“In investing, the return you want should depend on whether you want to eat well or sleep well.”

—J. Kenfield Morley, sales manager Bell & Howell Co., in The Rotarian February 1937, “Some things I believe.”

“An economist is someone who sees something happen and then wonders if would work in theory.”

—Ronald Reagan, 40th president of the United States 1981–1989, 33rd governor of California 1967–1975, Hollywood actor, union leader, radio sports commentator; 1911–2004

“When a falling stock becomes a screaming buy because it cannot conceivably drop further, try to buy 30% lower.”

—Al Rizzo, investment advisor, Dynamic Growth Letter (1986)

Inflation Headlines January 12, 2022

–Surging prices: Key inflation measure hits a 39-year high – CNN

–U.S. consumer prices increase strongly in December – Reuters

–Stock futures climb after in-line inflation report – Bloomberg

–Consumer prices rise 0.5% in December and push inflation rate to nearly 40-year high of 7% - MarketWatch

–Inflation surges 7% in December, highest rate in 40 years – Fox News

The world is coming to an end. Or so it would seem. But maybe not because the stock market went up. Inflation? Piffle. Just a (transitory) annoyance. Or so it would seem, given an initial positive stock market reaction. But will it hold? Probably not. The Fed remains poised to hike interest rates. For the record, inflation as measured by the U.S. CPI rose 7% year-over-year (y-o-y) to December 2021. A 7% handle hadn’t been seen since 1982. Core inflation (less food and energy) rose 5.5% y-o-y. Both were largely as expected. The Fed pays more heed to the core rate as if people don’t eat or drive cars, heat their homes, etc. The two can be volatile which is the prime reason the core excludes them. There is little expectation that inflation will moderate for the next few months, at least.

“The economy no longer needs or wants the very highly accommodative policies we’ve had in place to deal with the pandemic and the aftermath” —Federal Reserve Chairman Jerome Powell, January 11, 2022

The producer price index (PPI) also came out this week. The results were much the same. Y-o-y the PPI rose pretty well in line with expectations at 9.7%. The core PPI rose 8.3% above the expected 7.8%. But, in a possible piece of good news, the December PPI rose only 0.2% below the expected 0.4%. But then the core PPI rose, as expected, 0.5%.

However, the pandemic is not over. Omicron is everywhere and it seems as if no one is being spared. Daily global 7-day average cases are 2.8 million. In the U.S. the 7-day average of cases is over 750,000. And that is just the reported cases. Absenteeism is rampant. Mandates are kicking in particularly as it applies to truckers crossing borders. It is estimated that only about 50% of U.S. truckers are vaccinated. The number is higher for Canadian truckers. Given an already short supply of truckers, this will exacerbate the problem, which will feed itself into food inflation and more. Taken together, absenteeism and mandates, that in turn exacerbates the supply disruptions and shortages which in turn feeds inflation

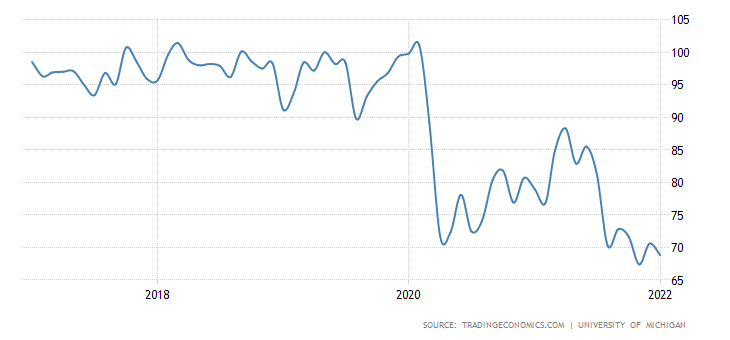

Yet the Fed is taking away the “punch bowl.” QE will end in March. Three, even four interest rate hikes are projected for 2022 with apparently even some Fed officials leaning towards four hikes. The first hike would come in March. There has been talk of QT (i.e., quantitative tightening, where the Fed sells securities). We won’t see the full impact of the Omicron until the January numbers are released in February. We are not expecting them to be very good. In a possible early warm-up for the January employment numbers, it was reported this week that initial claims were 230,000, well above the anticipated 200,000. Worse, retail sales for December were actually negative, coming in at -1.9% when the market expected a 0.3% rise. Consumer confidence has also sunk with the Michigan Consumer Sentiment Index registering at 68.8 below the expected 70.4. It’s the second lowest in a decade.

So, does all of this matter as long as the stock market keeps going up? Seems not. For the most part, the stock market historically usually keeps going up, at least through the early phase of interest rate hikes. Elsewhere, the response to the inflation numbers was slightly different. The U.S dollar fell and bond yields fell slightly before rebounding higher again. Gold did go up but not by much and the gold stocks were mixed. Gold is struggling to clear $1,820. While bond yields fell short, short-rates tightened up narrowing the yield curve. And, according to Jeffrey Gundlach, the billionaire bond investor, that signals that the Fed could spark a recession.

The Fed is typically behind raising rates—too late, then too much. Bond yields are not exactly busting out, despite possible technical targets at higher levels. A narrowing yield curve is often associated with a coming recession, although we are a long way from a negative yield curve signalling a potential recession as we have seen in the past. Four rate hikes might do it. Add in the possibility of the Fed slashing its balance sheet and the question could quickly go from a recession maybe to a recession when. The Fed is probably trying to engineer a soft landing. Odds of success are low. It has been a very confusing market. By almost any historical measurement stocks are overvalued. But the persistence of a hugely negative yield curve vs. the CPI says stocks are actually cheap compared to bonds.

The rest of the page is blank

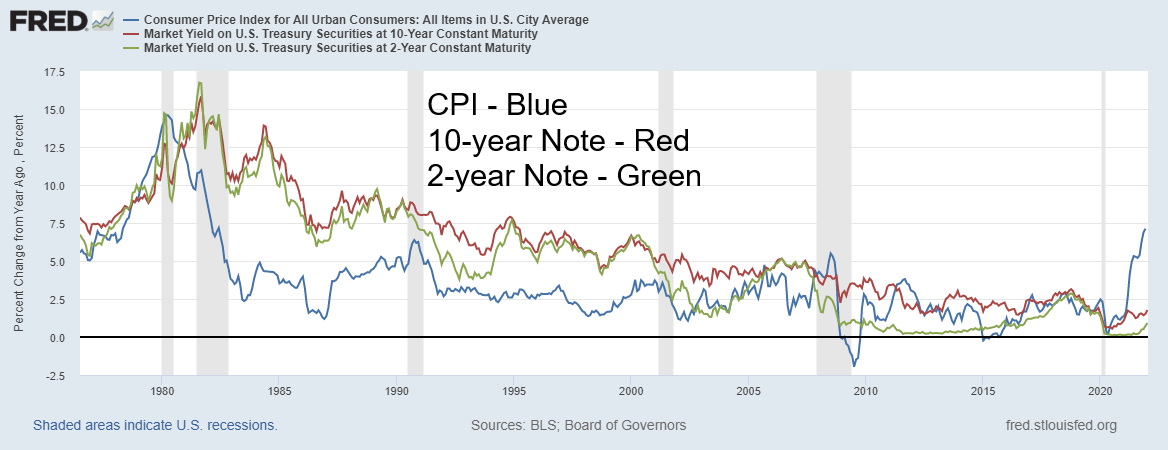

CPI, 10-year Note, 2-year Note

Source: www.stlouisfed.org

A year ago in January 2021, the spread between the CPI and the 10-year was 12 bp, the CPI and the 2-year 123 bp. The 2-year–10-year spread was 111 bp. Today they stand at 539 bp, 622 bp, and 83 bp respectively. Raising rates may not do much to take the 10-year much higher but the 2-year could rise sharply, thus narrowing the yield curve further.

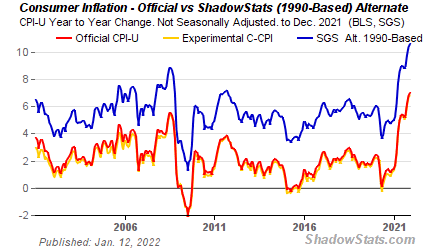

Source: www.shadowstats.com

Shadow Stats (www.shadowstats.com) tracks inflation as it was calculated in 1990. This was before methodological shifts suppressed inflation that moved the concept of the CPI away from being a measurement of the cost of living to one needed to maintain a standard of living. Based on the 1990 methodology, the CPI for December y-o-y rose 15.2%—more than double the officially reported CPI rise of 7.0%. If we thought a

negative spread of almost 525 bp was high between the 10-year note and the official CPI, a negative spread of 1343 bp between the 10-year note and the 1990 CPI is astronomical. And unheard of.

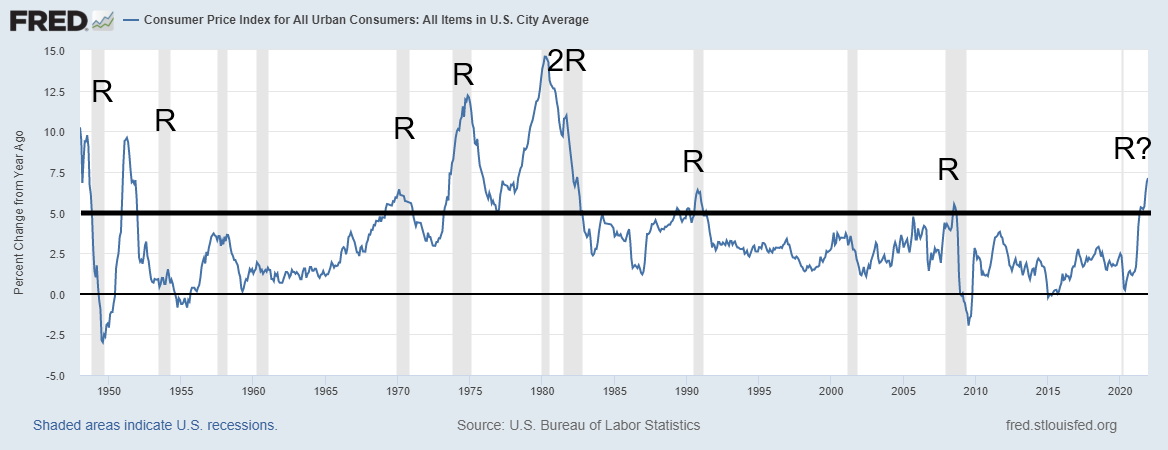

One thing we noticed is that almost every time inflation rose over 5% since 1949 a recession has followed. Does that hold true again? Recessions followed spikes in inflation at 5% or higher in 1948–1949, 1953–1954 (although that one delayed a good two years after the peak in inflation), 1969–1970, 1973–1975, the double dip recession 1980 and 1981–1982, 1990–1991, and 2007–2009. Inflation peaked under 5% before recessions in 1960–1961 and in 2000–2002. These were the only two misses. By that measurement, seeing inflation rise over 5% has 80% accuracy of calling a recession since 1948. What this could be is a double dip recession like we saw in 1980 and 1981–1982. The second recession was longer and deeper than the initial recession in 1980. That doesn’t portend well for the possibility of another recession following the 2020 pandemic recession.

Source: www.stlouisfed.org

Investors have enjoyed a powerful 12-year bull market. Thanks should be given to the guardians of the Federal Reserve and other central banks around the world for dropping interest rates to zero (even to negative as we saw in the EU and Japan) and pumping up the money supply and providing trillions in liquidity through QE. Since the March 2009 low following the 2007–2009 recession and the 2008 financial meltdown the S&P 500 has gained 592%. Money supply as measured by M2 is up 156% and up 38.5% since February 2020. But the real explosion has been in M1 that is up 1,288% since March 2009 (the bottom of the stock market) and up 405% since February 2020. No wonder we have seen asset inflation in the stock market and housing. Monetary growth has been the primary driver, coupled with ultra-low interest rates and massive stimulation from the Fed and to a lesser extent the BofC.

There have been three significant corrections during that period: 2011, 2015/2016, and 2020. The swiftest and the steepest was the 33.9% pandemic collapse in March 2020. Arguably, we could say this is not over yet. From 1982 to 2000 the S&P 500 gained 1,431%, an incredible bull-market run. There were four significant corrections: 1984, 1987, 1990, and 1998. The steepest was the 33.5% correction in 1987.

We are awaiting the front page from The Economist on soaring inflation to signal that inflation is most likely peaked. We were pointed to this front page of The Economist from December 2020. In December 2020 y-o-y inflation was 1.3%. Headlines like this often signal important tops and bottoms. The absolute bottom was in May 2020 when y-o-y inflation, as measured by the CPI, rose 0.2%.

The Economist December 2020

Source: www.economist.com

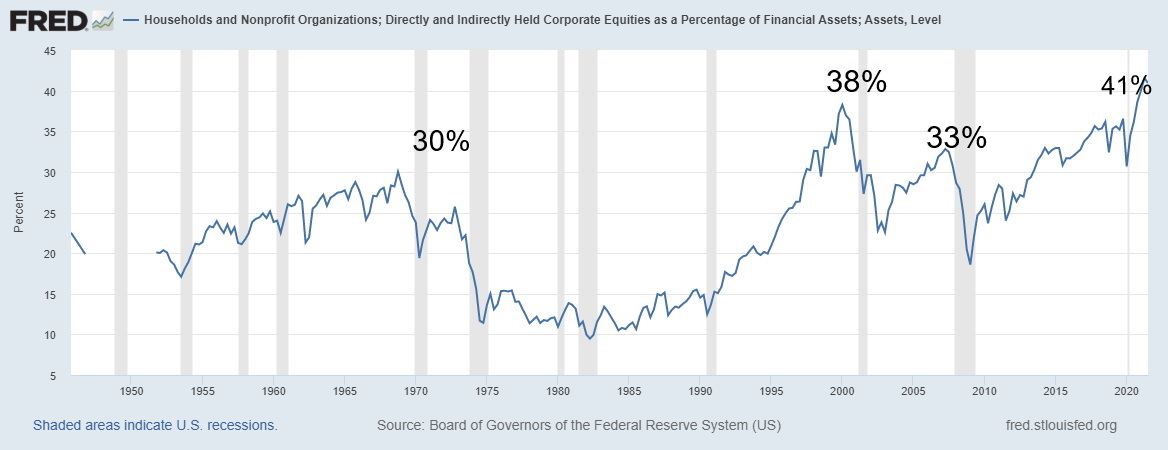

A characteristic of previous major tops in the stock markets was the participation of households in the market. It is not surprising today to find that households are at record levels for equities. David Rosenberg of Rosenberg Research (www.rosenbergresearch.com) recently noted this. In Q4 1968 household equity exposure as a percentage of financial assets hit 30%. Over the next two years the S&P 500 fell 36.1%. Following a recovery into Q4 1972 when exposure hit about 26% another drop set in as the S&P 500 fell 48.2% into 1974. In Q1 2000 exposure hit 38%. The S&P 500 fell 49.1% into 2002. Another recovery saw equity exposure hit 33% in Q2 2007. Again, the market fell 56.8% into 2008/2009.

Here we are again, only household equity exposure has hit a record 41.5% in Q2 2021. Q3 2021 saw exposure fall slightly to 40.9%. It’s a big warning sign. Households (the public) are typically overexposed at tops and underexposed at bottoms. Could we be facing a coming stock market correction of 50% + as we have seen in the past?

Households & Non-Profit Organizations: Directly and Indirectly Held Corporate Equities as a % of Financial Assets 1945–2021

Source: www.stlouisfed.org

Household and non-profit organizations’ total net worth hit a record $144.7 trillion Q3 2021. Some $110 trillion is in financial assets. Roughly $45 trillion of those financial assets are in equities. Household debt in the U.S. totals $21.2 trillion, 90.5% of GDP. In Canada, household debt to GDP is 109.4%, one of the highest in the world, surpassed only by Switzerland, Australia, and Norway.

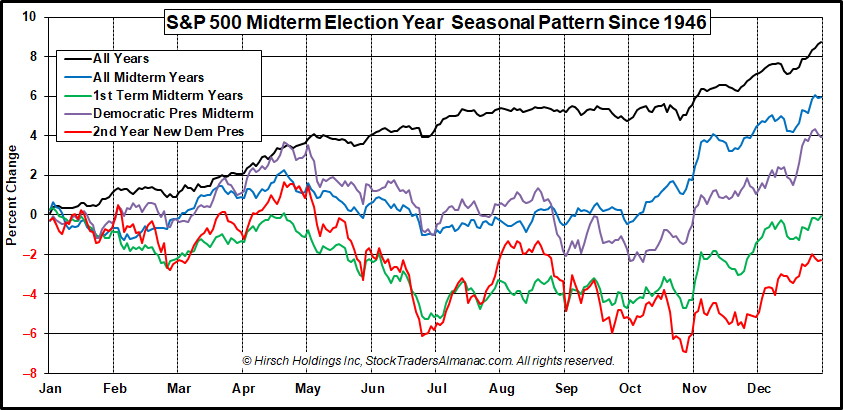

2022 is a midterm election year. According to the Stock Trader’s Almanac (www.stocktradersalmanac.com), markets tend to be weak into the November election. Our chart below from the Stock Trader’s Almanac shows the weakness including first term midterm years, Democratic president’s mid-term years, second year Democratic midterm years, and all midterm years. Consistently, weakness was visible into the midterm election; then once it was out of the way the market rallied, often putting the markets back in the black by year-end. We are reminded that the first week January barometer saw the markets fall which could portend a difficult year ahead. Still to be determined is the January barometer, and if January ends in the red then it too could portend a difficult year ahead.

Rest of page is blank

Source: www.stocktradersalmanac.com

There are numerous negative signs in the background.

- The record-shattering Omicron wave with potentially negative effects on employment and the economy as retail sales fall and consumer confidence falls.

- Rising damage from climate change—2021 saw numerous natural disasters costing economic losses of $283 billion of which only 38% was covered by insurance. The top three natural disasters were Hurricane Ida, the European floods, and the Texas winter storm. The numerous fires and floods didn’t crack the top 3. Hundreds of lives were lost. Thousands were left homeless. The expectation is that 2022 will be another year of costly natural disasters. Climate refugees are growing worldwide, including here in Canada and the U.S.

- The ongoing dispute with Russia. Is Russia getting serious about preparation for war? We have learned that Russia has eliminated most if not all debt in U.S. dollars and euros in their portfolios and shored up with gold and yuan debt. Threats of sanctions overlook the fact that Russia could turn off the EU pipeline taps in the dead of winter. As well, Russia is already working on workarounds for any sanctions that include forging more mutual interests with China. Cyberwar is a strong possibility, more so than a shooting war.

- The U.S. is very polarized with an election coming in November. There are and have been threats of violence. In some respects, the election has been pre-ordained with cries that if the Democrats win it is through fraud. Republican state-controlled legislatures have passed laws that include voter suppression, gerrymandering, and allowing the state legislature determine who the winner is. None of this bodes well, particularly if both sides claim fraud if the other side wins. A constitutional crisis could follow.

