USA is closed today. Trading volumes will increase significantly in precious metals and base metals and energies as the week progresses. In my view large number of retail traders are fence-sitters. They are waiting for Friday's US August non-farm payrolls. Yes, a surprisingly higher NFP on Friday can cause a selloff in gold and silver albeit temporarily. A moderately low NFP number is already factored.

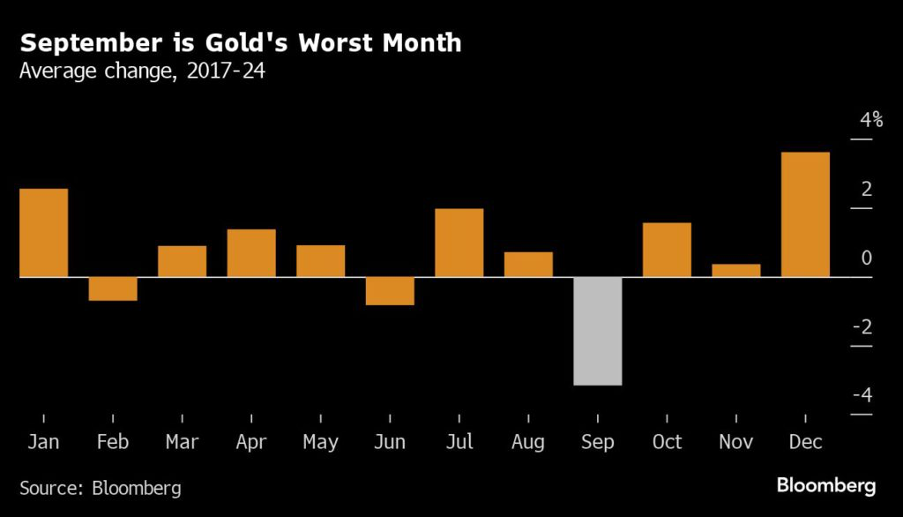

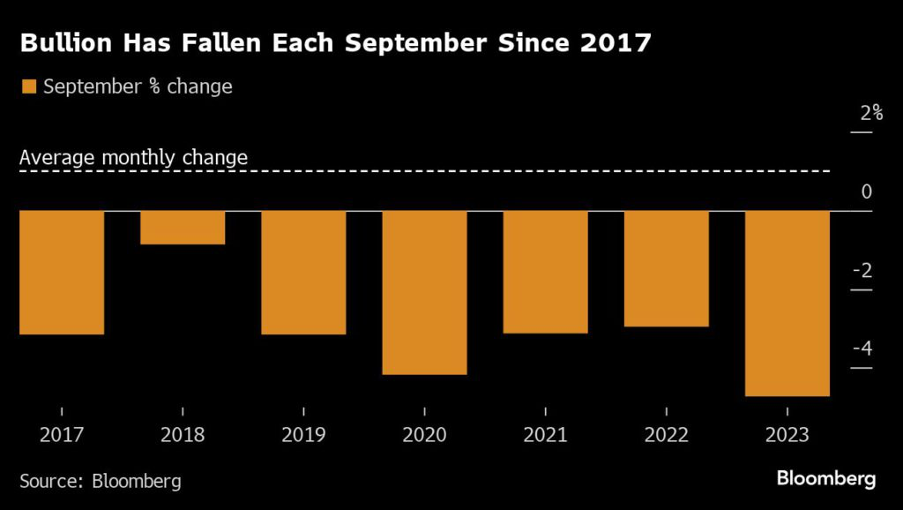

Gold has mostly fallen in September month since 2017. I believe that fall or sell-off (if any) will be short-lived and should be used to increase short-term investment and medium-term investment. At the end of the day, there are more reasons to stay invested in gold and/or increase investment in gold for investors investing with a time period of ten months or more.

Gold has mostly fallen in September month since 2017. I believe that fall or sell-off (if any) will be short-lived and should be used to increase short-term investment and medium-term investment. At the end of the day, there are more reasons to stay invested in gold and/or increase investment in gold for investors investing with a time period of ten months or more.

Copper and base metals are bullish. However, a correction or sell-off in US stock markets can result in a sell-off first followed by an equally big rise. Base metals need to keep a close watch of signs of Chinese growth news.

Copper and base metals are bullish. However, a correction or sell-off in US stock markets can result in a sell-off first followed by an equally big rise. Base metals need to keep a close watch of signs of Chinese growth news.

INDIA’S SILVER IMPORTS

India's silver imports are expected to nearly double this year due to rising demand from solar panel and electronics makers, and as investors bet the metal will give better returns than gold. India imported 3,625 metric tons of silver last year. This year's silver purchases could rise to between 6,500 and 7,000 tons due to the rising industrial demand. (this is the estimate or expectation.).

GEOPOLITICS – South China Sea

Geopolitically keep a close watch on the developments in the South China Sea and the Bay of Bengal. The next president of the USA will be focussed on these regions till 2030 and more. Ukraine does not impact global financial markets. But the Bay of Bengal and South China sea have (i) One the fastest economic growing nations in India and Indonesia. (ii) A very large densely populated nation. The global economy and global supply chains can be affected in a big big way if and when (in the future), the South China Sea and the Bay of Bengal are converted into the Strait of Hormuz (Iranian peninsula). This is an advance warning that we need to keep a close watch on the developments in the South China Sea and Bay of Bengal region.

Pakistanization of Bangladesh has already begun with unofficial support for CIA and NATO. Physical demand for gold will rise significantly in the Eastern part of India. People in Eastern India can buy/invest in physical gold much over expectations and/or past trends. Calcutta is already burning due to a rape case in a medical college. Bangladesh will only act as a fooder to the fire of rising gold demand in the Indian state of West Bengal.

Spot Gold

- TODAY VIEW: Spot gold has to trade over $2489.70 to be in the bullish zone today and tomorrow and rise to $2532.50 and $2561.50.

- Crash or sell-off will be there if there is a sustained fall below $2489.70 with $2474.40 as the breakdown price point.

Spot Silver

- TODAY VIEW: Spot silver has to trade over $28.11 to rise to $29.62, $30.38, and more.

- Crash or sell-off today and tomorrow will be there if there is a sustained fall below $28.11 to $27.50 and $26.98.

Disclaimer

- The investment ideas provided is purely independent view point and are solely for collective learning and for academic interests. There is no commercial benefit accruing or have deemed to accrue to me out of providing such investment ideas.

- The investment ideas shared here cannot be construed as investment advice or so. If any reader is acting on these advices, they are requested to apply their prudence and consult their financial advisor before acting on any of the recommendations made here. I am not responsible to anybody in the event of profits and losses (if any) upon acting on such advice.

- I hope that our reader is aware about this well aware of the risk involved in trading in commodity derivative trading.

Disclosure: I trade in India's MCX commodity exchange. I have open positions in India's MCX commodity future. I do not trade in CME future or OTC spot gold and spot silver.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE