Aztec Minerals Corp. (TSX-V: AZT, OTCQB: AZZTF). is freshly financed with strong backing to aggressively advance its projects with two drill programs at its highly prospective properties in Mexico and Arizona. The company is setting up for a busy summer with plenty of news.

The company recently closed an attractive $1.1 million private placement, paying no fees nor offering any warrants, to fund this round of exploration. The multi-billion dollar gold miner, Alamos Gold, took the lion’s share of the financing with 7,926,089 Units, for total proceeds CAD$2,377,826.70 out of the CAD$3.4 million financing.

Alamos now holds 9.9% of the company’s shares on an undiluted basis and 18.0% on a partially diluted basis assuming the exercise of Alamos’ warrants.

Aztec is eager to deliver value through drilling and discovery, and build momentum after consolidating ownership of its Cervantes project and a strong 2022 exploration program

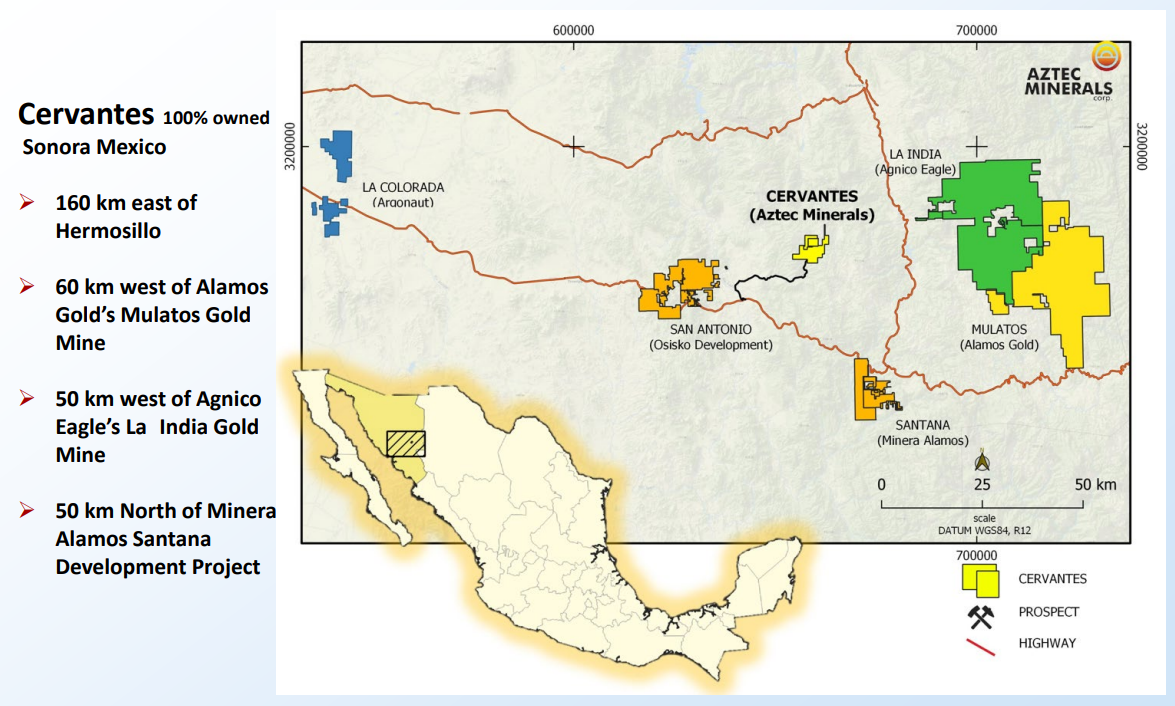

Building Heap Leach Potential in Mexico at Cervantes

The company recently announced its 2023 exploration program at its 100-per-cent-owned Cervantes porphyry gold-copper project in Sonora, Mexico.

The primary objectives of the 2023 exploration program are to continue to define the open-pit, heap-leach gold potential of the porphyry oxide cap at the California target, and test for extensions at California Norte.

Every hole drilled at California has intersected near-surface, oxidized gold mineralization with minor copper values. The area currently being drilled measures approximately 800 metres long east-west by 730 metres wide, with demonstrated, continuous mineralization of up to 170 metres depth. The porphyry gold-copper mineralization is still open in all directions.

