Sentiment is bullish for 2026 for precious metals and non-ferrous metals in 2026. But needs to be careful of short-term trades and short-term investment. Long term bullish trend is intact even if there are a few months of bearish trend.

Comparison between closing price, 50 day simple ma and 100 day simple ma will tell us the trend of silver and an idea as to when it can crash.

- Average price gap between near dated active CME silver future price and 50 day simple ma in 2025: $266.00

- 31st December 2025: Closing price gap between near dated active CME silver future price and 50 day simple ma: $1407.70

- Average price gap between near dated active CME silver future price and 100 day simple ma in 2025: $167.23

- 31st December 2025: Closing price gap between near dated active CME silver future price and 100 day simple ma: $2061.30

- Average price gap between simple 50 day MA and simple 100 day MA in 2025: $167.30.

- 31st December 2025: Price gap between simple 50 day MA and simple 100 day MA in 2025: $653.60

How to use the above in 2026 for silver

A wider price gap or a rising price gap between (i) 50 day MA and 100 day MA indicates medium term bullish trend. A falling price gap (between 50 day ma and 100 day ma) for ten to twelve consecutive trading sessions is needed for a sustained short term bearish trend in silver in 2026.

We need to keep a close watch on convergence/divergence between 50 day simple MA and 100 day simple MA in 2026.

MORE ON SILVER

In silver the divergence between simple moving averages (50 day and 100 day) zoomed on or from September 2025 month BUT BUT in a very big way from November 2025 month. A falling trend for seven consecutive trading sessions to twelve consecutive trading sessions can result in a big convergence between 50 day MA and 100 day MA and chance of a big short-term crash and even a short-term bearish phase.

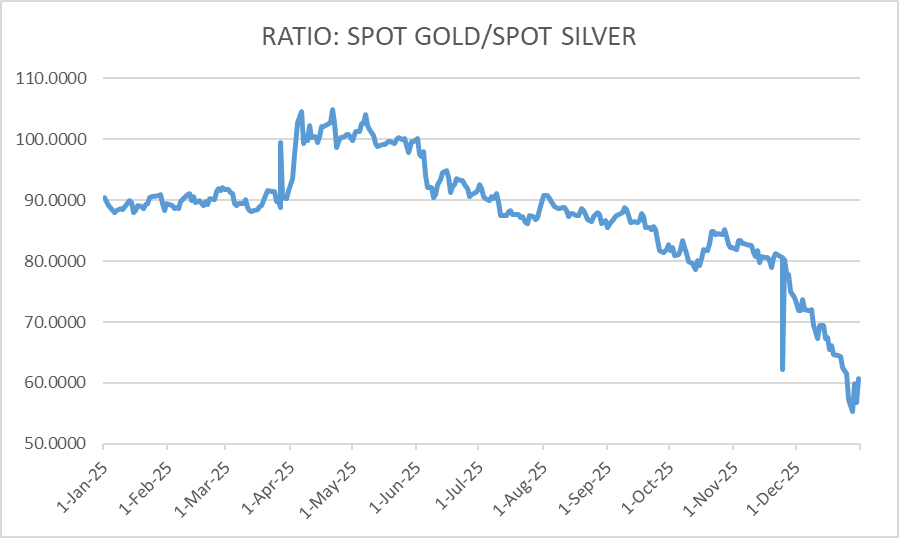

RATIO: SPOT GOLD/SPOT SILVER

- 50 DAY MA OF SPOTGOLD/SPOT SILVER RATIO: 72.20

- 100 DAY MA OF SPOTGOLD/SPOT SILVER RATIO: 77.40

- 200 DAY MA OF SPOTGOLD/SPOT SILVER RATIO: 84.56

- 400 DAY MA OF SPOTGOLD/SPOT SILVER RATIO: 87.11

- 31st December closing price ratio: 60.70

Spotgold/spotsilver ratio needs to rise and trade over 65.10 for any crash or sell off in silver and gold. A falling ratio (if any) over the coming weeks and coming months will result in buy gold-sell silver as compared to sell gold-buy silver.

