As FOMC readies its .25% rate hike today…

In 2021 and 2022 we called the Federal Reserve “tardy” on several occasions as they doggedly held to their “transitory” inflation stance long after reasonable people (using the right indicators) would have given up on such a notion. In this May 2, 2022 article we noted that they had finally started to move… too late.

Eggheads tardy in doing the right thing

The CNBC article from which the above photo came noted that Ms. Brainard said the Fed could start reducing its balance sheet as soon as May at “a rapid pace”.

A rapid pace? Why that sounds a little desperate. Almost as if the big brains at the Fed had issued a collective “RUH ROH!!” as the final vestiges of their “transitory inflation” fantasy had slipped away into the ether and all at once they realized something drastic had to be done.

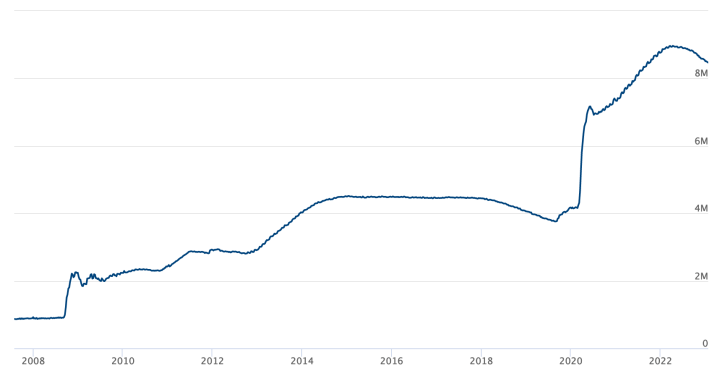

The Fed’s balance sheet, you ask? Well, it’s not a pretty sight as the Fed of today continues to cobble away at trying to fix the grossest distortion to date in its inflationary monetary policy. The 2008 spike, which seemed extreme at the time, is nothing compared to what went on in 2020.

Source: Federal Reserve

Source: Federal Reserve

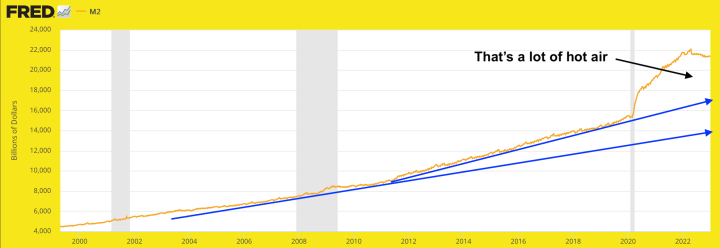

But it is not just the balance sheet that was put in an extreme condition. The M2 aggregate of money supply also makes the previous gross panic of 2008 look like a little blip (it wasn’t). M2 was blown out of previous trends and it is a good bet that pictures like these are what the desperately hawkish Fed has been trying to address since last spring.

Source: St. Louis Fed (my markups)

Source: St. Louis Fed (my markups)

There must be consequences to something as important (to a Keynesian monetary system) as gross distortions born of excess and previously free license to inflate the system at every deflationary turn (e.g. Q4, 2008 & Q1, 2020). It’s not magic after all, much though the Fed has over the years tried to work it as such (successfully until the current cycle).

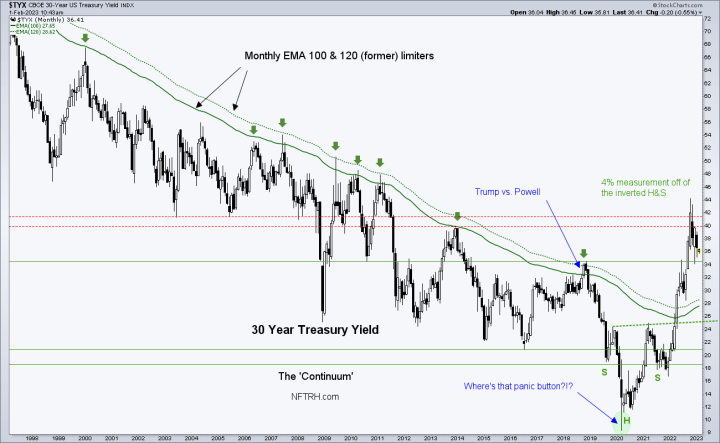

We knew something was very wrong when the “Continuum”, AKA 30 year Treasury bond yield, AKA an NFTRH tool used to measure the Fed’s ability to inflate the system at every turn toward a deflation scare since the 1980s, broke its decades old trend of disinflationary signaling. Boy did it bust it, but good!

The bullish Inverted Head & Shoulders pattern shown on the yield is the mirror of the bearish H&S that showed up on the long bond. A hysterical bond bear market spiked yields up and through the previously limiting moving averages and well Dorothy, we’re not in Kansas anymore.

Here on Fed day I am not going to go into the details of what it all may mean. There are too many details and probabilities, which will be left for NFTRH and its forward strategies to interpret.

What I wanted to illustrate above, as a panel of eggheads readies its “decision”, is that the macro we knew for decades is not the macro ahead… and the Fed knows it. So if you are thinking logically and in linear fashion per the last few decades you might want to hit refresh on that. The above are stark pictures of one thing (today’s macro) that is not at all like the other thing (yesterday’s macro).

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.