The company has identified several target areas:

Purisima East: geochemical soil anomaly in 193 samples that average 0.25 g/t gold, a small historic glory hole mine where rock chip sampling returned high-grade mineralization up to 44.6 g/t gold.

Purisima West: a mirror image of Purisima East in size and type of gossans, altered and mineralized breccias and intrusions in association with gold and copper soil anomalies.

Estrella: Rock chip samples up to 3.9 g/t gold and 2,010 parts per million copper.

Jasper: 2017 trenching returned skarn/replacement-type mineralization up to 0.52 per cent copper and 0.62 g/t gold over a 92.4 m length. In 2022, reverse circulation drilling found a broad zone of copper-gold mineralization in JAS22-001.

California North: coincident IP chargeability and gold-copper-molybdenum soil geochemical anomalies with demonstrated gold-copper mineralization by RC drilling; it may be a north extension of the California target.

Other targets: porphyry alteration and geochemical soil anomalies mark the Jacobo and Brasil prospects but more work is required to expand and define these targets.

The Cervantes lies along an east-west trending gold belt 60 kilometres west of their strategic investor – Alamos Gold’s Mulatos epithermal gold mine, 35 km northeast of the Osisko Development’s (TSX-V: ODV) San Antonio gold mine, 45 km west of Agnico Eagle’s (TSX: AEM) La India gold mine, and 40 km northwest of Minera Alamos’ (TSX-V: MAI) Santana gold deposit.

These projects host approximately 13 million + in gold resources and reserves, and share similar mining methods for low grade but high tonnage gold deposits.

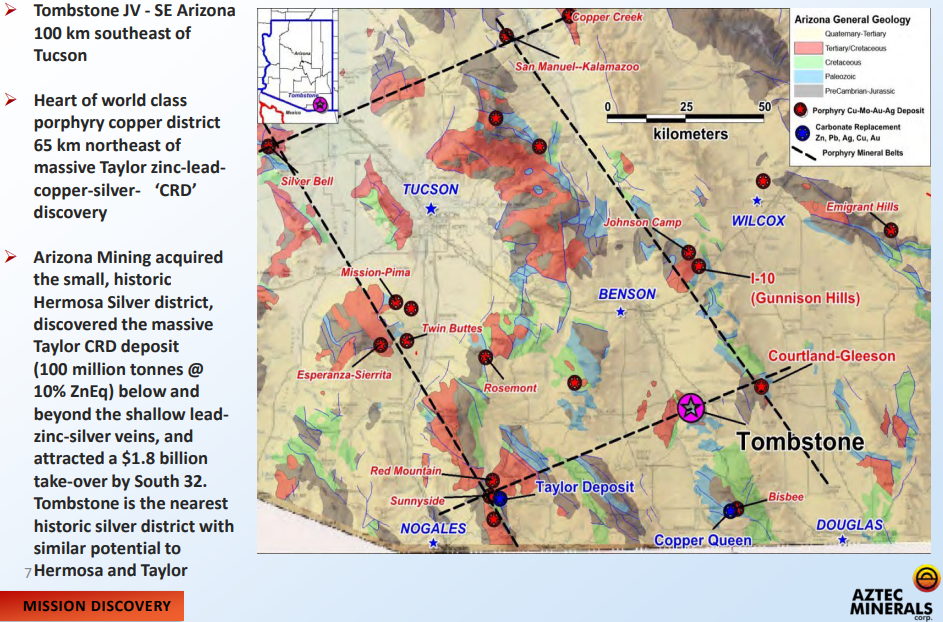

North of the Border: Testing Arizona’s Silver History

While the company’s main focus has been in Mexico, it is not ignoring its other projects. It commenced core drilling in the Contention open-pit gold-silver target at the company's 75-per-cent-owned Tombstone project in Arizona.

The 10-hole, 2,250-metre core drilling program is a continuation of the prior, very successful, 2020/2021 drill programs and is focused on expanding the oxide gold-silver mineralization.

