With demand soaring for high-potential trades, newer speculators and investors shouldn’t overlook the gold miners’ stocks. For decades contrarians have used this volatile sector’s big swings to multiply their capital. Gold-stock uplegs yield massive gains, which are realized near toppings to weather subsequent corrections in cash. Timing entries and exits to ride the lion’s share of these major moves is fairly simple.

The gold miners’ stocks are ultimately leveraged plays on gold. Their earnings really amplify changing prevailing gold levels, so their stock prices follow. And gold’s fortunes are also silver’s dominant primary driver, which in turn drives silver miners’ profits and stock prices. So “gold stocks” is a generic term that really means precious-metals-mining stocks. Gold, silver, and their miners’ stocks tend to move in lockstep.

Fueled by secular gold bulls, gold stocks enjoy long-and-strong bull markets. Per the leading gold-stock benchmark which is the GDX VanEck Vectors Gold Miners ETF, this current specimen has run 256.7% higher at best over 4.5 years as of early August. That is still tiny by this sector’s wild standards, with the previous gold-stock bull soaring 1,664.4% higher over 10.8 years by September 2011 per the older HUI index!

Born in May 2006, GDX wasn’t around long enough to encompass that mighty earlier bull. That epic run included a dozen major uplegs and corrections, with the former averaging huge 87.5% absolute gains over 7.8 months! The latter rebalancing selloffs averaged 30.0% losses over 3.1 months. Riding uplegs and sitting out corrections generated enormous realized gains for contrarian traders gaming these big swings.

This young current gold-stock bull isn’t much different, seeing four uplegs and corrections so far. Through that GDX lens, they averaged huge 99.2% absolute gains over 7.6 months! The price of those were subsequent corrections averaging 33.6% losses over 6.9 months. Actively trading these big swings in this bull is far more lucrative than buying and holding. Again at best today’s bull is up 256.7% in GDX terms.

Yet its individual uplegs added up to much-larger 396.6% gains. There’s far-greater wealth-multiplying potential in riding uplegs and sitting out corrections than staying deployed. Since exact bottomings and toppings are impossible to know in real-time, the goal with timing gold-stock trades is to catch the middle 2/3rds or so of those big swings. Do that successfully for a few bull cycles, and your capital will just soar.

For decades now I’ve published weekly and monthly newsletters striving for this very goal. GDX’s last upleg was extreme, born out of March 2020’s COVID-19-lockdown-spawned stock panic. Over the next 4.8 months, GDX rocketed 134.1% higher. We realized 17 and 9 gold-stock and silver-stock trades in our newsletters during that span, averaging +81.3% and +83.6% absolute gains! This sector multiplies wealth.

Over the decades I’ve executed thousands of gold-stock trades, gradually developing and honing a gold-stock trading system that has proven very successful in real-time. And it is fairly simple, easy to apply even for traders not deeply immersed in this high-potential sector. To ride gold-stock uplegs and cash out before the subsequent corrections, the mission is to buy in relatively-low then later sell out relatively-high.

Defining “relatively-low” and “relatively-high” in real-time can be done subjectively. Major gold-stock uplegs tend to run for around 8 months or so on average. So simply looking at a 6-month GDX chart to see if that leading gold-stock benchmark is low or high within that timeframe is a solid eyeballed estimate. If GDX is near the bottom of its 6-month range, that is likely a good time to deploy capital in gold stocks.

But if GDX is near the top of that short-term chart, it is probably prudent to abstain from adding more positions then. This contrarian approach runs counter to traders’ natural instincts. We humans love to pile on and chase momentum, which means buying high. And we get scared when prices fall, leading to selling low. Buying high when gold stocks are exciting then selling low after they’ve fallen leads to big losses.

Buying in relatively-low can only happen following correction-grade gold-stock selloffs leaving this sector deeply out of favor and riddled with bearishness. If you are eagerly anticipating buying gold stocks, you are probably doing it at the wrong time! Buying in after major selloffs feels miserable, there’s a pit in your stomach fighting the herd. General consensus after corrections is gold stocks will keep spiraling even lower.

