Well, here we are again. We've reached that time of year where we look back at what was and look ahead to what might be. The year 2025 will be long remembered for historic gains in the prices of gold and silver. What drove those gains and might the trend continue in 2026? Let's discuss.

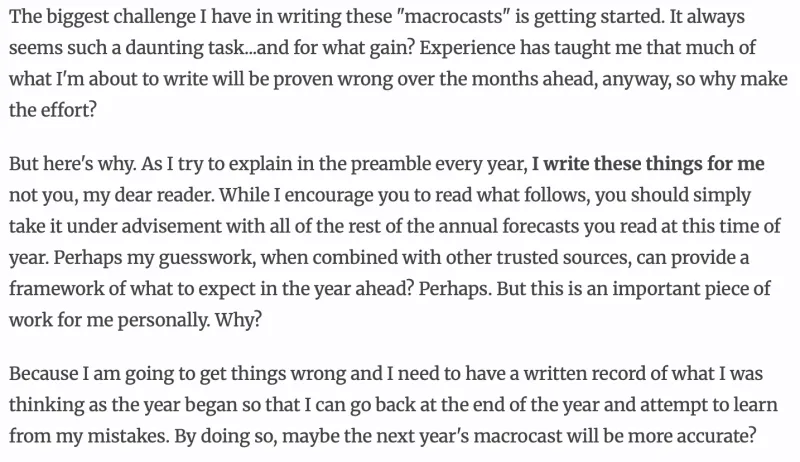

As we get started, let's begin with the usual disclaimer. I'm getting old and tired so, instead of writing this up background again, I thought I'd just copy and paste this information from Macrocast 2025:

I've been writing these annual forecasts for over a decade and here's the other downside. If I'm wrong and precious metal prices fall, I get emails about what an idiot I am for being a "permabull". However, if I'm correct and precious metal prices rise, I get emails about what an idiot I am for "not being bullish enough". Talk about a no-win situation!

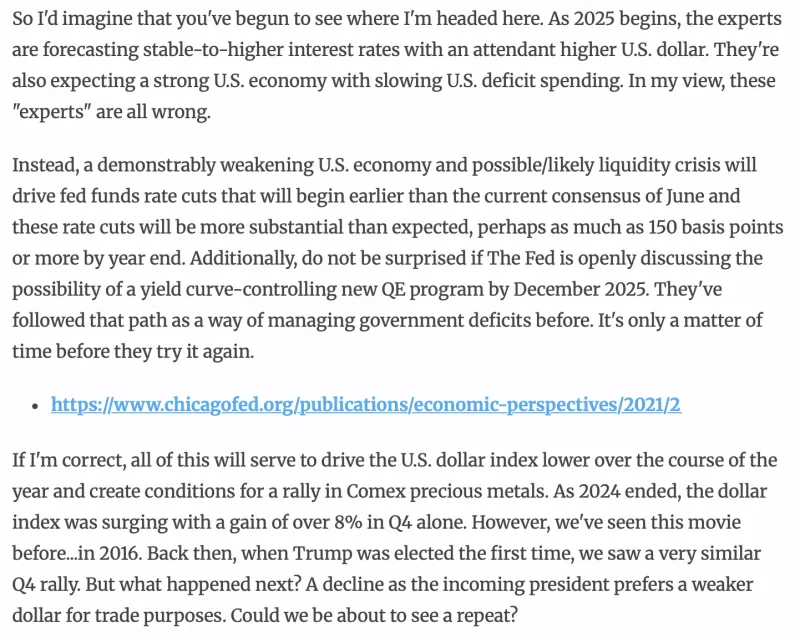

But that's OK. As I've always said, I write these forecasts for me because I need a written record of what I was thinking twelve months earlier. For example, while the PMs have had an historic year in terms of price gains, it's easy to forget how uncertain things appeared last January with the U.S. dollar index soaring as Trump/Musk/DOGE promised massive spending cuts and a balanced budget. At TFMR, we knew that was bogus and that not much in Washington was going to change. However, what you see below was a pretty uncommon take as 2024 ended.

With all of that in place, let's begin Macrocast 2026.

In recent years, I've spent a lot of effort and time writing about what I expect out the U.S. economy and The Fed...and I've been consistently wrong. I expected a recession to begin in 2023. It didn't. I then thought that 2024 would bring the recession. Nope. And then 2025 was certain to bring the recession as the yield curve uninverted. Hardly.

