This was one of those days where every news headline that went into The Daily Doom this morning made me say, “Of course it did!” — not in the approving kind of way, but in the way you say it as you roll your eyes because you see that, yes, the bread did land jelly-side-down on the carpet, or you discover that, rubbing against the door frame as you slid into your car, did leave a big grime smear on your white pants, which also rubbed off on the seat.

Of course it did!

Oops. And it looks like that jellied slice of bread nicked your pants on the way down to the floor, too.

Of course it did!

That was the news about inflation all over the place. Inflation rose, instead of falling like the Fed wants and like the stock market fantasizes.

Of course it did. That much was obviously coming. (See: “The Return of Inflation: It’s Back, it’s sticky, and it’s bound to get ugly!“)

Stocks fell off a cliff at opening as a result. Of course they did … because of the initial shock that inflation wasn’t as well-adjusted as investors sanguinely believed after all. Surprise, surprise. But then stocks launched toward the moon. Of course they did … because investors immediately put a rosy monocle over their investigating eye, and did their best to scan the report to find justification to rise like they wanted to. It took only moments to dig out those bits of bright color. But then stocks fell off an even steeper cliff. Of course they did … because investors, having gotten their initial bids in, read a little further, and realized they had run out past the edge of the cliff like Wile E. Coyote. So, you know what happened next: After their big fall, they spent the rest of the day trying to crawl back out of their canyon because their sentiment has determined they will rise, at all costs (and those will be great for them), by ignoring everything they don’t want to believe.

The US military, meanwhile, spent $800,000 to take down another unidentified flying objectionable, even though the fighter jet’s machine gun could have done the job for a few bucks. And that doesn’t even include the cost of the flight. Of course it did. The military will always find the most expensive way to accomplish anything. You know, like the plastic control knob that costs $145 because it’s going into a fighter jet. Maybe they used their $400,000-each sidewinder missiles because the pilots needed the target practice anyway. Of course they did, given that the first shot missed! Now, hitting a balloon — the slowest-traveling, big-as-the-broad-side-of-a-barn, ancient-world aero-tech in the skies — has to be the easiest target there is to hit since it cannot possibly get away. So, if precision-guided sidewinders couldn’t hit it on the first mark, clearly someone needed target practice. So, of course the military spent nearly a million dollars — once you factor in the full cost of the squadron involved — to knock down something Gunny McGunderson from Wisconsin could have wiped out with his goose gun.

And … Joe Biden plunged back into the Strategic Oil Reserves to rescue himself from getting tarred and feathered for the return of inflation. Of course he did. He saw that energy prices started increasing after he stopped draining our national reserves down to offset the costs of his sanctions. He also saw that oil has returned, as the the fuel for the dragon’s fire, to being one of two major drivers in today’s CPI inflation report; so, of course, SloJo went back to bringing our reserves down toward strategically riskier levels of depletion in order to curb oil’s impact on inflation.

Joe had to get a jump on this because rising energy prices, this very same day, shoved inflation back up, as I had said they would. That happened even though the Bureau of Belabored Statistics did its best to work CPI down by reducing the weight that energy carries in the report now that energy prices are back to rising … as I had said you would find happened solely to the things that rose the most in today’s report. (Again, see: “The Return of Inflation: It’s Back, it’s sticky, and it’s bound to get ugly!“)

US inflation and jobs “show the fastest recovery in 30 years under Biden!” said another article. Of course they do. Never mind that the inflation dragon is lighting a fire up the back side of Jerome Powell’s suit again; but, hey, it did dip awhile back (old news now) … well, until some of those months got revised higher a couple of days ago … probably in order to make today’s report look comparatively a little less horrible! Never mind, also, that the Fed doesn’t want a hot jobs market right now because it needs to cool inflation or that Biden claims to be fighting inflation. So, not exactly the kind of recovery we should be boasting about right now. Rising inflation and rising labor tightness became great news today because that is how the White House fed it to the press, so that is what the press reported! Of course it did. When do they ever do anything these days but spit out predigested pablum?

Never mind, as well, that inflation would not have been out of control in the first place without Powell’s massive money printing and the equally massive government giveaways under both President Trump and President Biden. Never mind that the labor market is busted beyond measure because it still has about 4-5,000,000 laborers who are MIA or that most of that would not have happened without the initial global economic lockdown and subsequent partial lockdowns under both President Trump and President Biden and mandated by many Democratic mayors and governors. Never mind that Biden’s vaccine mandates exacerbated the situation by causing even more people to give up after government-forced unemployment.

So, great, nearly record inflation has gone back to generally rising again but not as fast as it could be, and we have a labor market that is only tight because it is incapable of supplying labor even to meet lowered production, but it’s all great; therefore, the CEO of Goldman Sachs said today that he sees brighter prospects now for a soft landing. Of course he does! He has stuff to sell that requires his clients believe that … even in the face of a raging inflation war that obviously is FAR from over. But don’t expect anyone interviewing the Goldman child to question his opinion. It’s all smiles when you land an interview with one of the golden boys.

