There are three basic questions that need to be asked, and subsequently answered, regarding gold price manipulation. Here are the three questions:

- Is there an ongoing attempt to suppress the gold price?

- If so, is that attempt successful?

- If it is successful to any degree, does it matter?

If the answer to No. 1 is yes, then it follows that the answer to No. 2 becomes critical. We, of course, have to define what “successful” means. Finally, then, we can judge the effects of those attempts and their impact.

ATTEMPTS TO SUPPRESS GOLD PRICE

I think it is obvious that there are attempts to suppress the gold price, but we need to clarify some things before moving on to question No. 2.

Suppressing the gold price is not the primary goal. The goal is to support the US dollar. The purpose is to avoid or temper the crippling effects of inflation and the eventual demise of the dollar.

By doing so, the environment for banks to continue to lend money – and collect interest – in perpetuity is preserved.

Since the higher price of gold over time is a reflection of the loss in purchasing power of the US dollar, the focus and concern has to be the dollar. The logic is that if the price of gold can be suppressed, then the dollar weakness might be less apparent.

Functionally, this logic is similar to bonds and interest rates. If you want to manipulate interest rates to a lower level, and you have enough money, you buy bonds. Higher bond prices are the same thing as lower interest rates.

This particular strategy allows the US Treasury to borrow lots of money at cheaper rates; as long as the Fed and its primary dealers buy up whatever amount of debt isn’t sold at auction.

Sometimes, as in 2008 and again in 2020, a collapse in the credit markets is countered by the Federal Reserve gobbling up huge amounts of bonds and carrying them on their book for years afterwards.

In any case, the link between the gold price and the US dollar is clear. A higher gold price over time is indicative of a cheaper US dollar and vice versa.

ARE GOLD PRICE SUPPRESSION ATTEMPTS CONSIDERED CONSPIRACY?

Attempts to manipulate money and currencies have been evident for centuries. They are conspiratorial in nature, but they are not necessarily secret. They may also be interrelated to and part of larger conspiracy efforts that are incredibly more harmful and ill-conceived.

Regardless of the intentions of the perpetrators, at least with regards to money, the attempts are real and fairly evident. (see Gold market manipulation: Why, how, and how long?)

GOLD PRICE SUPPRESSION SUCCESSFUL?

Are attempts to manipulate and suppress the gold price successful? Some people think so. Generally, that is the argument given by those who think the gold price should be much higher than it is.

How high should the gold price be? Answers given range from $3k to $10k and higher.

If the evidence of gold price suppression attempts are there, is the logic so simple as to infer that if it weren’t for the Fed, gold investors would be rich?

If one argues that “the gold price should be much higher” and it’s not, then logically, one might feel inclined to blame it on someone or something else.

Can a price projection of $3k gold justified? We have to know that any higher price expectations for gold are justified before we can assess how successful attempts to manipulate or suppress the gold price actually are.

For example, using $2k gold as our current benchmark price, and with the belief that gold should be priced at $3k, we are saying that gold is underpriced by fifty percent. Can that be attributed to price suppression?

If so, that would seem to indicate a reasonably successful attempt to suppress the gold price.

Absent the price suppression, then, would gold go straight to $3k? Maybe, but likely not. There are several reasons why not.

First, a gold price at $2,180 oz. would come close to matching its previous inflation-adjusted peaks from 1980, 2008, and 2020. At $2,180 oz., the gold price would fully reflect the additional effects of inflation since its peak of $2060 oz. in August 2020. Hence, at $2180 oz., gold reflects full value in current dollars.

Second, in order for gold to exceed $2,180 oz., there would have to be further apparent and sustained weakness in the US dollar. That may happen, but it will take some time.

And, should that occur, it will mean that the US dollar will lose a commensurate amount of purchasing power before the gold price can move higher.

Also, while the effects of previous Fed inflation are showing up right now, the US dollar has been stronger of late – not weaker. In addition, there are the possibilities of disinflation and deflation, neither of which bode well for higher gold price expectations.

Currently gold is priced reasonably close to its inflation-adjusted value. It has never exceeded that point in the past. Don’t expect it to do so now.

DOES GOLD PRICE SUPPRESSION MATTER?

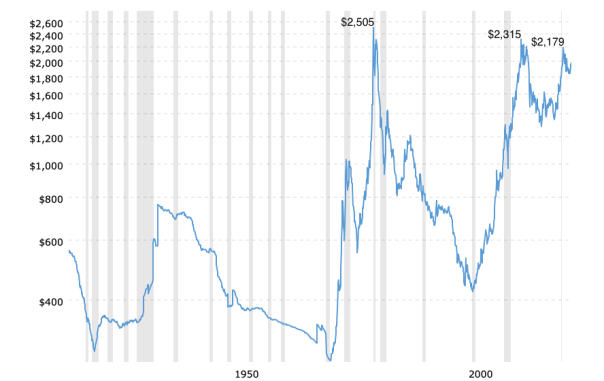

Attempts to suppress the gold price may appear to have an impact but they will not be successful in keeping the gold price from eventually reflecting the US dollar’s actual loss in purchasing power. See the chart below…

Current Gold Prices (inflation-adjusted) – 100 Year Historical Chart

The three successive peaks on the chart above from 1980, 2011, and 2020 are nearly identical; and that is not coincidental. They are all points where the gold price matched closely its actual value.

Gold’s value is in its use as money. There is no other value to gold except in a secondary role as jewelry, or for adornment.

Those who speak most strongly about gold price manipulation seem to think that without price suppression gold would be much higher. But that assumption presumes that gold’s value is something else other than real money and a store of value. It is not.

In other words, gold is not subject to the law of supply and demand in the ways that other goods and services are. Nor, is it comparable to stocks or other financial investments, real estate, etc.

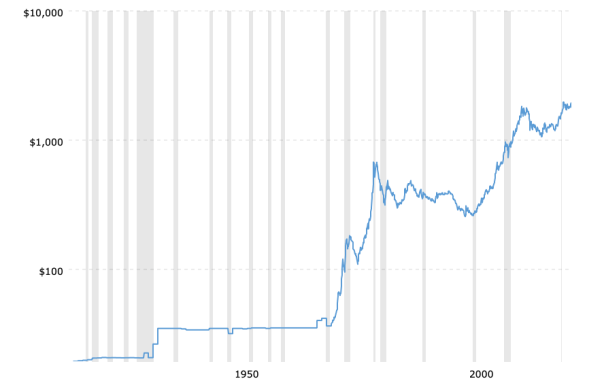

In other words, strong demand for gold does not drive its price up. Only the actual loss in purchasing power of the US dollar determines a higher gold price. Below is the same chart as above, but in nominal prices only; no adjustments for inflation…

Gold Prices – 100 Year Historical Chart

Looking at the chart immediately above we might feel that it is just a matter of time before the gold rocket launches us into ultra-wealth. At this point we need to remember that even though the price of gold tripled between 1980 and 2011, it was no more valuable in 2011 than it was thirty years earlier.

And one ounce of gold today at $2000 is no more valuable than it was a century ago at $20.

REVIEW AND CONCLUSION

Yes, gold price manipulation is evident and ongoing.

Whether it is successful or not is open to debate. At times it may appear to be so, but attempts at gold price suppression have never kept the gold price from eventually reaching its true value.

It matters not so much that gold price manipulation occurs, or that it may have an impact. What matters more, and that which presents a greater risk to investors, is unrealistic expectations.

It is unrealistic to expect substantially higher gold prices without an equally greater loss in US dollar purchasing power first. That could happen quickly or it might take longer than many expect.

Whatever the timeline, any appreciable movements higher in the gold price above $2000 oz. don’t present a profit opportunity as long as gold remains close to its previous inflation-adjusted high points. (also see Gold Gains In Price Only – Not In Value and Not About Gold – All About The Dollar)

Check out my NFTs at voice.com/kelsey !!

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!