We were struck by all the end-of-the-world headlines pertaining to inflation. These types of headlines tend to show up at tops (the opposite at bottoms). However, we’ll wait for our front page from The Economist to signal the top. Nonetheless, there are a lot of danger signs on the horizon in an

overvalued market. While the timing may not be perfectly right, owning gold and treasury bonds as protection and a hedge may prove to be not such a bad idea. Although we do note that in the event of a stock market meltdown it becomes a liquidity crisis and gold and gold stocks get thrown out along with everything else. Gold tends to outperform in these situations but the gold stocks tend to underperform because of a lack of liquidity. If the stock market falls 50% the gold stocks fall 60%.

Treasury bonds perform well. However, a word of warning on treasury bonds. There are negative real interest rates. So, buying bonds is on the surface “madness” as some have described it. Buying the 10-year at 1.7% when inflation is 7% is not the best move. But if the stock market breaks, then bond prices tend to rise (yields fall as yields move inversely to prices).

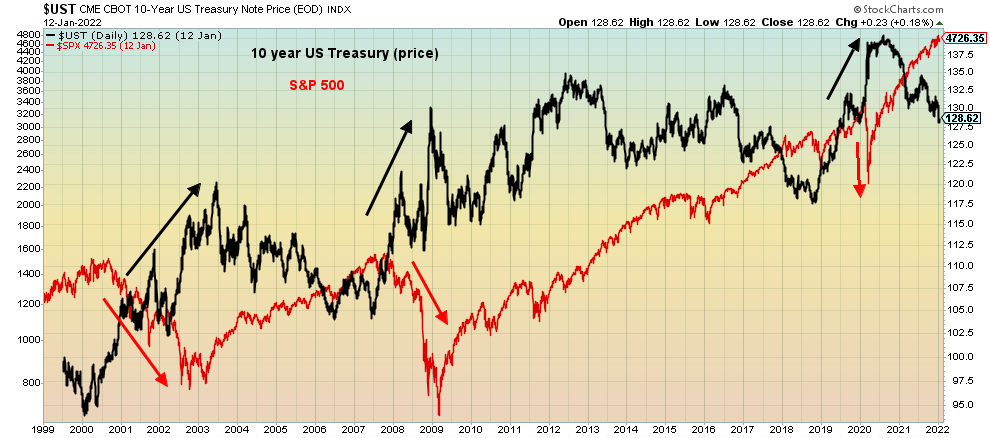

Our chart below shows the 10-year U.S. treasury note vs. the S&P 500. Noticeably, during the 2001–2002 crash, the 2008–2009 crash, and the pandemic crash of March 2020 as the S&P 500 fell, bond prices rose. In between not so much. We suspect that the current rise in yields is to form what appears to be a 3-year cycle low. Bonds tend to move in 6-year cycles of lows (troughs) for prices. Significant lows were seen in 1981, 1987, 1994, 2000, 2006, 2011, and 2018. The next one is due around 2024. But the half-cycle 3-year cycle low could be in formation now. In the event of a market meltdown, bonds are the place to be. Note that bond prices below tended to start rising before the stock market topped and broke down.

Source: www.stockcharts.com

As for inflation, we do note that inflation spiked in 1918–1920 during the Spanish flu as well. While the Fed is believed to be on target for three, possibly four rate hikes this coming year we wonder if it is all talk. As we have often noted, the Fed is trapped. Raise rates too much and you risk crashing the stock and housing market. The Fed could be trying to jawbone the market down for a soft landing.

Mortgage rates have already begun to tick higher, although they are not yet at a point that could spark a problem. But the Fed might be happy with inflation high as that devalues the debt. After all, it worked in the 1950s as they kept interest rates low even as inflation rose. This helped work off the massive debts from

World War II. The same could be at work this time, given the massive debts as a result of the pandemic and the potential for more debt to deal with effects of climate change. Ultimately, that could be a short-term negative for the stock markets as we go into the midterms, but it could be bullish coming out of them.

Chart of the Week

Source: www.stockcharts.com

- Artificial intelligence

- Robotic process automation

- Edge computing

- Quantum computing

- Virtual reality

- Blockchain

- Internet (metaverse?)

- 5G (or higher)

- Cyber security

- Electric vehicles and other clean energy innovations

- Biotechnology

We can’t hope to identify all of the companies that are involved, but one thing we can note is all of these technologies are going to require a lot of minerals—copper, lithium, uranium, gold, silver, molybdenum, chromium, and more. Finding these minerals is one thing. Finding supplies and grades in sufficient quantity to build a mine is another thing. Assuming one finds the mineral and determines it is mineable, it takes years to build a mine. It is not atypical that from the time a drill goes in the ground until a mine gets built 15 years have passed.

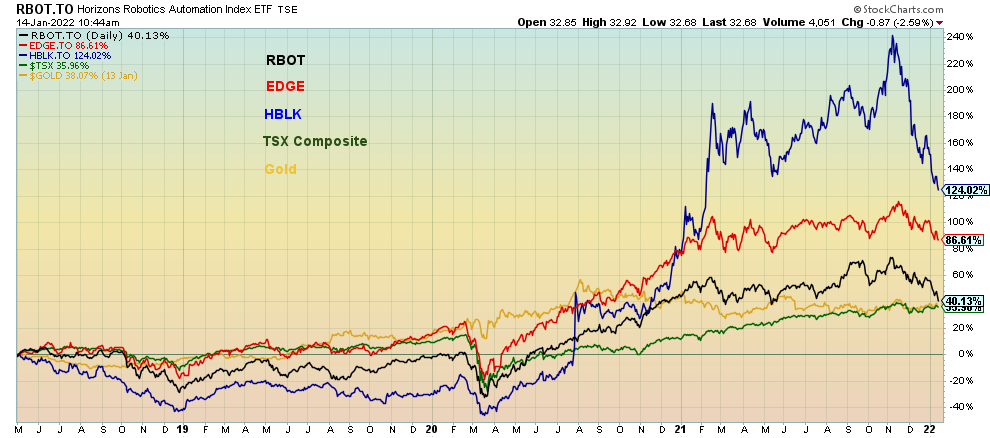

We decided to take a look at a select few ETFs (exchange-traded funds) that trade here in Canada to see how they looked strictly from a technical standpoint. Even more ETFs are available on U.S. exchanges, too many to list.

The three we picked are:

- Horizon’s Robotics Automation Index (ROBT/TSX)

- Evolve Innovation (EDGE/TSX) – electric vehicles and more

- Blockchain Technologies (HBLK/TSX)

This is not a recommendation to purchase these ETFs. ETFs are merely a way to participate in the market without having to research individual companies. Many individual companies may well outperform the ETFs. We are using the ETFs as an example. The patterns we see above are very similar to many other technology ETFs we looked at. While Microsoft, Apple, Amazon, Nvidia, etc. may have dominated during the past decade, the coming decade could see different companies dominate, particularly ones from the growing technology sectors noted above.

What was consistent with all three charts as well as many others we looked at is that they have all taken quite a hit over the past the past couple of months. RBOT is down about 20% from its November high, EDGE is off roughly 14%, and HBLK is down a very bearish 36%. All three are at or near major support lines. Indicators are

in oversold to deeply oversold territory. We did not examine as to why they have fallen so hard. Ours is an observation that they have fallen hard and are at/near major support and that they are oversold.

Since the March 2020 pandemic crash stock markets have been on quite a tear to the upside. All three, we note, have outperformed the TSX Composite and gold since March 2020. And that is despite the sharp drop

over the past couple of months. Given the importance that these technology sectors could play in our economy over the next decade, the sector could appear to be on the cusp of a potential buying opportunity.