RATIO’S CONCLUSION

Ratio trades volumes are massive. In 2025 the core theme was sell gold-buy silver, buy gold-sell crude oil, buy copper-sell aluminum among the ratio traders of precious metals and non-ferrous metals.

Every year there is change in ratio trade. In 2026, we need to keep a close watch on trend of crude oil and natural gas. Any sustained rise in crude oil price will result in re-emergence of (i) buy crude oil-sell gold or (ii) buy crude oil-sell silver among other forms of trade.

Spot Silver – View for 2026 full year

- 50 day MA: $59.03

- 100 day MA: $52.91

- 200 day MA: $44.86

- View till 31st December 2026: Spot silver has to trade over $64.45 on daily closing basis till 31st December 2026 to rise to $98.82, $126.80, $258.90 and more

- Crash or sell off will be there if and only if spot silver has a daily close below $64.45 for twelve consecutive trading sessions.

- Overall in 2026, spot silver is bullish as long as it trades over $43.00.

- All the price crash upto $43.00 will be a part and parcel of the bullish trend.

- Spot silver will crash, sink or test $43.00 and even lower if it does not break $115.20 by 15th November 2026.

LME ZINC - - View 2026 full year.

- 50 day MA: $3062.00

- 100 day MA: $2980.50

- 200 day MA: $2852.00

- View till 31st December 2026: LME Zinc has to trade 2773.00 on daily closing basis in 2026 year to rise to $3818.80, $4804.00 and more.

- Crash or sell off will be there only if LME Zinc has a daily close below $2773.00 for fifteen consecutive trading sessions.

LME ALUMINUM - - View 2026 full year.

- 50 day MA: $2877.00

- 100 day MA: $2770.00

- 200 day MA: $2651.90

- View till 31st December 2026: LME Aluminum has to trade 2300.00 on daily closing basis in 2026 year to rise to $3691.00, $4731.00 and more.

- Crash or sell off will be there only if LME Aluminum has a daily close below $2770.00 for fifteen consecutive trading sessions.

CONCLUSION - A few important points for note for 2026

- Investment world and trading world is expecting interest rates to cut or see a falling trend in 2026.

- Everyone believes that only hints of a hike in interest rates will cause a selloff in stocks, precious metals and non-ferrous metals alike.

- Slowdown and mild recession has a zero chance in 2026.

- Inflation rise will be ignored by central banks (including federal reserve) in favor of growth by cutting interest rates.

- Soccer World Cup in USA in June-July will be positive for US economy.

- US president Donald Trump and the related uncertainty will continue in 2026 and can also increase due to US senate elections in early November 2026.

- Chinese economy and Chinese stock markets is expected to grow in 2026.

- Shortage of copper, silver and other non-ferrous metals (including nickel) is expected in 2026. This is the trader view and investor view in the world as on date.

I WILL PREFER TO …………. IN 2026

- I am one of those who believes that global economic doom can happen in 2027 if global interest rates near zero in 2026 and/or economic stimulus package continue to announced by almost every key country in the world.

- Prefer to be extra cautious on my long term investment.

- Prefer to close watch on currency trend of my country like usd/inr, usd/idr, usd/php etc.

- Prefer to keep a close watch on the pace of rise of precious metals, non-ferrous metals and not the actual rise. Bust type short lived can be there anytime if world sees a December (2025) silver type price in every asset class.

- Prefer keep a close watch on usd/jpy price or yen price. A daily close below 147.00 (usd/jpy) for twenty consecutive trading sessions can induce a short term bearish trend in precious metals and non-ferrous metals as due to increase in currency arbitrage cost.

Trade and invest in the most profitable way in 2026. Review short term investment after every six days. Review intraday trades after very six hours. Review medium term investment after every eight weeks.

In short, do not sleep on your trades/investment else you will have sleepless night in 2026.

Disclaimer

The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE