whatever major trend in the gold price was in effect at the time.

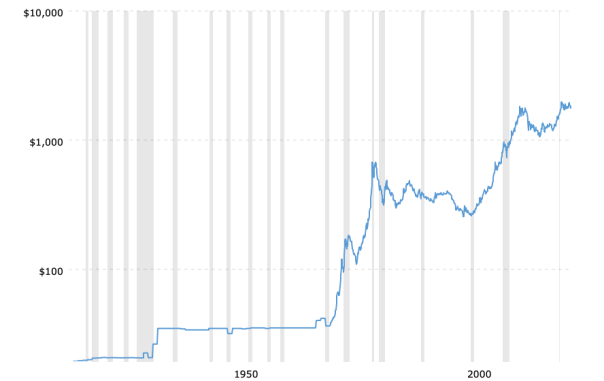

This can be seen on the chart below as well, which shows the same gold price history without adjustments for inflation…

Gold Prices – 100 Year Historical Chart

CONCLUSION

The price of gold is not affected or determined by economic events, such as recessions, depressions, etc. Nor, is the gold price subject to considerations involving wars, political instability, interest rates (see Gold And Interest Rates – No Correlation), etc.

The only determining factor in the increasing price of gold over time is the actual loss in purchasing power of the US dollar. That loss in purchasing power is the effect of inflation which was created previously by the Federal Reserve. (also see Not About Gold – All About The Dollar)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!