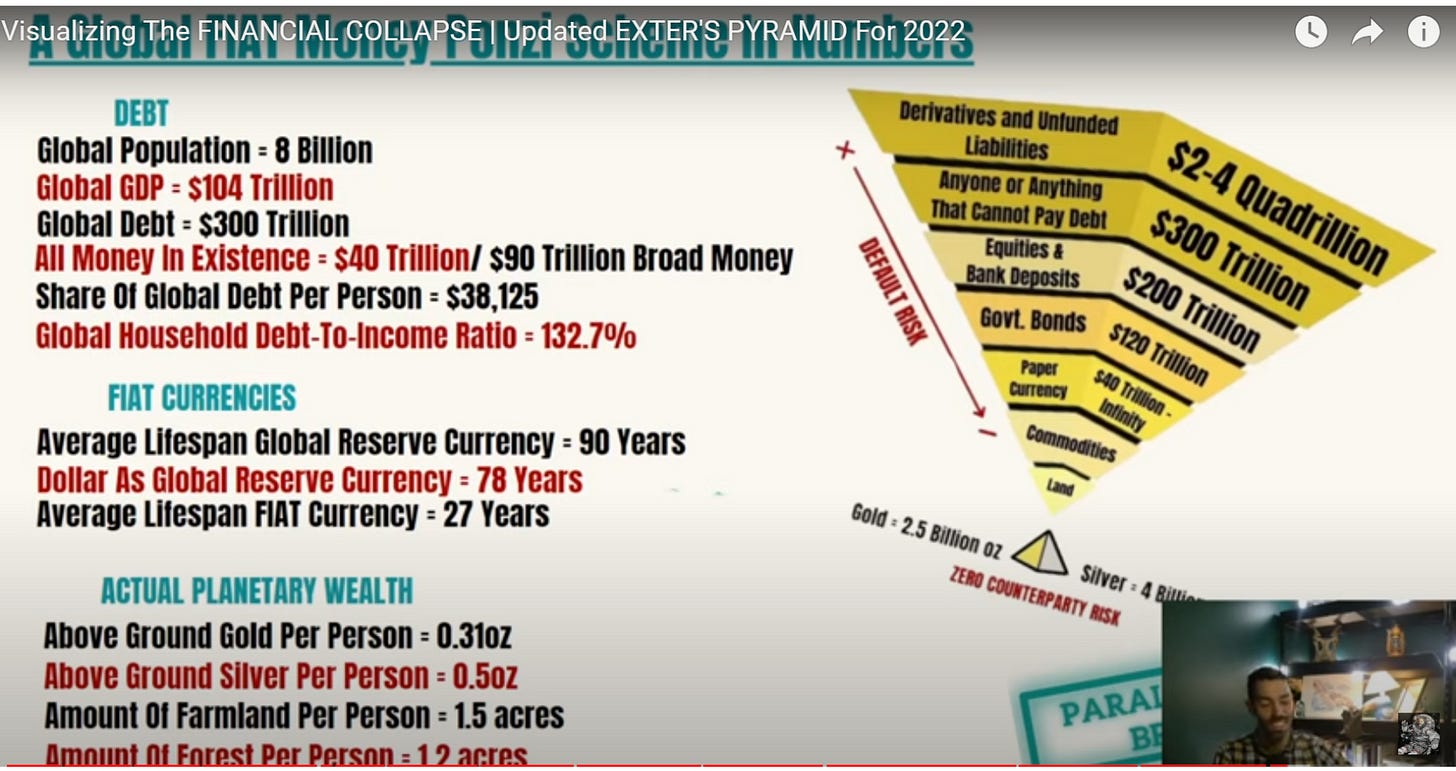

Reason #1 - Exters Pyramid

Exter's Pyramid, also known as Exter's Golden Pyramid or Exter's Inverted Pyramid, is a financial model that illustrates the relationship between risk and size of asset classes. It was created by American economist John Exter in the 1960s.

The pyramid is inverted, with gold at the bottom and derivatives at the top. This reflects Exter's belief that gold is the most reliable store of value, while derivatives are the riskiest asset class. The different levels of the pyramid are as follows:

- Gold. Gold is the most reliable store of value because it has intrinsic value and is not subject to government or financial institution manipulation.

- Physical cash. Physical cash is backed by the full faith and credit of the government that issued it, but it is still subject to inflation and other risks.

- Bonds. Bonds are loans that are issued by governments or corporations. They are considered to be relatively safe investments, but they do not offer the same level of protection as gold or physical cash.

- Stocks. Stocks represent ownership in a company. They are considered to be more risky than bonds, but they also have the potential to generate higher returns.

- Derivatives. Derivatives are financial instruments that derive their value from another asset. They are considered to be the riskiest asset class because their value can be highly volatile.

Below is an extrapolation of Exter’s Pyramid by my friend (living in Poland) Parallel Mike (the graphic is cut off at the bottom where he documents amount of Forest per person as 1.2 acres)

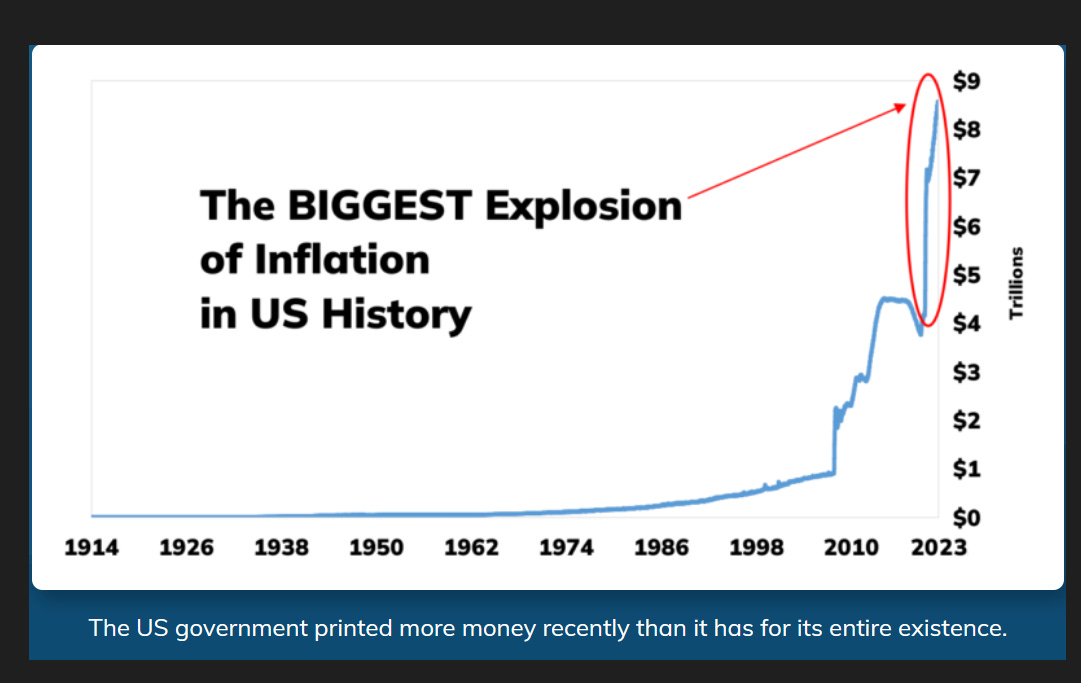

Reason #2 - Inflation

Below is a simple graphic from colleague Nick Giambruno of FinancialUnderground. When you create this much paper money (out of thin air) it creates a system where more dollars are chasing the same goods and services. Increasing the money supply is the classic definition of inflation even though there have been recent attempts by Central Bankers and the Parasitic Class to redefine this classic definition.

Giambruno states, “the US government has printed more money recently than it has for its entire existence. It has expanded the money supply by more than 39% since March of 2020.

It’s the biggest monetary explosion that has ever occurred in the US.