Putting a sunny face on a dour inflation report

You should have heard Rick Santelli spin the inflation new at the top of the morning. Here you go. See if you catch the spin:

Oh, “We strip out the all-important food and energy” and everything came in as expected! Well, of course it did! That is where inflation is running the hottest. Did you get to strip it out of your purchases last month?

Guess what? That is the part that is going to remain the stickiest, too. Why? Because you have to have it. It’s not discretionary spending. Without energy, you don’t get to work, so you die. Without energy, you don’t heat your house, so you die. Without food, you die. So, no matter what happens in prices there, you keep buying, which makes it a lot easier for corporations to raise those prices than, say, to raise the price of tulip bulbs or bedding.

Oh, but “the big numbers,” said Santelli:

CPI year-over-year — and this number has been going down — is 6.4%…. This follows 5.7., and it is the fourth number in a row in this series to move LOWER [emphasis his].

Did my hearing aid just fall out of my year and land in the jelly that’s on that carpet? Did I just hear him say the numbers have been going down and that 6.4, following the previous reading of 5.7, is the fourth number in a row to go lower? I guess in the world where bad news is good new, then up is also down.

But let’s continue …

And if we look at the year-over-year core we were expecting 5.5. It is higher at 5.6, but it is sequentially lower than the 5.7 in the rearview mirror.

Then Santelli stumbles all over himself to correct his math and say the 6.4% headline inflation is actually not the one down from 5.7, but is the SEVENTH in a row to come down, starting at 9.1%, while core inflation was actually the number that came down from 5.7 to 5.6. I guess this is what happens when you’re rushing to make things sound positive. Core CPI, by the way just rose for its 32nd straight month in a row, but clearly no one is counting.

Services CPI, which the Fed says it is most concerned about because those prices are especially sticky because they are the prices most highly impacted by wages, which don’t tend to fall quickly, only rose to their highest level in forty years! So, nothing to be concerned about there. Move along, Folks. Of course, whether they focus on the year-on-year rate or the month-on-month depends on which looks best for investors.

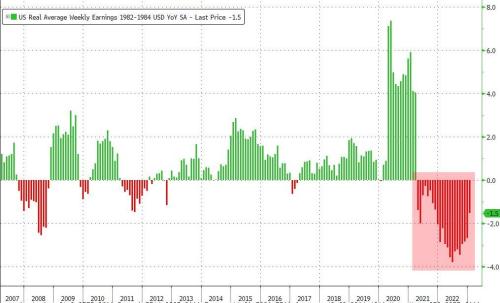

Speaking of wages, here, by the way, is what your real wages have been doing since Biden took office:

Those wages reflect the impact of inflation on your actual spending power; so thank God the red lines shown there are have just started reflecting the reduced wage impact from inflation on all the main things you spend your money on, or you’d feel a lot worse looking at that! That is the rubber-meets-the-road presentation of the great jobs market Biden was bragging about in his State of the Union Address. Quite the accomplishment. It sure stands out over other periods going a long way back! (And, of course, those negative results include all the positive wage increases that have been talked about during that time.)

Now, you can see why I say inflation is such a fire-breathing monster. You see your wages go up, but in real spending terms, they are just going up in smoke … perhaps more than any other time in your life.

Back to Santelli: If you’re not confused enough, Santelli lets you know that, if you want to use Powells’ favorite numbers for gauging the inflation fight, you not only subtract out the food and energy but also subtract out housing. That grouping is now known as the “super core.” Great. So, just eliminate ALL of the things that are the biggest hit on your budget and that are the things you can LEAST do anything without (therefore, are the stickiest prices once they inflate), and then the picture doesn’t look quite as bad. Of course it doesn’t. That is why the Fed now wants you and all the press to keep your eyes on “super core” inflation because the old “core inflation,” which used to be the number that made things look much better, isn’t good enough anymore. It’s so second millennium.

Of course, energy, food and shelter are all the expenses that are rising the most quickly right now, and shelter is expected to rise for several more months because of the lag time we’ve talked about here in how the BLS goes about calculating it. That is why it had to be given less weight as the numbers being reported now show. You know the nice thing about shelter is that, because of the extreme lag time in reporting, it doesn’t show up for anywhere from 6-12 months in the inflation reports you read as inflation is growing; then, when it finally comes screaming in right as the Fed wants to show they are succeeding in battling inflation, the Fed and all their professional writers in the financial media tell you, “Well, housing inflation doesn’t really matter now because prices in real time are coming back down, so we can ignore the rise we’re seeing in shelter costs because disinflation is already baked in there.

