- Not Just Wrong but Incredibly Wrong

- Down on the Farm

- Imploding Superblocks

- Traumatic Ends

- Travel Plans, Over My Shoulder, and Birthdays

Six months ago, few Americans had heard of Evergrande. Now many worry this Chinese property developer’s downfall will start an economically devastating chain reaction.

They’re right about the chain reaction part, but I don’t think it will “devastate” anyone outside China (unless they have business there). Nonetheless, this episode exposes some other China issues worth discussing.

A few months ago in Xi’s Big Mistake , I said Beijing risked killing the entrepreneurial activity that had spurred the country’s rapid growth . As we learn more, this is looking less like a mistake and more like a mistakenly-conceived plan .

It’s hard to be sure because Chinese plans unfold so slowly. Leaders like Xi also don’t panic when their plans encounter difficulty. They patiently wait to get back on track, maybe nudging events along here and there. As long as society is stable and the regime not threatened, they just let it unfold. This opacity makes understanding China from the outside difficult.

Not Just Wrong but Incredibly Wrong

My views on China and Russia are rooted in the teaching and mentorship of Andrew Marshall. He was spectacularly right about both while the rest of the political/economic establishment, the CIA, and the State Department were not just wrong, but incredibly wrong.

Andrew Marshall (his biography is called The Last Warrior ) was a legend in military circles. He served at the premier Defense Department think tank from 1976 up until a few years ago. He was reappointed by eight presidents of both parties. His impact on US defense planning and thinking cannot be overstated. For whatever reason, in the mid 2000s, he began to have longer discussions with me and eventually took me under his wing. I had a great deal of access to his thinking, especially after he resigned.

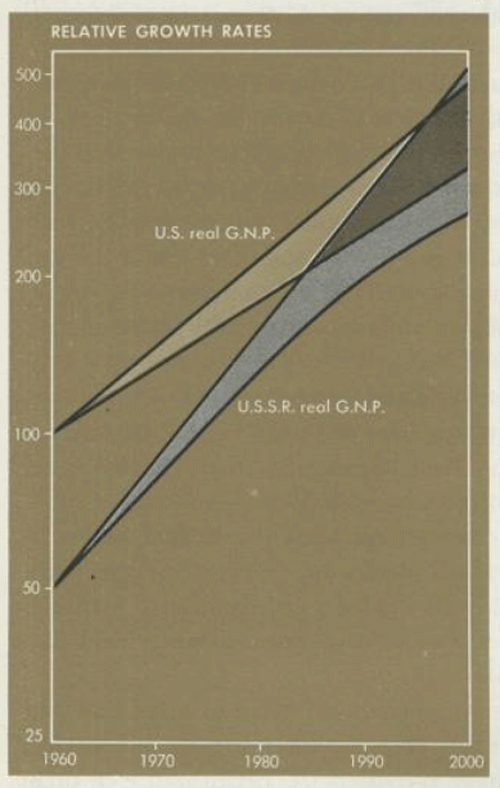

Let’s rewind to the 1970s. Paul Samuelson, Nobel laureate and textbook writer (if you took Econ 101 in that era you likely used his text), had this chart from 1961 and similar ones in each succeeding edition.

Source: marginalrevolution.com

Samuelson predicted that the GNP of the USSR would surpass that of the US by 1984 or in the worst case 1997. He would move the dates back in each edition and sometime in the late ‘80s the chart simply disappeared, as it had become embarrassing. It wasn’t just Samuelson; this was accepted thinking in many academic and government circles.

Source: Vintage News

Samuelson’s thinking influenced multiple generations of economists and bureaucrats. This from the same source as the graph above, emphasis mine:

“In Samuelson’s case, some of his pro-Soviet bias may be, in part, a result of his personal beliefs. He was a fan of socialism, and as he said in the 1989 edition of his hallmark text, ‘The Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive.’”

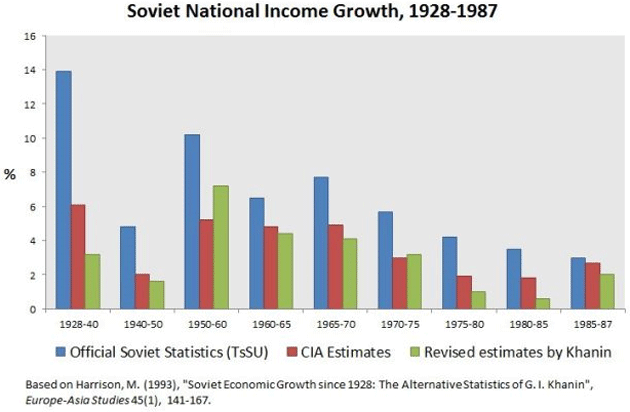

Andy Marshall (and James Schlesinger as well) argued Russia was a literal Potemkin village, not growing nearly as much as Samuelson and others said. Andy, along with Jim Williams, helped develop what is called “inferential analysis.” You have to look past the headlines and do the analysis on the ground, not unlike what value investors do when analyzing a company. Counting the number of cars in the parking lots, etc. As the old saying goes, it’s what’s on page 16 that will end up making a difference in the future.

Much of today’s China analysis is based on headlines and not what’s really happening on the ground. There is a great deal of bias and sensationalism used to attract eyeballs and readers. Similarly, in the 1980s when US government agencies and especially the Defense Department were focused on Russia, Andy Marshall was saying China would be a bigger problem.

Like much of our discourse these days, the China discussion suffers from either/or thinking. Some call China an implacable foe bent on world domination, whatever the cost. Others see an aging autocracy clinging to a failed Communist ideology that will inevitably collapse.

I don’t rule out either of those possibilities, but there’s a lot of room for China to “muddle through” between them. That’s the far more likely outcome in China, in my opinion, just as it is in the US. Muddling through doesn’t mean “no problem.” It can bring big problems, but they fall short of the doomsday thinking of the either/or scenarios.

To understand how/if China will muddle through, we need to view current events in context. Change happens slowly even in small countries. China certainly isn’t small, so it can take years to even notice a change is happening. But consider the last few decades.

Modern China’s founding father, Mao Zedong, led the government from 1949 until his death in 1976. He was ideologically Communist and acted accordingly. There was nothing resembling capitalism in China during those years. And like the Soviet Union, it didn’t work very well. China under Mao was an unmitigated disaster. Tens of millions of people literally starved as government officials lied about farm production in order to please Mao. Massive misallocation of capital kept the country poor. Reeducation camps for anyone thought of as an intellectual scarred a generation.

A once-thriving economy became an impoverished mess. Mao’s successors recognized this and started “restructuring” long before Moscow did under Gorbachev. This may be why China avoided a similar disorderly breakup. And understand, many of the subsequent and current leaders of China grew up and were influenced by those events under Mao.

So throughout the 1980s and 1990s, Chinese authorities, under the encouragement of Deng Xiaoping, allowed some capitalist-like innovation and entrepreneurship, but always within limits. It led ultimately to China’s 2001 admission to the World Trade Organization, now widely seen as the launch of globalization.

Louis Gave argues (and I think rightly) that in global historical perspective, China entering the WTO may have been more important than 9/11. The country’s growth in the early 2000s was unlike anything in economic history. As many as 250 million people moved from subsistence farming to working in cities with far better lifestyles in a few decades. That’s a bigger migration by a factor of 10 than anything else of which I’m aware.

But as the old song went, “How ya gonna keep ‘em down on the farm after they’ve seen Paree?” Show people even a little prosperity and they don’t want to go back.

Source: Wikimedia Commons

This became a problem for China when the Great Recession struck in 2008. Those millions of newly-happy peasants became a threat to social order, something Beijing couldn’t abide.

The solution was simple, though. With exports dried up, the government turned inward by launching massive infrastructure and housing projects around the country. These produced some valuable facilities but their real point was to produce jobs. And it was mostly debt-financed.

All this happened before Xi Jinping became president in 2013. He was on the Politburo at the time, though, and so involved in the decisions. Did he agree? We can’t know. He had grown up under Mao and spent his career advancing through the Party’s ranks. Everything we know says he is a dedicated communist. But he reached the top by being a pragmatic, get-things-done administrator.