Every one of the 44 drill holes in 2020/2021 programs intersected shallow oxidized gold-silver mineralization over substantial widths, several drill holes encountered visible gold, and all drill holes ended with mineralization, indicating the main mineralized zones are still open to depth.

Tombstone 2020-21 Drilling Highlights:

- TR21-22: 2.44 gpt Au and 66.56 gpt Ag (3.39 gpt AuEq) over 65.5m

- TR21-10: 1.39 gpt Au and 56.40 gpt Ag (2.20 gpt AuEq) over 96.0m

- TR21-03: 5.71 gpt Au and 40.54 gpt Ag (6.28 gpt AuEq) over 32.0m

- TR21-13: 1.80 gpt Au and 36.90 gpt Ag (2.33 gpt AuEq) over 70.1m

- TR21-17: 1.73 gpt Au and 56.20 gpt Ag (2.53 gpt AuEq) over 64.0m

- TR21-08: 2.09 gpt Au and 47.1 gpt Ag (2.76 gpt AuEq) over 39.6m

- TR21-18: 0.76 gpt Au and 20.61 gpt Ag (1.05 gpt AuEq) over 64.0m

- TR20-02: 0.94 gpt Au and 42.1 gpt Ag (1.60 gpt AuEq) over 77.7m

- TR20-03: 0.77 gpt Au and 25.2 gpt Ag (1.07 gpt AuEq) over 97.5m

Aztec holds a 75-per-cent joint venture interest in the Tombstone property, which includes many of the original patented mining claims in the district. The project is located 100 kilometres southeast of Tucson, Arizona and covers much of the historic Tombstone silver district.

Tombstone is known for its high grade, oxidized, silver-gold-lead-zinc-copper deposits that were mined in the late 1800's and early 1900's.

Drilling as Exploration Interests Grow

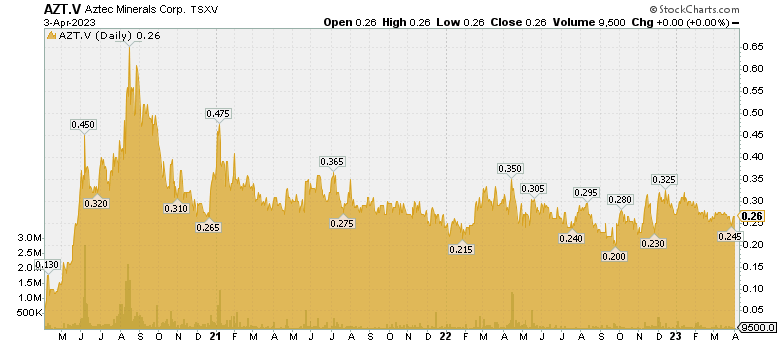

Gold and Silver prices bottomed out in late 2022 with interest in the precious metals sector steadily developing. Now with Gold prices flirting with $2,000/oz and prospects for record highs around the corner with Silver prices looking very promising, the trickle of interest into gold and silver stocks will turn into a stampede.

The beaten down exploration sector really stands out in times like these, where a return of investment interest will find its way into the best opportunities sending share prices much higher. I believe Aztec Minerals is very well positioned to attract new investor interest as the sector revives and the company progresses forward with adding more value through exploration.

Aztec is freshly financed with strong backing to aggressively advance its projects with two drill programs at its highly prospective properties in Mexico and Arizona. The timing for these drill results is timing up very well with a sector reviving.

I continue to grow my investment position in Aztec Minerals making it into one of my top five gold-silver exploration holdings. With cash in the bank, pending drill results providing near-term upside potential, a strategic gold mining investor and focused ownership, Aztec Minerals is well positioned to be a leader in the gold/silver exploration space!

To continue your research and learn more about Aztec Minerals, please visit AztecMinerals.com

This report’s analysis was produced with the work of Nicholas LePan, GoldSeek.com

To Stay Connected:

- Twitter: @GoldSeek

- E-mail List: Sign-Up Here

Disclosure: GoldSeek.com employees own shares of Aztec Minerals Corp. and the company is a sponsor of this website.

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The companies mentioned herein may be sponsor of GoldSeek.com. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.