In short, if your after-tax wealth hasn't increased by 39% since then, you aren't keeping pace with the monetary debasement.”

source - https://financialunderground.com/articles/the-truth-about-how-governments-will-use-inflation-to-redistribute-wealth/

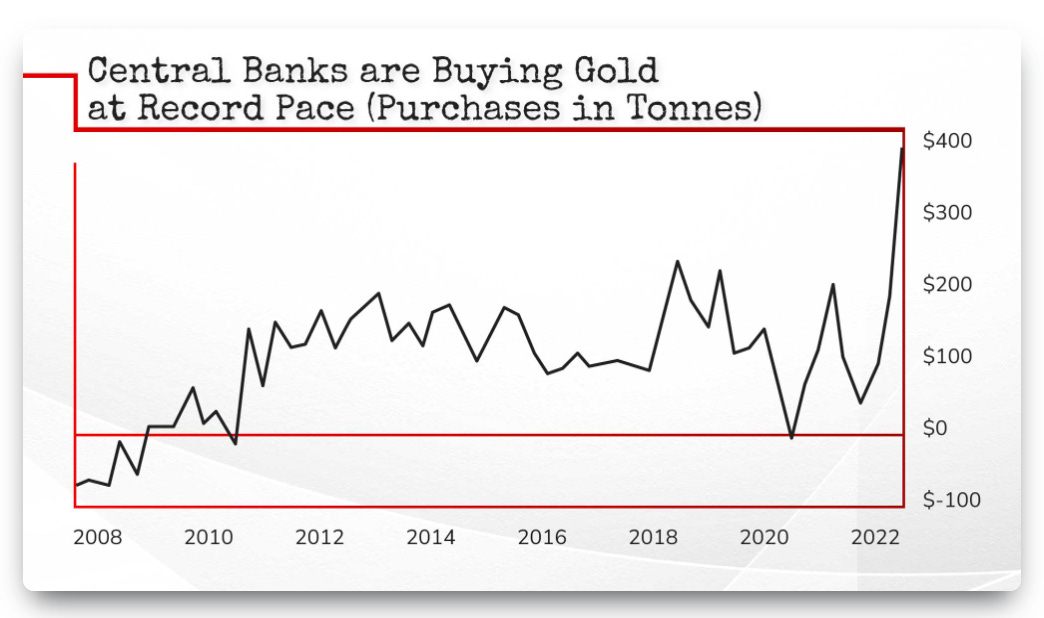

Reason #3 - Central Banks are Buying Gold at Record Pace

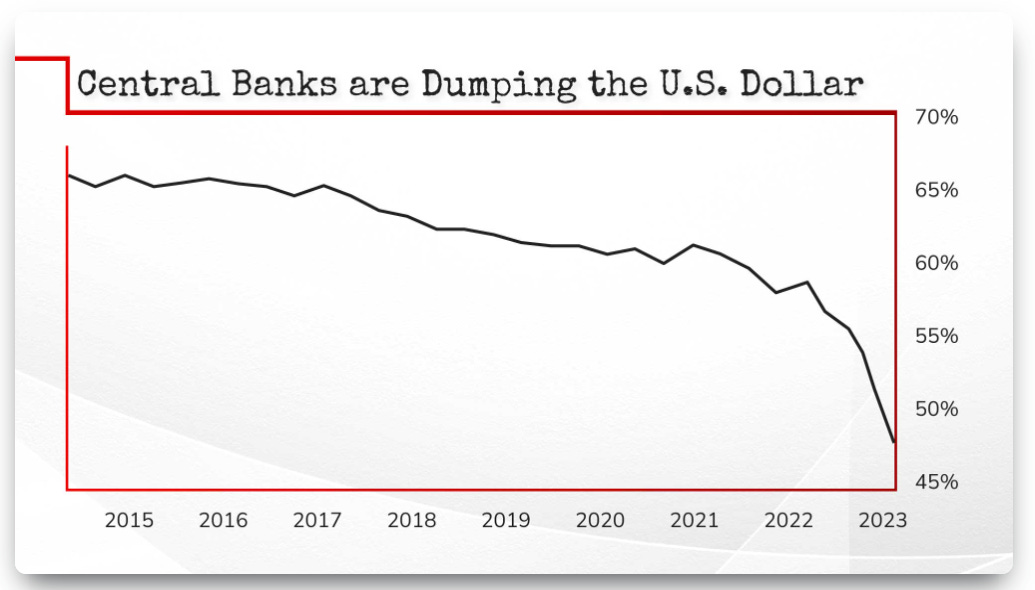

U.S. dollar hegemony is over, meaning we are now watching in real time the dwindling dominance of the U.S. dollar in the global monetary system.

This means the dollar must share the stage with other trade methods (international trade, investment, and financial transactions.)