As a long-time gold-stock speculator, I prefer hard empirical data on whether this sector happens to be relatively-low or relatively-high at any given time. So well over a decade ago, I developed a system that I called Relativity Trading. It uses a simple construct to reveal not only when prices are relatively-low or relatively-high, but the actual degree of oversoldness or overboughtness to compare with sector precedent.

In order to define relatively-low or relatively-high, some baseline from which to measure is necessary. It can’t be static, as prevailing price levels are changing all the time. In January 2016 when this gold-stock bull was born, GDX averaged $13.68. But last month this dominant gold-stock ETF’s average was much higher at $35.94. What is low and what is high gradually changes as bull markets march higher and mature.

After making endless spreadsheets and back-testing data, the best dynamic benchmark I found to gauge current price levels proved to be their 200-day moving averages. Widely used by technical traders, the 200dmas followed prices slowly enough to prove a great baseline. Yet these 200dmas are still dynamic, gradually adjusting to reflect new prevailing price levels. 200dmas have another fantastic attribute as well.

During secular bull markets, prices’ 200dmas tend to closely parallel their primary uptrend. So looking at GDX’s 200dma on a 6- or 12-month chart reveals where that bull is likely heading. Technically-oriented traders closely watch prices relative to their 200dmas as well, making many trading decisions based on that relationship. That further increases the utility of 200dmas as baselines from which to measure prices.

While current GDX levels can be eyeballed relative to this ETF’s 200dma, that’s still subjective. And it can be visually-distorting when comparing higher or lower prevailing price levels. So Relativity Trading quantifies and renders that price-200dma relationship in perfectly-comparable percentage terms. Simply dividing a closing price by its 200dma shows its Relativity multiple, the Relative GDX which I shorten to rGDX.

In the middle of this week, GDX closed at $35.28 while its 200dma was running $37.52. Divide these, and it yields an rGDX of 0.94x. In other words, GDX was trading at 94% of its 200dma. When these multiples are charted over time, they often reveal horizontal trading ranges. These in turn show when gold stocks as a sector have proven relatively-low and relatively-high in the past, greatly aiding trade timing.

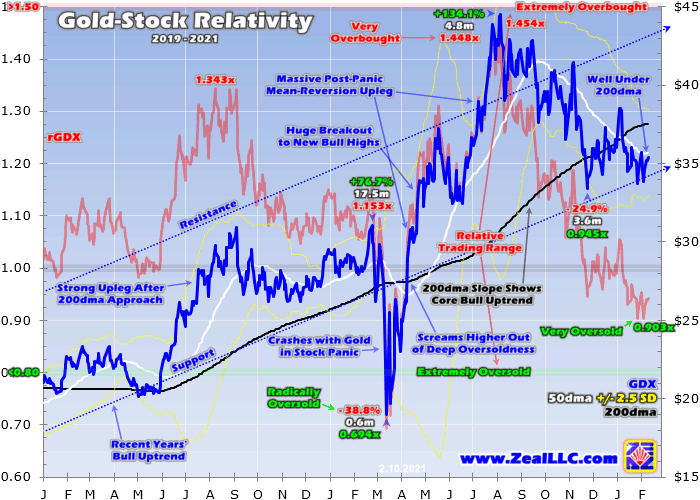

This gold-stock Relativity chart renders GDX’s closes in blue, and their trailing 200-day moving average in black. Dividing these yields the rGDX multiple, which is shown in red. This effectively flattens GDX’s 200dma to horizontal at 1.00x, then renders this ETF’s distance from that baseline in percentage terms that are constant and comparable regardless of prevailing gold-stock prices. This is a powerful trading tool!

This chart encompasses the past couple years or so, showing more detail for gold stocks’ recent price action per GDX. But I use the past five calendar years to define Relativity trading ranges. For the rGDX, that is currently running between 0.80x on the low side to 1.50x on the high side. Gold-stock price levels generally oscillate between 80% to 150% of GDX’s 200dma. This knowledge really helps trade timing.

The closer the rGDX is to 0.80x, the relatively-lower the gold-stock prices and thus the better the buy-low opportunities. This week the rGDX again was running 0.94x, after slumping as low as 0.903x back in late January. That means now is a high-probability-for-success time to deploy capital in the out-of-favor gold stocks, buying in relatively-low! They recently suffered a 24.9% correction per GDX, and are bottoming.