Source: www.stockcharts.com

MARKETS AND TRENDS

|

|

|

|

% Gains (Losses) Trends

|

|

||||

|

|

Close Dec 31/21 |

Close Jan 14/22 |

Week |

YTD |

Daily (Short Term) |

Weekly (Intermediate) |

Monthly (Long Term) |

|

|

Stock Market Indices |

|

|

|

|

|

|

|

|

|

S&P 500 |

4,766.18 |

4,662.85 |

(0.3)% |

(2.2)% |

down (weak) |

up |

up |

|

|

Dow Jones Industrials |

36,333.30 |

35,911.81 |

(0.9)% |

(1.2)% |

neutral |

up |

up |

|

|

Dow Jones Transports |

16,478.26 |

15,904.96 |

(2.2)% |

(3.5)% |

down |

up |

up |

|

|

NASDAQ |

15,644.97 |

14,893.75 |

(0.3)% |

(4.8)% |

down |

neutral |

up |

|

|

S&P/TSX Composite |

21,222.84 |

21,357.56 |

1.3% |

0.6% |

up (weak) |

up |

up |

|

|

S&P/TSX Venture (CDNX) |

939.18 |

902.81 |

(1.0)% |

(3.9)% |

down |

down |

up |

|

|

S&P 600 |

1,401.71 |

1,388.27 |

0.3% |

(1.0)% |

neutral |

up |

up |

|

|

MSCI World Index |

2,354.17 |

2,383.17 |

1.8% |

1.2% |

up |

up |

up |

|

|

NYSE Bitcoin Index |

47,907.71 |

43,083.42 |

4.2% |

(10.1)% |

down |

down (weak) |

up |

|

|

|

|

|

|

|

|

|

|

|

|

Gold Mining Stock Indices |

|

|

|

|

|

|

|

|

|

Gold Bugs Index (HUI) |

258.87 |

251.62 |

3.4% |

(2.8)% |

down |

down |

neutral |

|

|

TSX Gold Index (TGD) |

292.16 |

280.18 |

2.3% |

(4.1)% |

down |

down |

neutral |

|

|

|

|

|

|

|

|

|

|

|

|

Fixed Income Yields/Spreads |

|

|

|

|

|

|

|

|

|

U.S. 10-Year Treasury Bond yield |

1.52% |

1.79% (new highs) |

1.7% |

17.8% |

|

|

|

|

|

Cdn. 10-Year Bond CGB yield |

1.43% |

1.77% |

2.3% |

23.8% |

|

|

|

|

|

Recession Watch Spreads |

|

|

|

|

|

|

|

|

|

U.S. 2-year 10-year Treasury spread |

0.79% |

0.82% |

(8.9)% |

3.8% |

|

|

|

|

|

Cdn 2-year 10-year CGB spread |

0.48% |

0.60% |

(9.1)% |

25.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currencies |

|

|

|

|

|

|

|

|

|

US$ Index |

95.59 |

95.16 |

(0.6)% |

(0.9)% |

down |

up |

neutral |

|

|

Canadian $ |

.7905 |

0.7959 |

0.6% |

0.7% |

up |

down (weak) |

up |

|

|

Euro |

113.74 |

114.14 |

0.5% |

0.4% |

up |

down |

neutral |

|

|

Swiss Franc |

109.77 |

109.45 |

0.5% |

(0.3)% |

up |

neutral |

up |

|

|

British Pound |

135.45 |

136.78 |

0.6% |

1.0% |

up |

neutral |

up |

|

|

Japanese Yen |

86.85 |

87.55 |

1.2% |

0.8% |

up (weak) |

down |

down |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Precious Metals |

|

|

|

|

|

|

|

|

|

Gold |

1,828.60 |

1,816.50 |

1.1% |

(0.7)% |

up |

neutral |

up |

|

|

Silver |

23.35 |

22.92 |

2.3% |

(1.8)% |

up (weak) |

down |

up (weak) |

|

|

Platinum |

966.20 |

964.60 |

0.9% |

(0.2)% |

up (weak) |

down |

neutral |

|

|

|

|

|

|

|

|

|

|

|

|

Base Metals |

|

|

|

|

|

|

|

|

|

Palladium |

1,912.10 |

1,878.20 |

(2.3)% |

(1.8)% |

neutral |

down |

neutral |

|

|

Copper |

4.46 |

4.42 |

0.2% |

(1.0)% |

up |

up (weak) |

up |

|

|

|

|

|

|

|

|

|

|

|

|

Energy |

|

|

|

|

|

|

|

|

|

WTI Oil |

75.21 |

83.82 |

6.2% |

11.5% |

up |

up |

up |

|

|

Natural Gas |

3.73 |

4.26 |

8.7% |

14.2% |

neutral |

neutral |

up |

|

Source: www.stockcharts.com, David Chapman

Note: For an explanation of the trends, see the glossary at the end of this article.

New highs/lows refer to new 52-week highs/lows and, in some cases, all-time highs.

Source: www.stockcharts.com

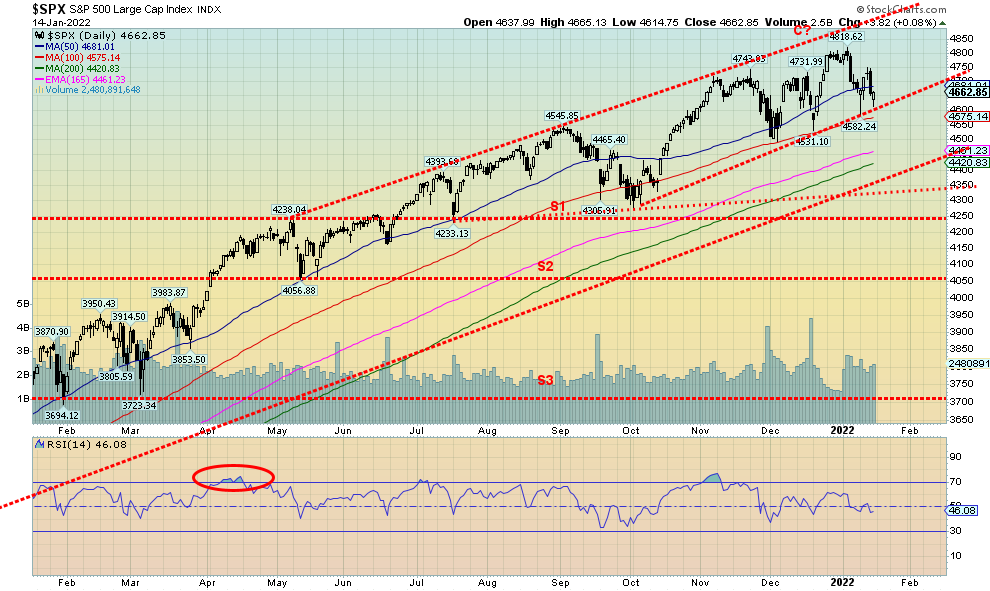

Stock markets wobbled this past week as fear of inflation and fear of interest rate hikes kicked in. The S&P 500 fell 0.3% on the week as markets offset the gains seen earlier in the week. The Dow Jones Industrials (DJI) dropped 0.9%, including a 200-point drop on Friday, while the Dow Jones Transportations (DJT) fell 2.2% on the week. The NASDAQ fell 0.3%. However, the small cap S&P 600 gained up 0.3%. Does that portend a turnaround? In Canada, the TSX Composite held up by Energy and Materials gained 1.3%. But the small cap TSX Venture Exchange (CDNX) dropped 1.0%. In the EU, the London FTSE gained 0.9% but the Paris CAC 40 dropped 1.1% and the German DAX was off 0.4%. In Asia, China’s Shanghai Index (SSEC) was down 1.6% while the Tokyo Nikkei Dow fell 1.2%. Bitcoin gained 4.2% and the MSCI World Index was a star, up 1.8%, hinting that maybe we should be looking at emerging markets.

Surprisingly, the financials, or at least the U.S. financials (banks) wobbled this past week despite reporting of their earnings. Seems the results were underwhelming despite strong numbers. Or maybe investors are getting tired and worried about other things like the sharply rising Omicron numbers and the threat of war Russia/Ukraine/US. As to the financials, well, J.P. Morgan reported profits that topped estimates but it didn’t stop the stock from falling 6%. The same held elsewhere with Citigroup, Wells Fargo, Morgan Stanley, and Goldman Sachs also falling on the week. Okay, sorry, Wells Fargo bucked the downtrend. The opposite of what happened in Canada where the banks rose. Two similar markets, opposite results.

Once again, the S&P 500 came down and tested the uptrend line from September 2021 lows. This is the third test of the line and it is either showing that the markets have resilience or continued pounding will eventually see the line break. Regaining back above 4,750 would be very positive and suggest new highs ahead. But a break of the uptrend line and especially under 4,500 could start a decline to test major long-term support and the 200-day MA near 4,400.

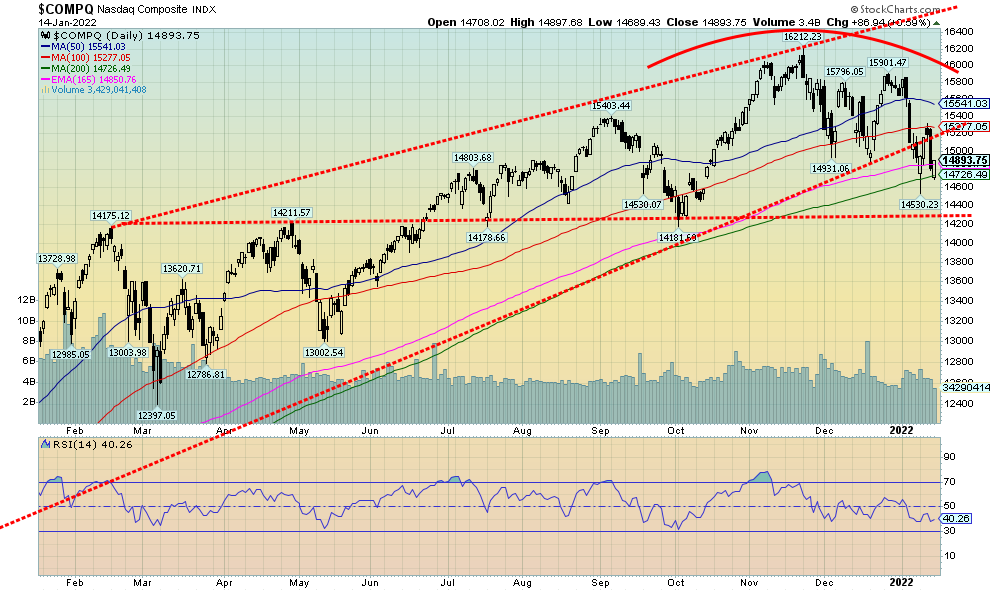

Source: www.stockcharts.com

The NASDAQ continued its recent woes this past week as it fell 0.3%. That was actually good as it wasn’t as bad as the previous week. The NASDAQ is now down 4.8% in the first two weeks of 2022. Before, tech was the star. And now its name is mud. What led the market up could now be leading the market down. After all, the big FAANGs are probably the most over-owned stocks in the world. This past week Meta (Facebook) rose a small 0.1%, Apple was up 0.5%, Amazon fell 0.3%, Netflix dropped 2.8% and is now down 12.7% in two weeks, while Google gained 1.9%. Microsoft fell 1.2%, Tesla was up 2.2%, and Twitter fell 3.1%—it is another big loser, down 11.1% in the first two weeks. The Chinese stocks gained with Baidu up 0.7% and Alibaba up 1.4% (and is now a star up 10.8% in the first two weeks), and finally Nvidia fell 1.1%. Value stocks continued to benefit from recent market turmoil as Berkshire Hathaway, the value stock of value stocks gained 1.3%. The NASDAQ bounced back on Friday after opening lower and testing the 200-day MA once again. Note how the NASDAQ rejected going back up into the bull channel. Yes, the 200-day MA is acting as support as this is the second rejection of the line but ultimately continued testing should lead to a breakdown. We’ll change our mind on that if the NASDAQ were able to regain the turning down 50-day MA currently near 15,540. With an RSI of 40, that’s still pretty neutral and not oversold leaving the NASDAQ room to break lower. Friday’s bounce-back regained a bit of the previous day’s mini-meltdown following release of the PPI.

