Today was yet another day marked by geopolitical turmoil, much like many others over the past year. This time, the turmoil was triggered by Iran launching at least 180 ballistic missiles toward Israel, marking the largest missile strike against Israel in history. Israeli Prime Minister Netanyahu declared that Iran has made a grave mistake and will face consequences as the world inches closer to all-out war with each passing hour. I hope for a peaceful resolution to this crisis, however unlikely that may seem. In this article, I’d like to share my observations on two assets often touted as safe havens—gold and Bitcoin—and how they perform during times of geopolitical crisis.

The chart below shows a tale of two assets: gold and Bitcoin. At approximately 9:32 AM EST, reports began circulating that Iran was imminently preparing to launch ballistic missiles at Israel. Interestingly, gold and Bitcoin responded in starkly opposite ways—gold surged while Bitcoin plummeted. This price action confirmed a long-standing frustration I have with Bitcoin: it behaves more like a risk asset than a true safe haven. If Bitcoin were truly "digital gold," I would expect it to rise during periods of geopolitical turmoil, not decline.

For comparison, here’s the S&P 500, which, much like Bitcoin, immediately dropped in response to the news:

In case you think today’s contrasting moves in gold and Bitcoin are an anomaly, a similar pattern occurred during the Iranian strikes against Israel in April 2024:

In case you think today’s contrasting moves in gold and Bitcoin are an anomaly, a similar pattern occurred during the Iranian strikes against Israel in April 2024:

Furthermore, the same behavior was evident following the October 7th 2023 attack on Israel:

Furthermore, the same behavior was evident following the October 7th 2023 attack on Israel:

I have long maintained that Bitcoin behaves more like a speculative risk asset, similar to hot tech stocks, rather than a safe-haven asset. This is evident in how closely Bitcoin's price movement tracks the tech-heavy Nasdaq 100 Index. The data reveals a striking correlation coefficient of 0.88 (out of 1) between Bitcoin and the Nasdaq 100 over the past five years, confirming their strong relationship and closely aligned movements. As the Twitter user “The Great Martis” frequently points out, “Bitcoin is merely a Nasdaq ETF,” and I couldn’t agree more.

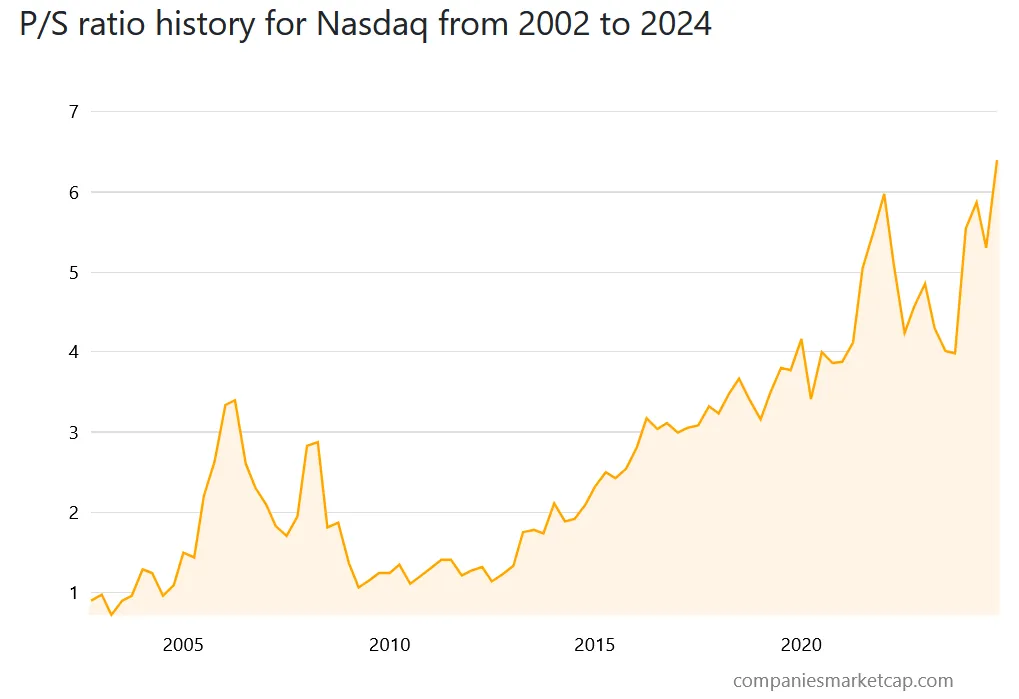

So, what’s the issue with Bitcoin being highly correlated with the Nasdaq 100? The problem is that U.S. tech stocks are currently in the midst of a massive bubble, fueled by unprecedented stimulus from the Federal Reserve. Like all bubbles, this one is bound to burst, and when it does, Bitcoin is likely to be pulled down with it due to their close correlation. There are numerous metrics indicating that the Nasdaq is in the midst of a massive bubble, one of the most telling being its highly inflated price-to-sales ratio:

So, what’s the issue with Bitcoin being highly correlated with the Nasdaq 100? The problem is that U.S. tech stocks are currently in the midst of a massive bubble, fueled by unprecedented stimulus from the Federal Reserve. Like all bubbles, this one is bound to burst, and when it does, Bitcoin is likely to be pulled down with it due to their close correlation. There are numerous metrics indicating that the Nasdaq is in the midst of a massive bubble, one of the most telling being its highly inflated price-to-sales ratio:

