Ticker: CXB (TSX), CXBMF (OTC)

52-Week Range: US$0.85 – US$2.40

Shares Outstanding: 330.88m (Basic), 383.11m (F/D)

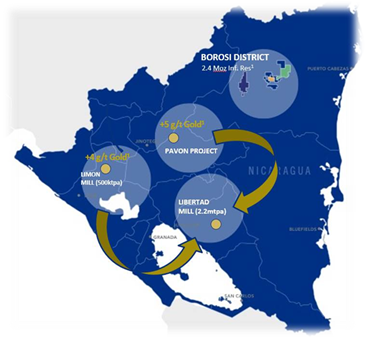

Calibre Mining is a junior producer we have been quite excited about for a while. It acquired B2Gold's non-core assets in Nicaragua (2018), transforming the company into an immediate junior gold producer, having two processing facilities and a large land package in Nicaragua, a largely underexplored country. A very competent management team runs Calibre and has shown it can execute its hub-and-spoke strategy (identifying and developing gold deposits and trucking the ore to its nearest processing facility). It has ample capacity to grow production organically, given the available processing capacity at Libertad. Since our last report, there have been some exciting developments, which include identifying and acquiring new “spokes” to develop. The hub and spoke strategy allows the company to quickly translate exploration success into production and cash flow with limited process-related capital requirements (only the cost to develop a mine/mine development). The company has undertaken an aggressive 80,000m drill program for 2021, which has shown early success, the results of which we will discuss later.

Calibre is one of the few companies focused in Nicaragua, which is an underexplored country. The management team and Board of Directors have a history of success. CEO Darren Hall has worked at Kirkland Lake Gold, Newmarket Gold and Newmont Mining, serving as COO (Kirkland Lake & Newmarket) and various other roles (Newmont Mining). Darren Hall, COO Dustin VanDoorselaere, Chairman Blayne Johnson, and others in the company worked for and founded Newmarket Gold, which unlocked some of the potential at the Fosterville gold mine in Victoria, Australia. The Newmarket acquisition Is a big reason Kirkland Lake's stock price has so drastically appreciated over the last 5+yrs.

It has two mining complexes, Limon and Libertad. There is limited upside (production-wise) at the Limon Complex. The mill is running at capacity, and the company has identified enough resources to continue production for roughly the next 10yrs. Value can be unlocked through resource expansion as excess mill feed is trucked to the Libertad Complex, where excess capacity is substantial.

El Limon:

The El Limon mining exploitation permit covers 12,000 hectares and was granted by Ministerial Decree for a 25-year term in 2002. The project also comprises the Bonete-Limόn, Guanacastal III, San Antonio, and Guanacastal II exploration permits, which are contiguous with the exploitation permit and cover a total area of 8,147 hectares, and Villanueva 2 exploration permit, which is located 12 km north of the exploitation permit and covers an area of 1,200 hectares.

While the El Limon processing facility is relatively small in terms of potential average annual output (50-70k oz. Au p.a.), it provides a moderate amount of long-lived gold production and a solid launching pad to unlock organic growth at Libertad. Mining operations use conventional open-pit mining methods at the Limon Central pit and a combination of top-down and bottom-up longitudinal open stoping at the Santa Pancha underground mines. There is both open-pit and underground expansion potential at Limon. There expansion potential along strike and down plunge of the Limon open-pits. as well underground potential at Panteon, Veta Nueva, and Atravesada.

In mid Q3, 2020, Calibre provided a 10-year outlook for the El Limon Complex (open-pit material only). Calibre guided for average annual production of 50-70k oz. Au at AISC of $900-$1,100/oz. There is additional upside from the Panteon underground; however, excess mill feed is trucked to and processed at the Libertad complex.

2P Reserves: 462,000 oz. Au (Limon O/P) @ 4.24 g/t Au & 102k oz Au (Limon U/G) @ 5.14 g/t Au

M&I Resources (Exclusive of Reserves): 166k oz. Au (Limon O/P) @ 4.70 g/t Au & 157k oz. Au (Limon U/G) @ 5.63 g/t Au.

