And I’m kind of glad to see it happen. Having seen the bursting of the bond bubble coming, I stepped out of the way financially (no money in stocks or bond funds) to watch the plunge from the sidelines during what has turned suddenly into an epic plunge in bond prices (rise in yields).

While stock bulls party at the rodeo, they are likely celebrating nothing but a big bear rally (bull trap), which is being heightened because bond markets are blowing apart all over the world. That leaves bulls without the traditional safe haven they are used to. One thought going around is Might as well stay with the risky assets when the traditionally safe ones are riskier still. Another thought is that money already in bonds is actually backflowing into stocks because bond funds look more perilous than anything on the market right now.

Inflation is blistering the skin off everyone’s back, driving up bond yields (down prices), while the world is at war, resulting in sanctions that are driving prices up even more while suffocating economies all over the world, and all that is happening just as central banks are almost all backing out of their money-printing operations because the printing presses are all smoking under inflationary heat. This is one heck of a rodeo!

So, why am I saying, “Yay, the market’s are finally going down.” Why would I feel so uncharitable toward the poor souls who are about to get pummeled, tumbling over each other in their own downhill stampede? It could be that I’m maniacal or sadistic or masochistic or jaded or an apocalyptic adrenaline junky. I wouldn’t necessarily argue the point. Or it could be that markets have all been so rigged for so long that I wish they would break down so they can get rebuilt properly and do the breaking while I am as far out of the game as one can get when still holding some form of spendable money or other preciousness of sparkling kinds so that I can eventually hope to find a safer place to get back in.

I may just be wishing investors in their invincible hubris would get all the stupidity and corruption and pure speculative greed smashed out of them so sane people could finally just invest in a company or finance a bright idea with a bond because they thought the company was a good company or the idea was interesting and looked likely to pay off someday.

Or it may just be that I have seen it coming for a long time and wish it would just get over with! I’ve actually heard a lot of people express that feeling. I look at it as how my father felt in his 97th year when he just wished for death to come quickly. He wanted nothing to slow it down. Just get it over with! Better a quick death than one that is long drawn out.

You see, I’d prefer to invest in that latter kind of world I just described where you simply buy a stock because you think a company is good … like the old man I knew who bought Coca Cola stocks and sat on them for decades because everyone likes a Coke, so it had to do well. That’s starting to feel like a heaven that never existed on earth. It’s been so long since anyone has reportedly seen a world where you invest in a stock because you believe in a company, so want to be one of its owners … so long that I’m not sure it ever even existed. Now, it’s mostly about accurately guessing which meaningless meme stock the other idiots will bid up, all atwitter, so you can buy it first and take the lift.

So, I don’t care if the casino blows up since it no longer allows thoughtful investment to be the investment that pays. It’s all speculation about what all the other players are going to do, riddled with inhuman algorithms that try to out-game each other like dueling slot machines. I’ve done my part to warn people to save themselves and get out before the wrecking ball hits. If they choose to remain inside the grand casino and play cards as the great iron ball cracks through the wall, that’s on them. This ain’t my rodeo, ain’t my casino.

However, instead of making this about me cheering on the collapse of the gluttonous monstrosity that I think is rigged to the roof of its gaping mouth, let’s just talk about how the thing is breaking up.

Bonds are going for broke

The primary fault lines in our financials systems all over the world right now are in the deep bond strata (government bonds — the safest of all bonds). As I recently reported in the “The Big Bond Blowup,” we’re witnessing the worst bond bust since the US bond market had to finance the Marshall Plan after already financing a world war. It was a lot to carry, but a darn good plan for peace after a war, which actually worked splendidly well. Two nations, Germany and Japan, that had acted as mortal enemies to nations all over the world became good business partners and lived in peaceful co-existence with everyone ever since. Well, so the fairy-tale goes, but its not all that far off.

