Trend from tomorrow till 1st October is the key for all metals and energies. Copper and nickel are not out of the bear shadow as yet. Silver is a 'buy on crashes' strategy. Silver is a good investment at its current price. Please do not confuse between intraday trading and investment in silver. Physical demand for gold and silver will be good in Asia as long as prices remain firm.

There is too much hype on the Federal Reserve meeting today. A lot of various probabilities on taper has been factored in by the traders. The Federal Reserve Chairman has to clearly say on the timing of taper. Next week will start a new quarter of hope of near normalization and higher global economic growth. “If the Federal Reserve beats the bush on taper” then gold, silver will rise very sharply against the US dollar. US dollar Index sink below 89.00 tomorrow of any indirect view on taper at FOMC meet tonight.

Traders and investors are think of global financial markets beyond taper. Interest rates or repo rate will not be hiked by big three central banks. (Federal Reserve, Bank of England and European central bank). Asian central banks are expected to raise interest rates in the first quarter of next quarter. Big three anytime after second quarter of next year.

Monetary policy will not be a theme after taper in the final quarter of the year. So what news will move the market? (a) Pre covid normalization (with vaccine and mask) is the key. The booster dose of vaccine will reduce drastically the hospitalization rates and death rates. Coronavirus will just another disease like dengue, malaria or chikangunia or aids. Normalization to pre covid times will happen but with mask. It is this expectation (of normalization) which has resulted in global stock markets rising endlessly. Gold is not breaking past $2000 as some traders and investors are yet to be convinced of the need for investment in safe havens. (b) Various US jobs numbers (NFP, ADP and challenger job cuts among others). I will be closely watching the trend of jobs in travel, tourism and business travel sector and leisure activities sector. A strong jobs growth in this sector (in fourth quarter and next year) will cause an exponential rise in global growth. Stadium revenues for sports or a business travel away from zoom meetings etc contributes to a significant part of every nation’s growth. (c) School opening for kindergarten kids. (d) Lastly people will also closely watch for danger caused by new variants of coronavirus.

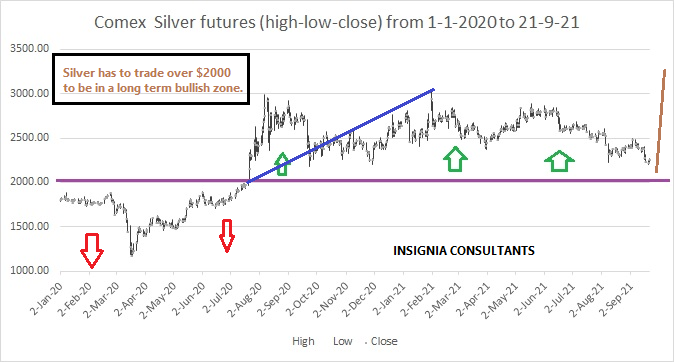

COMEX SILVER DECEMBER 2021 – current price $2274.20

- Average closing price from 1st January 2020 till 21st September: $2287

- 400 day moving average: $2329.00.

- Silver has to trade over September 2020 low of $2181 to be in a short term bullish zone and rise to $2572 (one hundred day moving average) and $2737.

- Bearish trend in silver will be there if (a) Silver does not break fifty day moving average of $2430.00 before end October. And/or (b) There is a daily close below $2181 for three consecutive days to $2100 and $1967.20 and $1852.

One needs to look at the long term technical in silver to trade and invest. Short term technical are all bearish.