Bond traders, who are supposedly the wiser money, are betting the bond yield curve, which is FAR more inverted now than it has been in decades stretching back through one truly bad recession and two horrendous stock crashes and which has been virtually unfailing in accurately predicting recessions, is WRONG because the recession “isn’t happening” as had been predicted.

They are betting on Nirvana when their own yield curve predicts hell on earth. In fact, if this yield curve is Powell’s altimeter for making that landing, what it says is the nose cone of his plane is already buried deep in the dirt.

Clearly, these traders must have been stunned due to the blow they took to their unshielded heads when their plane landed upside-down, leaving them with scalp skid marks. They, and many others are betting on the softest of imagined landings (no recession at all) due to the most failed economic gauge in history, which I have been sounding the alarm about for two years. (And I am NOT talking the yield-curve gauge, which I assure you is as accurate as it has ever been.)

It is not surprising, of course, that the dumb money in stocks is making a run for its past record; but, as one analyst says, this is exactly what happens before most recessions. Stock investors think everything looks great when it really doesn’t, then suddenly things clearly do not look great to anyone, and the bottom falls out of the market. Investors in both stocks and bonds are betting on heaven from the mouth of hell.

I think Pilot Powell is wearing welding goggles and so are his investing passengers. They don’t see too well. When the top of your plane is sparking and the propeller has stopped spinning and is bent and the runway tarmac is passing by over your head, something has clearly gone awry.

How great do things actually look? Well, corporate debt defaults have already surpassed last year’s total, and we’re just halfway through the year. Three banks have failed, two of which were the among the largest failures in history. Gross Domestic Income, a corollary to Gross Domestic Product has gone negative for two full quarters; yet, GDI is almost never out of line with GDP, which means one of those two gauges is way off. (Guess which one.) Corporate earnings beat expectations only because expectations have been dismally pounded through the floor. The amount of vacant office space, visualized in one article below, is staggering beyond belief, and guru real-estate tracker Robert Shiller says it is finally clear the housing market has made its turn from a decade-long rise in prices. He explains that the tiny spike in the early summer means nothing because that is simply what real-estate always does this time of year.

One article seems to contradict this and claims the rebound in housing is a problem for the Fed, but look at their own graph:

While the trend for listings is clearly down, it has consistently spiked up in the summer every year (as Shiller says) then fallen back down, but this last spike was the lowest spike in market history — so hardly a sign that the housing market is becoming more robust again.

The only thing I’ll note is that its last drop on this graph put in a rising bottom, but a still-falling peak is hardly promising. As Wolf Richter points out, no one wants to list and sell because nearly every homeowner now has the lowest interest rates in history due to a decade of absurdly loose Fed policy. Who wants to double their interest rate while having to buy a replacement home at a time when inventory is truly abysmal (leaving sellers with almost no options to find a replacement home) and prices are still sky high but starting to fall? So, the market is frozen for the time being, and the housing market is the biggest driver of the US economy.

Buying things up in price in this stench of economic decay is like buying a mansion with a prime view of the city garbage dump. Yet, here we are: stocks have been booming in belief that we’ve escaped a recession when our boots are clearly mired in recessionary muck.

In this week’s “Deeper Dive” I’ll lay out why the market is dead wrong about the soft landing and why the biggest player in all global markets — BlackRock — has now come around to the exact position I have been stating for almost two years as a lone voice about a seriously broken economic gauge. One of their analysts says we could be in for a deep shock because the Fed (and everyone else) has so badly misunderstood this one key gauge. They also point out a very strong sign that GDP is wrong and that we’re already in a recession. I’ll cover that, too.

The weather is not all its cracked up to be either

Finally, do you want more evidence that the media and particularly weather-reporting agencies are hyping the weather, look at AccuWeather’s claims about its new HeatWave Severity Index that it is so proud of. I pointed out lately how AccuWeather has focused on reporting “heat,” instead of raw temperatures because their new “RealTemps” gauge can massage the temperatures like the Bureau of Lying Statistics constantly massages government job data with “seasonal adjustments” to seek out desired goals.

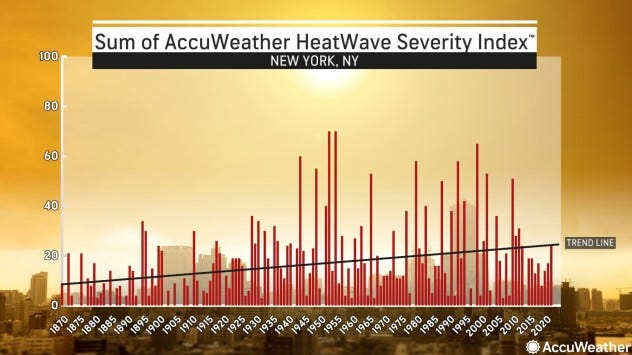

Notice how AccuWeather claims its new HeatWave Severity Index, which they calculated backward to the start of recorded weather in NYC, shows a continually rising trend:

Well, except that it doesn’t! Clearly the latest heat wave falls far short of prior spikes, and AccuWeather simply refused to drop the end of the trend to match up with the falling data! The real peak was obviously back in the 50s! In fact, their “trend line” does not even mark a true average as its end point for the last decade rests on the tip of the highest of all bars for the entire decade, not at an average point. What a farce! Their own graph proves their own claim in their own article is false.

Expect from this point on to see AccuBlither and those who report based on their withering weather “data” to use fanciful “heat” metrics more often than actual raw temperatures. You cannot easily cook the data on raw temperatures, but “heat” metrics give you some flexibility. Hyping the weather gets you a lot more clicks, and that is all they are really all about — that and advancing the popular bias. (However, that’s why you have The Daily Doom to help sort out true doom from conspiracy theories, true government from false government, true economic observations from fanciful ones, and truly bad weather from hype about the bad weather.)