Just to recap where we journeyed over the past week, I noted the following in the article just referenced:

This past week was a stormy ride through the badlands of hell for bonds…. In just a couple of days, the 10YR treasury blew right through the 2.5% top of the range I had said would be the exit from low-interest days of easy riding to greater trouble…. The point where rapidly climbing bond interest is likely to cause serious trouble for stocks was in the 2.25%-2.5% range…. So, we’ll see what happens as that fact gets digested by stock investors; so far they seem to be in a state of denial about what they are seeing… This has left the yield curve pancaked at the top…. So, we’ve now got us one full-on-recessionary, weird-and-wild-looking, blown-out yield curve…. That flattening presages a recession….

All of that, however, stopped just short of the most critical inversion in the yield curve, which is where two-year government bonds trade at higher interest than 10-year bonds. That’s the gauge the Fed looks at as being one of its most accurate gauges of a coming recession.

For anyone who has actually lived through a Fed hiking cycle, or has read any market history, the 2s10s curve is the most-monitored, the most-studied, and the most accurate predictor of recession the market has to offer.

Shortly after publishing the article, I saw some banks and others speculating that within a few months that part of the curve could invert, too. My thought was, You’re crazy. You think it’s going to take that long? I figured it would happen within a couple of weeks.

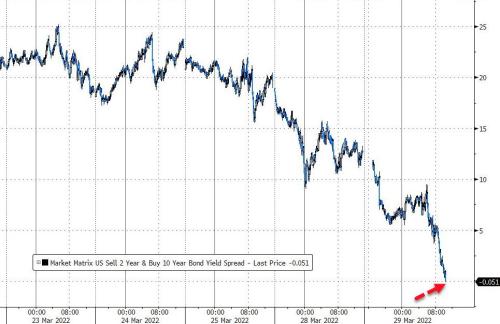

However, before I could even write my thought in another article, the bond vigilantes had already taken care of that little bit of cleanup, too, riding their bond horses over the edge of a bluff, slamming the 2s v 10s almost straight down into the earth:

Bond yields have’t looked this tightly jammed together at the bottom of a steep fall since the Great Recession:

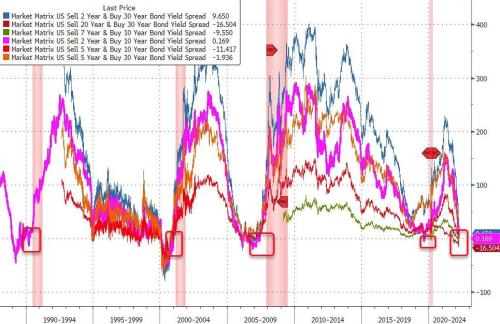

2s10s has finally inverted… chasing the rest of the curve (3s10s, 5s10s, 5s30s, 20s30s) all into inversion.

As Zero Hedge just noted in another article,

The Fed Owned The Bond Market, Now It’s Breaking It

The fallout from all these central bank maneuverings is degrading the haven qualities of fixed-income securities and threatens to turn yield curves into mere noise, rather than reliable signals about real-world economics.

Actually, central banks had already accomplished that during the last two years of their pandemic money printing. What they did was destroy the ability of the yield curve to predict a recession by tightly controlling it with full-spectrum purchases. If they wanted yields up more at one part of the curve than another, all they had to do was buy fewer bonds at that tenor. Months ago I warned my readers that, the moment CBs got out of their QE bond business, the yield curve would sprint toward showing the recession it would have been predicting last summer if CBs had not turned yield curves into meaningless noise by wiping out all true price discovery.

Why did an inversion of the yield curve between the 2s and 10s, which some banks and analysts thought would rapidly play out in a few more months happen in just two more days? Because, as I have maintained, the recession is here. The yield curve is doing precisely what I said it would do once freed of Fed rigging. It is rapidly trying to catch up and price in a recession and price in inflation all at the same time. It is frantic repricing now that central banks are suddenly all out of the game.

As I had also written in “The Big Bond Blow-up,”

This time it [the yield curve] is a delayed indicator because of how tightly the Fed held the reins on bond pricing, restricting its own best indicator like a broken gauge to where the Fed doesn’t even see recession is already at the door.

The yield curve, I have stated more than once, would realign to reality faster than we’ve ever seen, and still arrive late to the party.

What I’m here to point out today is how the rapidity of everything that has taken place to fulfill all of that is truly historic … as ZH goes on to describe:

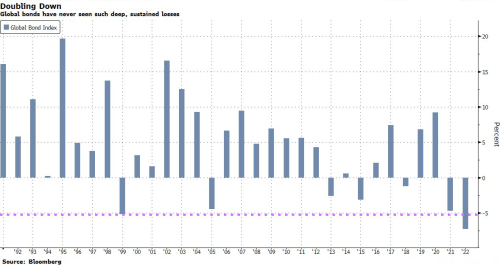

The meltdown across global bonds is truly epic and unprecedented. Whether you look at Bloomberg’s global aggregate bond index, which started in 1990, or at the U.S. gauge that goes back to 1976, the drops [in aggregate bond prices] of more than 6% seen year-to-date exceed any full-year declines. Each index is well-nigh certain to suffer consecutive yearly losses for the first time on record.

ZH presents the following graph to verify how the decline in bonds in just the first three months of this year exceeds any decline for any entire year as far back as the data goes:

It could be easy to shrug this off as a fairly modest slide — other asset classes like equities, commodities and junk bonds regularly switch between bull and bear markets. But that’s not the way bonds were supposed to work because as they decline [in price], the increased yields they start offering would normally start to draw money back in to bonds — especially because their role as benchmarks for risk-free rates means those rising yields start to place an increased burden on other assets.

That would be the money pump I’ve described in past articles where rising bond yields draw money flow out of risky stocks. As that money flows into the now more attractive bonds, bond yields fall (prices rise) toward a new equilibrium between stocks and bonds due to the increased demand for bonds; then, if the financial world continues to tighten where people are less willing to lend out money, yields rise again to try to obtain funding and repeat the interaction with stocks.

That machinery lies in a heap of ruins right now.

The way it’s supposed to work, doesn’t work

It is a huge peculiarity that, when bond yields rise, making them more profitable to own, that imperils today’s bond market more than anything else that could happen. Rising yields should be exactly what all bond buyers are looking for, right? Who doesn’t want more yield? I understand how some people have a hard time trying to wrap their heads around that because I do, too; so, I’m going to try to explain it.

The dependable relationship between falling stock prices and rising bond yields is suddenly breaking down, perhaps in part because the rise in yields (fall in prices) has been so meteoric, yet inflation so hot and growing, that investors, as they see rapidly rising yields, may be saying, “I’ll hold off on buying bonds because yields are rising so fast, I’ll get even more yield for my money in another month, so I’ll wait to lock into something longterm” -or- “because inflation is rising so quickly, these bonds I could buy today won’t be paying enough in another few months to compensate for inflation, and I’ll be stuck with them until they mature and pay my money back because yields will rise even more under inflation, so no one will want the older bonds I have unless I sell them at a loss” -or- “all of that could create runs on bond funds loaded with older, low-yield bonds; so I don’t want to buy into a bond fund.”

There can be, in other words, many individual reason investors are reluctant to buy bonds as yields become more enticing, causing yields to rise even more quickly to entice investors in.

For one thing, how you look at bonds depends on whether you are thinking of buying government bonds directly and holding them to maturity to simply make safe money off the interest until the government pays your money back when the bond matures … or are looking at putting money into a bond fund. I think the rise of popularity in bond funds over the past decade and their speculative nature has made bond funds unreliable as safe havens because, if bond yields are rising, funds that are loaded entirely with bonds purchased through a decade in which the Fed kept bond yields suppressed to almost nothing (to where their yield is now negative once inflation is factored in) are no longer appealing.

