Below is an excerpt from an NFTRH report (#676, due out on 10.10) that has not even been written yet, outside of this opening segment that clarifies and makes some of the concepts NFTRH deals in more standard and hence, more readily understandable by more people.

Unless you are a pure day trader there should always be a reason for a given investment stance at any given time. That is because the MACRO (top-down global economic/financial backdrop) is the environment within which the micro (trades, investments) exists. At any given macro juncture there are (generally speaking) dos and don’ts with respect to micro trades and investments. From the October 10th edition of Notes From the Rabbit Hole…

Stock/Asset Selections With Respect to the Macro

It has been an active period for a top-down macro guy like me since early 2020 as the order of business since the March 2020 crash has been 1) recovery favoring ‘remote work/commerce’ oriented Tech and gold stocks, 2) a broader market recovery, 3) cyclical reflation-sensitive stocks favored, 4) the anticipated ‘summer cool-down’ favoring Goldilocks items like Tech/Growth and 5) a grind back to the inflation view, possibly favoring cyclical reflation-sensitive items but with a forward view of economic impairment (Stagflation) if/when the inflationary pressure starts to compound.

That’s a mouthful!

NFTRH 676’s opening segment will not provide analysis of the macro as it often does. Instead, I want to explain more about how I go about selecting the vehicles (equities, assets) with which to be aligned properly for any given macro view. Lately, there has been all too much balancing/rebalancing activity for my liking and that is a reflection of the weekly shifts in macro market indicators.

Rally, correction, increasing or fading inflation signals, said signals (long-term yields, inflation expectations, yield curve, etc.) in play but with divergences by the liquidity indicator tandem of the US dollar and Gold/Silver ratio. And so on. Again, it’s a mouthful or more accurately, a brain full. It’s a lot to keep track of on a weekly basis.

But what I see happening now is a grind, a churn, a process toward a decision point, a point of mass recognition about something. Until we reach that point conclusively, man and machine will, I suppose, continue to have doubts about what is ahead.

The Fed and its various talking heads (with Yellen in the side car) are in the game trying to manage our expectations about the inflation they enthusiastically created (and Yellen’s government continues to cost-push into the economy) and the media as always, is harvesting your eyeballs for those ad dollars. That of course should mostly be tuned out. We have proven why again and again over the years. By the time the media most loudly report to you the titillating or alarming news the play is pretty much done.

So it’s back to the top-down macro, its indicators and its trends. We are going to grind into a trend at some point and my lean here in Q4, 2021 is an inflationary one, with a likely Stagflationary impairment that will at best narrow the selection of effective vehicles (equities, assets) to use as we venture into 2022. In other words, if the macro continues to swing inflationary the ‘good’ inflation phase will end. As a side note, that is part of the reason I’d be constructive on gold, unlike the negative view we’ve had during the cyclical inflation (that is, inflation working to economic benefit) of 2021.

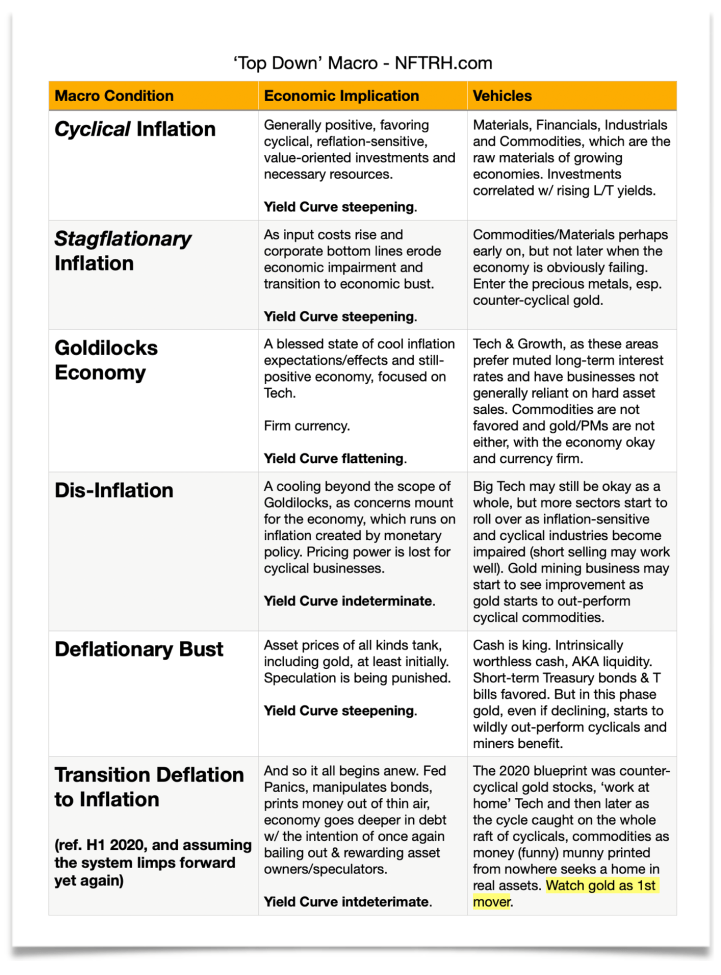

For more clarity, below are various macro conditions with associated investment stance.

These are the general conditions that we deal with, at least in the NFTRH scope of work and are my interpretations of those conditions. They are not necessarily in order of events as this is the real world replete with meddling, manipulative and intrusive central banks, politics and news cycles. It does, however, cover the scope of our work and assigns general ‘micro’ investment themes (vehicles) to a given top-down’ macro condition.

Consider it a playbook or reference, but as always I welcome your questions, critiques and additional color added because no one participant, no matter how nerdy or involved, has got all the answers. With this table I hope to standardize NFTRH orientations a bit.

Finally, the table notes typical conditions. As with managing the markets week to week, month to month we should not be robotic about it as if this were boilerplate from the Wharton School. A system managed by MMT (modern market theory) TMM (total market manipulation) will include plenty of unexpected speed bumps.

Now offering a 2 week free trial to the NFTRH Premium service with no obligation whatsoever. Sign up by PayPal, enjoy 2 free weeks of on-point market management and if it is not for you, cancel at any time with no further obligation. When you find that it is for you, stay on for as long as you like and let’s manage and take advantage in a cold and rational way as we head toward 2022 and its new macro challenges. 1st time subscribers only please.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by PayPal or credit card using a button on the right sidebar (if using a mobile device you may need to scroll down). Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter @NFTRHgt.