In other words, there is never a time when shelter (your most important budget item, now rising the fastest) matters. Of course, it doesn’t. By the time it is rising, the Fed stops looking at it. Before it was rising, they never talked about it because it didn’t show up in the numbers anyway, so they didn’t know how much it was rising, and neither did you in any quantifiable way.

Of course, they don’t look at it …

… because, all of a sudden, the Federal Reserve is very concerned about what’s going on only with the core service sector.

Of course, it is.

So, rates have moved up, but not that much!

Well, hold it! I didn’t think inflation rates were supposed to be moving up at all! I thought you guys told us the Fed has this under control. Stock analysts especially have been telling us this. You mean we’re back to inflation rising “just a little bit” exactly like that old curmudgeon David Haggith said we would be early in the year?

And, so, Santelli springboards off this good news to talk about how close the Dow is going back to the highest number it has seen “all the way back to January 17th!” (Never mind that it failed today completely to hold that bounce and went lower.)

Wow! The highest prices since less than a month ago! “All the way back!” There’s a claim to fame. Another way of expressing that would be to say, “The Dow has gone nowhere for almost a month!” If it could have made the leap it wanted to today, it would have been almost as good as it used to be, so there is good news!

Yes, it is. We almost clawed our way back to unch from a month ago.

Don’t let this inflation stuff hold you back from piling into the stock market! So, Santelli would like you to think … because investors tune in to good news, not to sourpusses like me. Such positivity for what turned out, in the end, to be not such a great day for stocks and actually a rather dismal day for inflation, unless, of course, you rule out all the worst stuff, then it didn’t look too bad at all!

No, it didn’t.

So, here we are: We almost made it back to where we were in January, which, in turn, ALMOST made it back to where we were in December:

In other words, a long, gradual grind downhill as the market keeps betting off fantasies that fail to materialize. Of course, Santelli made sure to reference the intraday high this morning; and, yes, by that measure the stock market nipped January’s intraday high, too. BUT we don’t really count intraday highs. We count where the market closes as what matters most. And, so, try its best as it did today to beat inflation’s news by using every way of wrangling the facts into prettier colors that it could find, the market still slouched lower by day’s end.

Yes, it did.

(And I had lots of quotes by those putting lipstick on this pig, but I’m running out of your likely attention span.)

Pig minus lipstick

Now, how about a little burst of objectivity on what those inflation numbers really did:

Inflation rose 0.5% from December to January. That’s a lot in one month. And it’s entirely in the wrong direction. It even looks like it could be the start of a big turn in inflation if next month does the same. Worse still, that was after December was revised higher, as I wrote about yesterday, to make the comparison look not as awful. Of course, they don’t want you to realize that. AND it was after the BLS also revised how much it weights all the stuff that is coming in hotter so that those things carry less weight in the total numbers this year than they did last year now that they’re the main things rising.

Yes, they did.

“Super core inflation,” which strips out all the worst stuff, only rose 0.2%; but, hey, if the least offensive inflation rose 0.2% from last month, isn’t that bad, too? I think the Fed is going to have to invent a “super uber core inflation” if it wants to get inflation to merely hold flat.

And, while the weighting for shelter has been reduce and while shelter still has months of lag time to play through, guess what? The rise in shelter still accounted for HALF of the monthly rise in inflation. That is why we must factor it out in order to show progress, but don’t let anyone tell you that isn’t fair … or that isn’t even a picture at all of the real world. Shelter, it turns out, even after being weighted lower, went up 0.7% from a month ago and 7.9% from a year ago!

But that was NOTHING compared to energy. Energy screamed upward 2% from a month ago. Now, you see why the Bureau of Belabored Statistics really had to work that weighting down for energy because even with their hard work that, 2% is screaming hot. And food? Thank God, they took that out of the important figures because it bolted up 10.1% from a year ago and 0.5% in just the last month. So, you can see now why I told you in yesterday’s article it would be really crucial to understanding inflation to follow the money and look at what happened beneath the hood to things they reweighted. They still stand out the most!

Can you believe they reweighted downward the things that rose the most so they would count less and reweighted upward the things that are tending to fall so the fall would count for more, and then the Fed subtracts out the the things that still rose by far anyway.

Of course, they did!

But, hey, at least eggs were only up 70% year-on-year. Don’t let the chickens now; they’ll be striking for a pay raise. And just remember, when tomorrow’s retail sales report comes out, the prices used to measure sales in that report are not adjusted for inflation, so most, if not ALL, of the increase you see in “sales” will be due to inflation; and, if anyone factors out the part of the rise in sales that is due to inflation using the CPI rate, they’ll be using a much lower rate than anything in the real world experiences. So, sales may come out looking fair-to-middlen by either measure.

Still think the Fed’s going to pivot soon? Well, you’re not a typical stock investor if you’re reading here; however if you are a typical stock investor who just stumbled through my door in a drunken stupor after downing a shot or two of today’s great inflation news, then …

Of course, you do!

Liked it? Take a second to support David Haggith on Patreon!