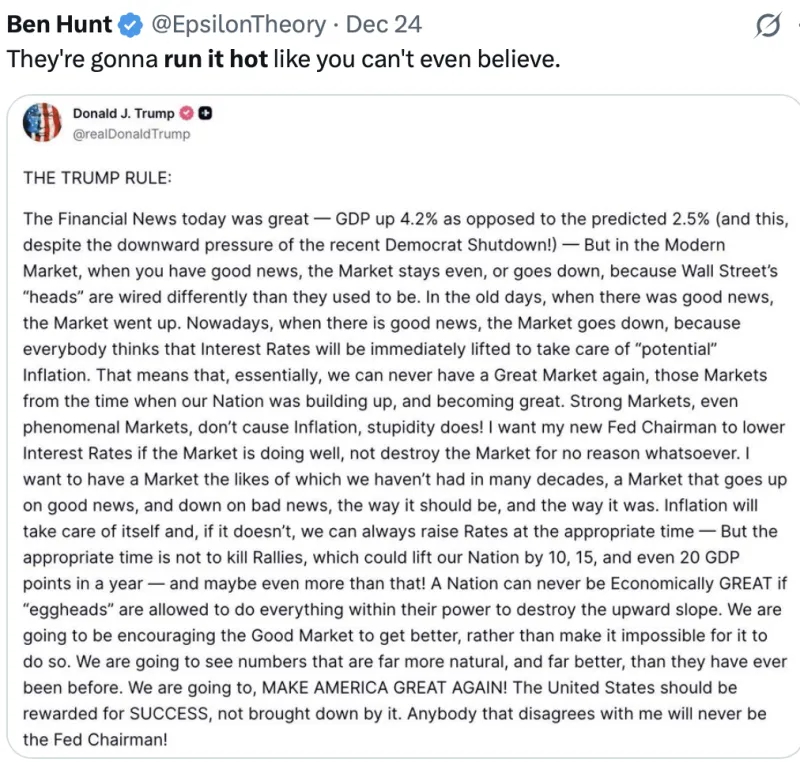

So, you know what? Screw it. I don't think that there's going to be a recession in 2026. In fact, I think that nominal "growth" in the U.S. economy won't be half bad. Maybe a 2-3% annualized GDP gain. And why? There's a common theme that keeps being repeated on X and elsewhere...they're going to run it hot!

I've also spent a lot of time in previous macrocasts trying to project how many fed funds rate cuts might be pending in the year ahead. Could it be one or two or more? But for 2026, we don't need to worry about that, either. Jerry Powell's term ends in May and Trump has made it abundantly clear that Jerry's replacement will be a Yes Man, tasked with carrying out Trump's wishes for immediate rate cuts. At present, the fed funds futures market projects just two, 25 basis point fed funds cuts in 2026. LOL! As if! Trump's Yes Man is very likely to trim the fed funds rate by half, at a minimum. This would leave fed funds at about 1.5% by December 2026. That's how you run it hot!

Additionally, on multiple occasions in 2025, SecTreas Bessent has referenced the necessity of "melding the operations of Fed and Treasury". What does this entail? A number of things come to mind but key to the precious metals is the foreshadowing of Yield Curve Control. If cutting fed funds to under 2% drives a sell-off in duration and longer yields spike, The Fed and Treasury will work together to cap long-term interest rates. At first through simple jawboning but then, if necessary, through official policy of "asset purchases" and QE. Trump's message changed over the course of 2025 from austerity to "growing our way out of debt". Running it hot, by virtue of sharply lower short rates and YCC on the long end is how he and Bessent are planning to get it done.

And in the end, this places the U.S. right where you'd expect it to be as we enter the Crack-Up Boom phase of the global, debt-based monetary system. The U.S. is betting that artificially low interest rates and economic growth will forestall collapse and The End of The Great Keynesian Experiment. And it might work...for a while. But in the end, the existing fiat currency regime will meet its demise in the same manner that all previous attempts have ended...with monetary debasement that demolishes wealth and purchasing power.

Physical gold and physical silver are your protection against this madness and prices rose substantially in 2025. But what about 2026? Where do prices head from here? For answers, let's turn the clock back to Sunday, February 2, 2025. Much of the gains of 2025 can be traced back to that day and this press conference in The Oval Office. Trump was signing an Executive Order to create a Sovereign Wealth Fund and he asked SecTreas Bessent to make a few comments. You can watch for yourself in the embedded video below with Trump's discussion followed Bessent's comments beginning at about the 4:10 mark.

