- The Eight-Body Problem

- What the Recovery Looks Like

- Some of the Consequences of a Three-Part Economy

- On the Road Again: Montana

"It's a recession when your neighbor loses his job;

it's a depression when you lose yours."

—Harry S. Truman, 33rd US President

In recent weeks, numerous commentators started to suggest the US and the world are entering a depression.

For some areas of the economy, that is clearly true. But not every area.

Today we will explore what some smart minds are saying about the current economic environment. I'll also aim to help you navigate through its complexity.

Here's one thing I think we can all agree on…

This recession/depression is unlike anything we have experienced in the history of the US.

I am at a loss to find anything like it in world history. That is because we have never experienced an economic disaster—and that’s the correct phrase—like we are witnessing today.

Furthermore, the recovery—when it happens, and it will come—is going to be very uneven.

- Part of the economy will be in what can only be described as a depression for quite some time.

- Another part will recover, albeit a little slowly, but faster than the Great Recession.

- Other parts of the economy are going to take off like a rocket ship.

The media and politicians tend to talk about “the economy” as a general term. But I think that will be a misnomer. How fast you will see recovery, or how long you will see depression, depends a great deal on where you are and what part of the economy you are in.

My friend George Friedman of Geopolitical Futures suggests that our search for answers starts with September (emphasis mine):

"I have argued that unless a solution is found by September, the probability that the recession could turn into a depression would mount. A recession is a normal part of the economy, a primarily financial event that imposes disciplines on an overheated economy. A depression, from a geopolitical standpoint, involves the physical destruction of the economy, something that lays waste to businesses, dislocates labor and vaporizes capital. A recession is the economy cycling. A depression is an economy breaking.

"I chose September because two quarters of intense economic contraction is instructive. Economists’ definition of a recession is two successive quarters of negative growth (also known in English as decline). This is generally enough time to understand how resilient an economy is. Uncoincidentally, it is also the point at which economies begin to recover in normal cycles. Under normal circumstances, basic economic structures remain intact during recessions so financial stimulus measures can restart the system. "

Just for the record, there have been five depressions in the history of the US: 1807–1814; 1837–1844; 1873–1879; 1893–1898; 1929–1941. I believe all of them were associated with banking crises and financial panics.

A little history is in order to understand why the current situation is different from anything we have seen…

The first four “depressions” were indeed banking panics. But they were also associated with the agricultural cycle.

Farmers would borrow money in the spring and pay it back after the fall harvest. Money would move from money-center banks in the big cities, especially New York, to smaller banks out in the country. And then back.

(Think about the old piece of market wisdom here: "Sell in May and go away." The money-center banks would have less money to lend for speculation during the summer.)

If you're as fascinated by this topic as I am, Art Cashin turned me on to a book by Walter Lord called "The Good Years." Truly the best 99 cents you can spend. Click on the chapter heading "1907" and read how J.P. Morgan essentially forced bankers and financiers to save the country.

It was actually quite the harrowing tale. And it was what led governments and banks to create the Federal Reserve in 1913, to have a lender of last resort.

Things indeed changed. Not long afterward, the US became less dominated by the agricultural cycle and more dominated by the manufacturing cycle.

As my friend Dr. Woody Brock says, when Henry Ford would lay off 10,000 workers, that also meant steelworkers, tire manufacturers in Akron, and so on were also laid off.

That percolated throughout the economy. And we got what we called the Great Depression. (I know this is a huge oversimplification: Herbert Hoover allowed Smoot-Hawley in 1930. He also raised taxes in the teeth of a depression/recession. Monetary policy was not helpful.)

After World War II, “recessions” became more frequent. (Sidebar: You won’t find the term “recession” in the historical literature prior to World War II.)

Up until 2000, recessions were associated with the manufacturing cycle. But those became milder over time. That is because manufacturing had less of an impact on the economy.

Going into 2020, 85% of the US economy was in the service economy. The Great Recession was caused by financial excess, but we worked through it.

