It has been over a month since I wrote my last article. Nothing has changed. Silver is bullish on the expected line. The current rise in silver price is just the tip of the iceberg. Copper is purely a speculative play in CME and the Trump tax. The pace of rise of copper CME futures is indicative of a big bust in the final quarter of the year.

I just held on to my investment. Exited investments that were fundamentally weak. Key factors moving the precious metal price have not changed since last month. Central banks continue to increase gold reserves. Gold ETF inflows are rising every month. Silver, masses are finally realizing the massive undervaluation. So, investment demand is rising with the passing of each day.

I expect a very good silver jewellery demand (for the rest of the year) in India. The historical high silver price in India, with expectations for a further rise, will not dent silver jewellery demand in India. Silver coin demand should see a parabolic rise in India, Asia, and worldwide.

I am not sure whether the US inflation numbers, CPI, PPI, and Core PCE, will have any long-lasting impact on changing the trend in gold and silver. The Trump tariff is expected to increase inflation over the coming months. June and July month inflation number will not reflect the impact of Trump’s additional increase in import duty on US consumers. Expectation of firm inflation in the USA and less chance of an interest rate cut will ensure an overall bullish trend in gold and silver. Intraday volatility will still be on the higher side.

I have been asked whether to shorten silver by my close friends. My reply is that I am not confident of short selling silver at the current price. We need to wait and watch if spot silver manages to break and trade over $40.00 or not. Spot silver has a higher chance of a crash or a short-term sell-off if and only if it does not break $40.00 by 20th September. (After the September Federal Reserve meeting). This is my view.

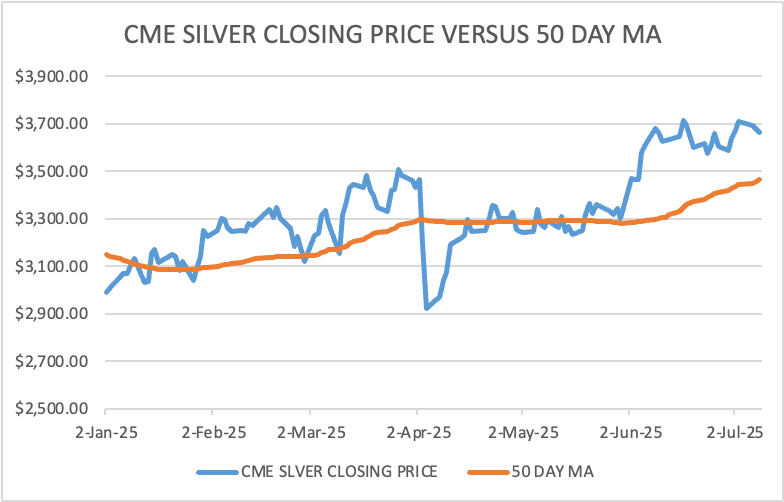

The above is the Price Gap or Price Difference between the CME closing price and the fifty-day simple moving average. Technically CME silver future price has to be more than the fifty-day simple moving average to be bullish. A bearish trend in silver happens when the fifty-day simple moving average remains over the closing price for over two weeks and more.

- 1st January 2025 to 9th July 2025: Gap average $87.90

- 1st April 2025 to 9th July 2025: Gap average $79.84

- 1st June to 9th July: Gap average $258.90

If the silver price continues to rise for the rest of the quarter, then this gap will narrow, which can cause a sell-off for a few days. This is just one of the ways to analyze when the silver price can correct.

The above is another way to understand the Gap Analysis. The more the divergence between the daily CME silver closing price, the greater are chance of a sustained bullish trend. Narrowing of divergence indicates booking partial profit or even completely exiting short-term investment. (depending on other global news and expectation indicators.)

Nowadays, the masses in India and worldwide are just obsessed with options. Very few do a gap analysis based on end-of-day data. Gap analysis is one of the simplest ways to know the short-term trend. Gap analysis based on end-of-day data is not useful for intraday trading. It has to be used in conjunction with other technical.

SPOT SILVER – current price $37.03

- Spot silver has to trade over $36.28 today and next week and rise to $38.34, $40.74, and more.

- A crash or sell-off will be there only if spot silver has a daily close below $36.28 for a minimum of six trading sessions.

- Views are intraday, unless otherwise specified.

Disclaimer

The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE