- Demand Is Booming

- Running It Hot

- Bipartisan Failure

- Easy Money

- New York and Dallas

Because I believe in the division of labor, I rarely use hand tools today. In the ‘80s and ‘90s, I had two 4 x 8 pegboards on my garage wall full of tools along with my large Craftsman toolbox. I had the right tool for every job around the car, house, and yard. I worked on the plumbing, electricity, built rooms, and flooring. My current friends might not believe it, but I was quite handy back then. It was almost a bit of a fetish.

Now, I know others can wield them more efficiently and I’m pleased to let them do so. My tools of choice today are my computers, iPad, and phone. I am much more productive with my current tools than trying to fix a light switch.

The right tool in the right hands can do miracles. However, it gets more complicated when you want to work on the markets and the economy. Hammers work because nails don’t unpredictably reshape themselves. The economy does. Fiscal and monetary authorities must rely on tools that don’t work consistently and may not work at all. As we’ll discuss today, this is a big part of our current dilemma.

We’d all like to think it has an easy explanation and a quick solution. Readers tell me all the time: “John, the problem is really ______.” Unfortunately, it’s not one problem. We face a swirling mess of different problems, interacting in ways we don’t fully understand. We do have some clues, though. It now looks more and more like August/September marked some kind of turning point. Economic data has weakened considerably since then.

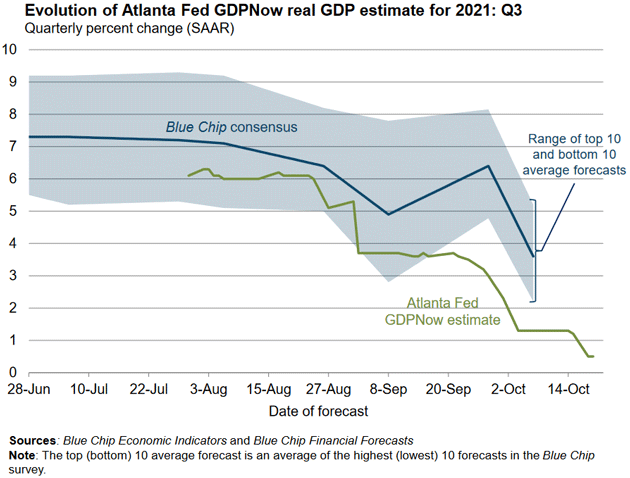

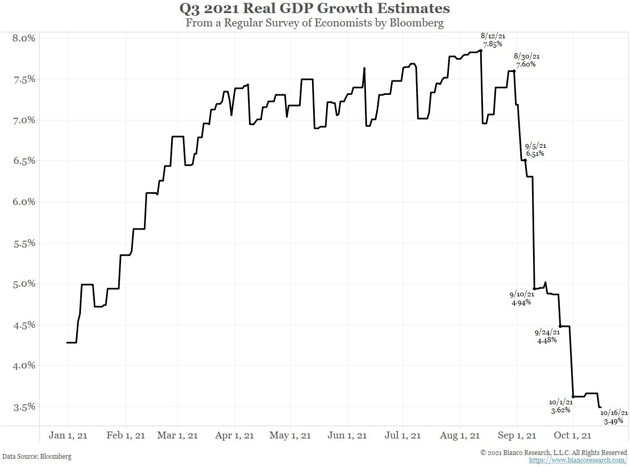

You know what I think of economic models, but they have a kind of objectivity. The numbers do what they do. It’s probably important that the Atlanta Fed’s third-quarter GDPNow estimate crumbled from 6.1% as of August 23 to 0.5% on October 18. That’s a whale of a change in less than two months.

Source: Atlanta Fed

Note the chart also shows a consensus of private forecasts dropping at the same time, though not quite as dramatically. Clearly something changed in the last 60–90 days. Here are some possible factors, in no particular order.