And then we get to the current crisis. And something happened that never happened before…

We literally shut down 30% to 40% of the service economy. Wiped it out. Restaurants, hotels, gyms, airlines, tourism, all manner of personal services. The list can go on forever.

The Independent Restaurant Coalition conducted a poll by Compass Lexecon, a Chicago-based consulting firm. The report predicts a grim future for roughly 500,000 (of 660,000) Main Street restaurants unless a more robust financial assistance program is established.

That's potentially 85% of independent food establishments, gone forever.

I am told by a member of the National Restaurant Association that, as things stand, some 30% to 40% of restaurants will likely close by year-end without further aid.

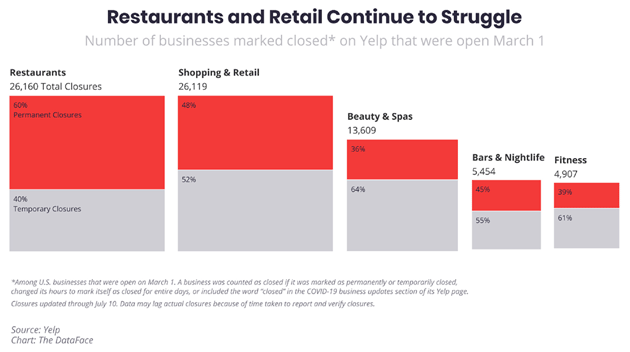

Yelp is a surprisingly good source for information on business closings. Some 55% of businesses that are listed as closed on Yelp have been closed for good.

Image credit: MarketWatch

It's not just restaurants…

Half of hotel rooms in the US are empty as of six days ago. They need at least 80% occupancy to break even. Some 70% of hotels in India are expected to close.

Hotels that depend on tourism? Toast. Airlines? The list goes on and on.

And it's not just the US…

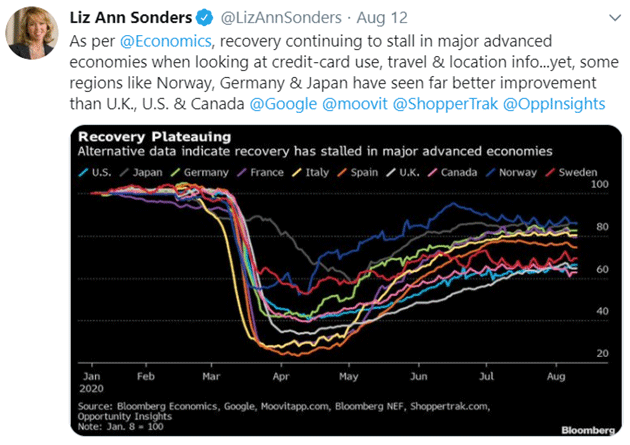

Other countries around the world are having their own problems. Liz Ann Sonders gives us this graph:

Be sure to follow me on Twitter (@johnfmauldin) so that you can see my research, analysis, and retweets of important charts like these in real time.

Emerging markets and frontier markets are having their own even worse crises brought on by COVID-19.

The Eight-Body Problem

If you have three large objects that have gravitational impact on each other, you can determine where they have been in the past. However, you cannot predict where they will be in the future. At least, not without great difficulty.

In physics, this is called the three-body problem.

In economics, we are well beyond the three-body problem. I think it is more like an eight-body problem. See if you agree:

Body No. 1: The service economy has imploded. We don’t know when it is coming back. I am not going to argue the correctness of whether we should lock down or open up. I am simply talking about what is. And it appears that much of the economy is going to be locked down for some time. There is simply no telling when that part of the economy will normalize.

Body No. 2: We have seen the largest central bank intervention, not just in the US but in many parts of the world, ever in history. Clearly that is keeping markets up. Furthermore, governments are providing fiscal stimulus in an unprecedented manner. In essence, the government borrowed money to give people the money that they would’ve earned in their jobs. Interestingly, not all of it was spent. We have seen a record amount of disposable income being added to savings.

The US government is in a food fight over the next round of stimulus. Not that the purpose of this letter is to argue what is correct. Some amount will likely be determined. Your guess is as good as mine. But can we keep that up in 2021? How long? That is a major economic gravitational body, and we have no idea what it will look like this year, let alone next year and 2022.

Body No. 3: Federal Reserve policy and, to some extent, government policy has short-circuited both Schumpeter’s creative destruction cycle and moral hazard. We literally have no idea how that’s going to impact the future, but those are big deals. Companies with the lowest-rated junk bonds are refinancing their debt at lower rates. We are keeping zombie companies afloat. Is every company that accesses the market a zombie company? No, of course not. But many are.

Body No. 4: Global trade is beginning to implode. Like it or not, we truly live in a global economy. This is a global depression and it affects everyone. I was writing 20 years ago that the biggest threat to prosperity in the future would be protectionism and tariffs. I have made it clear that China is not a good actor, and we need to review our policies and our reliance upon them. But tariffs are just a bad idea, whether it’s China or Europe or whatever country. Can we say Smoot-Hawley?

Body No. 5: On average, six companies with assets larger than $50 million have filed for bankruptcy every week since April. This is going to increase and become a tsunami. Small local companies don’t even bother filing because it’s too expensive. Every one of them represents jobs.

This is the hard one…

Body No. 6: The working class will be last to see the recovery. Most of the jobs that are being lost are by the least-well-off in our society. They can’t work from home. Those with children have to figure out how to take care of them in case schools don’t open… or if they don't want to send them back. Unemployment insurance won’t cover the bills when the federal money runs out.

This represents tens of millions of workers. Unemployment is not going to bounce back miraculously in the first quarter of next year. It is going to be a long, slow climb.

Now for some good news…

Body No. 7: Entrepreneurs will re-emerge, and new ones will seize this moment to shine. All those businesses going bankrupt or out of business? They are run by entrepreneurs who have the entrepreneurial bug. It is part of their DNA.

I was talking to a Dallas restauranteur who is “down” to three restaurants. He is stretching his cash and hoping for another round of PPP. He will breathe easier when he can get his normally booming restaurants up to 50% occupancy.

Depressed? Not at all. He believes this will all eventually normalize, and he will have the greatest opportunity he has ever had. He can see 10 restaurants in his future. This is the kind of vision that accelerates recoveries.

He and hundreds of thousands of other entrepreneurs throughout the country and the world look for opportunity. It’s just what they do. They can’t help themselves.

It will take time, and they have to figure out where the capital will come from. But I am convinced that entrepreneurs will be the ones to dig us out from this, not governments.

Body No. 8: We are in the midst of The Greatest Transformation in history. Elon Musk just launched and landed a massive rocket as a test. That is just a very visible example of tens of thousands of new technological revolutions happening all around us.

These disruptive technologies will truly change the world. I can’t even begin to describe what is happening in the biotechnology and aging space. Artificial intelligence, robotics, self-driving cars, incredible advances in agriculture, shipping, quantum computers… you name it. The list is just too long. And it's growing.

We are about to witness history-making advancements… potentially in record-breaking time.

What the Recovery Looks Like

I frankly think it is misleading to draw a graph and say this is what the economic recovery will look like.

Talk about a V- or U-shaped recovery is simply silly. Every one of the “bodies” I mentioned above will have a significant recovery impact. We don’t know how they will interact.

My guess is that we are going to see several different economies. Heather Long (a fellow Camp Kotok regular) illustrates this for The Washington Post.

This dichotomy is evident in many facets of the economy, especially in employment. Jobs are fully back for the highest wage earners, but fewer than half the jobs lost this spring have returned for those making less than $20 an hour, according to a new labor data analysis by John Friedman, an economics professor at Brown University and co-director of Opportunity Insights.

If we have to choose a letter for the economic recovery, maybe it should be a “K.” Some go up and others go down.

