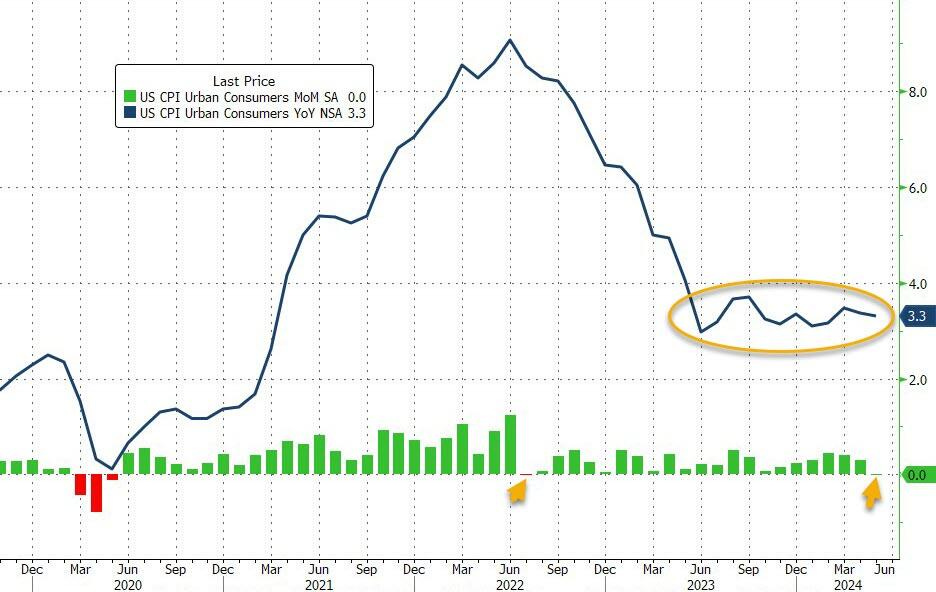

Before much is made of the CPI report, as much will be made simply because it gave a small nod in the direction that the stock and bond markets both lust for, let’s look at one simple graph that proves how completely insignificant the dip in CPI was:

We are one month short of a year now in which the Fed has made ZERO progress on inflation. The graph proves that year-on-year, we have chopped nothing but sideways. In fact, the number is a low that is higher than all previous YoY lows. Clearly I am not fit to run the Fed because, if I saw a graph like that, I’d say (long before now), “Cleary we are just spinning our wheels in the sand, Guys. We’re getting nowhere, and we’re taking a long time to do it. It’s time to give inflation one more tap on the head to get it started moving back down again.”

If that doesn’t look like stalling along a plateau, nothing does. In fact, you can see there has been a very slight upward tilt even in the YoY numbers for a year if you were to run an average through those ups and downs. The month-on-month numbers (green), on the other hand, started to rise in the summer of ’23, took a dip when Powell’s loose lips undercut the Fed’s tightening last fall, and then rose for several months. Now they’ve been slowing a little, but still incrementally raising the YoY average.

So, there is much ado about nothing in the markets, but where all that goes will ultimately depends on whether the Fedheads look at that graph as I do and say, “We’re not getting anywhere” or come out with news that one or two rate cuts are likely on the way this year. While they do love to help the stock market out from time to time and especially the bond market now that their old colleague, Janet Yellen, needs help at the Treasury, I am inclined to think the downtick in CPI will be fairly meaningless to them. (It should be, but nothing happens as it should at the Fed, or we wouldn’t be going sideways due to all of Powell’s verbal undermining of the Fed’s tightening and due to the Fed’s lack of further policy action.) Obviously, there is always a high chance that Powell will be his usual dovish sounding self, but the Fed’s dot plots of where voting members think they’ll be putting interest in the months ahead may speak loudest.

I’m going to save the technical analysis of the CPI for my weekend Deeper Dive, which will show that the two components that brought CPI down are the ones most likely to rise again. One of them will likely rise in the summer because that is what it does. The other is on a much longer timeframe, but I can PROVE it certainly will rise months from now, but is also certainly going to bring downward protection in the next few month. It’s going to make for a tough few months ahead for my prediction of continuing rises in inflation. At least, it is likely to look like it is, but that is expected on my part. We got the year of rise that I’ve been talking about. So, that’s in the bag. In the Deeper Dive, we’ll analyze where it goes in the months ahead.

What the markets are making of the news

Here are the initial market takes, many of them overoptimistic, some more realistic:

-

"The CPI is a really nice inflation reading. The Fed meeting today should see officials move toward two rate cuts for 2024 and softer CPI readings from here will keep a September cut in play." (Gregory Faranello, head of rates strategy at AmeriVet Securities, based on nothing but optimism because the Fed just glances at CPI. It much prefers PCE inflation readings.)

-

“A 0.2% monthly core CPI reading should be the base case for the balance of the year, especially as it looks more and more like the long-awaited slowdown in shelter costs will hit as soon as the next report.” (Omair Sharif at Inflation Insights. That’s true, but it is based on short-term facts about shelter costs that I’ll go into in detail in the Deeper Dive. A big trick is coming for the unaware, and that is based on rock-solid facts that are already established. These guys see the part they want to see.)

-

“The knee-jerk reaction in the Treasury market isn’t surprising given the Fed-friendly CPI print, particularly the “low” 0.2% on core CPI. Jay Powell can now say ‘we’re making slow but additional progress on inflation’ at this afternoon’s press conference. Investors have been asking if members of the FOMC might change their summary of economic projection forecasts after the CPI print, since they are submitted prior to the start of the meeting. Today’s report probably doesn’t really shift expectations much. We’ve been thinking November and December cuts as our base base, and this data solidifies that view.” (Ira Jersey, Bloomberg Intel chief rates strategist gives a very solid take on how Powell is likely to play this, even though the Fed doesn’t pay a lot of attention to CPI. A November/December cut is the only cut possibly in play at the Fed, as they will need, at least, that much time with constantly improving inflation metrics to make that kind of decision. They’re not going there in September based on the sideways churn shown above, which is equally the case in PCE.)

-

“This was good news but it is one piece of news. June is a no-go. We have felt July the same. Again today is a good print for restrictive rates working to quell inflation, so September is a possibility.” (Lindsay Rosner of Goldman Sachs Asset Management is right on June but too optimistic on September.)

-

“A calm CPI report. This CPI report gives the Fed the flexibility to still cut rates. We still expect the Fed to hold off until after the election though.” (Bryce Doty, Sit Investment Associates senior PM. A realistic projection)

-

"Until greater dis-inflation evidence is seen both in breadth and depth, today’s softness is supportive of a preemptive cut rather than a pivot in Fed policy towards accommodation.” (Ashwin Alankar, head of asset allocation at Janus Henderson Investors gives a possibility as ridiculous and overly optimistic as the “Fed pivot” was for an entire year. It is based on nothing but wishes. There will not be a “preemptive” rate cut—pure semantics—with inflation trending sideways. Preemptive would mean it comes before a recession hits and before unemployment rises. Not going to happen with inflation churning sideways to slightly upward.)

-

“The downside surprise in CPI could have an impact on asset prices over the medium term, not just today.” (Ana Galvao, Bloomberg Economics. It will EASILY affect asset prices today, unless Powell makes a very dovish response in today’s Q&A. It is not going to impact the Fed’s policy decision, though it may play nicely in Powell’s normally dovish presser.)

Next up, what Powell makes of all of this.