Everyone in financial media is singing in unison, and the song they are all singing is a recessional for the recession — a hymn or musical piece sung while making an exit. It’s an attempt to make the recession recede from view, to talk it out of existence, to convince everyone that what is, is naught, and it’s working in this Wonderland world where so many now define things — even their own gender and, yes, now race too — as they want them to be. However, it is actually the singers, themselves, who are receding from reality.

The following post, originally shared only with my Patrons on September 4, is the key for understanding the massive error the Fed (and markets) are making. I promised I would share it with everyone before the Fed’s big meeting this week, so here it is with a few updates:

President Biden has been bending over backward to declare we are not in a recession, in spite of two quarters of increasingly lower gross domestic production. Papa Powell has been bending backward right beside him. And, of course, everyone who works for either of them is doing the same backbend. Biden and Powell, thus, look like two old men leading a yoga class in the standing backbend.

It is not just these relics who are doing the backbends. Economists and corporate CEOs and anyone who wants to convince the world that business is good (or anyone who wants to see Democrats re-elected) has gotten in the flow and joined the Biden-Powell yoga class. In unison, they do a recessional march backward as they sing the same tune, not realizing Pied Piper Powell is marching them all aboard a demonic ark set to sail to their own peril.

The song they sing to chase the recession out of view is called “We’re not in a recession yet.” Its chorus claims, “because the labor market is strong.” They sing this illusion almost like sirens, beckoning a ship to steer into the rocks — their own ship. In spite of two consecutive quarters of declining gross domestic production splashing against the rocks and making the peril around them obvious, the quartermaster orders the tightening of the lines and turning of the tiller, and the ship lists and turns harder into the rocks.

One writer, MN Gordon, whose articles I share on my blog from time to time, described how absurd this official foolishness looks in the following words:

Elizabeth Warren must be a fool. That, or she thinks the rest of us are fools.

The Senator recently took to CNN to publicly fret over the Federal Reserve’s rate hikes. She’s worried they will tip the economy into recession.

What’s Warren afraid of? Her fears have already come true.

The U.S. economy already is in a recession. GDP data alone shows the economy contracted in both the first and second quarter of 2022.

In our world of make-believe reality, US senators are fearing that the obvious thing that has already happened might happen. That’s our upside-down world. The Fed, they argue, needs to stop trying so hard to kill inflation, or it will shove us into the hole we are already in! The data to prove we’re already in the hole streams in front of their eyes month after month, quarter after quarter, but somehow they don’t believe the data. Seeking Alpha , as it sings the same tune, summarizes the reason the delusional chorus doesn’t believe in the recession that has already engulfed them:

Economists are expecting 300K jobs were added in August, down from the larger-than-expected 528K added in the previous month, while the unemployment rate is expected to stay at a 50-year low of 3.5%. A strong jobs showing means that FOMC policymakers will likely be considering another 75-basis-point rate increase later this month as they seek to tamp down demand and control inflation while the labor market is strong.

And that, you see, it the key to understanding the illusion that hides the rocks of recession that we are already grinding past.

Everyone is picking up the tune to the labor lyrics

Bank of America describes just how successful the labor tune has been at convincing the stock market that the recession all around investors is not real. According to their strategist, Savita Subramanian,

Our analysis of the ERP indicates a 20% likelihood of a recession is now priced in vs. 36% in June. In March, stocks priced in a 75% probability of recession.

In other words, the further we have gone into the rocks of recession, the less likelihood BofA has seen that the stock market is pricing it in. Now, that’s delusional! Back in June, BofA saw a 36% likelihood the stock market had actually priced in a recession. Further back in March they saw a 75% likelihood the market had already priced in a recession. But today, with two recessionary quarters already under our belt for the year, BofA sees only a 20% likelihood the stock market has priced itself properly for a recession.

Sheer lunacy. The deeper we have gone into an actual recession, the more delusional the market has become in thinking a recession is not even going to happen in the future, much less today. We saw BofA’s downward revisions to the likelihood that that market has positioned itself for a recession play out in the big bear-market rally we just had in August where, typical to all bear markets, the bulls became rabid with fevered brains again, so they charged ahead on a spending spree, bidding the market way up beyond all reason at a time in which GDP is steadily declining. That was all anchored on the fantasy of a Powell Pivot, suddenly turning the ship from the rocks as it took a glancing blow. However, Powell at Jackson Hole finally tried to dispel them all from believing in the pivot, even though he keeps singing the “no recession yet” tune. The bull trap sprang, and the market is falling again as we head into Powell’s next meeting where few are expecting a lifeline.