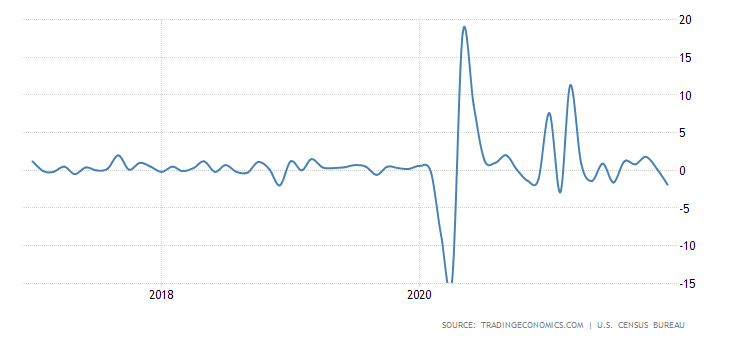

Retail Sales 2017–2021 M-O-M

Source: www.tradingeconomics.com, www.census.gov

Retail sales unexpectedly fell 1.9% in December, the biggest decline since February 2021. It halted four months of decent growth. The market had expected retail sales to grow by 0.3%. Y-o-y retail sales grew 16.9%, largely in line with expectations. The huge surge was tempered by the fact that retail sales were coming out of a big hole from 2020. More telling perhaps were the retail sales in December where ex auto fell 2.3%, well below the expected 0.2% gain. Most sectors saw declines. Retail sales are being negatively impacted by the growing Omicron variant and higher prices (inflation). It was thought that many shopped early to avoid what might have been the Christmas rush. The weak retail sales, coupled with rising inflation, falling consumer sentiment, and a rising trade deficit do not bode well for Q4 GDP.

U.S. Michigan Consumer Sentiment 2017-2022

Source: www.tradingeconomics.com, www.umich.edu

Consumer sentiment is waning. The preliminary reading of the Michigan Consumer Sentiment Index came in below expectations at 68.8. The market had expected 70. It was the second lowest level in a decade. The dip was driven primarily by inflation, unemployment, and the spread of the Delta and Omicron variants. With waning consumer sentiment, it is probably not surprising to see weak retail sales numbers as noted. In a separate reading, consumer inflation expectations rose.

Source: www.stockcharts.com

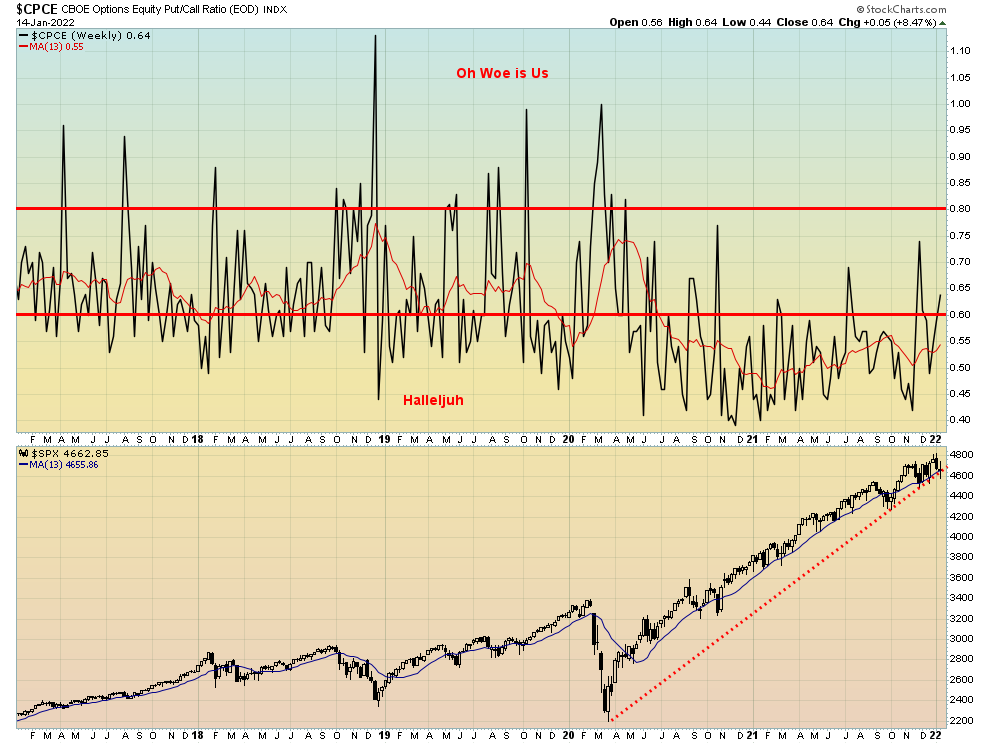

With the stock market wobbling, we’ll keep an eye on the put/call ratio for clues that the market could be bottoming. Typically, the put/call ratio is at extreme calls at market tops and extreme puts at market bottoms. Currently, the put/call ratio is at 0.64, a far cry from the 0.38 seen at market tops but nowhere near highs we saw in December 2018 and March 2020 at stock market bottoms. At 0.64 we are moving into the neutral zone. We’ll monitor the put/call ratio weekly for clues on the state of the stock market.

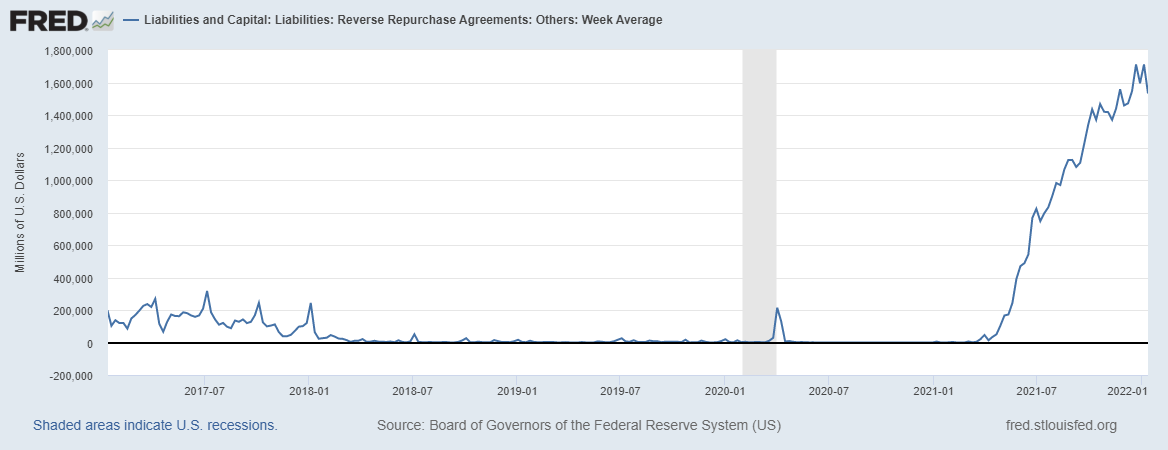

Reverse Repurchase Agreements 2017–2022

Source: www.stlouisfed.org

With the Fed slashing QE, it is quite surprising to see that the Fed is still conducting large reverse repurchase agreements daily. A repurchase agreement occurs when the Fed or anyone agrees to lend funds against collateral of bills, notes, bonds, etc., usually on an overnight basis. A reverse repurchase agreement is the opposite and the Fed instead lends securities into the market for cash and pays an interest rate to the lender. So, on one hand, the Fed giveth through QE and then taketh with the other hand with reverse repurchase agreements. Sounds weird. Except now the Fed is cutting back on the giveth and maintaining the taketh. But what it does accomplish is to help set a floor for money market funds and other securities—meaning that they won’t go negative because the Fed as lender of last resort is willing to pay an interest rate for the privilege of lending out its securities on an overnight/short-term basis. The result is that money market funds in particular are able to continue paying an interest rate, albeit a pretty slim one. What kind of chaos would follow if interest rates went negative as they did in the EU? The EU has effectively destroyed its money and bond markets through negative interest rates. Japan is not far behind. After all these months the Fed is still doing roughly $1.5 trillion of reverse repurchase agreements on each day.