- Increasing supply chain snarls

- Jumping energy prices

- COVID-19 Delta variant case surge

- Evergrande and China housing crackdown

- A hasty US Afghanistan withdrawal

- End of enhanced US unemployment benefits

- Difficulties for pending infrastructure bills

- Oh, yes, the return of 5%-plus inflation which deducts from Nominal GDP to get Real GDP.

We can’t pin it on any one of these. They all had some influence, along with others not listed, adding up to the lower growth estimates. And let’s note, “lower growth” isn’t the end of the world. If Q3 real GDP growth is 0.5%, it won’t be what we hoped but it won’t be recession, either.

The economy is performing well in many ways. Plenty of jobs are available, new businesses are being launched, companies are profitable (third-quarter earnings season has started off with a bang!) and stock prices are strong. We could do much worse. But we could also do better, and the missed opportunities are frustrating.

Today’s letter will be the first of at least two parts. Next week I’ll describe where I think this is heading, and how we still have a chance to save the recovery if certain people/institutions make the right choices. But first, I want to establish three important points. They are foundational to my outlook. Here they are, summarized in one sentence.

We are facing demand-driven inflation as a consequence of misguided monetary policy and misdirected fiscal stimulus.

That may sound simple and obvious, but this one short sentence has a lot to unpack. We’ll start below.

|

Last week I wrote about the growing Logistical Sandpiles problem. It shows no sign of improvement. That’s not good, but I think this situation is also a clue to our deeper problems. The ports and railroads are clogged because the economy is demanding more goods, and this demand is driving inflation pressure.

My friend Jim Bianco explained what is happening in a magnificent Twitter thread you should read. I’ll excerpt his key points and charts below.

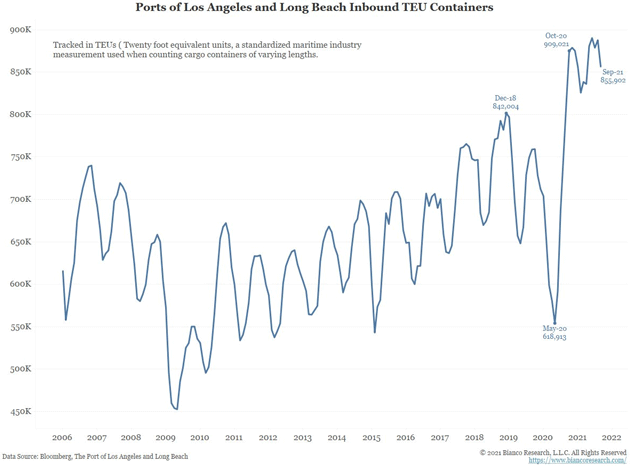

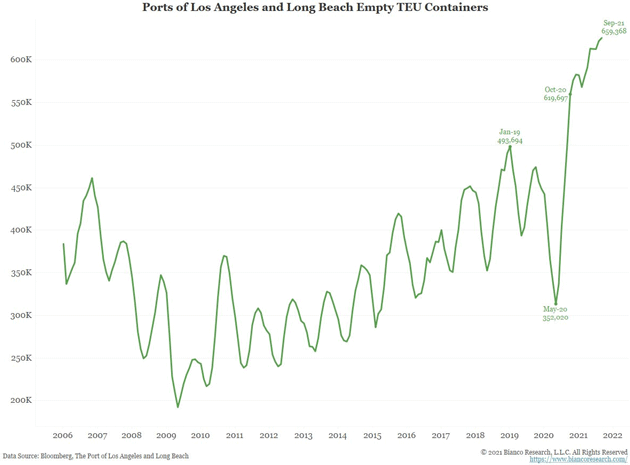

“The Los Angeles and Long Beach ports collectively unload just under one million containers a month. For the last year, they have been running at/near a record pace.

In other words, they are running as fast as they can. The problem is they are at their limit.”