Inferred Resources: 34k oz. Au (Limon O/P) @ 4.07 g/t Au & 193k oz. Au (Limon U/G) @ 3.90 g/t Au

This is the highest level of reserves at Limon and the consolidated (Limon Libertad) reserve grade of 4.50 g/t Au is the highest in company history. Some drill highlights at the Limon and the Limon complex thus far in 2021:

- 2.1m @ 5.43 g/t Au (Panteon underground)

- 2.4m @ 6.67 g/t Au (Pavon Norte open-pit)

- 17.5m @ 4.81 g/t Au (Pavon Central open-pit)

- 6m @ 5.35 g/t Au (Limon Central open-pit)

- 6.8m @ 7.98 g/t Au (Atravesada underground zones)

- 9.8m @ 8.92 g/t Au (Atravesada underground zones)

- 2.5m @ 7.82 g/t Au (Atravesada underground zones)

- 13.6m @ 4.78 g/t Au (Veta Nueva underground zone)

- 3.10m @ 10.94 g/t Au (Veta Nueva underground zone)

- 1m @ 251 g/t Au (Limon Norte open-pit)

- 5.8m @ 4.44 g/t Au (Pavon Central open-pit)

- 5.50m @ 4.85 g/t Au (Atravesada & Veta Nueva underground)

- 7.1m @ 5.50 g/t Au (Atravesada & Veta Nueva underground)

- 3.2m @ 13.35 g/t Au (Atravesada & Veta Nueva underground)

- 2m @ 13.42 g/t Au (Panteon & Santa Pancha 1 underground)

- 1.80m @ 12.58 g/t Au (Panteon & Santa Pancha 1 underground)

- 4.9m @ 5.95 g/t Au (Panteon & Santa Pancha 1 underground)

- 2.3m @ 5.40 g/t Au (Panteon & Santa Pancha 1 underground)

The Libertad Complex:

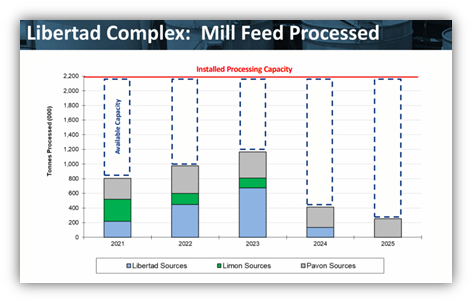

The mill has a processing capacity of 2.2mtpa, but per the PEA, on average, over the next 5yrs, capacity utilization is only expected to be 33% and 45% over the next 3yrs. It will churn out 120k oz. Au from 2021-2023 and 100k oz. Au from 2021-2025 with AISC of $846/oz.; however, this is the base case scenario and will change for the better. This will be easy to beat as it assumes there will be no excess mill feed at Limon beyond 2023, no resource expansion at Pavon, excludes a lot of exploration results after year-end 2018, new targets identified, and Eastern Borosi, which looks like it will be the company's next substantive "spoke."

With excess mill feed from El Limon, ore is sourced from nearby mines, i.e., Jabali pits, Jabali underground, Pavon-Norte, the Panteon Project, and Eastern Borosi in the near future. It is Eastern Borosi that could create significant value for the company by utilizing some of the excess capacity at Libertad. Calibre acquired the remaining 70% interest in the project from IAMGOLD in August 2020, and if the past is prologue, this could enter the mine plan in 2023, if not 2024.

Illustrated in the below chart is the significant excess mill capacity at Libertad, which on average is over 54% over the next 3yrs and almost 70% over the next 5yrs. Calibre is just as much an exploration play as it is a production play. It owns a highly prospective land package in an under-explored country. If the company has success with the drill bit, it will add tremendous value, and to date, it has done just that. This base case scenario is already out of date because Calibre has since acquired the remaining interest in the Eastern Borosi Project. Having talked with management, the company envisions incorporating mill feed from Eastern Borosi in the near-medium term. It will likely start relatively small to moderate and increase as more mine development occurs, especially if the company has exploration success. There is no need for expansion drilling at Eastern Borosi, at least for the time being, with over 700k oz. in gold resources. While there is no need, 2021 exploration will be focused on the higher-grade zones and areas drilled outside the current resource estimate, in addition to infill drilling to upgrade resource categories.

As mentioned earlier, the projected mill feed processed at Libertad (which is already out of date) assumes no exploration success in and around the Libertad mining complex. It assumes there will be no excess mill feed from Limon beyond 2023, no contributions from Eastern Borosi, and no greenfield or brownfield exploration success. In the near term, Calibre believes there is resource expansion potential along the La Libertad Proper concessions, Amalia, and the Rosario concessions. For 2021, Calibre has engaged in an aggressive 80,000m exploration program. The following are some exploration results over the past 6+ months, in and around Libertad:

- 5.4m @ 11.37 g/t Au (Volcan vein: within 10km’s of the Libertad mill)

- 1.7m @ 9.26 g/t Au (Volcan vein)

- 2.8m @ 16.78 g/t Au (Tranca vein: within 10km’s of Libertad mill)

- 4.4m @ 13.83 g/t Au (Tranca vein)

- 8m @ 3.67 g/t Au (Rosario vein)

- 2.4m @ 4.02 g/t Au (Rosario vein)

- 3.30m @ 5.45 g/t Au (Jabali vein)

- 0.80m @ 51.90 g/t Au (Jabali vein)

- 3.1m @ 4.43 g/t Au (Socorro open-pit target ~ Libertad)

- 1.1m @ 21.90 g/t Au (Socorro open-pit target ~ Libertad)

- 1.90m @ 6.70 g/t Au (Jabali underground ~ Libertad)

- 11.5m @ 6.0 g/t Au (Jabali underground)

Eastern Borosi has Inferred resources of 700k oz. Au @ 4.93 g/t and 11.4m oz. Ag @ 80 g/t. Most of the current resource is underground. In March 2021, Calibre initiated a diamond drill program to upgrade resources (Inferred to Indicated) from three high-grade gold deposits. This work is being done to advance this Eastern Borosi to be the next high-grade "spoke."