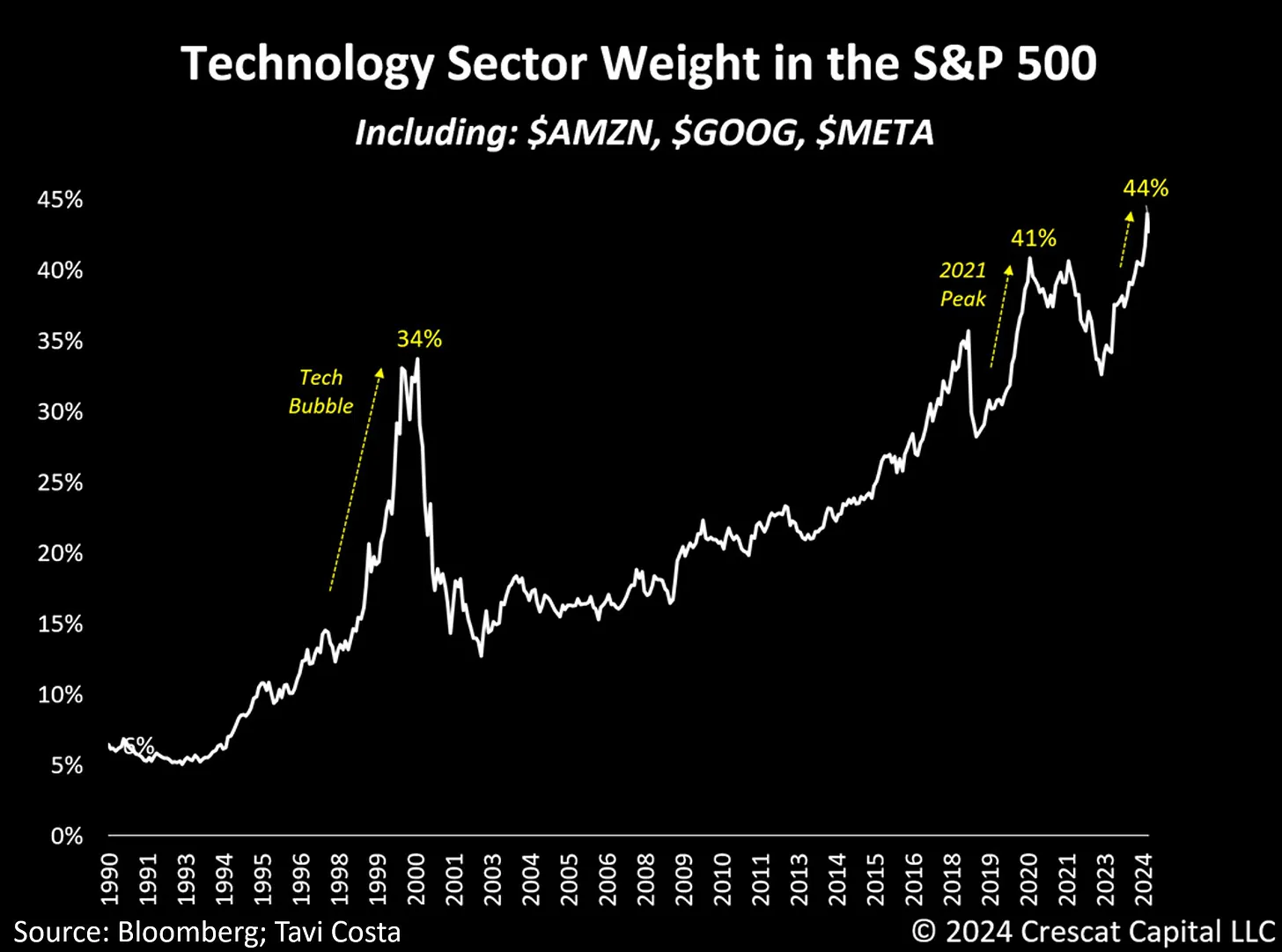

Another clear sign of the bubble in U.S. technology stocks is their inflated weighting in the S&P 500, which now surpasses even the peak levels seen during the 1999 dot-com bubble—an episode that ended in a market collapse:

Another clear sign of the bubble in U.S. technology stocks is their inflated weighting in the S&P 500, which now surpasses even the peak levels seen during the 1999 dot-com bubble—an episode that ended in a market collapse:

The strong correlation between Bitcoin and technology stocks is likely driven by the significant overlap in investors—those who are enamored by and overly confident in modern technology. I believe that this group will be blindsided by the bursting of the tech stock bubble, and when they’re forced to liquidate their tech stock holdings and lose their jobs in the tech field, it will drive Bitcoin's price down as well. Of course, that’s not to say Bitcoin couldn’t experience a wild surge at some point, reaching $100,000 or much higher. However, I don’t see it as a reliable investment like gold, which has a proven track record as a store of value over thousands of years.

The evidence shows that Bitcoin, despite being dubbed "digital gold," consistently behaves more like a speculative asset, particularly in times of geopolitical crises. Its correlation with the Nasdaq 100 Index and its susceptibility to the same forces driving tech stocks reveal that Bitcoin lacks the stability that defines true safe-haven assets like gold. As the bubble in tech stocks continues to inflate, Bitcoin’s fate is closely intertwined with theirs, making it vulnerable to sharp downturns when the bubble bursts. While Bitcoin may see significant price spikes, it cannot offer the reliability and historical strength of gold, which has proven itself a steadfast store of value throughout history. Investors should consider this reality before treating Bitcoin as a dependable hedge in times of uncertainty.