Summer in USA and Europe will come to an end in the next two weeks. “Taper” and “New delta variant of coronavirus” has been the dictating themes for global financial markets from May of this year. These two themes will continue for another month and thereafter markets will look for something else to worry and ponder. Traders and global financial markets have a tendency to hurry and worry too much over too many small things. The “hurry and worry” theme (once taper timing is known) will the next big market mover and shaker. It will be something other than interest rate bets for next year. Winners will be those who are able to anticipate the next big factor which will dictate markets after Taper. Interest rate hike will happen among Asian central bankers next years. German elections in October and Canadian elections in September will also need a close watch next month. USA and Germany relations under Merkel rule was best after Second World War. Any big change in German-USA political relations under the next head of Germany will see its effect spilling over to euro, bunds and financial markets. I will be keeping a close watch on changes in US-Germany political relations for the rest of the year as well.

Only sharp gains in the US dollar Index can cause another sell off in gold and silver. All the taper issues will move to trash if coronavirus cases in G7 nations rise rapidly. There will be a chain reaction if covid cases rise sharply worldwide in the next three weeks. How? Taper Timing will be moved further à US dollar Index will sink below 91.00 as a result in delay in taper à Gold and silver will rise sharp and try to test this year’s high on safe haven demand à Bond yields will sink à Energies and industrial metals will fall more in demand concerns but fall will be limited on supply concerns as well. à Asian stock will rise and Asian currencies will gain against the US dollar if covid spares Asia. The next three weeks will be a roller coaster time for precious metal traders and forex traders.

Technically industrial metals and energies have formed a medium term bottom yesterday. Silver is a buy on crashes strategy. Gold is in a neutral zone. Copper and nickel are also a buy on crashes strategy till next week. Euro and cable are approaching key short term resistance. Another one percent fall in euro and cable and bearish bet will increase multi-fold. This is just to caution you.

Comex Gold December: Fifty day moving average is around $1793. (a) Gold needs to trade over $1793 till next week to rise to $1815.70 (two hundred day moving average) and $1836.00. (b) A daily close over $1793.00 today should result in $1835 and $1862 being tested next week. (c) For a bearish trend gold needs a daily close below $1770 today and for three consecutive days.

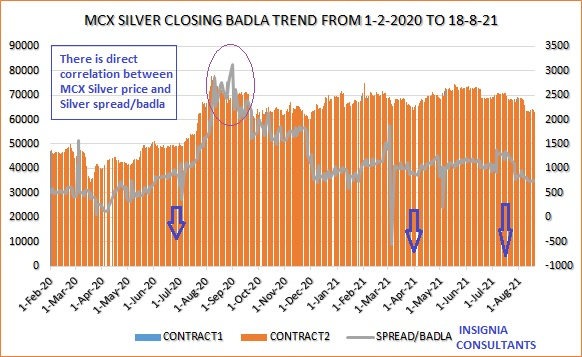

MCX SILVER SPREAD/BADLA VIEW/REPORT

#The above graph is correlation between MCX silver price and MCX silver badla (price difference between two silver future contracts).

Conclusions from the above

- There is a direct correlation between silver price and silver badla/spread.

- One can know the silver price trend by just analyzing the gap between two MCX near term silver futures. (i) A fall in gap/badla will imply a bearish trend. (ii) A rise in gap/badla will imply a rising silver price trend.

- 2021 highest closing spread/badla: 1887 (on 3rd March 2021)

- 2021 lowest closing spread/badla: -563 (on 5th March 2021)

- Both the high and low closing price spread happened in the delivery period of MCX Silver March futures.

- 2021 Average closing silver spread/badla is Rs.1035.30.

My view on MCX silver badla/spread

- I do not see the silver badla falling below 588 with every possibility of a rise back to 1163 and 1805.

- In case the silver badla trades below 588 then chances of parity or negative is highly possible.

MCX silver September future will expire on 3rd September (including delivery period). Knowing the trend of spread/badla will help in making the roll over decision in futures as well as options.

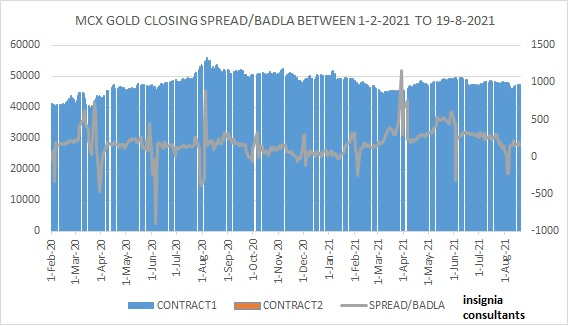

MCX GOLD SPREAD/BADLA VIEW/REPORT

Conclusions from the above

- Gold spread/badla/price difference between two MCX near term future contracts reflects trader sentiment.

- 2021 Highest spread/price difference between two near term future contracts: -313

- 2021 Lowest spread/price difference between two near term future contracts: -1153

- Lowest spread/badla of Rs.1153 was when MCX gold April future closed at Rs.43545. This is near the lowest gold price of 2021.

- Average MCX gold spread/badla of 2021 is Rs.213.00.

- In 9th August 2021 when MCX gold October price closed at Rs.45886, the October-December spread closed at Rs.162. Why? Trader sentiment was hyper bearish on 9th August.

My view on MCX Gold badla/spread/price difference between two near term future

- Backwardation or negative spread (if any) can happen but will not last long.

- Gold spread/badla can rise to Rs.322 and more by end September as long as it trades over Rs.30-Rs.40 zone.

- Spread traders can use a buy on crashes strategy (sell MCX gold October and buy MCX gold December) with a stop loss below –Rs.200. However at current price one should wait till next week and then decide.