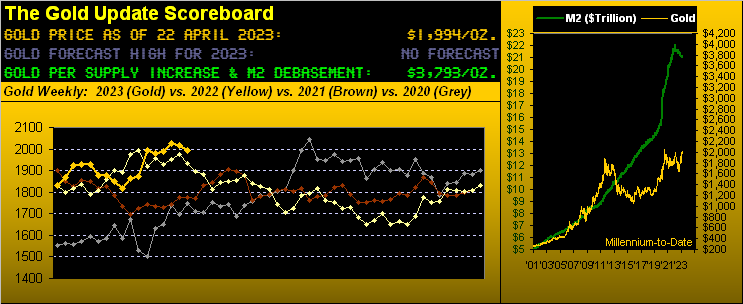

Yes, per last week’s 700th missive, an All-Time High for Gold remains nigh, (i.e. above 2089). Yet en route to said notion of nigh, we also penned our expectation for Gold to first recede into the 1900s, price indeed having traded this past week to as low as 1981 before settling yesterday (Friday) at 1994.

Nonetheless with respect to a new Gold high being nigh, might price still a bit further slide? After all, per The Oxford English Dictionary (circa 1879 as The New English Dictionary) “nigh” is simply defined as “near”. And contextually, “near” is not that far from here. Or numerically, 2089 is not that far from 1994, i.e. +95 points.

‘Course ’tis always about “The When”. In round numbers, let’s say Gold basically from here has to pop up +100 points to eclipse its existing All-Time High. Can that happen quickly? Historically since 2001, there have been 25 mutually-exclusive (for you WestPalmBeachers down there that means “non-overlapping”) occurrences wherein Gold has gained better than +100 points within just five trading days, the most recent case being in just three sessions from 1815 on 09 March to 1920 on 13 March. “You can bank on that.” (Ouch).

But in terms of Gold’s present ranginess, our EWTR (“expected weekly trading range”) is now 63 points; thus solely by that metric, a new All-Time High above 2089 in a week’s time is a bit of a stretch. Moreover, we’ve the following near-term technical concern.

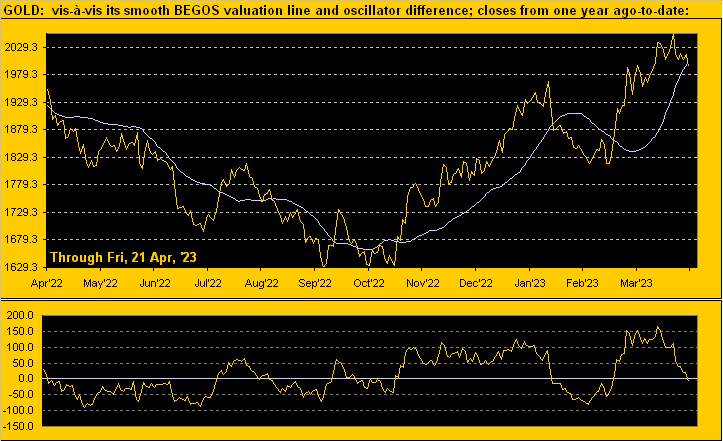

Recall a week ago our “continuing coverage” of Gold having significantly deviated above its smooth BEGOS valuation line. Here they are paired in the upper panel from one year ago-to-date:

The lower panel is the oscillator (price less valuation), at one recent point showing price as better than 150 points too high. Thus as anticipated, price this past week came back to this near-term method of valuation. However, upon price penetrating to close below valuation as just occurred yesterday, the “rule of thumb” is to expect still lower levels. Such negative penetrations have happened six times since a year ago to an average downside deviation of -77 points … which from here at 1994 “suggests” 1917, (just in case you’re scoring at home). But: our sense is — in staying with the theme that a new Gold All-Time High is nigh — we’re not anticipating much material downside. Rather, some of the levels we noted a week ago (such as 1953 and 1975) seem more reasonable, especially given our perception of Gold awareness being on the increase amongst the non-Gold crowd.

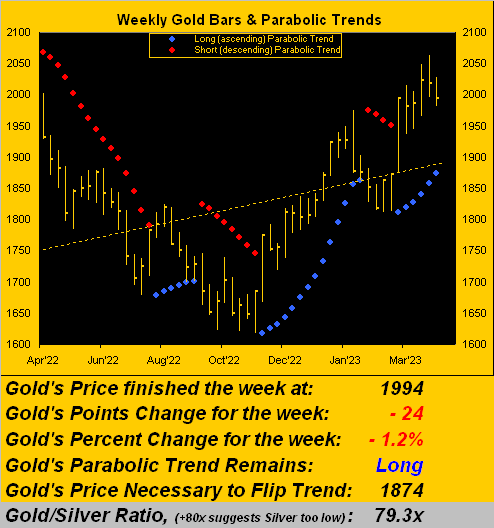

Moreover, as we turn to Gold’s weekly bars from one year ago-to-date, the blue-dotted parabolic Long trend continues to ascend such that we continue to seek the new All-Time High along this bend, leading further toward the mid-2100s before reaching an end:

‘Course, there’d be no market for Gold were it not for “The Other Side of the Trade Dept.” represented just yesterday in Barron’s by one “AA” (and you know who you are out there) who penned “Gold is Hitting a Wall” such that the 2050-2075 zone somehow is “formidable resistance”. From our purview, such “resistance” is really the two tops formed first ’round COVID in 2020 and second ’round RUS/UKR in 2022 … and now thrice ’round Common Sense/Fundamental Undervaluation (per our opening Scoreboard level of Gold 3793). Thus we still see a wee dip … but then up with it. ‘Tis a time to add to one’s Gold stack. For as we’ve quipped of late quite a bit: “Triple tops are meant to be broken.”

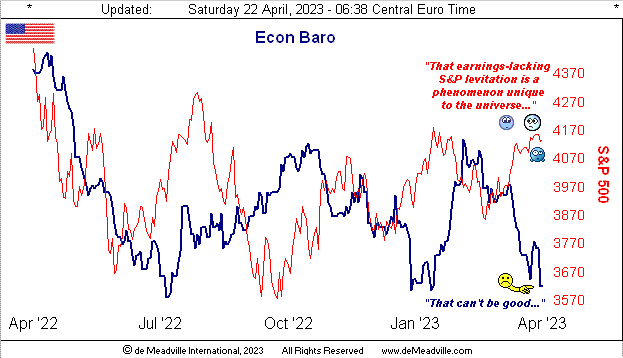

Indeed speaking of “broken”, surely you’ve been following the daily track of the Economic Barometer. ‘Twasn’t the busiest of weeks for the Baro, but it did take in eight material metrics, six of which worsened period-over-period, those being April’s Philly Fed Index, March’s Housing Starts, Building Permits, Existing Home Sales and Leading (or “lagging” as they’re already incorporated into the Baro) Indicators, plus the second highest level of weekly Initial Jobless Claims since last August. The only two improvements were a one pip increase in April’s National Association of Home Builders Index, plus the month’s New York State Empire Index having turned positive for the first time since last November, (although just its fifth positive reading of the past 16 months). Toward tying it all up (or better stated down) with a bow, the Econ Baro nearly touched a one-year low:

Such “El Plungo” by the Baro obviously elicits the “R” word. Recall the back-to-back StateSide negative Gross Domestic Product readings for Q1 and Q2 of 2022 as having “defined” a recession … which was met with a rising Q3 and Q4, (i.e. per the lowly convention wisdom level, “the recession ended as soon as it started”). And now come this Thursday (27 April) we’ve the first peek at Q1 GDP, consensus calling for +2.0% annualized growth, albeit weaker than the prior two quarterly readings respectively of +3.2% (Q3) and then +2.6% (Q4). ![]() “Slip Slidin’ Away” –[Paul Simon, ’77]

“Slip Slidin’ Away” –[Paul Simon, ’77] ![]()

“But don’t you ever get skepitcal of the reported numbers, mmb?”

At times, ’tis hard not to, Squire, albeit, the Econ Baro over its 25 calendar years has been on balance a magnificent precursor to such reports as the GDP, Leading Indicators, at alia. But skepticism is a natural reaction at times, a most glaring example being the Baro’s significant decline through much of last year’s Q4 metrics … but then +2.6% GDP growth was “reported”. One’s eyebrow thus is on occasion raised, but the bottom line is our maintaining the consistency in calculating the Baro all these many years. Still if the “reported” metrics via our sources are fudged, ’tis a bold disservice to us all.

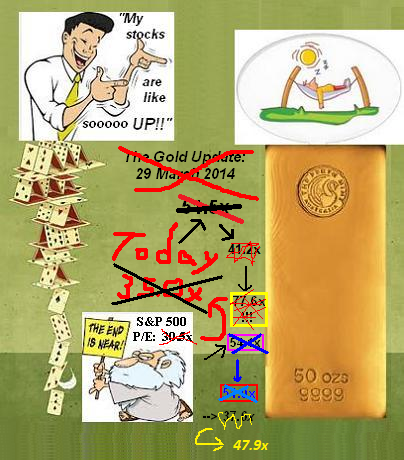

Indeed speaking of “disservice”, the broadest one upon which we perennially harp is the disingenuous math used at large to dumb-down the price/earnings ratio of the S&P 500. Research it via the internet, and the number (22.1x) is less than half that of our “live” 47.9x. (We’ve herein posted the formula a bazillion times — but that which was dutifully taught in B-school is irrelevant today — for at any cost do not let The Truth scare investors away).

And with respect to Earnings, the Q1 Season is well underway. How are we doing? Fairly poorly, one has to say. Thus far, some 72 S&P 500 constituents have reported, of which just 56% (40) bettered their bottom lines from a year ago. Going back 24 quarters (six years), that 56% (thus far) ranks fifth-worst … and if we eliminate the four COVID quarters of 2020, today’s Q1 ranks second-worst. And yet the S&P (now 4133) remains stratospherically up there in goo-goo land. ‘Tis nothing short of extraordinary. (Oooh… “short”…)

Time was when lousy earnings were fundamentally weak for the S&P. And now technically? (Prepare hard hat): by the website’s Market Trends page, the S&P Futures’ “Baby Blues” measure just confirmed dropping below the +80% axis (a highly reliable precedent to lower prices); by the MoneyFlow page ’tis running out of puff; the daily Parabolics on the Futures just flipped to Short; the MACD likely crosses to negative come Monday’s settle; and the “textbook technicals” just completed their 16th trading day as “overbought”. Thus for the S&P’s ensuing week or longer, can you say “Down”? ‘Tis our sense.

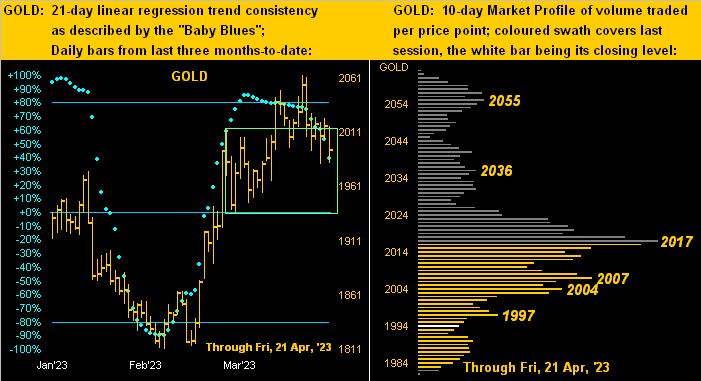

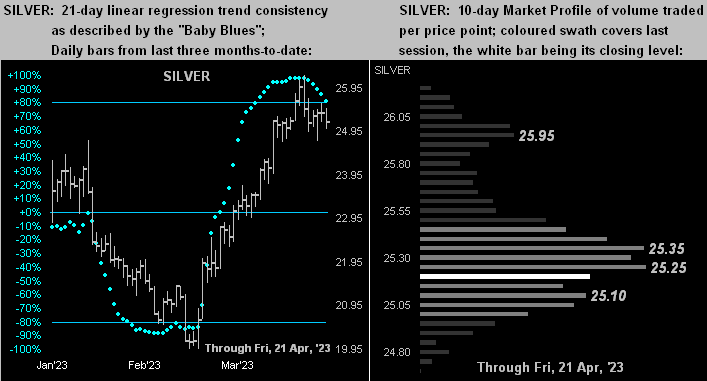

And again, our immediate sense too for the precious metals is a wee bit lower. Yet by our title we imply a chance to buy given the All-Time High being nigh. First to Gold and our two-panel graphic of price’s daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. For the bars we’ve put in an arbitrary green box encompassing a reasonable support area for Gold, even as the declining “Baby Blues” of trend consistency become less so. As for the Profile, what had been notable overhead resistance at 2039 has since shifted lower to the now-dominant 2017 level:

Second with the same graphical drill for Silver, her Baby Blues (below left) are poised to cross below that key +80% axis, suggestive of a price run down into the lower 24s. And in her Profile (below right), those denoted lower 25s now show as trading resistance:

‘Course all that said, we’ve this from the “Who’s Next? Dept.” Upon whichever bank next suddenly zooms to the above-the-fold newspaper position shall swiftly send the precious metals back on the upside track, in turn putting the S&P flat on its back. Not that Gold nor Silver need that to happen: the yellow metal (1994) again by the Scoreboard valuation (3793) is presently priced at but 53% that, whilst the S&P 500 by earnings-to-historical value is arguably more than double that.

We’ll thus wrap it for this week with one of our (again updated) all-time favourite Gold Update graphics toward the next All-Time Gold High being nigh!

Cheers!

…m…