Condolence for the people of Israel. I just hope Israeli leadership does not get pressured by United Nations to stop the war, till the foundation of Hamas is blown away. Impact will be short lived for global financial markets. Ukraine will be impacted. Less intelligence could be shared with Ukraine. Less weapons could be provided to Ukraine by Israel and other nations. Ukraine will temporarily get less media coverage.

Key resistances need to show signs of a sustained rise for gold and silver to continue. Physical buyers of gold and silver will be using a buy on crash strategy. Position squaring and rebuilding will be there by Chinese traders in copper, base metals and precious metals.

WEEKLY VIEW

The first week of the quarter has been all about bonds yields. Bond yields will near bubble levels in the next six months. China closing implies that firm trend will be established before the end of this week. China is a key price mover in precious metals and base metals.

A lower September US inflation number is needed for gold and silver and copper to rise or show signs of a medium term bottom. On the contrary a rising September inflation will increase bets for a 0.25% interest rate hike on 1st November federal Reserve meeting.

Obsession with zero interest rates is still there as western world is unable to digest rising bond yields and higher bond yield. All this hype on bond yield is due to obsession with near zero interest rates in USA, Japan and Eurozone and UK. Asia does have near zero interest rates and will never have ZIRP. (zero interest rate policy).

The zero interest rate policy and global acceptance of US dollar, Euro, Yen and UK Pound provides liquidity to almost of all of Asia, Africa and South America. Higher interest rates in west and gap reduction of interest rates reduces forex inflows and causes local currency weakness versus the US dollar. Nations are now too dependent on bond market inflows (apart from foreign portfolio inflows and foreign direct investment) to meet current accounts deficit and manage every rising energy bills.

A bit on how the US dollar index is computed – ICE Futures US, US Dollar Index Contracts

What is the Dollar Index?

The U.S. Dollar Index is a geometrically-averaged calculation of six currencies weighted against the U.S. dollar. The U.S. Dollar Index originally was developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar as it freely floated against global currencies. Since the inception of futures trading on the U.S. Dollar Index in1985, ICE Futures U.S. compiles, maintains, determines and weights the components of the U.S. Dollar Index and causes it to be calculated and disseminated.

Which currencies are included in the U.S. Dollar Index?

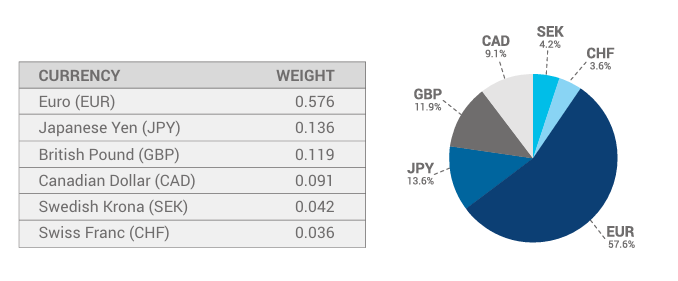

The U.S. Dollar Index contains six component currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc. Before the creation of the euro, the original USDX contained ten currencies—the ones that are currently included (but not the euro), plus the West German mark, the French franc, the Italian lira, the Dutch guilder, and the Belgium franc. The euro replaced the last five of these currencies.

What are the formula and the percentage weights of the component currencies? The U.S. Dollar Index is calculated with this formula: USDX = 50.14348112 × EURUSD 0.136 USDJPY-0.119 × GBPUSD 0.091 × USDCAD 0.042 × USDSEK 0.036 × USDCHF

How is the U.S. Dollar Index calculated?

The ICE U.S. Dollar Index is calculated in real time approximately every 15 seconds from a multi-contributor feed of the spot prices of the Index’s component currencies. The price used for the calculation of the Index is the mid-point between the top of the book bid/offer in the component currencies. This real-time calculation is redistributed to all data vendors. The prices of the DX futures contracts are set by the market, and reflect interest rate differentials between the respective currencies and the U.S. dollar.

I had re tell you all about the US dollar index and the way it is computed. Asian nations have far greater share in global trade of Euro and UK and Yen and Cable but none of them are included in the computation of the US dollar index. This implies that the US Dollar Index and its underlying trend does not give us the real picture of global forex prices. The US dollar index is just a short term hedge against wild swing in US dollar and major G7 currencies. US dollar index is not a not term solution to currencies. Gold and precious metals are the only long term hedge.

Ask yourself how just currency price of just six nations control global forex markets? Will it be sustainable in the coming years? No. Why! The current rise in bond yields and interest rate hikes is significantly increasing bilateral trade. Nations are trying to reduce dependence on currencies in the US dollar and US dollar index basket currencies. As a hedge central bank gold buying spree is not showing any signs of stopping.

There is a slight chance that gold and silver and copper have formed a medium term bottom last week. The longer it takes to deescalate the war, the greater are the chance of a medium term bottom. Volatility will rise. Use the volatility to day trade with higher stop losses in gold and silver, copper and crude oil.

Spot Gold (current market price $1850.30)

- Daily support: $1823.40, $1832.00 and $1842.50

- Daily resistance: $1856.30 and $1871.10 and $1901.10

- Spot gold has to trade over $1841.00 today to rise to $1871.00 and $1891.00.

- Mild sell off will be there if spot gold trades below $1841.

- Crash or sell off will be there if spot gold does not break $1871 by tomorrow close.

Spot Silver: (current market price $21.78)

- Daily Support: $21.24, $21.50, $21.95

- Daily Resistance: $22.34, $23.09 and $23.40

- Spot silver has to trade over $21.64 to rise to $23.09 and more.

- Crash or sell off will be there only if spot silver does not break $22.52 today and tomorrow.

Disclaimer: Any opinions as to the commentary, market information, and future direction of prices of specific currencies, metals and commodities reflect the views of the individual analyst. In no event shall Chintan Karnani have any liability for any losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided in this material; or in any delays, inaccuracies, errors in, or omissions of Information. Nothing in this article is, or should be construed as, investment advice. All analyses used herein are subjective opinions of the author and should not be considered as specific investment advice. Investors/Traders must consider all relevant risk factors including their own personal financial situation before trading. Prepared by Chintan Karnani

Disclosure: I not trade in CME futures or spot gold and spot silver. I trade in India’s MCX commodity exchange. I may or may not have any open positions at any time.

NOTES TO THE ABOVE REPORT

- ALL VIEWS ARE INTRADAY UNLESS OTHERWISE SPECIFIED

- Follow us on Twitter @chintankarnani

- PLEASE NOTE: HOLDS MEANS HOLDS ON DAILY CLOSING BASIS

- PLEASE USE APPROPRIATE STOP LOSSES ON INTRA DAY TRADES TO LIMIT LOSSES.

- THE TIME GIVEN IN THE REPORT IS THE TIME OF COMPLETION OF REPORT

- ALL PRICES/QUOTES IN THIS REPORT ARE IN US DOLLAR UNLESS OTHERWISE SPECIFED.

- ALL NEWS IS TAKEN FROM REUTERS NEWSWIRES.

- TECHNICAL ANALYSIS IS DONE FROM TRADINGVIEW SOFTWARE