Source: Jim Bianco

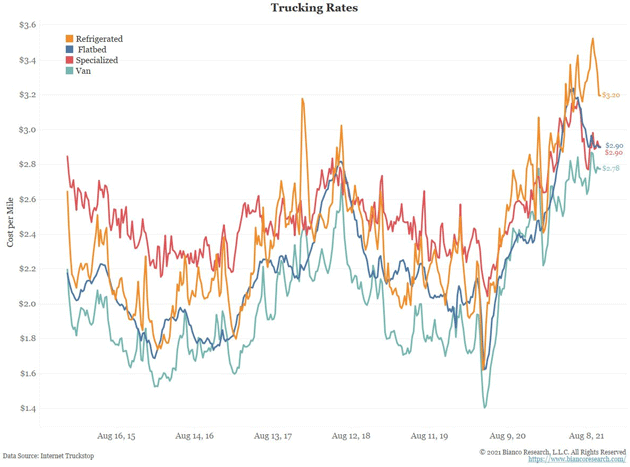

“There are also problems getting these containers off the dock. Unfortunately, there is a trucking shortage, which has led to soaring trucking rates (chart below). Demanding more trucks at 3 am to get these unloaded containers off the dock is going to be a taller order.”

Source: Jim Bianco

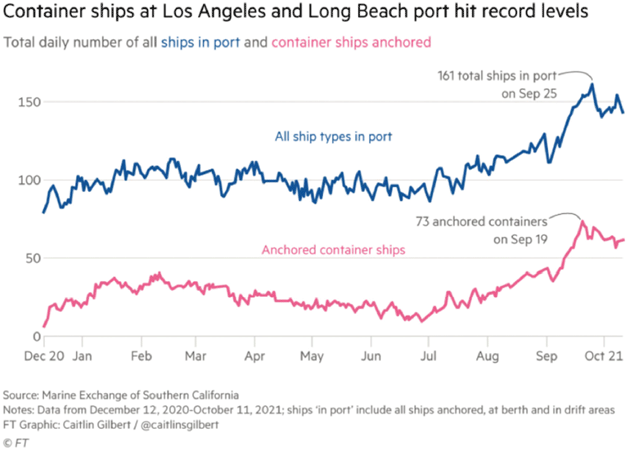

“This is leading to a backlog of ships anchored off LA. And since these containers are taking longer to unload, shippers now have to factor in this dead time anchored off shore. This is a disincentive to ship, so the number of empty containers are piling up in the ports.”

Source: Jim Bianco

Source: Jim Bianco

“This is leading to a recent fall in container rates. No one is in a hurry to ship these containers back to China for reuse if they are going to just sit anchored off LA for many days. Then one has to struggle to find a truck to haul it away.”

After illustrating the problem, Jim explained the cause.

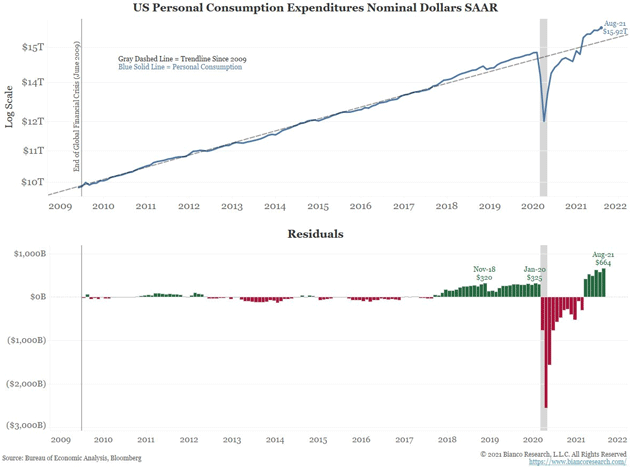

“Simply, demand is booming. Below is personal consumption since ‘09, its trendline, and residuals (actual-trend). Consumption is off the charts at $662B > trend.

Again, we want a record amount of stuff and the supply chain cannot handle it.”