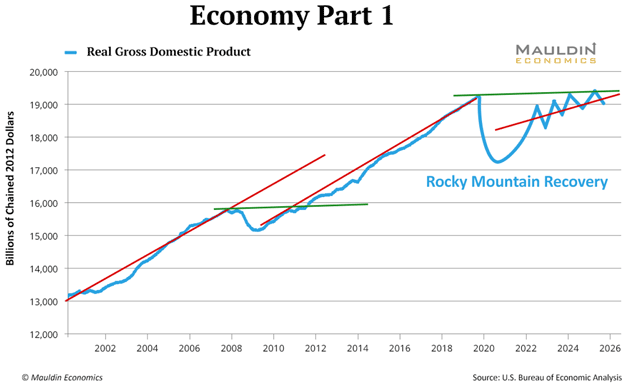

I have two more charts for you today. The first is what I call Economy Part 1. This graph goes back to 2000, and the red lines roughly show the trajectory of the recovery. The St. Louis Federal Reserve database has not updated the second quarter, but I tried to represent it.

For a large part of the economy—maybe the largest part—recovery is going to be slower than that of The Great Recession. And it is going to be lumpy. Notice that I have a recovery with a lower slope.

That is in part because of the research by Dr. Lacy Hunt and others demonstrating that growth is slower in high-debt economies. Just a fact.

Note that we do recover; it just takes longer for this portion of the economy.

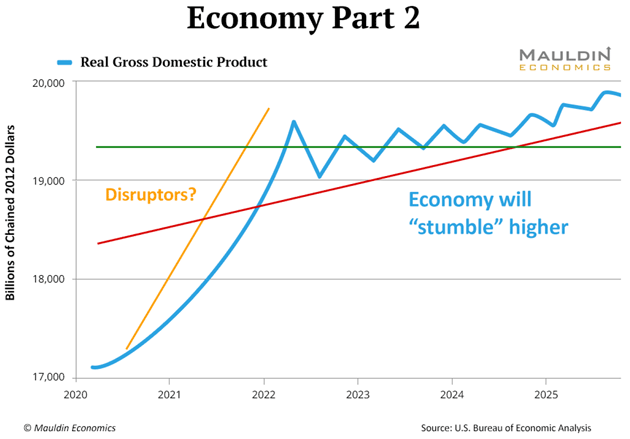

Then we come to Economy Part 2. Faster recovery and the slope of the recovery is higher. More like what I call the Stumble-Through Economy.

It still doesn’t look like the recoveries of the past, but perfectly acceptable given the problems.

On this second chart, I want you to look at the yellow line I call the Disruptors. These are the companies that are truly changing the world and their growth is, well, through the roof.

I think by now most investors are well aware of the FAANG or FAAMG stocks, or whatever acronym we use. I am not including them in my thought experiment version of Disruptors. I mean, they are, but they have been around for a while.

Rather, I’m talking about the new companies that will not replace them, but will join them in the pantheon. (Though some of them may get replaced. Don’t ask me which ones.)

Some of the Consequences of a Three-Part Economy

Whether it's K-shaped or some other to-be-determined letter, there are three economic takeaways:

1. This is going to change the way we live. We have already seen savings increase, not unlike our parents and grandparents during the Great Depression. It is going to change spending and saving habits. It is going to force businesses and entrepreneurs to adjust in ways that they never dreamed they would need to.

I think it is fair to say that many of us have looked at our lives and decided we don’t need quite as much “stuff” as we did before. We are not going to hunker down in caves, but we may pack them with less paraphernalia.

Each one of those choices represents a buying decision that impacts some entrepreneur who provided that product.

This crisis is simply the greatest demand destruction of our lifetimes. It will come back, but it is not going to come back to what it looked like in 2019. Our future economic buying decisions are going to be different.

Everything, I mean everything, is going to be repriced and thought through. You can’t take anything for granted. Inflation numbers and measures are going to be warped for at least a few years. We are using old tools to measure a new economy. We are going to have to develop new models to appropriately analyze the world we now live in.

How do we value the price of a home or apartment? I don’t think it is unreasonable to expect 10% unemployment, or something close to it, in the middle of 2021. That is going to affect prices up and down the housing value chain.

How do you value retail and office space? If your tenants are gone, do you pay the mortgage? Hotels will come back, eventually, but who is going to own them? The old private-equity owners or the new ones? At what price? We already knew we had too many retail stores. What is the correct number in the future? How will malls and commercial space be repurposed?

Hundreds, if not thousands of planes are sitting on the tarmac. Who is going to own them?

There are thousands of scenarios playing out in thousands of industries all over the world. What they have in common is that…

Everything is going to be repriced.

That makes me very uncomfortable.

2. Inequality is not going to get better. Thought experiment: It is more than probable we will see some form of universal basic income in the future. It will not solve the inequalities of either income or wealth, but it will still be tried.

Those individuals who were part of the devastated service economy will still struggle for jobs, and they are in the lower income group already. The second part of the economy will be growing and pulling away from that first part.

And that doesn’t even begin to describe what happens to the disruptors.

Just for the record, in this letter and on op-ed pages in various publications, I outlined a methodology for increasing taxes while actually improving the ability to create new businesses and to help those in the lower echelons of income.

I am not a priori against higher total revenue for the government. It’s all about how we collect it. Social justice as our driving mechanism for tax policy is not going to improve the comity in our country.

3. We have two major cycles coming into play at the same time in this decade. One I have written about on numerous occasions: The End of the Fourth Turning. It is always a time of great social unrest, and we are just at the beginning of the end. I expect the period between the middle of this decade and the end to be far more disruptive than where we are today.

Second, my friend George Friedman has written a book called, "The Storm Before the Calm: America's Discord, the Coming Crisis of the 2020s, and the Triumph Beyond."

In it, he discusses two separate cycles in American history, an 80-year cycle and a 50-year cycle. Both are disruptive. For the first time, they coincide in the latter part of this decade.

He predicts that the 2020s will bring dramatic upheaval and reshaping of government, foreign policy, economics, and culture.

A two-part/three-part economy, where the outcomes for significant portions of the population are dramatically different, is a recipe for the types of crises both of their books outline.

And just so I can pile on, just as we are in the middle of their crises, we get to experience The Great Reset. It is a toss-up whether we will have a $30 trillion national debt by New Year’s Day. We will be at $40 trillion by 2025. Plus massive corporate debt, multiple pension crises that will boggle the mind.

All of the debt MUST be "rationalized." We have absolutely no idea how, because we don’t know who will be in charge or what the crisis will look like.

All while disruptive technologies are changing the very foundations of our society and job.

Various people will read this letter and have different reactions.

I hope most of you come away with the idea that you want to find out who the disruptors will be and how you can participate, rather than hunkering down.

I am a believer in the entrepreneurial free market society, and I believe that is what will ultimately bring us into that period that George Friedman calls "The Calm" after the upheaval of the '20s.

I am excited about the future. I truly think we are on the cusp of actually reversing aging in our lifetimes, if not this decade. And that's just one of many other wonderful things.

As my dad would say, don’t let the bastards—the crisis around you—get you down.

Look for the opportunity. There’s a pony in there somewhere.

On the Road Again: Montana

This Monday, I will wake up at 4:45 am (ugh) and get on my first plane for five months, eventually landing in Missoula, Montana, where I will meet Shane coming from California. We will stay at my friend Darrell Cain’s home on Flathead Lake for four days.

I have no other flights planned for this year. It was only three years ago that I traveled 250,000 miles in one year. I regularly notched 200,000-mile years. American says I have 8 million miles.

I don’t miss airports, but I do miss travel. I miss going to New York and putting together dinners with brilliant people. Actually, I miss going anywhere and doing that. And my family. I find I spend more time on the phone and I’m starting to Zoom because I just miss my friends. And my gym.

This letter could have easily been 10,000 words. Maybe even a book. My partners tell me to keep it at 3,000 words. But I tried to hit the highlights of how I think.

New technologies allow us to amalgamate a wide variety of offerings into one framework. It is really rather cool to see it come together.

And with that, I will hit the send button. Have a great week and join me in calling more friends!

Your looking for opportunities in the midst of change analyst,

|

John Mauldin Co-Founder, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.