But of course no one but hardened contrarians want to buy gold stocks today, as they are limping along near lows and feel really bearish. But weak technicals and damaged sentiment are necessary to buy in relatively-low. Successfully multiplying your capital demands buying low before later selling high, which in turn requires fighting the herd. Buy when everyone else is selling, then later sell when everyone else is buying!

Even over the past couple years, the greatest gold-stock gains came after GDX had fallen back under its 200dma. That includes during the summer of 2019 and after March 2020’s extreme stock panic. The general rule is the farther GDX is hammered under its 200dma, the greater gold stocks’ potential gains in their next bull-market upleg. The gold stocks are very oversold now, nearing extremely oversold in rGDX terms.

Almost regardless of which gold stocks you trade, if you deploy capital in them when the rGDX is low you will likely see big gains during the next 6-to-12 months. This is easy for anyone to do regardless of gold-stock-trading experience. Pull up a 6-month GDX chart on StockCharts.com, see whether this leading sector benchmark is relatively-low or -high, and use the numbers on that chart to calculate the rGDX level.

All our newsletters also include the latest rGDX read, as well as this key indicator’s 6-month trading range. I show our current trading bias on gold stocks based on this, either long, short, or neutral. I also recommend gradually deploying new gold-stock trades over time on a low rGDX read, which increases the odds of straddling the actual correction bottoming. A new campaign can be added over a couple months.

While everything is fairly simple at this point to buy in relatively-low, I add a major layer of complexity which helps amplify our subsequent upleg gains. I do deep fundamental research on many dozens of gold miners and silver miners, analyzing their operating and financial results each quarter and comparing them to their peers. The goal is to uncover the fundamentally-superior gold stocks, this sector’s better miners.

They have the best upside potential in gold-stock bull uplegs, usually well outperforming fundamentally-inferior miners. And strong fundamentals also limit downside during inevitable sector pullbacks. Better-quality gold stocks traded in fundamental terms lowers risks while increasing returns. I recommend my current fundamental favorites as trades in our newsletters, explaining why these stocks have made the cut.

Unfortunately this stock-picking knowledge only comes from hard-won experience, from long decades of wading through thousands of quarterly reports and actively trading gold stocks. The resulting expertise on individual gold stocks is vast, impossible to impart quickly like technical trade timing. But you can still “apprentice” in this by subscribing to our newsletters for years, gradually growing your stock-picking acumen.

The odds are high of seeing big gold-stock gains accrue when you buy in relatively-low in rGDX terms and deploy your capital in fundamentally-superior gold stocks. That’s the whole game really, as selling after subsequent gold-stock uplegs mature is best done mechanically. That removes all the emotion from selling decisions, nullifying the inevitable greed that arises after big gains. This too is simple to execute.

When adding new gold-stock trades, trailing-stop-loss sell orders should be applied right after the entries. These limit orders instruct your stock broker to close out your positions once pre-defined conditions are met. Since gold stocks are so darned volatile, I’ve long run very-loose 25% trailing stops when buying in relatively-low. The odds of such big selloffs are fairly modest after gold stocks have already corrected hard.

Trailing stops automatically rise with stock prices during a trade, locking in unrealized gains. If you buy a gold stock relatively-low that rallies 75% in an upleg, and then falls 25% to trigger its trailing stop, you will realize about 50% gains on the overall trade. Worst case is generally a 25% loss, although those are rare since gold stocks usually rally after being relatively-low in rGDX terms. That in turn drags up stop-loss levels.

But as gold-stock uplegs mature, the risks of major selloffs mount. Gold-stock prices get relatively-high, as evidenced in the rGDX moving towards the upper end of its trading range. By that time we usually have big unrealized gains in gold stocks, which are important to protect. So I ratchet up the trailing-stop-loss percentages themselves as gold-stock uplegs mature. That locks in more of our gains when selloffs hit.

Although started at that very-loose 25% during correction bottomings, once subsequent uplegs grow too overbought I tighten our stops. That 25% is first raised to 20%, then later 15%, 10%, and sometimes even 5%. The speed at which those stops are ratcheted tighter depends on how fast gold stocks are surging late in uplegs and how overbought they are getting in rGDX terms. This guarantees more realized gains.