Source: Jim Bianco

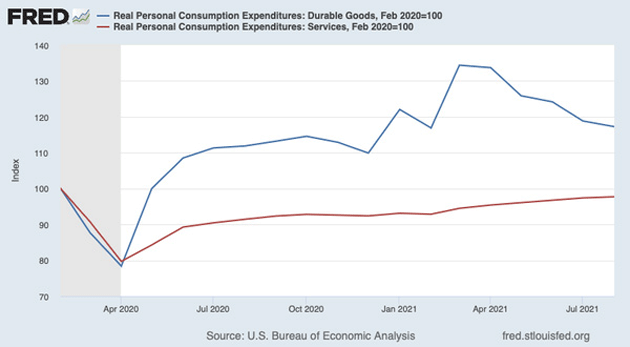

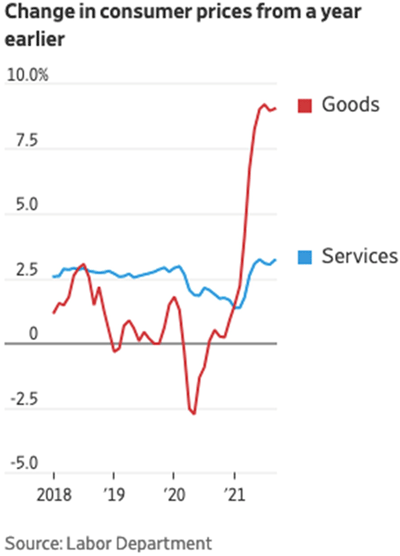

Interestingly, Paul Krugman highlighted some of the same problems but he notes a different distinction: Consumers have shifted their buying from services (experiences) to materials and specifically durable goods.

Source: The New York Times

This makes sense as the government sent trillions of dollars of “hot money” directly to consumers and/or businesses. Restaurants, hotels, and airlines were generally off the market, vacations were crimped, so people bought “stuff.” Thus, those ships off the shores of California contain extra goods that both manufacturers and shippers hadn’t planned for.

Jim thinks prospects for near-term relief are nil, and it will generate more inflation.

“Many assume increasing the throughput of the supply chain to meet overstimulated demand over the short term is doable.

But if the problem is the supply chain is at capacity now, expanding will be hard/impossible over the next several months. (JM: And if you are a business, do you increase your capacity for what will likely be a short-term demand increase?)

So to bring everything into balance, prices will rise until enough demand is destroyed to bring everything into line with the limits of the supply chain.

We might be seeing this happening as Q3 growth expectations are crumbling as prices are soaring.”

Source: Jim Bianco

Source: Jim Bianco

John here again. Let me add a couple of notes. First, as noted above, the consumption growth Jim describes is partly a consumption shift. Thanks to COVID, Americans have reduced spending on services (restaurants, concerts, hotels, airlines, etc.) and spent more on goods. It’s pretty clear in the inflation data.

Source: Tony Sagami

In barely more than a year we reversed a shift that unfolded over decades. Of course it’s not going smoothly!

Second, it would be nice to know more specifically what is in all these containers. I suspect a big part of it emanates from housing construction growth. Building materials are bulky and consume a lot of shipping capacity relative to their value. New homes, once occupied, also spark many other purchases: furniture, lawnmowers, garden hoses, etc.

If I’m right on that, then a break in the housing boom might have a swift effect on the supply chain problems. But right now there is no sign of such, in part because the policies driving it aren’t changing. Which brings us to my next big point.

Traditionally, the Federal Reserve prevents the economy from overheating by taking away the punchbowl, as the old saying goes. That skill set seems to have atrophied from disuse. Understandably so, too. We have seen nothing you could reasonably call “overheating” since the 1990s. Surging first-half 2021 growth simply recovered the prior year’s decline, more or less, and now seems to be ending.

So the current generation of Fed leaders and staff has spent years looking for ways to fill the punchbowl. They have long talked of letting the economy “run hot,” tolerating higher inflation for some extended period that would balance out years of lower inflation.