The initial infill drill program is focused on the higher-grade Guapinol, the adjacent Vancouver, and the Riscos de Oro deposits, which contain a combined 515k oz. Au @ 8.15 g/t and 4.37m oz. Ag @ 69 g/t. There are five earlier stage targets initially intercepted between 2016 and 2019, illustrating further upside and will be a focus of future exploration. The following drill results are outside current resources:

- 2.6m @ 8.93 g/t Au (Cadillac zone)

- 5.7m @ 10.92 g/t Au and 859 g/t Ag (San Cristobal zone)

- 5.4m @ 10.15 g/t Au (Veta Loca zone)

- 12.7m @ 5.75 g/t Au (La Luna)

2019 drill highlights (unreported as it is outside of the 2018 mineral resources):

- 1.15m @ 23.82 g/t Au (Southwest Riscos De Oro zone)

- 3.57m @ 4.83 g/t Au (Southwest Riscos De Oro zone)

- 1.67m @ 11.20 g/t Au (Pueblo Santos zone)

The following highlights Libertad mill's production potential at various throughput rates and grades:

As we can see in the table above, there is the potential for significant organic production growth over the coming years.

2P Reserves: 296k oz. Au @ 4.71 g/t Au (Libertad U/G, O/P, and stockpiles)

M&I resources (exclusive of reserves): 82k oz. Au @ 4.80 g/t Au

Inferred Resources: 386k oz. Au @ 4.24 g/t Au + 700k oz. Au @ 4.93 g/t Au (Eastern Borosi)

In Q4 2020, Calibre provided an update on its generative exploration program, focused on identifying near-term organic growth opportunities to complement its hub-and-spoke strategy. This began in June 2020, with the objective of identifying resource expansion opportunities located within trucking distance of the Libertad mining complex. Calibre is doing this through regional and district scale geological modeling and data analytics, coupled with field reconnaissance and first-pass drill testing to systematically evaluate its exploration concession's broader potential. Further, the company also applied for new mineral concessions covering another 800km2![]() that exhibit similar geological characteristics to the bonanza-style epithermal gold systems at Limon, Libertad, and Pavon. Longer-term, Calibre has a JV agreement with Rio Tinto on a large land package.

that exhibit similar geological characteristics to the bonanza-style epithermal gold systems at Limon, Libertad, and Pavon. Longer-term, Calibre has a JV agreement with Rio Tinto on a large land package.

2021 gold production is in line with the previously provided 3yr guidance with output forecast of 170-180k oz. Au (30% growth) @ AISC of $1,040-$1,140/oz. Costs are estimated to come down after 2021. Calibre paid off its outstanding debt owed to B2gold as part of the acquisition of Limon and Libertad. It is now building cash, and it will be reinvesting more into exploration and development at Panteon and Astravesda underground mines, which are expected to begin ore deliveries before the end of Q3 in 2021 and 2022.

Valuation:

Assumptions: $1,750/oz. gold price deck @ 6.50%. Libertad mine life: 7.50yrs. Limon mine life: 10yrs. Peak production at Libertad of 160k oz. Au in 2025. We will apply a 0.85x NAV multiple for the base case and a 1.20x NAV multiple for the upside case, given the exploration upside potential. We also assume very moderate production from Eastern Borosi, contributing a maximum of 30k oz. Au in 2025 and 2026. Assumed developed capital for Eastern Borosi (small-scale) is $35m. This is still on the conservative side if we assume average annual production from the Limon complex of 60k oz. Au and a maximum of 60% capacity utilization at Libertad (2024-2026).

NAV Sensitivity: Change in Gold Price (Vertical) & NAV Multiple (Horizontal):

The stock price is currently trading with an implied gold price of approx. $1,450-$1,500/oz. applying a 0.85x multiple. As mentioned, we have applied some value to Eastern Borosi, though there remains significant upside in terms of valuation. In Short, Calibre Mining is a quality junior gold producer with significant leverage to the price of gold. We believe there remains material value to be unlocked via the drill bit, which we will see as more drill results are released through the remainder of 2021 and 2022.

Disclosure: This author and Goldseek employees hold a long position in Calibre.