Other nations are also dumping their U.S. Treasury percentages in favor of Gold.

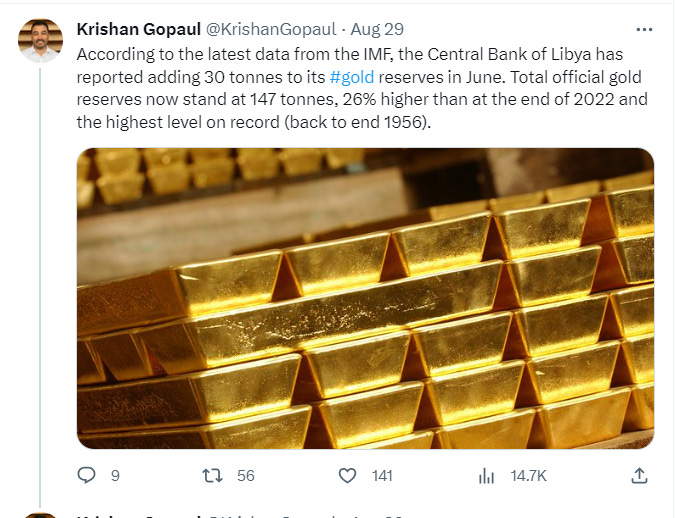

- According to the latest data from the IMF, the Central Bank of Libya has reported adding 30 tonnes to its gold reserves in June. Total official gold reserves now stand at 147 tonnes, 26% higher than at the end of 2022 and the highest on record (back to end 1956).

- The Qatar Central Bank added 3 tonnes of Gold to its reserves in July. This lifts YTD net purchases to nearly 5 tonnes, taking total gold reserves to 97 tonnes [via IMF IFS].

- Central Bank of Turkey data shows that its gold reserves rose by 17 tonnes in July, adding to the 11 tonnes bought in June when it resumed net buying after heavy net selling between March-May. YTD net sales total 85 tonnes, with total gold reserves at 457 tonnes.

- The Czech National Bank added 2 tonnes to its gold reserves in July. Year-to-date net buying now totals nearly 10 tonnes, with gold holdings over 21 tonnes.

- The latest data from the IMF shows that the National Bank of Poland increased its gold reserves by 22 tonnes in July. This brings year-to-date net purchases to 71 tonnes and lifts total gold reserves to 299 tonnes.

- The People's Bank of China reported gold purchases of 23 tonnes in July, lifting year-to-date purchases to 126 tonnes. Its gold reserves now stand at 2,136 tonnes.

Source, World Gold Council [data via IMF IFS]

Reason #4 - Holding Wealth outside a Central Bank Digital Currency (CBDC)

In February 2022, the U.S. government (as they've done before) began escalating, weaponizing the U.S. dollar. In response to Russia's war with Ukraine, The U.S. froze ALL the dollar reserves of Russia's central bank. That was $630 billion.

To be clear, these were not American assets.

These were dollars owned by the Russian Central Bank and the Russian people.

But because they were held in U.S. dollars, our government had the ability to freeze them. So the rest of the world watched that unprecedented move…

And they started thinking…

"Wait a second… if the U.S. can do that to Russia, a nuclear superpower, they can do that to anyone."

That's why many nations from Asia to Europe and Latin America have recently announced plans to dump the U.S. dollar…

So the US isn’t going to just sit back and let this trajectory come to its logical conclusion (which is dethroning the US dollar) This would put the Parasitic Class (Central Bankers and their client politicians) out of business. Instead you will see a Central Bank Digital Currency within the next year.

The CBDC has these disturbing features:

1. Since it is digital it can be tracked (just like when you search for shoes online and over the next few hours all you see are shoe ads online, or when your smart phone asks you if you want to write a review at the restaurant you just visited)

2. Your funds can be frozen (taxes can be automatically deducted, same with police tickets)

3. Your funds can expire (this is the ultimate social control and the way the State can silence people who protest wars or want civil rights)

During the era of Central Bank total control those with real money (silver and gold) will have more negotiating power by having less dependence on The Fed.

