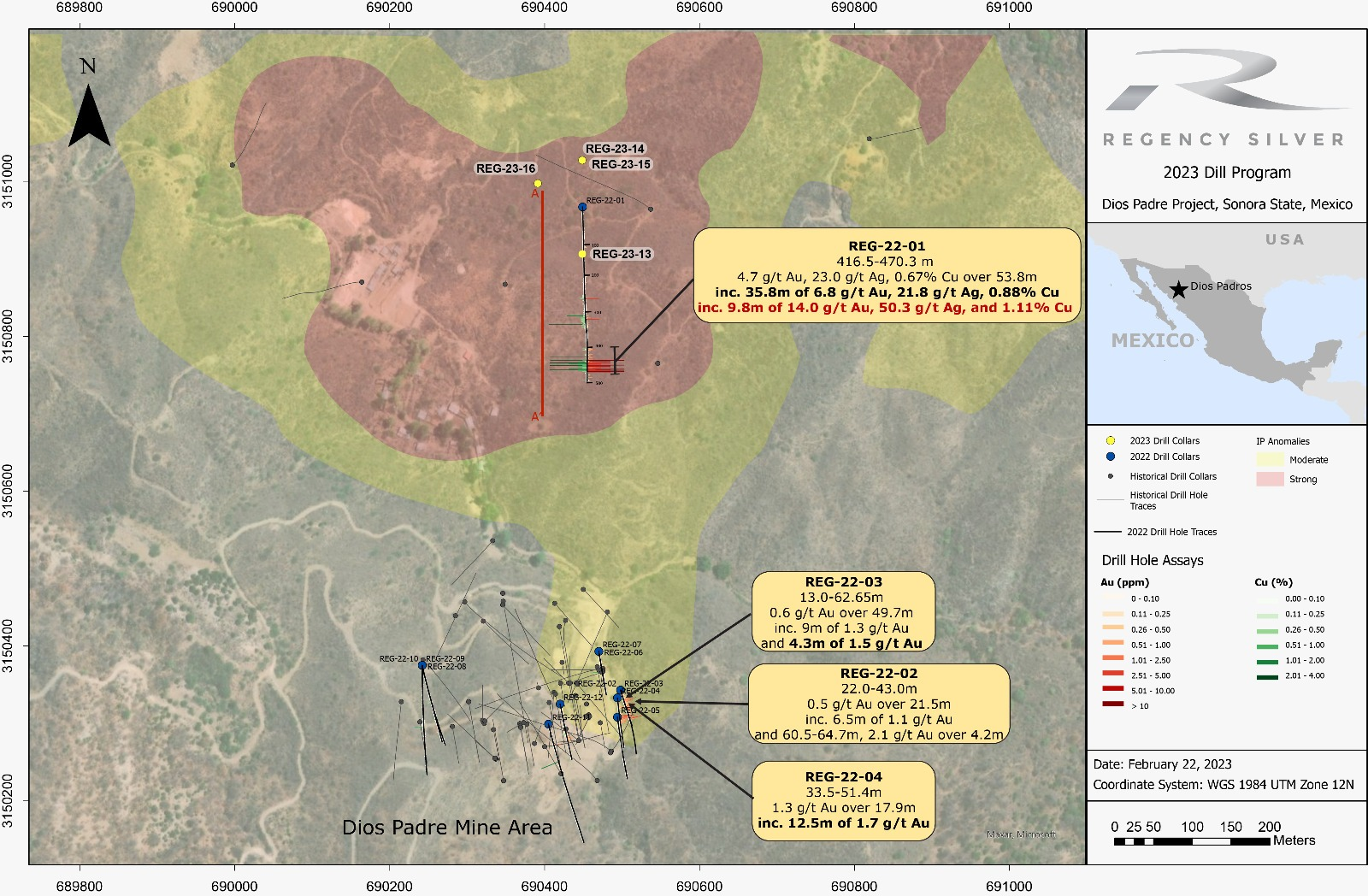

Regency Silver Corp. (TSX-V: RSMX, OTCQB: RSMXF) delivered fresh results from an ongoing drill program at the company’s Dios Padre Gold-Copper-Silver Project in Sonora State Mexico showing the growing potential of a district-scale sized gold-copper-silver system.

