The rebounds in Gold and Silver exceeded my expectations and closed May in a strong fashion, near the highs of the month.

Gold's monthly close was the third-highest ever. Silver failed to break resistance at $28.50, but its monthly close at $28 was the second-highest in the last eight years.

As noted last week, Gold and gold stocks have perked up in real terms.

Gold relative to Bonds has broken out to a seven-year high. It has decoupled from Bonds. Also, both Gold and gold stocks have perked up against the stock market.

To understand immediate trends in precious metals, one must follow the various ratio charts. They can help us understand capital flows and anticipate the future.

Multiple ratio charts currently show potential for huge moves in Gold and gold stocks.

The answer to the title is the following chart.

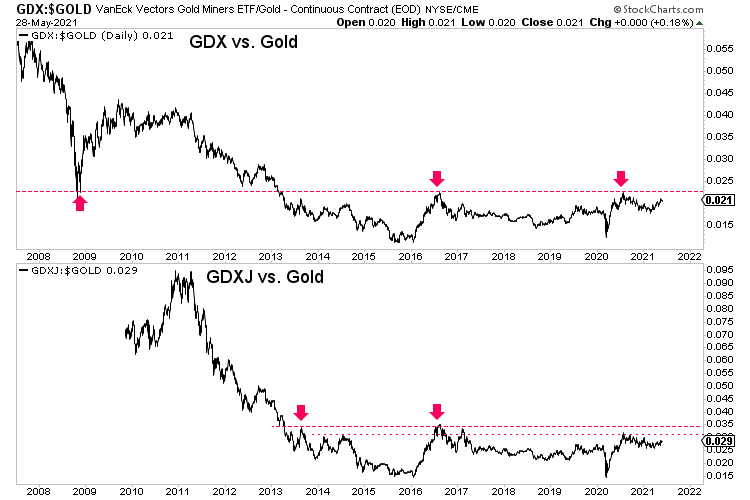

We show GDX against Gold and GDXJ against Gold.

GDX against Gold could be as soon as several months away from a major breakout, and that would be followed by GDXJ breaking out against Gold.

In other words, gold stocks are setting up for dramatic outperformance against Gold over the next year or two.

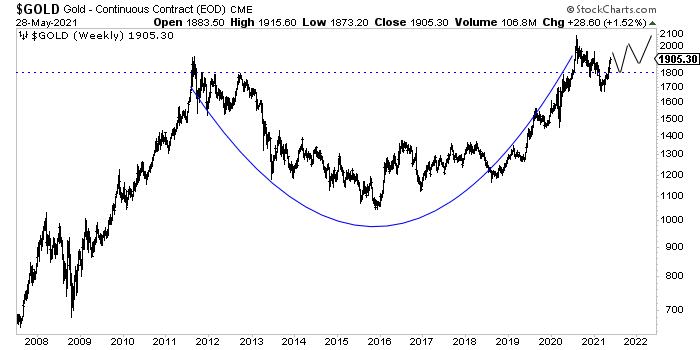

Oh, and the outlook for Gold is not bad either.

It’s only correcting and consolidating in the form of a larger, super-bullish cup and handle pattern.

The corrective low in gold stocks is definitely in as GDX and GDXJ successfully retested the multi-year breakouts they made last year.

After a successful retest of a significant breakout, a market typically trends higher in a steady and sustained fashion.

An early signal of the relative strength in gold stocks will be GDX breaking out relative to Gold, which may occur before Gold makes a new all-time high. In other words, gold stocks could make new highs before Gold.

Over the next year or two, we will witness something we haven't seen in over 15 years.

Most market participants avoid gold stocks because of the crash of 2008 and devastating "forever" bear market and because of their consistent underperformance against Gold. As a result, generalist investors have preferred to own Gold instead of the miners.

This is an important shift, and it's only in the first inning.

I've positioned myself in companies with the best combination of upside potential and fundamental quality. These are companies you can buy and hold for a few years that have the potential to be 5,7, and 10 baggers after Gold breaks past $2,100/oz.

In our premium service, we continue to identify and accumulate those quality juniors with considerable upside potential over the next 24 months. To learn the stocks we own and intend to buy with at least 3x to 5x potential and more, consider learning more about our premium service.