The US dollar, a currency on the brink of a financial abyss, is in a critical state. With an alarming 34 Trillion debt, unfunded liabilities approaching 200 Trillion, and no signs of ceasing perpetual wars, the situation is grave.

The outcome? MORE MONEY PRINTING.

BRICS ++ can now purchase more oil (the lifeblood of our factories, cars, power grids, hospitals, schools, and militaries) with the gold proxy than they could previously using the US dollar, which has lost its petrodollar status.

The unprecedented offloading of US treasuries results in those dollars flooding back to US shores, triggering a 2nd wave of inflation.

This is the very inflation that temporarily halted QE, a significant development with potential implications for your financial assets.

So QE Infinity resumes with a vengeance the the killshots:

- CBDC launch.

- The parasitic class will dig in further to launch more money laundering schemes (wars, disease protocol, climate lockdowns, insider trades).

- Moreover, expect heightened surveillance state and intensifying legislation.

- As any empire winds down, the legislators get even busier passing worthless laws harkening back to the Diocletian Edict of Maximum Pricing or, in the Modern era, the establishment of wasteful laws and bureaucracies such as The Department of Homeland Security (when 9-11 had nothing to do with hijacking)

- Increase IRS surveillance and unlawful seizure of the villager's bank deposits.

- With more bailouts of the Political Class (the kleptocrats creed)

- Profits are privatized, and losses are socialized.

How to Safeguard Your Wealth in the Face of Thievocracy?

Diversify your investments and HOLD Gold and Silver, (and Copper,) which historically have proven to be resilient during times of financial instability.

- The threat of bank runs is looming ominously.

- It's not a time for hesitation.

- ACT NOW.

- WITHDRAW YOUR MONEY IMMEDIATELY to protect your financial future.

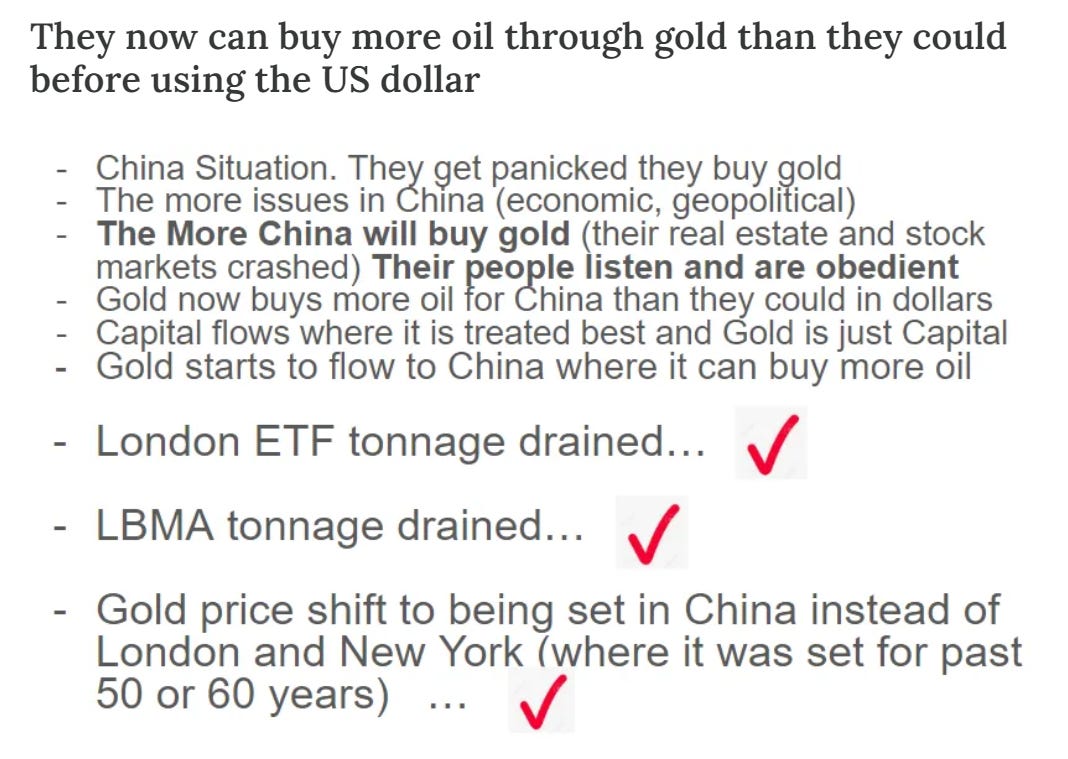

Chart below shows what happens now that BRICS ++ can buy more oil using gold than US dollar, which accelerates point #3 above

These items bear repeating

Dollar Demise Looms as BRICS Embrace Gold, Inflation Soars

Highlights:

- US dollar teeters on $34 trillion debt, unfunded liabilities nearing $200 trillion

- BRICS nations can now purchase more oil with gold than greenbacks

- Massive sell-off of US Treasuries fuels renewed dollar devaluation

- Quantitative easing set to restart, stoking inflation fears

- Central bank digital currencies poised for launch amid currency turmoil

- Bank runs imminent as government tightens grip on private finances

The shifting global economic order, with the BRICS group pivoting to commodity-backed currencies, appears to be catalyzing the dollar's downfall after decades as the world's reserve currency. As inflation spirals, concerns mount over draconian government measures to maintain control.

Steve Forbes, Chairman and Editor-in-Chief of Forbes Media, expressed his perspective that there are escalating signals pointing towards the adoption of a global gold standard monetary system. Forbes articulated this viewpoint during an interview Forbes stated, "What you're seeing is more and more countries, led by Russia and China, accumulating gold reserves. They are doing this because they recognize that the U.S. dollar's reign as the world's reserve currency is becoming increasingly tenuous."

He elaborated that nations are diversifying away from the U.S. dollar due to concerns over its long-term stability and purchasing power amid rising inflation and debt levels. Forbes remarked, "They want an alternative to the U.S. dollar, and gold has always been that alternative throughout history."

Forbes highlighted that central banks globally have been net buyers of gold for over a decade, underscoring their diminishing confidence in fiat currencies. He noted, "Central banks understand that paper money, by definition, will lose value over time due to its unlimited supply."

In contrast, Forbes emphasized gold's inherent scarcity and lack of counterparty risk, making it an attractive store of value and medium of exchange. He advocated for a return to the classical gold standard, where currencies are backed by and redeemable for gold.

While acknowledging challenges in implementing a global gold standard, Forbes expressed optimism about its growing acceptance, stating, "The idea of restoring links between currency and gold is gaining traction worldwide as people become increasingly disillusioned with fiat money."

In Conclusion

- BRICS nations can now buy more oil using gold instead of US dollars.

- A large-scale sell-off of US Treasuries is fueling a renewed devaluation of the dollar.

- The restarting of quantitative easing is raising fears of inflation combined with the US Treasuries increasing Dollar inventories will set off new wave of inflation that makes our existing inflation look measly.

- Central banks are poised to launch digital currencies in the midst of currency market turmoil.

- Bank runs seem likely as governments tighten their control over private finances.

- Gold, Silver and Copper to skyrocket.

- The 2024 election will do nothing to change any of these points.

- Both sides of the aisle 100% incompetent and 100% kleptocrats (thieves)