Gold and Silver are set up to challenge these Dystopian initiatives like

https://id2020.org/ which will be linked to the Central Bank Digital Currency

From the ID2020 website (their goal is to set the global standards for a personal digital ID to tie together:

- E-passports

- Driver’s licenses

- Debit and credit cards

- Transit passes

- Health records

- Bank accounts

- All in a single, Digital ID to tie our entire lives together…

A CBDC is only possible if you force everyone on to the platform. Gold and Silver are the anti-CBDC.

Reason #5 - Emergence of BRICS

80% of the World’s oil flows through BRICS+ which means US Dollar is now circling the drain.

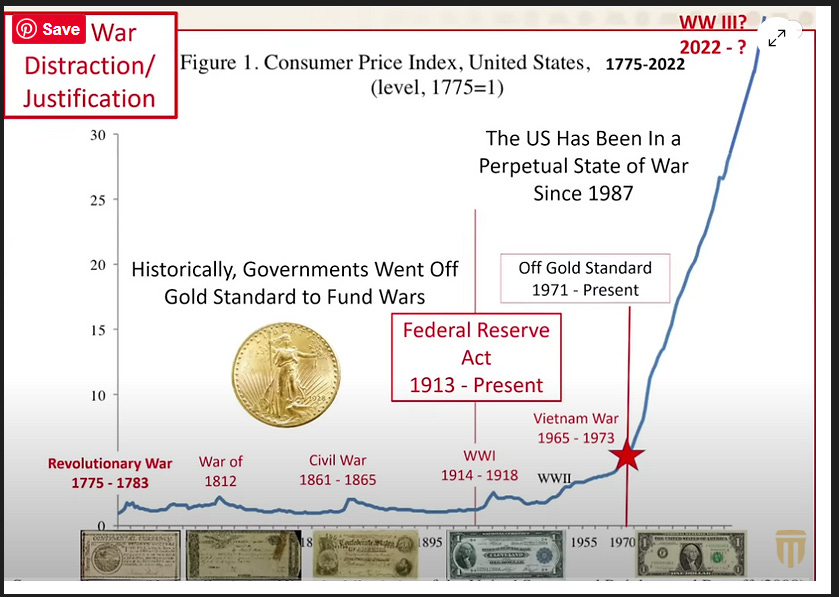

In 1971 President Nixon shocked the World by removing the gold peg from the US dollar and since that time look what happened.

There was a time when politicians had to return to their districts to justify wars precisely because wars are most always immoral and always expensive. Once the US could print money to finance wars the wars have accelerated. There have been over 57 undeclared wars in US since WW2 ( a story never told in mainstream media)

But Nixon and Kissinger convinced Saudi Arabia to transact oil in US dollars so the US had a “gold substitute” to anchor the dollar but in a matter of weeks here is what has happened

In a matter of weeks, Saudi Arabia has:

1. Restored relations with Iran.

2. Restored relations with Syria and welcomed it back to Arab League.

3. Supported multiple OPEC+ oil production cuts against American wishes.

4. Announced an end to the war in Yemen.

5. Agreed to sell oil in other currencies.

6. Decided to join the Shanghai Cooperation Organization (SCO).

BRICS just met August 22 through 24 and they are engineering systems exchanging a barrel of oil for a gram of gold.

Soon the plan is to make the trade based on two barrels of oil for the same gram of gold which will double the price of gold meaning the West will completely lose control of manipulating the gold price and the oil price. Gold and oil are Planet Earth’s most valuable commodities and now BRICS controls both.

Reason #6 - All Paper Currencies Die, Not one Fiat currency has ever lasted

There are numerous reasons why all paper currencies die, but in general, the reasons are tied to this same pattern.

1. A nation has a lust for blood in unending wars (Athens, Rome, Spain, France, Germany, British, USA)

2. The Parasitic Class cozies up to corporate elites and rigs monetary policy, leading to an unsustainable and unhealthy wealth divide. The republic may begin as a representative democracy but, over time, morphs into an autocracy or plutocracy (ruled by an elite few)

3. But then ends up a kleptocracy (theft by the Parasitic Class in the wide open); think of Trumps kids fast-tracking patents or Hunter Biden brokering enormous energy deals in China, Ukraine or members of Congress transacting on Wall Street post “classified” briefings which is “insider” training (you go to jail if you do it, they retire rich when they do it)

Holding gold and silver protects you from having paper notes that are becoming increasingly worthless year after year.