Gold will continue to rise as long as war fears, chemical war fears and nuclear war fears supersede every other important news. Economic has taken the rear seat for now. Most traders and economists believe that central banks interest rate hikes this year will not be sufficient to curb rising inflation.

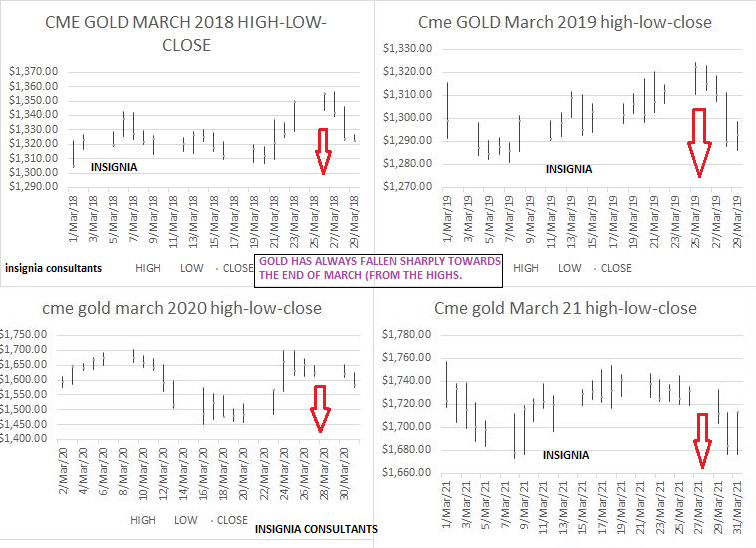

The above is the gold price chart of March month from 2018 to 2022. The above chart indicates that the gold price has fallen sharply from the monthly highs around the middle of March. This also suggests that gold prices have formed a high just before the March FOMC meeting or just after the March FOMC meeting and thereafter crashed. There are still questions over the sustainability of the gold price rise. If history repeats itself then the gold price will form a short-term top between 14th March and 24th March and thereafter crash.

|

COMEX GOLD trend in march months |

|||

|

MARCH |

HIGH |

LOW |

CLOSE |

|

2018 |

$1,356.80 |

$1,303.60 |

$1,322.80 |

|

2019 |

$1,324.50 |

$1,280.80 |

$1,293.00 |

|

2020 |

$1,704.30 |

$1,450.90 |

$1,583.40 |

|

2021 |

$1,757.40 |

$1,673.30 |

$1,713.80 |

March historical price data suggests that gold has fallen quite a big from the monthly highs only to close higher.

The trading strategy are (i) Look for top formation between 10th March 21st March. (ii) Use price crash in the last week of March to invest for end May.

The risk to this view is that if Ukraine hits a war zone then gold, silver and other non US dollar safe havens will see a linear one way stratospheric price rise. There will not be any major $70-$80 price correction from the high in case NATO troops are involved in a war with Russia in Ukraine territory.

US ECONOMIC DATA RELEASES OVER THE NEXT TWO WEEKS

- 22nd February (Tuesday): US CB Consumer Confidence February.

- 24th February (Thursday): US Q4 GDP Numbers.

- 25th February (Friday): US Durable Goods (January) and US January personal income and personal spending.

- 1st March-2nd March: Federal Reserve Chairman testimony to US Congress.

- 2nd March to 4th March: Various US February jobs/payroll numbers.

The next two weeks are very crucial for gold, silver, base metals and global stock markets. Momentum and technical are very bullish for gold, silver, crude oil and natural gas. Base metals will be very volatile.

COMEX SILVER MAY 2022 (current market price $2424.50)

- Weekly Support: $2221.90, $2260.70, $2318.40, $2346.50 and $2374.60.

- Weekly Resistances: $2451.50, $2503.70, $2560.70 and $2753.70

- Bullish View: Silver can rise to $2560.70 and $2867.20 this week as long as it trades over $2294.70.

- Use a buy-on dips strategy with a stop loss below $2260.00 and a price target over $2600.

There will be long-term economic damage if the crude oil price continues to rise this week and the whole of March. Higher energy price has a lagging effect on economic growth. Pent-up demand after Omicron is there. The general consensus is that global economic growth will not be impacted long as crude oil does not break $125 (brent). Global economic growth will be derailed or suffer long-term structural damage if crude oil trades over $125 for a few months. One needs a keep a close watch on crude oil if it breaks and trades over $110 for the rest of 2022. Rising crude oil prices will create a “Goldilock” dilemma for central banks. Gold price will rise or remain firm as long as crude oil continues to rise.