Using trailing stops not only removes dangerous greed from selling decisions, but it lets traders remain deployed in gold stocks as long as possible. Along with buying low and selling high, another core axiom of trading is cut losses fast but let your winners run. Trailing stop losses do both. They let the markets realize gains or losses on trades, eliminating subjective sell decisions while maximizing realized gains.

So timing gold-stock trades is fairly simple. Only deploy capital relatively-low, after the rGDX indicator gets oversold revealing a maturing sector correction. Run loose trailing stops just in case. Then as the subsequent gold-stock upleg matures, as seen in the rGDX getting more overbought, start ratcheting up those trailing stops to realize more of your gains. Then keep your capital in cash while gold stocks correct.

That skipping-correction discipline further amplifies overall gold-stock gains. Again the average GDX correction during today’s bull market has been 33.6%, call it a third. Holding cash through that selloff cuts out these serious losses, preserving capital. Then when the subsequent bottoming arrives, that cash has more buying power to redeploy in about a third more gold stocks! This really speeds up multiplying capital.

The final key to gold-stock trade timing is carefully watching gold, this sector’s dominant primary driver. Applying this same Relativity Trading methodology to gold reveals when it is relatively-low or relatively-high compared to its own baseline 200-day moving average. Since gold-stock uplegs mirror and amplify gold’s own, gold stocks are more likely to surge after low rGold reads and more likely to sell off after high ones.

In addition to tracking rGold, rSilver, and the rGDX, our newsletters are always analyzing what is driving gold’s price action on a day-by-day basis and where this metal is likely heading next. Gold-stock uplegs depend on gold’s own, since gold-mining earnings leverage prevailing gold prices. Another key factor in achieving the best long-term success trading gold stocks is staying engaged. Checking out is the worst mistake.

I see this constantly in the newsletter business. People are really excited about gold stocks after prices have surged in a major upleg. They are eager to buy in relatively-high to attempt to chase that upside momentum. That’s exactly the wrong time to deploy capital! Then after gold stocks correct, they wallow in popular fear and get discouraged. So they check out mentally, not renewing subscriptions to stay informed.

They stop watching gold stocks during correction bottomings, the very times to buy back in relatively-low before the next uplegs! Multiplying wealth trading stocks demands buying relatively-low then later selling relatively-high. But that’s only possible if you stay engaged 100% of the time, always watching this sector whether it feels fun and bullish or depressing and bearish. Long-term success demands always staying abreast.

With the rGDX remaining low after this leading gold-stock benchmark’s 24.9% correction that started to bottom in late November, this is the time to buy back in! So ever since we’ve been aggressively layering into fundamentally-superior gold stocks and silver stocks. The current count is up to 17 and 8 new trades in our weekly and monthly newsletters. There’s still time to mirror these high-potential trades at low entry prices.

At Zeal we walk the contrarian walk, buying low when few others are willing before later selling high when few others can. We overcome popular greed and fear by diligently studying market cycles. We trade on time-tested indicators derived from technical, sentimental, and fundamental research. That’s why all 1178 stock trades recommended in our newsletters since 2001 averaged hefty +24.0% annualized realized gains!

To multiply your wealth trading high-potential gold stocks, you need to stay informed about what’s going on in this sector. Staying subscribed to our popular and affordable weekly and monthly newsletters is a great way. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! Early in a young gold-stock upleg is a great time to get deployed.

The bottom line is timing gold-stock trades to ride sector uplegs then sit out subsequent corrections is fairly simple. Watching where this sector’s leading GDX benchmark is trading compared to its 200-day moving average reveals when gold stocks can be bought relatively-low then sold relatively-high. Actually executing on that requires being contrarian, fighting the herd to do the opposite of popular consensus.

New gold-stock trades added after corrections should be protected with loose trailing stop losses. These can be ratcheted tighter to protect more gains as subsequent gold-stock uplegs mature. Fundamentally-superior gold stocks yield better trading results, with lower risks for losses and bigger gains as this sector powers higher. And gold-stock traders have to watch gold, as its fortunes drive gold miners’ earnings and stocks.

Adam Hamilton, CPA

February 12, 2021

Copyright 2000 - 2021 Zeal LLC (www.ZealLLC.com)