Those funds can no longer make money selling their bonds when they need to raise cash for buyers who want out, as they they could when yields kept predictably falling (prices rising) under Fed suppression; so, they have to sell them at a discount to pay out people who want out of the fund. The funds are locked into low returns because their interest is frozen at the rates paid by the bonds they loaded up on, and they can only sell those bonds at a loss, so more people want out because better yields are found outside the fund.

That means funds could conceivably not be able to pay everyone out who wants out because, the more they sell their bonds, the more the remaining bonds drop in value. Investors can smell the end of that Ponzi coming now that there are not enough new buyers entering the fund to pay out those who want to leave. With all bond funds in almost all countries selling their bonds to pay people out, you can wind up with runs on the funds in a feedback loop because the world is suddenly overflowing with bond supply as bond funds enter selling mode at the same time central banks enter selling mode with their massive holdings. The added bond supply drives bond prices almost straight down in competition to find investors (yields up) even faster. And that is what I think we are seeing — the Bond Bubble implosion.

You see, as quickly as yields are rising, they are still far below what inflation normally demands from yields (because central banks pumped up inflation while suppressing bond yields). So, it’s a race down in prices, up in yields. That means, if you’re one who has been buying bonds to make money selling them later, falling prices are clearly bad news. If, on the other hand, you’re one who buys them just to clip coupons and make money off dependable interest, rising yields are not yet such great news as to entice you because interest is still way below inflation. So, bonds aren’t creating the normal draw of money out of stocks right now. It’s just money going out of bond funds with little new money coming in.

Because I’ve never experienced a global bond-market crash, this is a learning curve for me, too. To simplify this mess, all those factors come down to all major markets (stocks, bonds, housing, everything but commodities) looking risky at the same time because the Everything Bubble is bursting, so the financial world is becoming chaotic. (Commodities were the one thing that never entered an overall bubble because price inflation remained extremely low for over a decade.)

The rise in bond yields, in other words, being epic in scale (compared to the normal glacial speed of bond moves) has the bond market too shaken up for it to feel anything like a stable or safe haven. For an analogy, it’s as if the long-stable Appalachian Mountains, which have few and usually mild earthquakes compared to mountains along the Pacific Coast, suddenly start heaving up volcanoes. Appalachia is supposed to be the area of placid geology, not major crustal upheaving and new volcanic vents. That’s what is happening in the bond market.

The Great Bond Bubble Bust may even be making stocks look comparatively like a safe haven to some, actually helping accelerate the recent bear-market rally because there is no safe haven in bonds to flee to! That’s why in my Patron Posts I particularly noted that the most dangerous part of the bursting of the Everything Bubble, by far, would be the breakup of the long-sanguine global bond bubble that built up for decades when central banks kept artificially pushing bond yields down further to lubricate the economy with cheap credit (bond prices/values up), inflating a bubble in bond valuations just like they did in housing and stocks. Investors could buy a bond, even at ultra-low interest (even negative interest), and make money selling it in a year because they could count on central banks causing even lower yields, raising the price/value they could get for their comparatively higher-yielding bond. That more-than-a-decade-long dynamic of CB price control in bonds has broken down as CBs everywhere are forced by inflation to stop buying so many bonds (stop lubricating the economy with low interest) and are starting to sell off all the bonds they bought earlier.

It’s a bust, and breaking up is hard to do

As ZH summed up,

An underappreciated dynamic in this year’s rout is the impact of central banks rushing to end quantitative easing and raise rates all at once as they realized they had stuck with pandemic-era stimulus for far too long.

And that, of course, as I also noted recently, has likely been exacerbated by the conflict in Ukraine and the sanctions that followed as ZH adds:

With the war in Ukraine underscoring expectations inflation will be the opposite of transitory, the previous taper playbook has been turned on its head.

The Fed had already admitted it was wrong about inflation being transitory, as I had been saying the entire time the Fed made that claim. It came around to admitting that last fall. However, admitting it and changing your play book can be too different things. Now the Fed and other Central Banks realize they are desperately behind the inflation curve, so central banks are racing to dump bonds in order to raise interest fast enough to curb inflation, while the bond market is demanding higher interest to catch up with inflation (a dynamic we refer to as the “bond vigilantes” now that CBs have released control over the bond market into investor hands), and it is all becoming a chaotic froth as markets plunge downhill.