Source: www.stockcharts.com

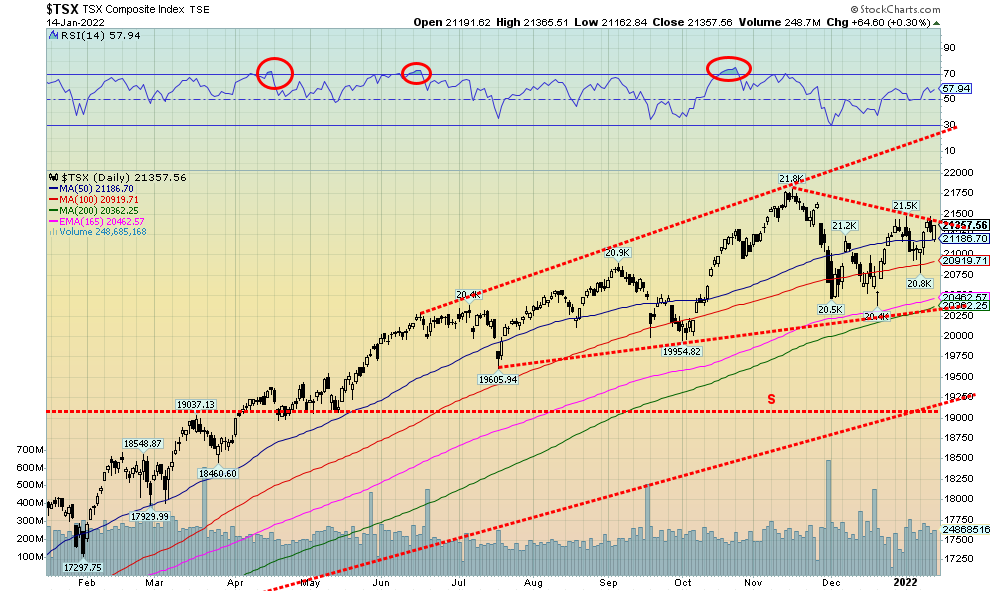

The TSX Composite bucked the downward trend for the stock indices this past week, posting a gain of 1.3%. The TSX was helped by a strong energy sub-index along with good gains for Materials. The Energy (TEN) sub-index gained 7.3% to fresh 52-week highs and Materials (TMT) was up 3.6%. Golds (TGD) also gained up 2.3% as did Mining & Metals (TGM), up 3.2%. Financials (TFS) hit new all-time highs, gaining 2.1%. All in all, seven of the 14 sub-indices gained this past week. Other winners were Consumer Discretionary (TCD) +1.3% and Telecommunications (TTS) +0.8%. Losers were modest. Leading the way was Real Estate (TRE) -1.3% and Utilities (TUT) -1.2%. Outside of Financials, it was not surprising to see interest-sensitive sectors weak. Income Trusts (TCM) were down 0.7%. Other losers were Consumer Staples (TCS) -1.1%, Health Care (THC) -0.3%, Industrials (TIN) -1.1%, and Information Technology (TKK) -1.1%. The small cap TSX Venture Exchange (CDNX) took a hit, down 1.0%. The TSX Composite did hit a downtrend line before turning down on Friday. However, the TSX did bounce back later in the day, giving some hope that the markets might rebound next week. Taking out 21,500 would confirm that a short-term low is in and the focus then could turn to the upside and the November all-time high. It is premature to say that the TSX will break to the upside this coming week, but Friday’s bounceback was encouraging. The TSX wound up in the black with a gain of 0.3%. To the downside there is some support down to 21,175 then 21,000. A breakdown zone is seen at 20,300.

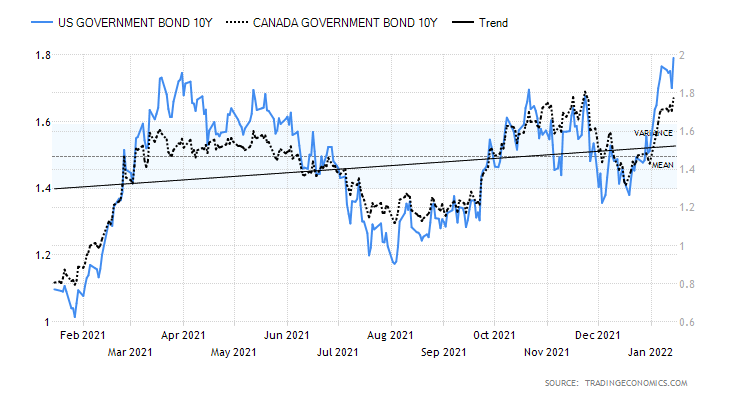

U.S. 10-year Treasury Bond/Canadian 10-year Government Bond (CGB)

Source: www.tradingeconomics.com, www.home.treasury.gov, www.bankofcanada.ca

The U.S. 10-year treasury note hit its highest level since January 2020 as it soared to 1.79% this past week, following the release of the CPI and PPI that showed inflation reached the highest levels since 1982. Given what appears to be a breakout, the 10-year could soar to as high as 2.25% over the next few weeks. That would still be well below the levels seen in 2018 when the 10-year rose to over 3.00%. The Canadian 10-year Government of Canada bond (CGB) also rose, jumping to 1.77%, although that is still short of a recent high near 1.81% seen in November 2021. But a funny thing happened on the way to the Fed. Given the talk from the Fed that there could be three and even four interest rate hikes in 2022, the short-term notes rose at an even faster rate. The U.S. 2-year treasury note jumped to 0.99% up from 0.87%. As a result, the 2–10-year spread fell to 0.80 a decline of 10 bp from the previous week or 11.1%. The Canadian 2–10 spread also fell by 6 bp to 0.60%. Okay, that is a long way still from the 2–10 spread going negative and potentially signaling a recession as it has done on a number of occasions in the past. However, checking the history of the spread we note that it can narrow very quickly in this kind of environment. With inflation hitting the highest level in 40 years, it is putting pressure on the Fed to act now and act quickly to quell inflation. Except, as we know, it is not as easy as that. Raise rates too fast too late and one is more likely to spark stock market turmoil and a recession just as much as you want to lower the rate of inflation. But raising rates is not going to resolve supply disruptions. Raising rates is not going to resolve the Omicron variant and rising absenteeism at companies. All of these are what is feeding price inflation, with wage inflation sure to follow as workers fall behind. We’ve already noted the lower-than-expected retail sales and falling consumer sentiment reported this week. We also noted the sudden jump in weekly initial claims, portending a possible drop in the January nonfarm payrolls

to be reported in the first week of February. However, comments from Fed officials appear to be leaning towards hiking rates and hiking faster and more often than originally thought. That in turn could spark a bond crisis and then a stock market crisis and a housing crisis as they respond to sharply rising interest rates. This coming week is not a big one for numbers, although we will receive a couple of manufacturing indices including the NY Empire State Index and we also get housing starts. Canada will report on inflation and the expectation there is for the y-o-y rate to be 4.7%. Compared to the U.S. rate that’s moderate. Canada will also report on retail sales.

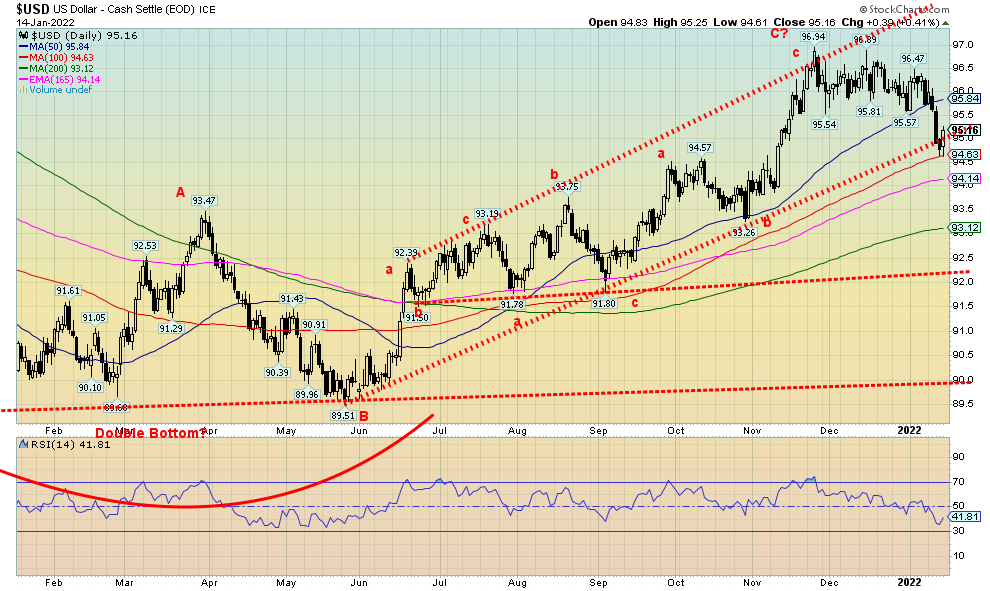

Source: www.stockcharts.com

Is the US$ Index on the cusp of a breakdown? This past week the US$ Index fell 0.6% and broke briefly under an uptrend line from the May low, testing the 100-day MA near 94.60 (low on the week was 94.61). Or is Friday’s upside reversal suggesting we have made at least a temporary bottom and are about to start to climb again? We won’t know for sure until the US$ Index takes out and closes over 96 and preferably over 96.50. There is a suggestion that this is fourth wave up from the May low at 89.51. But the pattern up from that low appears corrective in series of ABC or abcxabc. Only a return back under the week low of 94.61 and especially breaking under 94 would convince us that a potential top is in at 96.94, the high seen in November. The US$ Index needs to break down under 92 to absolutely confirm the top and then target down to at least 90. Under 90 the US$ Index would be entering a more serious bear market. If this is a fourth wave as suggested, then a run back towards to the 96.94 is possible to form wave 5. But that wave could be a failed wave (classic double top) or we see small new highs. We doubt we’d see highs well above 97. The potential for the U.S. to raise rates is very helpful for the U.S. dollar as it would spark further capital outflows, particularly from the EU zone. On the week, the Canadian dollar gained 0.6%, the euro was up 0.5%, the Swiss franc gained 0.5%, the pound sterling was up 0.6%, and the Japanese yen was the star, up 1.2%. A rising Japanese yen is good for gold just as a falling U.S. dollar is also good for gold.