Yesterday, the company released two follow up holes from REG-22-01 which yielded 35.8 metres of 6.84 g/t gold, 0.88% copper and 21.82 g/t silver along with 13.97 g/t Au, 50.25 g/t Ag and 1.11 % Cu over 9.8 m.

Three new drill holes demonstrate continuity of the mineralization beyond a recent estimate, showing there is plenty more to discover in Mexico and the market is reflecting this in the company’s share price.

Drillings Are Turning

The current drill and IP program is fully financed from the company's recently completed private placement of 10,795,000 common shares at a price of 20 cents per share for gross proceeds of $2,159,000.

The 2,000-metre drill program is designed to test a large anomaly only 550 metres to the north of the existing Dios Padre historical workings to determine whether it represents a significant continuation of the mineralization at Dios Padre.

"We are excited to begin the next chapter of the growth of Regency Silver. The current drill and IP program is designed to verify management's model of a large, district-scale magmatic-hydrothermal gold-copper-silver system." - Mr. Bragagnolo, executive chairman

The drill program began on January 15th 2023. Three holes have been completed to date totaling 1,974m of drilling. Hole 4 of the program is currently underway attempting to find continuity of the breccia 50m to the west.

Highlights of the program so far include:

REG-23-14 intersects 32m of pyrite-specularite-chalcopyrite supported breccia from ~454-486m within a broader zone of disseminated and vein hosted mineralization ~25m down dip from REG-22-01.

REG-23-15 intersects 120m of specularite-pyrite-chalcopyrite supported breccia from ~400-520m within a broader zone of disseminated and vein hosted mineralization ~85m down-dip from REG-22-01 and ~62m down-dip from REG-23-14

The current drill program is scheduled to last until the middle of March, 2023. Assay results are expected to take up to four weeks from the date of delivery of material.

“The first three holes can only be described as a success. We now know that the breccia continues to depth and appears to be of similar quality to what we had in REG-22-01. Our geologic understanding has increased significantly and our ability to target effectively in further step outs will only improve going forward” – Michael Tucker – Director and Lead Geologist.

These drill results will eventually be incorporated into the Dios Padre resource.

Building on a History of Discovery and Geography

The company delivered an updated resource estimate for its wholly owned Dios Padre gold-copper-silver project in under a year from its public listing.

This is the result of an experienced management team that has a long history of bringing new companies successfully to market with Mexican silver assets and a property with potential.

Within months of the IPO during the summer of 2022, Regency added a total of 1,658 metres of drilling from 11 holes to the resource area. The updated estimate comprises just 1,056 meters from 8 holes since holes REG-22-08, 09 and 10 were step out holes which were too far away to be added into the resource estimate.

The updated inferred resource for Dios Padre estimates 11.375 million ounces of silver equivalent with 1.384 million tonnes at 255.64 g/t silver equivalent. This is a 20% increase in inferred resources and an 8.3% increase in grade from a previous resource estimate contained in a technical report from November 24, 2020.

The resource estimate contains results from the historic Dios Padre silver mine only and does not include any information from the recent discovery hole REG 22-01 which contained an intercept of 35.8 metres of 6.84 g/t gold, 0.88% copper and 21.82 g/t silver.

Management: Bringing Value to the Market from Mexico

Executive Chairman Bruce Bragagnolo has a history of building shareholder value in Mexico. Mr. Bragagnolo has extensive knowledge of Mexico through his business dealings in the country over the last 20 years.

He is the co-founder and past chief executive officer of both Timmins Gold Corp. and Silvermex Resources Ltd. Mr. Bragagnolo took Timmins Gold through its IPO in 2006, to commercial production in 2010 and its NYSE-MKT listing in 2011. While he was CEO, Timmins Gold built the San Francisco Mine in Sonora, Mexico on time and on budget.

Timmins Gold went from an IPO market capitalization value of CDN$7 million to a market cap of US$475 million in 2012. He raised over $75 million in equity and $18 million in debt for Timmins Gold. Production peaked at 121,573 ounces of gold in 2014.