TRUMP: "We're creating a lot of wealth. Scott, maybe you'd like to say something about it?"

BESSENT: "It's very exciting. We're going to stand this thing up. Within the next twelve months, we're going to monetize the asset side of the U.S. balance sheet for the American people. We're going to put the assets to work and I think it's going to be very exciting. We'll use best practices as done around the world in a combination of liquid assets...assets that we have in this country...as we work to bring them out for the American people."

There's a little bit of word salad in Bessent's statement, and he certainly had the look of being caught off guard when being asked to comment. But his message was clear. "Monetize the asset side of the balance sheet" and what's the biggest "asset" the U.S. has? It's allegedto be 8,133 metric tonnes of gold. Of course, a combination of factors drove the gold price higher in 2025. However, as you can see below, the incredible year of 2025 got kick-started in early February.

Now most traditional financial analysts have brushed aside the idea of monetizing assets since it has never been tried before and the U.S. has carried the "antique" of gold on its balance sheet at $42.22/ounce for decades. But as I type this paragraph on Saturday, January 3, you were just put on notice that not only is an official revaluation a possibility, it's a probability. Why?

In the news conference that followed the U.S. action to capture and remove Venezuelan President Maduro, Secretary of State Rubio said this about Trump:

"Trump is not a game-player. When he tells you that he's going to do something, when he tells you he's going to address a problem, he means it. He actions it. This is a president of action. If he says he's serious about something, he means it."

Understand this...I don't type all of Rubio's words as any sort of political endorsement. How you or I feel politically is of no importance. What matters is that Trump has shown again that he's a different cat. While the professional politician preens and strongly condemns while writing letters and proclamations, Trump takes action. Again, whether or not you support his actions doesn't matter for the sake of this macrocast. What matters is that you understand that "this time is different".

So what you read next in this macrocast about the revaluation of the U.S. gold reserves is not just an academic exercise. Instead, it's a connecting of dots where, just like Maduro, the world has been warned of what's coming. Again, from SecTreas Bessent on February 2, 2025:

"We're going to stand this thing up. Within the next twelve months, we're going to monetize the asset side of the U.S. balance sheet for the American people. We're going to put the assets to work and I think it's going to be very exciting."

For months at TFMR and in my weekly public columns published by Sprott Money, I've been trying to warn and inform on this issue. If you're unaware and would like to get caught up, here are just a few of the Sprott Money links from early to mid-2025:

- https://www.sprottmoney.com/blog/some-golden-speculation

- https://www.sprottmoney.com/blog/possible-gold-price-revaluation

- https://www.sprottmoney.com/blog/to-monetize-the-asset-side

- https://www.sprottmoney.com/blog/us-to-revalue-its-gold-reserves

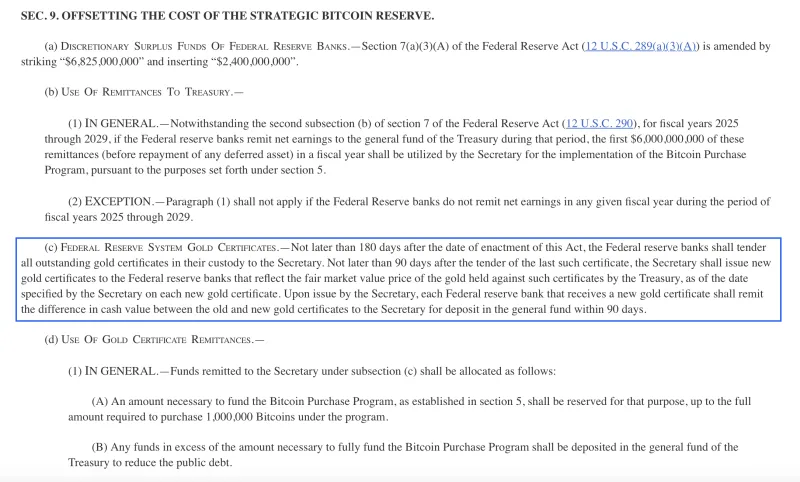

And why would the U.S. government seek to revalue its gold reserves? In order to create a horde of "deficit neutral" cash that could be used to fund the proposed Sovereign Wealth and Bitcoin reserves. But don't believe me, see for yourself in the links below. There are bills before Congress which are intended to authorize the creation of the Bitcoin Reserve. Both the U.S. House and U.S. Senate versions contain language as to the process of official gold revaluation. Both also contain the legal framework for amending the official U.S. Code that values gold at $42.22.

To save you the trouble, the relevant passage is below:

Now look, maybe this will never happen and the "Bitcoin Reserve" will never come about. Perhaps instead, the U.S will create that Sovereign Wealth Fund and it will hold an assortment of assets and investments, with Bitcoin being one of them. What's important is the funding process and, for that, the roadmap has been laid out ever since February 2, 2025.

This explains the rush of "repatriated gold" that was brought back to U.S. shores in the first half of 2025. Traditional analysis claimed it had to do with bullion banks and arbitrage. To me that always sounded like a cover story. Instead, what if it was a move to repatriate U.S. gold in preparation for the official revaluation that's coming in 2026?

And how much gold was moved in a matter of months? Greg Firth of StoneX is someone who you would think would have a good idea of the number. Fast forward to the 0:40 mark of the second segment of this video and note how he states that it's "2,000 tonnes plus"...and that was only through the first part of 2025 as this interview was recorded in March.

So I think you can see why I'm headed in a different direction with this year's macrocast. In the past, I've tried to assess the situation on the ground in January and then give you a price target for December. However, IF in fact the U.S. moves to officially revalue its gold reserves in 2026, no amount of predicting and forecasting can provide a price target.

You see, the higher the U.S. revalues its gold, the more "deficit neutral" dollars it will have for its wealth funds. At the $2600 price that gold finished in 2024, the U.S. reserves were valued at $700B. By the end of 2025 and with gold at $4300, the U.S. reserves are valued at about $1.1T. Is that "enough" for funding Trump's funds? Why not officially revalue the gold at $10,000/ounce and raise your supposedly deficit-neutral new cash level to $2.5T? Moving the bar to $20,000/ounce nets you $5T to play around with so why not aim high?

Again, you might think that this is all crazytalk and that fifteen years of following the precious metals has finally driven me over the edge and into the abyss of madness. And maybe you're right! It has certainly been a long, strange trip. But what if I'm not wrong and that I'm simply following a path of breadcrumbs that have been skillfully placed but too often overlooked. Again, as SecState Rubio just said in January 3, 2026, "Trump is a president of action" and "if he says he's serious about something, he means it".

With all of this in mind, stop reading and scroll back up to that Oval Office video from February 2, 2025. Watch it again. Listen closely to what's said. Maybe you'll start connecting the dots, too.

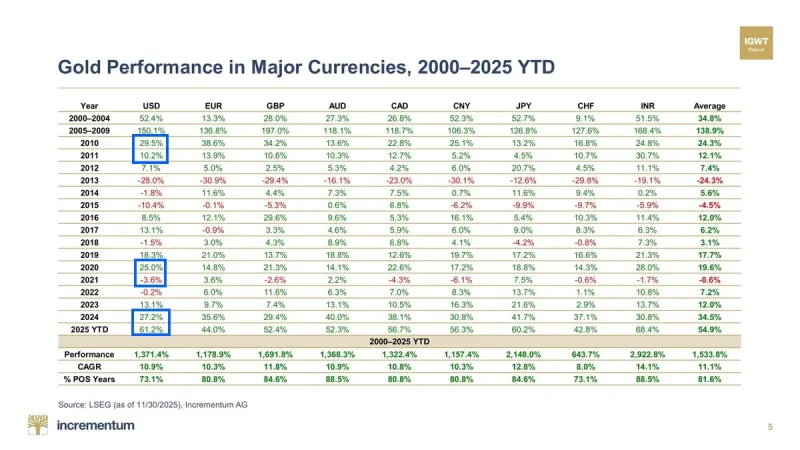

And maybe this recognition helps to explain the incredible surge in the gold price in 2025. In this handy chart from Ronnie Stoeferle, note that previous years that followed a 25% gain in gold had failed to produce gains of significance. But 2025 saw a follow-up gain of 65%! That's not only unusual, but it's also unprecedented. Were part of gold's gains in 2025 driven by governments, central banks, institutions, and large investors front-running the events that seem pending for 2026?

So now we've arrived at the point where I make a forecast for prices at the end of 2026. Let's do this in two forms...one where I'm correct about an official U.S. gold price revaluation and one where I'm wrong.

The first one is easy. If the U.S. officially revalues its gold reserves in 2026, then I have no idea where the price will be on December 31, 2026. A revaluation to the current price...whatever that may be as of the official marking...may not have much impact. However, if anything, it would officially reestablish the gold price as a sort of international benchmark, and this alone would be very bullish for the price.