Source: www.macrotrends.net

We are showing this long-term chart of the US$ Index to show how it may have a cycle of around 18 years like so many other markets appear to have. The floating rate U.S. Dollar has been in existence since the early 1970s following former President Richard Nixon taking the world off the gold standard in August 1971. So, there are not a lot of observations. The first trough to trough was 17 years in 1978–1995 while the second one was 16 years in 1995–2011. That would put the next major US$ Index low to occur somewhere between 2027 and 2031, although we’d lean more towards the former. The question is, has the US$ Index crested? So far, we see a high followed by a lower high. That is often a sign that a top is in. Keeping this long-term picture in mind we can then focus on the short-term picture, looking for clues as to when the US$ Index begins to break down. Currently, that is a breakdown under 94. However, this is a monthly close chart, not the day-to-day action. Our point we note on the daily charts is a breakdown under 90.

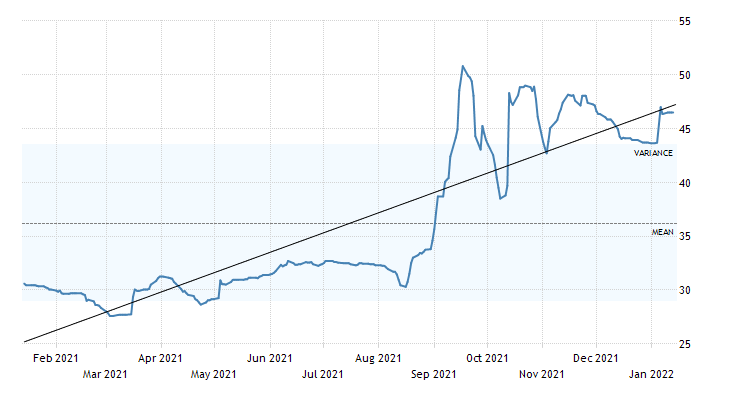

Uranium

Source: www.tradingeconomics.com

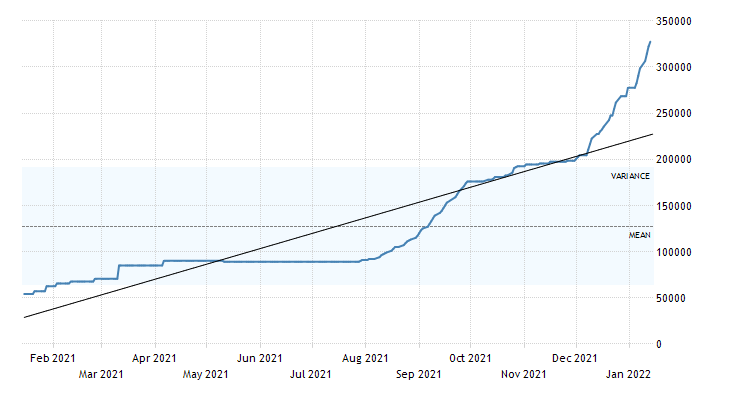

Lithium

Source: www.tradingeconomics.com

Both uranium and lithium prices have soared in the past year. Uranium is up 52% since January 2021 while lithium has jumped over 500%. Not surprisingly, uranium prices have been positively (or maybe we should say negatively) impacted because of the unrest in Kazakhstan. Kazakhstan produces 40% of the global uranium supply. Others do too, including Canada and Australia, but none on the same scale as Kazakhstan. Nuclear energy is expected to be a major source of sustainable clean energy going forward. Nuclear energy needs a lot of uranium.

Lithium could also be in big demand because of its use in lithium batteries and increasingly to fuel the growing electric vehicle market. In terms of reserves, the two largest by far are Chile and Australia. A bit further behind are Argentina and China. By comparison, the U.S. and others are small. In terms of production, Australia is the world’s largest producer followed by Chile and China and then much further behind is Argentina. However, supplies are low and producers cannot keep up with demand. That is putting sharp upward pressure on prices. The chart above is actually stated in Chinese yuan but it amply displays the supply pressures the producers are facing. Stocks are low everywhere.

Uranium appears to be forming what could well be a bull triangle and may have completed an ABCDE type of correction pattern. A breakout over $48 could see uranium prices rise to $60 or higher. Lithium is in a bull market and is not displaying any signs of a top. It would take a drop back under 200,000 yuan/tonne from the current 327,500 yuan/tonne to suggest that a top might be in.

Source: www.stockcharts.com

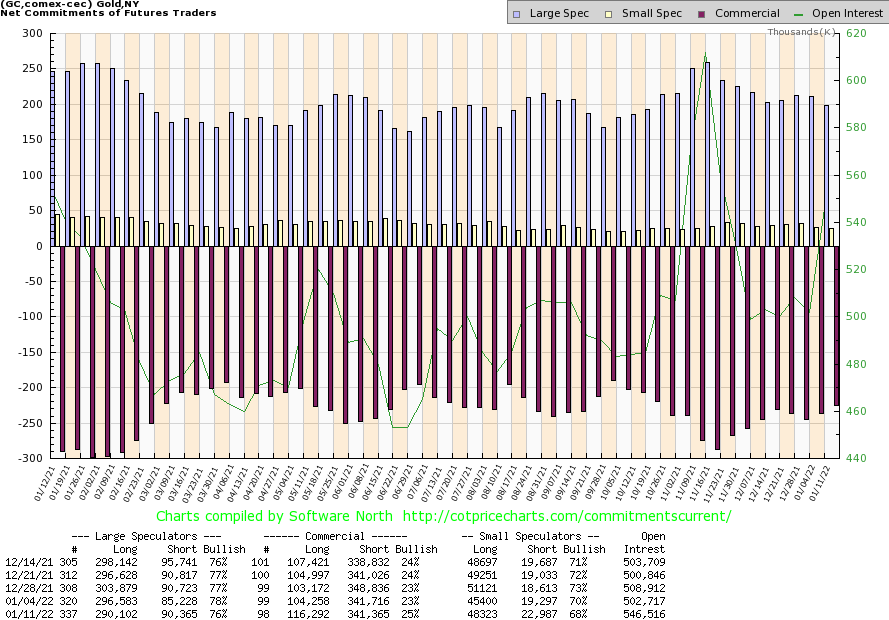

Gold rallied this past week on the backs of a weaker U.S. dollar as the Omicron pandemic surged. But fears of rising inflation, rising U.S. interest rates, and Fed rate hikes tempered the rally on Friday and gold fell. On the week gold gained 1.1%, silver was up 2.3%, while platinum gained 0.9%. Near precious metals like palladium fell 2.3% while copper was up 0.2%. The gold stock indices gained as well with the Gold Bugs Index (HUI) up 3.4% and the TSX Gold Index (TGD) gaining 2.3%. Considering the broader stock markets fell on the week, gold and the precious metals rebound was a good sign that the precious metals could outperform going forward. Right now, gold appears to be just standing in place. If we are to be bullish it is a slow burn rather than a rush. Support is seen down to $1,780/$1,790 but a break under $1,775 could trigger further declines to longer term support at $1,730. Below $1,730 and especially under $1,720 could trigger a test of the double bottom March/August low near $1,675. Interpreting the action of the past few months as a topping pattern could trigger a decline to at least $1,620. We continue to believe that the double bottom of March/August is our 31-month cycle low. Still to come is the crest of that current 31-month cycle. We hope it is not the high seen in November at $1,879.50. That would be the proverbial failed high we have talked about. We are still anticipating the eventual 7.8-year and 23.5-year cycle low but our expectations are that it would not come until sometime in 2023–2024. After that a major new up cycle could get underway. To the upside, we have been trying to clear above $1,820, preferably over $1,830. But that is only the first hurdle. The next hurdle is at $1,860. Once over that level new highs above $1,879.50 are possible. Our next major line to clear would be at $1,900/$1,920. Once we clear that level and regain $2,000 new highs above the August 2020 high of $2,089 become possible. A lot of work. That’s why a downside move remains more likely but not expected, given we are in the friendly seasonal period for gold, silver, and the gold stocks. But we have seen these rallies peter out before in January. We remain hopeful but inflation fears, interest rate hike fears, and Fed tightening fears are still overwhelming the potential for a slowing economy, the rising Omicron wave, fear of war in Europe, and still astronomical debt levels.

Source: www.cotpricecharts.com

The commercial COT (bullion companies, bullion banks) improved this past week to 25% from 23% as long open interest added roughly 12,000 contracts. Short open interest was largely unchanged. This is a good development. We note as well that total open interest jumped about 44,000 contracts on an up week—another positive development. The large speculators COT (hedge funds, managed futures, etc.) fell to 76% from 78% as they added roughly 5,000 to their short position and reduced their long position by over 6,000 contracts. Given gold’s rise in the past week this is a positive development.