Mr. Bragagnolo guided Silvermex Resources through its IPO in 2006 and the purchase of its initial assets in Mexico. Mr. Bragagnolo took the market cap of Silvermex from an IPO market cap of C$7 million to its sale to First Majestic for C$175 million.

Mr. Bragagnolo was a director of Continuum Resources Ltd. when it acquired the San Jose Mine in Oaxaca, Mexico. Continuum merged with Fortuna Silver in 2004 and the San Jose Mine is now its flagship asset with 2020 production of 6.17 million ounces of silver and 37,805 ounces of gold.

In Good Company, Dios Padre’s Neighbours

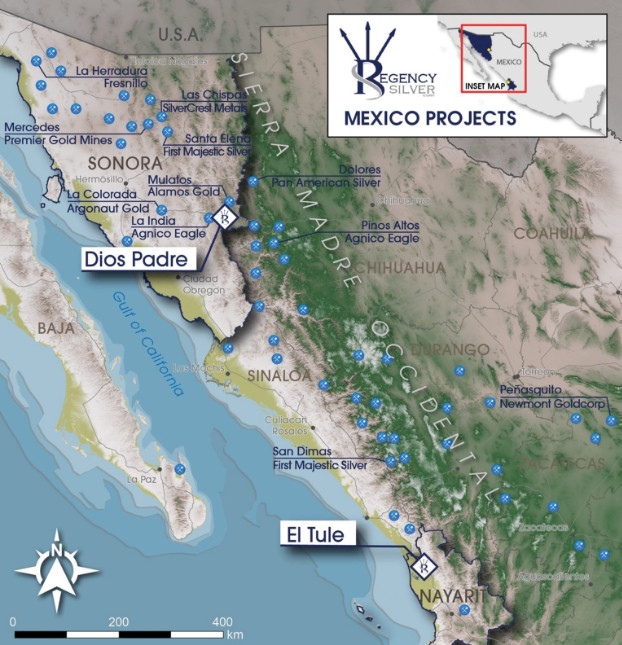

Experience in Mexico brings insight into the most prospective regions of Mexico, the company’s Dios Padre’s project sits in a geological belt producing silver mines.

For example, Pan American Silver’s Dolores open-pit mine lies 80 km away and began operation in 2009. Forecast 2022 silver production is between 2.85 - 3.15 million ounces of silver and between 157–179 Koz of gold. As of June 30, 2021 proven and probable reserves were 27 Mt containing 20 million ounces of silver at 24 g/t and 650 Koz of gold at 0.75g/t.

In addition, Alamos Gold’s Mulatos open-pit and underground gold mining operation has produced more than 2 million ounces of gold and lies 40 kilometres away. 2022E production is 130 -145 Koz ounces of gold.

Agnico Eagle has two projects in the region with its La India open-pit mine (45 km) with 2022E production of 83 Koz gold and its Pinos Altos open-pit and underground mine (75 km) with 2022E production of 128 Koz gold.

Regency Silver is already demonstrating to shareholders that with the right combination of a strong management team, with a highly successful past in developing projects and mines in Mexico and a highly prospective district-scale sized system potential, can yield big returns to investors. The company is poised to build off this initial drill success and turn Regency Silver into one of the most exciting exploration stories for 2023!

Learn more at https://regency-silver.com/

This report’s analysis was produced with the work of Nicholas LePan, GoldSeek.com

To Stay Connected:

- Twitter: @GoldSeek

- E-mail List: Sign-Up Here

Disclosure: GoldSeek.com employees own shares of Regency SIlver and the company is a sponsor of this website.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The companies mentioned herein may be sponsor of GoldSeek.com. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.

Additional Information on Regency Silver Corp

Capitalization Table Current Issued and Outstanding Common Shares 76,917,668 Incentive Stock Options 7,690,000 Share Purchase Warrants 1,640,000 Broker Warrants issued upon IPO 1,041,544 Fully Diluted Share Capital 87,289,212

Contact Information:

Bruce Bragagnolo

Executive Chairman & Director

(604) 417-9517

Gijsbert Groenewegen

CEO & Director

(646) 247-1000

Video of its drill program:

https://regency-silver.com/news/press-releases/regency-silver-announces…