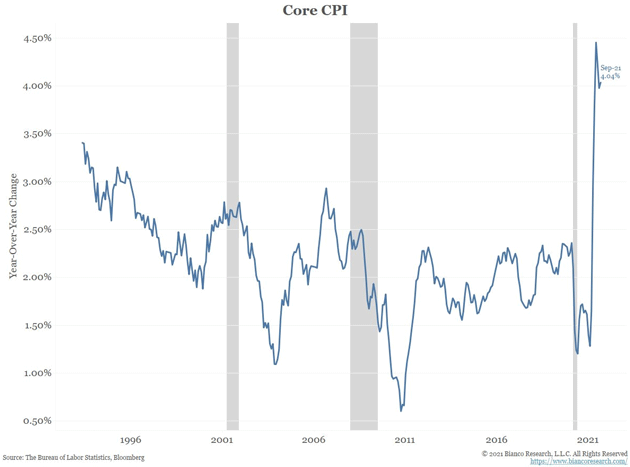

If that’s your perspective, then the idea this post-COVID period would bring only “transitory” inflation was likely disappointing. Look at Jim Bianco’s chart above, and you’ll see it has been many years since core CPI stayed above 2.5% for very long, and it’s often been well below. These last few months, while sharply higher, are still nowhere near restoring long-term “normal” inflation.

In my view even 2% inflation is too much. Some officials at least claim to be concerned about current levels. But as an institution, the Fed doesn’t seem to think the party is out of hand. They are certainly doing nothing to stop it.

Yet the supply-chain inflation Bianco describes is partly a result of the Fed’s actions since early 2020. Their initial dramatic moves were appropriate. We were in an unprecedented situation that could have destabilized the banking system. That risk passed pretty quickly, leaving a garden-variety recession they could have addressed without the drama. Yet their crisis programs and policies are still in place today. Why? I see two reasons.

First, they’re using new tools (like loan guarantees) because the old tools don’t work anymore. Debt loads, both public and private, are so gigantic that injecting more money no longer has the stimulative effect it once did. Lacy Hunt says declining velocity is key to this. They can create liquidity but they can’t force banks to lend, or businesses and consumers to borrow. Here’s Lacy in the most recent Hoisington quarterly (emphasis mine).

“As velocity declines, each dollar of money produces less GDP. The drop in velocity to lower levels indicates that monetary policy becomes increasingly asymmetric in its capabilities. While tightening operations are effective, Fed actions to support the economy are largely counterproductive even when they are novel in scope and massive in size. Benefits can accrue but their impact on economic growth has proved to be extremely minimal.

The Fed is able to increase money supply growth but the ongoing decline in velocity means that the new liquidity is trapped in the financial markets rather than advancing the standard of living by moving into the real economy.”

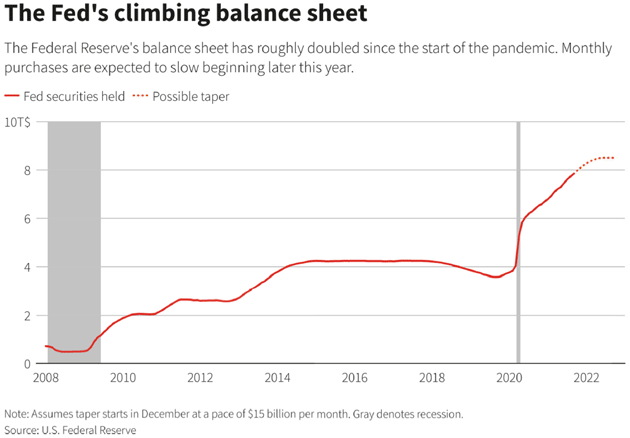

In other words, the Fed can still take away the punchbowl but is unable to refill it. They don’t want to take it away because they have this fantasy it will eventually work. So they are keeping short-term rates at zero and buying $120 billion in bonds every month, along with assorted other programs. You can see what it’s done to their balance sheet.

Source: Reuters

That $120 billion monthly bond buy goes $80 billion to Treasury securities and $40 billion to mortgage-backed securities. This is a giant rate subsidy to the federal government’s borrowing as well as home buyers. No surprise, both have been adding leverage. And as noted, the latter group is probably aggravating the supply chain problem.

All this monetary stimulus had some effect, of course, but the latest growth forecasts suggest it is already dissipating. The Fed did so much, so fast, it produced a self-limiting recovery in which supply-chain inflation caps potential growth.

That’s not good, but we have another culprit.

In March 2020, with COVID-19 spreading in the US, no one really knew what to expect. Just as the Fed was right to aggressively protect the financial system, the federal government acted correctly to help the millions who lost jobs and income. But details matter, and time is showing the stimulus programs were poorly designed and often counterproductive.

Let’s start with the core problem: They got the goal wrong. The target shouldn’t have been to stimulate the entire economy, but to maintain the status quo for affected individuals. At the time we (wrongly) thought a few weeks of inactivity would suffice. The goal should have been to replace the lost income and only the lost income, for the people who actually lost it.

But as a practical matter, that was apparently too hard. So instead we pushed them into an unemployment insurance system unprepared for the task and added a flat $300 weekly supplement that was more than some people needed and not enough for others. Then we also sent checks to almost everyone (excluding the highest income groups) whether they needed them or not. Then we did it again in late 2020, and again in 2021.

Note, this was a bipartisan policy failure. The first two COVID relief bills, totaling over $3 trillion, passed a Democratic House and Republican Senate. President Trump signed both. President Biden and a Democratic House and Senate added $1.9 trillion more. Everyone’s fingerprints are on this.

But whoever you blame, this money had a giant effect on consumer spending. Not all of it was bad. If the government is going to kill people’s jobs, it can at least help them buy groceries. The problem is that large amounts went not to basic needs but to discretionary luxuries, some of which are on those ships the ports can’t unload fast enough.

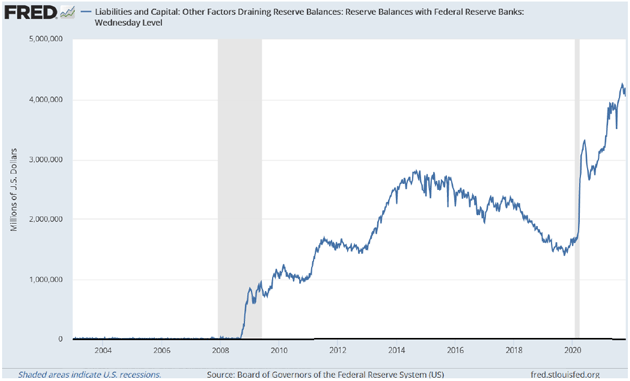

I have been trying to explain for years the subtle difference between QE (Quantitative Easing) and outright money printing (MMT). Essentially, the Fed does not buy government debt directly from the government. They go into the open market and buy it from people/institutions that originally bought that paper at Treasury’s auctions.

Typically, the money the Fed uses to buy that debt goes back on the Fed’s balance sheet as excess bank reserves. You can zoom in on the chart below and see what looks like a flat line up until about 2009 is actually composed of very tiny bumps. A small amount of “excess reserves” was normal. Then they started QE in 2009 and the amounts exploded. They began slowly tapering down in 2018 until the amounts jumped again from the COVID QE.

Again, in theory, banks could lend this money. That is not happening. It is ending up in margin accounts and other products, directly or indirectly boosting the stock market. That easy money policy coupled with extremely low interest rates is boosting home prices, exacerbating wealth and income disparity.

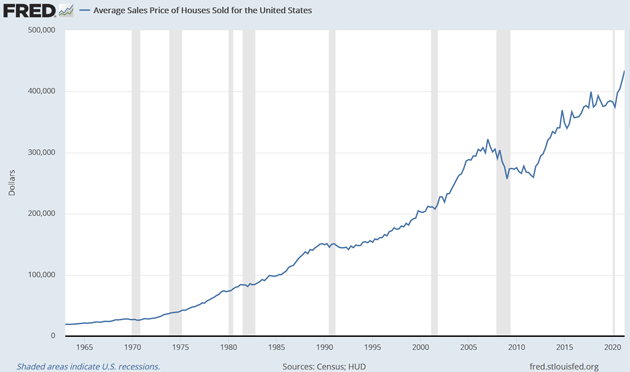

Source: FRED

Low interest rates are of limited help to first-time homebuyers when the average price goes from $380,000 to $420,000 in a little over a year. This is what happens when government, in this case the Federal Reserve, meddles in the market, albeit with good intentions. Now, if you already own a house that’s rising in value, you are not upset. But if you are trying to buy one the Fed is making it harder on you. It’s a corollary to financial repression.

An intended consequence? As many as 25% of homes are now being bought by yield-seeking funds that will rent them. When bonds no longer even keep up with inflation, investors look for other ways to get yield. And residential real estate offers not just yield but depreciation. That would not be possible or even necessary if Treasuries were 2½%.

Source: FRED

So where is the inflation coming from if it is not directly from QE? It is coming from the $6 trillion in high-powered Fed money plus fiscal stimulus spending. That money did not end up on the Federal Reserve balance sheet; it went directly into consumers and some businesses. The stimulus programs are the real helicopter money that Ben Bernanke mentioned almost 20 years ago.

For the record, I agree with Lacy Hunt. We will eventually go back to a slow-growth, disinflationary environment. I think real GDP will likely average 1% for the rest of this decade because of the debt burden. But in the meantime, until the stimulus and supply chain issues work out, until we figure out how to entice potential employees back to work, we’re going to have to deal with uncomfortably high inflation.

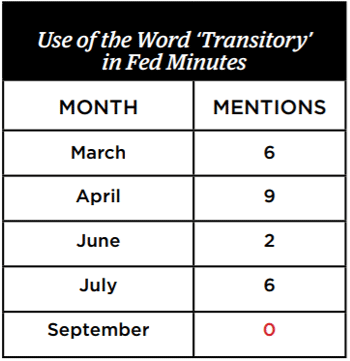

This from Grant Williams’ recent Things That Make You Go Hmmm:

Not only that, but recent comments by Fed officials suggest the Fed is trying to gently convince their adoring public that inflation may actually turn out to be “a little stronger than they forecast for a little longer than they forecast.” Sigh.

As you can tell, this is a vast problem with many moving parts. It has other elements I haven’t mentioned today, too. Like, for instance, low interest rates and quantitative easing can’t solve supply chain issues, microchip shortages, or changes in the labor market.

Together, the federal government and the Federal Reserve have put us all in a jam with no good alternatives. Yet we do have options. They aren’t great but would let us avoid the worst. I’ll describe them for you next week.

I had planned to be in New York next week, but circumstances changed. I will be in NYC beginning November 7 for a packed week of meetings and for my friend David Bahnsen’s launch party of his new book There Is No Free Lunch. It is going to be a powerful book. Then on to Dallas/Granbury for Thanksgiving.

I mentioned Jim Bianco’s powerful Twitter thread, which I quoted and made sure all those who follow me had a chance to read. Frankly, you should follow me on Twitter as much for the links I provide as well as my own commentary.

Halloween in my neighborhood, which has lots of kids, is interesting. This is a golf community so the parents and kids go from house to house by golf carts, often fabulously decorated. It is really quite fun. I think Halloween is Shane’s favorite holiday, and she really enjoys all the kids. She even gets me into the spirit, so to speak.

I have been busy with all sorts of things, and got undermined as my internet went down for a few days. We now have backup hotspots and it looks like I might even be able to get more reliable fiber-optic soon.

It’s time to hit the send button so let me wish you a great week and the start of a wonderful holiday season.

Your convinced the Fed has made a monetary policy mistake analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.