Source: www.stockcharts.com

Silver finally put in an up week, gaining 2.3% on the week. After rising into Friday on inflation concerns, silver and the precious metals fell Friday on inflation fears and the Fed tightening fears. Indicators are for the most part neutral here. Silver ran into resistance at the converging 50- and 100-day MAs at $23.20/$23.30. A solid close over $23 on Friday would have gone some way to suggesting that silver might be making a bottom. Alas, we didn’t get it. We are also a long way away, it seems, from breaking out of the bottom pattern. We need to rise over $25 to convince us that a low may finally be in. Further resistance is seen up to $26. If the pattern forming is some kind of topping pattern instead of a bottom pattern, a breakdown under $21.41 the December low might suggest a potential decline to $17.30. We were pleased with the rally this past week but we do need to see follow-through. Taking out first $23 and then $25 would go a long way to support our bullish outlook.

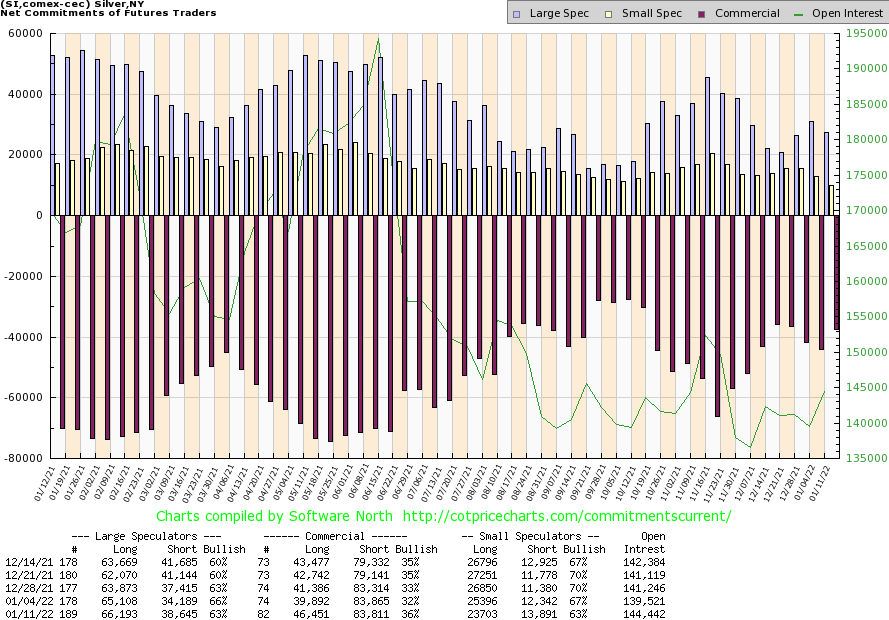

Source: www.cotpricecharts.com

The silver commercial COT jumped to 36% this past week from 32%. As with gold, this is a positive development. Long open interest rose almost 7,000 contracts while short open interest was largely unchanged. The large speculators COT fell to 63% as they added about 1,000 contracts to their long position but also added over 4,000 contracts to their short position. Overall open interest rose about 5,000 contracts on a week that silver saw gains. Another positive development. Overall, we view this as positive although we wouldn’t call it overwhelmingly bullish.

Source: www.stockcharts.com

Call it a save, but we’ll take the gains seen this past week for the gold stocks. The TSX Gold Index (TGD) rose 2.3% while the Gold Bugs Index (HUI) was up 3.4%. However, both indices ran into moving average resistance. The TGD near the 50-day MA and the HUI just above the 50-day MA. Both indices fell on Friday as inflation fears and interest rate hike fears weighed on the markets as well as on gold and silver, which in turn triggered short-term profit, taking in the gold stocks. Nonetheless, we remain encouraged that the gold stock indices (and many individual stocks) are in the process of forming a bottom pattern. So far, we do note a small series of rising lows following the most recent low seen for the TGD at 257 in early November. But the climb has been erratic thus far with gains wiped out almost as quickly as they were made. The key level for the TGD is at 270. A decline back below 270 would be negative and once under the December low of 265.83 then it is possible we could see new lows. Seasonally, we are in a sweet spot as the gold market tends to be buoyant into January and in strong cases into February and March. Still, it is too early declare that we are out of the woods. We’ve also seen many rallies suddenly die on the vine in January as well. We won’t feel comfortable that a bottom may be in place until we clear above 300 on at least two or even three occasions. Otherwise, all we can say is that we are in the fail zone. Some might argue that we are forming a potential head and shoulders top pattern with the head that spike to 310 in November. A firm breakdown under 270 could in theory target down to 218. Hence, our desire to see the TGD close on consecutive days over 300 a zone that appears to be the breakout zone. The HUI has even more work to do and needs to clear at minimum above 266 and preferably above 285.

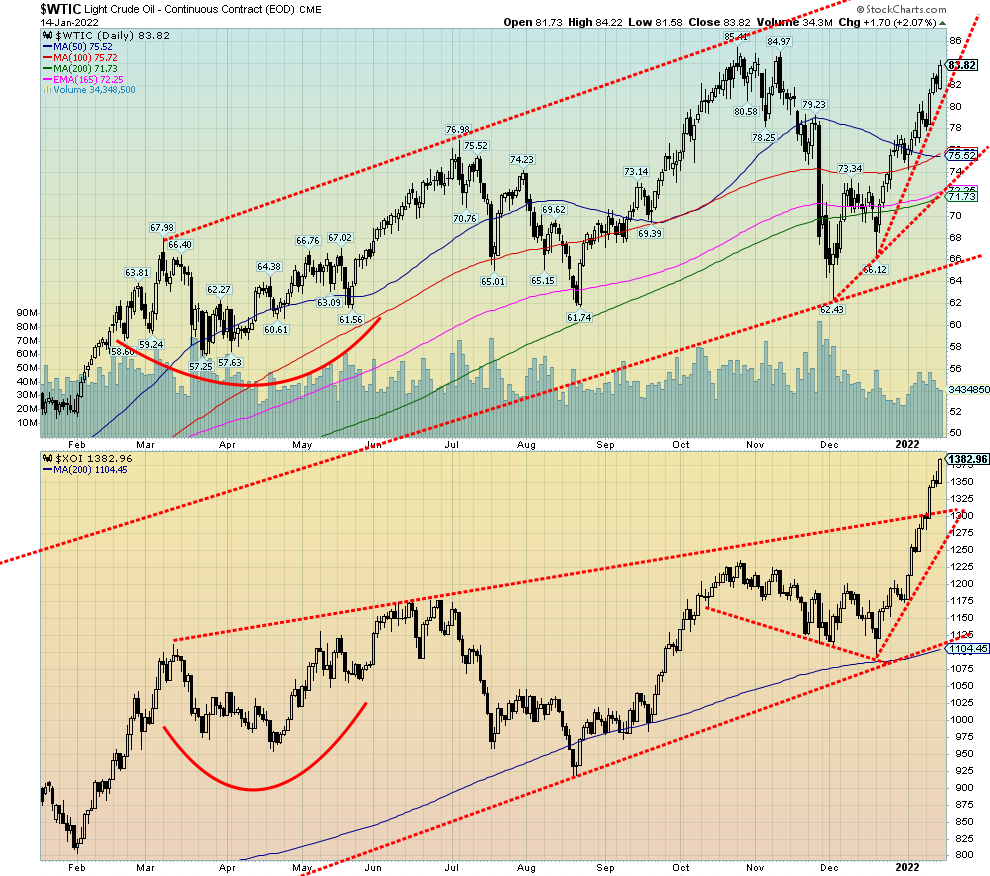

Source: www.stockcharts.com

Oil and gas and the energy stocks have been the place to be in 2022 as they were in 2021. Once again, oil and gas prices soared this past week with WTI oil up 6.2% and natural gas (NG) up 8.7%. In just two weeks WTI oil is up 11.5% and NG is up 14.2%. With WTI oil now over $80 we are anticipating new highs soon. There are numerous forecasts that we could hit $100 oil. The energy stocks soared to new 52-week highs once again. The ARCA Oil & Gas Index (XOI) jumped 6.3% while the TSX Energy Index (TEN) was up 7.3%. In just two weeks the XOI is up 17.4% and the TEN up 16.2%. We are awaiting the proverbial headline hailing the new oil era, that oil is not dead, that high oil prices are here to stay to signal a potential top.

A number of factors seemed to be driving oil prices higher this past week. Setting aside news regarding a potential Chinese SPR release, the issues remain much the same. We continue to see Libyan supply issues, lower than expected OPEC output, inventories hitting multi-year lows, and refineries slow to ramp up production, sparking shortages of distillates and even diesel and jet fuel. China’s potential release of SPR supplies is rather vague and they have not given any indication as to how much they might release.

Technically, WTI oil and the XOI are in very bullish uptrends with no sign of a top. The XOI (and the TEN) have already soared to fresh 52-week highs. WTI oil might not be far behind. The recent high was $85.41 seen in October. In theory, we could suggest a possible target of $107 once we start making new highs. Minimum targets should be at least to $91. The energy stocks (XOI, TEN) are already in overbought territory and WTI oil is not far behind. New highs could be seen as early as this week. NG lags and remains well off its high of $6.47 seen in September. But with cold, snowy weather, that could soon change as the demand for heating fuel heats up.

Copyright David Chapman, 2022

|

GLOSSARY

Trends

Daily – Short-term trend (For swing traders) Weekly – Intermediate-term trend (For long-term trend followers) Monthly – Long-term secular trend (For long-term trend followers) Up – The trend is up. Down – The trend is down Neutral – Indicators are mostly neutral. A trend change might be in the offing. Weak – The trend is still up or down but it is weakening. It is also a sign that the trend might change. Topping – Indicators are suggesting that while the trend remains up there are considerable signs that suggest that the market is topping. Bottoming – Indicators are suggesting that while the trend is down there are considerable signs that suggest that the market is bottoming. |

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.