The Fed have never been as behind the curve as they are today.

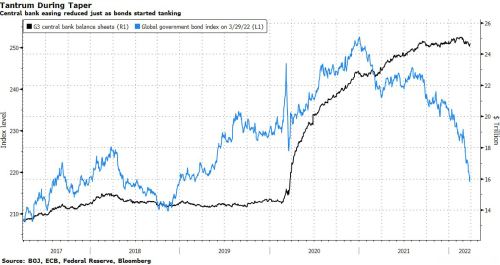

Here’s a little graph that shows quite clearly how bond prices started falling as central banks merely tapered (rounded off) their bond buying and how, as CBs finally started selling off their balance sheets just a little, right at the end of that taper, bond prices plummeted almost straight down (yields almost straight up):

As you can see, the banks are collectively a little late in the game. Bond prices are falling so steeply because yields need to catch up to where inflation already is, making this a heck of a downhill run. Bonds have already done the Omak Stampede Suicide Race down the steep bank and into the river, and central banks are just peaking over the edge at the top into the froth of horses and riders in the water below.

Bond vigilantes running prices downhill:

That’s what “late to the party” looks like. It is literally a priceless thing to watch as prices keep falling away.

Matters are only likely to get worse as the Fed pursues quantitative tightening, with more declines and more volatility looming. Heaven help investors and economists trying to read what bond pricing means once QT starts and further distorts already strained curves.

Yep, central banks are all attempting the Suicide Race at the same time.

That’s what has me glad to see markets breaking up. It’s not that I’m going to feel good in the pile of rubble that results. It’s that it’s been a long time coming due to all the nonsense central banks have baked into the financial system, and sometimes you’d just like to get it out of the way. So, I’m going to watch the Suicide Run from the sidelines, and those boys can have all the fun they want plunging over the bank and into the river.

Of course, I have no confidence that either banksters or their pocket politicians will learn anything from the breakup in order to “build back better.” Life tells me they never do; but this run is already happening, so the sooner it’s done, the sooner I can try to start scouting a place to homestead financially in the rubble.

Or as ZH concludes,

The new normal for bonds is that they become more and more about simply guessing at central bank moves, and less about real-world fundamentals because investors will turn elsewhere to express such views — precious metals, various equity sectors, commodity baskets and so on.

Do what you can, in other words, to find safe places to sit out the race to the bottom, but that place is not in stocks or in bonds. In my view, the sooner the crash happens, the sooner you can see whatever the new lay of the land is going to be and find your way through what’s left as a survivor because it is coming quickly anyway. I’m a get-the-bad-stuff-behind-me kind of guy. I’ll do my best to keep scouting the new landscape for you as it emerges; but for right now, we’re all in the throes of collapse. I’m just tired of endlessly anticipating it.

As for that matter of whether this yield curve is late to the party for the first time ever and is forming during a recession, instead of warning of one, Deutsche Bank ran the history of past yield curves and noted that the quickest arrivals of a recession after yield-curve inversions happened when the yield curve inverted by the time the Fed finished its last rate hike. (And the Fed’s rate-hike cycles can take up to three years.) So, what does it mean when the yield curve inverts right after the Fed has made its first rate hike? I think it means you must be riding your horse over the edge of the precipice already.

The recession is already arriving, and yields have been freed to rise as quickly as they possibly can in the face of hot inflation in order to show us where we already are, not where we’re going. So bond prices are going over a cliff as we plunge into recession now. The Fed messed with the warning system for years until it couldn’t work, and people will be surprised to find how quickly we are all up to our hips in the dark waters of recession.

Yes, it is different this time; but what is different is that the most reliable recession warning was broken for the first time in history. If we’re not already in a recession, its a short ride to the river from here!

Liked it? Take a second to support David Haggith on Patreon!