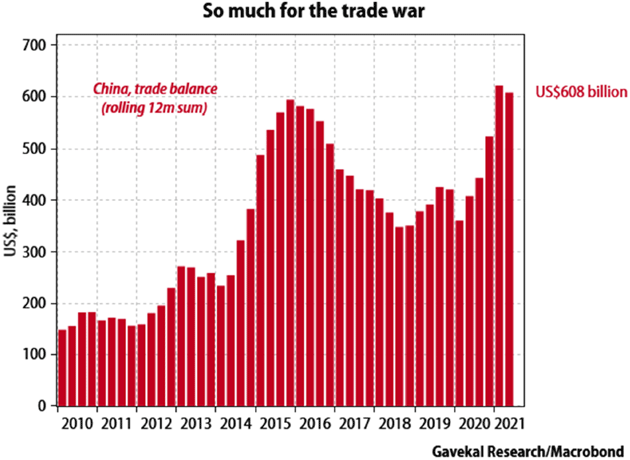

In any case, it fell to Xi to deal with the aftermath of these choices. The infrastructure campaign and related policies produced a giant economic boom in themselves, further enhanced by the rest of the world’s simultaneous recovery. China and Xi took advantage of the economic boom and their trade balance simply soared. It is hard to see a trade war in this data:

Source: Gavekal

China developed something new: a class of wealthy business founders, corporate executives, and professionals seemingly independent of the Communist Party. Their rise is now looking less like the goal and more like a temporary side effect.

“The phrase—“To get rich is glorious”—is the simplified version of what Deng Xiaoping told his country a generation ago: “Rang yi bu fen ren xian fu qi lai,” he declared. “Let some people get rich first.” It unshackled China’s economy, and created the tycoons and super-growth we see today.” (Evan Osnos in The New Yorker )

Which brings us to Evergrande.

Evergrande, the troubled property developer now emblematic of China’s problems, didn’t appear out of nowhere. It grew by providing a) something people needed which was b) consistent with the government’s goals.

Sometimes the best economic insight comes from outside economics. This is from an interesting 2019 article on Chinese “superblock” architecture —those giant, tombstone-like apartment towers that dominate city skylines there.

Chinese officials in the 1990s were under pressure to expand the housing supply, and fast. The most expedient way of accomplishing this was to parcel out enormous plots of land to private developers, who quickly filled them with 30-story residential towers. The city planning authorities, meanwhile, obligingly built eight-lane highways between the blocks to service inevitable car traffic.

One reason for this… is the symbolic importance of cars and highways. Chinese officials obsessed with projecting a “modern, world-class” facade would of course seek to emulate the American city model, no matter how badly that model has been discredited. For ordinary Chinese people, too, car ownership was a crucial indicator of socioeconomic status.

But an even more important reason behind the continued insistence on superblock planning is the reliance of Chinese city governments on land lease revenue. Since the tax-sharing reform of 1994, cities have been obliged to fork over an enormous percentage of their tax revenue to the central government. In order to generate enough revenue to cover social services and other costs, cities have come to rely heavily on China’s land-lease mechanism that allows the city to rent parcels of land to private developers for a period of 70 years.

Superblock planning therefore was irresistible to Chinese officials, who could quickly expand the housing supply and generate a massive amount of tax revenue in the process. Although it’s changing, it’s still the case that Chinese cities generate an astonishing percentage of their revenue from land leases—more than half by most estimates.

The key point here: Evergrande-like development in China wasn’t just capitalism doing its thing. It was capitalism facilitated by government officials for their own purposes. Beijing wanted social order and local officials wanted revenue. The housing projects helped deliver both. Capitalism with Chinese characteristics?

Not surprisingly, this led to excess. You may have seen the viral video of 15 empty towers being imploded in Kunming this summer. They had sat empty since the developer ran out of money in 2013. Many more such “ghost cities” exist, often financed by pre-sales before construction even started.

Here in the US we think of homeownership as a sign of financial maturity and stability. In China it is even more so. Some estimates show 80–90% of household wealth is in real estate. That wealth is now in serious danger. The Kunming implosions suggest portions of it will literally go up in smoke.

Evergrande’s problems, like those of other developers, began when the government cracked down on the same leverage and speculation it encouraged for years. That’s how central planning works. The plan can change.

The China experts I follow don’t expect this will spark a financial crisis. As Louis Gave said in a recent report I shared with Over My Shoulder members, Evergrande is collapsing not in spite of the government’s wishes but because the government decided to let it fail. Protecting big companies is inconsistent with Xi’s new “Common Prosperity” initiative, so it will stop. Here’s Louis.

Common prosperity is a way for the Chinese government to highlight the differences between policymaking in China and in the West, not just to China’s citizens but also to citizens of the developing world in general. The not-so-subtle message is that while policymakers in the West allow big tech monopolies to fleece small and medium-sized companies, China protects its mom and pop corner stores, restaurants and other small businesses from the predatory behavior of tech platforms.

While private education companies in the West are free to gorge themselves on the insecurities of parents, in China that behavior will no longer be accepted. While in the West, gains are privatized but losses are socialized, China aims to privatize the losses (as with Evergrande) and socialize more of the gains (as with the pressure on tech platforms to raise wages, hire more young graduates, and make big donations from their profits to charitable causes).

This isn’t entirely bad. Making businesses bear the cost of their mistakes is refreshingly capitalist. We should do more of that here. In the Chinese case, these mistakes were also the government’s. But because the government rules, it will decide who to protect. Chinese homebuyers who never got their homes will probably get bailouts. Property developer executives, shareholders, lenders, and suppliers probably won’t.

In fact, what is happening on the ground is that all of the cash from Evergrande and other equally distressed companies is being used to finish the projects for the homebuyers at the expense of the bondholders and of course the equity holders. The rule of law is the rule of Xi, and he is pragmatic. He deems the well-being and happiness of homebuyers more important than a few upset bondholders.

The visible impact of all this will be mostly within China, but its macro effects will be global. Such wealth destruction should be intensely deflationary. That may be part of the goal, in fact. Chinese consumers are feeling significant inflation in food, housing, and other living costs. Demographic factors, particularly population aging, will increase this pressure. Decades of the one-child policy reduced working-age labor supply, which raises wages and other prices.

But it won’t stop there. For years, China’s voracious appetite for energy and materials underpinned prices worldwide. At the same time, its low manufacturing prices basically exported deflation. Hence we saw little or no inflation in most finished goods but a lot of inflation in commodity-intensive services like food, energy, and housing.

In short, China is losing its role as the world’s lead manufacturing exporter. Government policies aren’t helping, but George Friedman notes this is actually a cyclical process. He wrote a thoughtful piece (which I shared with Over My Shoulder members here ) about the apparent 40–50 year pattern in which a nation takes on this role then loses it. The US did so in the 1890s, then it was Japan, and China since the 1980s.

This process seems to be built into modern capitalism. There is a hunger for low-price manufactured products by wealthy countries that can no longer afford to produce them. Why does the cycle take 40 years? I have no explanation. It could be coincidence if there were only three cases. Or there could be some structural cause. But it is there, and it seems to be reaching its terminal stage in China.

The end of this period is traumatic. The US marked it with the Great Depression, and Japan with its 1990s downturn, but both countries adapted and recovered. (You might even say they “muddled through.”) George expects the same for China.

China, of course, isn’t going anywhere, and it will be a permanent economic power after it stabilizes. But the breathless blather of its taking over the world will have been proved wrong. Another country we never expected will take its place, and then we will claim to have always known it was there.

China has its own wrinkles, which to me are quite frustrating. A country so large, with so many brilliant, hard-working people, really could take a leading economic role in the right circumstances, and the world would be better for it. But it would require a government that allows personal freedom and entrepreneurship, and China under Xi will have neither.

We will delve even deeper into the mysterious Chinese economic dragon next week.

Travel Plans, Over My Shoulder, and Birthdays

As mentioned before, I really do plan to get to New York in later October and of course Dallas for Thanksgiving and family. This next Monday I will have a quiet dinner with some friends in acknowledgment of my 72 nd birthday.

Today I mentioned some articles we sent to Over My Shoulder subscribers recently. I think it is our least expensive service but perhaps one of the most valuable. Each week Patrick Watson and I collect our favorite articles on economics and related matters, then send them to subscribers with a short summary. This is material we find intriguing from our rather large network. It’s like you’re reading, well, over my shoulder. We don’t overwhelm you, just a few pieces a week, and the summaries let you get the main points quickly. Click here to learn more.

And with that I will hit the send button. Writing about Andy Marshall and Jim Williams got me to thinking of all the influences I’ve had over the last 50 years. So, tonight I will raise a silent toast to the numerous mentors of my life. Some I never met but just read for decades, some like Peter Bernstein were shining stars for decades. I owe them so much.

And with that, have a great week! Oh yes, don’t forget to follow me on Twitter . John Mauldin unplugged and too often unfiltered, but we do have fun.

Your thinking how wonderfully marvelous this long strange trip has been analyst,

|

|

John Mauldin |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.