But what if the U.S. revalues its gold to $5,000 or $10,000 or $20,000 per ounce? How would that impact the price? I'm not sure. Just because the U.S. uses what is essentially an accounting gimmick to create some cash does not mean that the global pricing structure just automatically assumes that gold price. Could the U.S. value its gold at $10,000 only to have the market price remain at $4,000? I suppose. We've never been in this situation before, so no one can say for certain how it would turn out. However, it's hard to see a scenario where the market price falls after an official U.S. revaluation. It's more of an exercise of predicting just how far the price might rise.

Either way, in the revaluation scenario, your physical gold holdings become more valuable, regardless of the short-term price impact. Read that again....more valuable regardless of price. This goes for your physical silver holdings, too.

As for the second scenario...the one where no revaluation takes place and all that I've written and discussed is proven false...where will prices head in 2026?

Again, regardless of any potential revaluation, the picture is extremely bullish. Why?

- Trump to install a Yes Man at the Fed, and this person is going to immediately begin cutting the fed funds rate.

- "Running it hot" ensures a mix of growth with high price inflation.

- Yield Curve Control measures lock in sharply negative real rates of interest.

- Global central bank gold demand continues unabated.

- Global supply deficits for silver continue to place stress upon the fractional reserve pricing scheme.

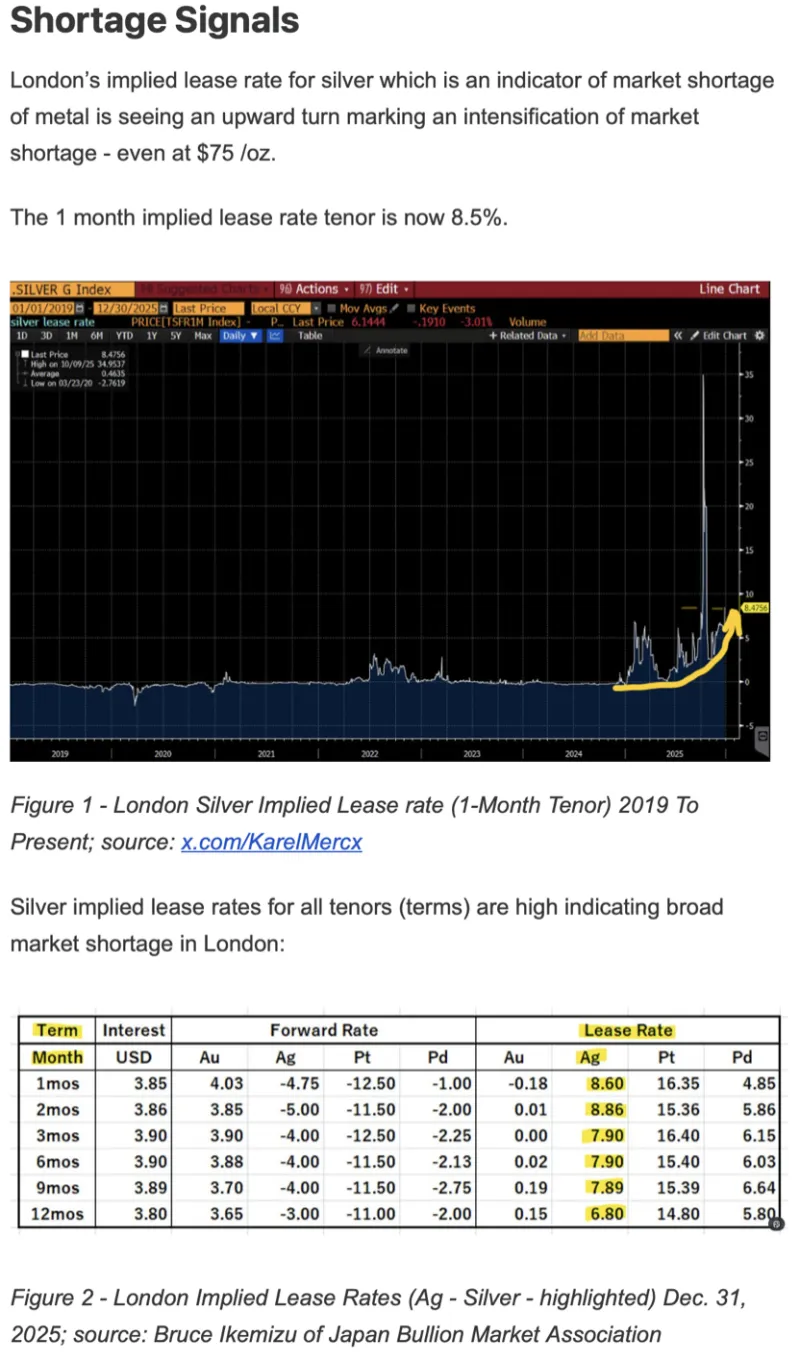

And that last point is the most significant. By late 2025, significant stress was building within the pricing scheme for silver, as witnessed by soaring lease rates in London and the backwardation of price from spot to front-month futures. See this from mining executive and market analyst, David Jensen:

Let's start with gold. Since price broke out on March 1, 2024, it has moved in a steady pattern of 20% rallies, followed by multi-month periods of consolidation. After considering what you've read thus far and as you can see on the weekly chart below, there's no reason to expect this pattern to end or reverse in 2026.

Accordingly, the next 20% rally will take the price to near $5000/ounce, and then, after a consolidation period that endures into and through summer, another 20% rally takes the price to near $6000/ounce before year's end, so let's go with that. Gold trades as high as $6000/ounce in 2026 before fishing the year at $6000±$200 or so.

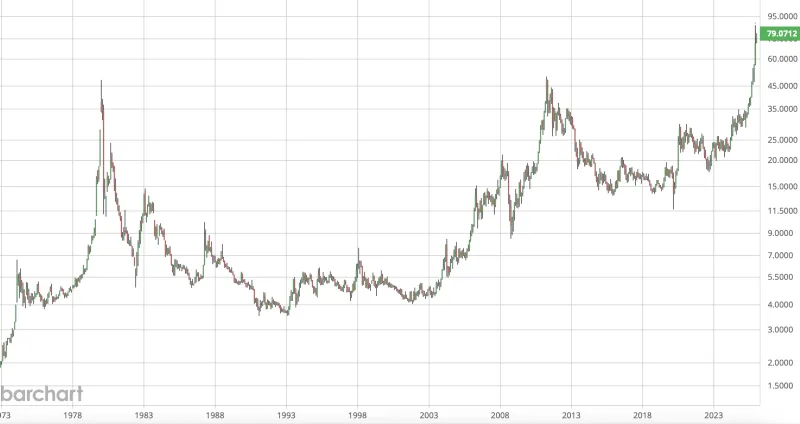

What about silver? Well, silver is a real wildcard in 2026. If anything, the price action since mid-October has proven that this time IS different and that, unlike 1980 and 2011, price is not immediately headed back to $30 or lower. Instead, I expect silver to continue along, just as "big brother gold" did in 2025.

Recall that gold broke out to new all-time highs above $2000 in March of 2024 and, by December of 2025, price had reached $4500. That's a move of 125% in just over 21 months as the bullion banks finally lost control after decades of price management. The Banks have now seemingly lost control of silver, too, so why shouldn't we expect it to follow the same pattern? And since silver moves about 2X gold over time, why shouldn't we expect a 125% gain in silver but in about half the time?

That sounds about right so applying that "logic", the breakout above $50 that began in October of 2025 yields a price target of $110 by August or September of 2026. Will price finish 2026 above or below that level? Much of that will depend upon the circumstances that drove it there but, with so little time remaining in the year after September, let's go with $120±10 as a price target for New Year's Eve 2026.

As with past years, maybe that forecast is too bullish and we'll look back a year from now at how poorly it worked out. The trolls will crawl out from under their bridges and once again denounce me as a "pumper" and a "charlatan". On the flip side, maybe my forecast is not bullish enough and my price targets are way too low in a historic year of change and deleverage. In that case, the trolls can criticize me all they want. I'll gleefully laugh and brush them aside while adding a few zeroes to my net worth. ![]()

So there you have it. A macrocast that deviates from what it has been in the past but retains the core message...You simply must own physical precious metal. No other asset can protect you from the madness of the politicians and their bankers at The End of The Great Keynesian Experiment.

Before leaving, I strongly urge you to join us at TFMR. Not only do I provide analysis and podcasts every day, the global community of TFMR members makes our site a safe harbor in the economic and political tempest. In times like these, we all need someplace where we can freely discuss issues and share information.

Thank you for taking the time to read this year's macrocast. I hope to see you at TFMR in 2026.

CEH