A crisis like no other, a crash for the history books

People all around us are failing to recognize the obvious due to the oblivious, such as the Fed, who keep singing there is no recession yet because the labor market is strong. That is supposedly proven by unemployment remaining so low. It seems nearly everyone joined the back-bending and piled like sardines into the ark of doom to declare the delusion that an obvious recession does not yet exist:

Nobel Prize-winning economist says he doesn’t see anything that resembles a recession in the U.S.…

Nobel Prize-winning economist Richard Thaler says the U.S. may have recorded two successive quarters of economic contraction, but it’s “just funny” to describe it as being a recession.

“I don’t see anything that resembles a recession. We have record low unemployment, record high [job] vacancies. That looks like a strong economy,” Thaler told CNBC’s Julianna Tatelbaum on Wednesday.

The proof he has to offer is the now familiar tune that record low unemployment, which I keep saying is an anomaly due to a broken labor market that is unable to supply a work force, is solid evidence the economy is strong. Due to their overconfidence in old measures, they fail to analyze why certain metrics are in discord. (Rest assured, I’m heading toward why here.) Thus, the Nobel economist says,

That means real GDP fell a little bit, but I think it’s just funny to call that a recession,” he said. “It’s not like any recession we’ve seen in my rather long lifetime.”

So funny. It never used to be funny to call “a little bit” of a fall in GDP a recession. Rather than seek to understand the discordance in the tune, he minimizes it. “Ignore the groaning against the rocks. It’s funny.” It’s true that this is not like any recession he’s ever seen, which is exactly what makes the labor situation such a tone-deaf spot for him and many others. What if the Covidcrisis created a recession that is unlike any other because it started unlike any other with a forced lockdown of the entire global economy and grave illness, so economists aren’t understanding the normal definition of a recession as applying even though they should because it is masked behind the anomalies of this strange period we’ve entered:

U.S. gross domestic product, or GDP, fell by 0.9% year-on-year in the second quarter, following a 1.6% decline in the first quarter. Two consecutive falls in GDP growth meet the traditional definition of a recession.

Yet, this is a guy who, more than any other economist, ought to be able to recognize a recession caused by a health crisis (and by our response to it):

Thaler, the 2017 recipient of the Nobel Memorial Prize in Economic Sciences, is best known for his work in behavioral economics — and for explaining the so-called “hot hand” fallacy alongside singer Selena Gomez in the 2015 film “The Big Short.”

His work looks at how people make decisions that are seemingly irrational according to economic theory, and his co-written book, “Nudge: Improving Decisions About Health, Wealth, and Happiness,”

Zero Hedge lays out the fact that most economists, in spite of half a year of deepening economic decline, see the recession as something that has not yet hit:

An overwhelming number of economists think a recession will hit the United States by the middle of next year, according to a survey by The National Association for Business Economics (NABE) published on Monday….

72 percent of economists polled expect a recession to begin by the middle of next year, including 19 percent of those who said the United States is already in a recession, as determined by the National Bureau of Economic Research (NBER).

The NBER defines a recession as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

The standard definition of a recession is also based on two consecutive quarters of declining gross national product, as has been seen in the United States.

Well, we’ve already seen a significant decline in economic activity that has spread across six months. Yet, only 19% of the 72% think a recession has already begun, while all the rest believe we are not in a recession yet, though one is coming within a year.

Nine percent of economists polled say the recession will start in the third quarter of this year and another 16 percent say it will begin in the fourth quarter. More than one-quarter of respondents (28 percent) expect a recession to begin in the first half of 2023, split between 22 percent who see the recession hitting in the first quarter and six percent who forecast it will hit in the second quarter.

Yet, they’re six months deep in declining economic activity according to GDP. So, why do the vast majority of these economists not recognize the recession in which they are already standing but sing a song that describes a different reality than they are in?

Over and over, I read the same reasoning:

Nick Timiraos … the new generation’s Fed-trial ballooner … has become a bit of a celebrity in Fed watching circles as everything he says is now viewed as gospel explicitly coming from Powell’s mouth….

“The latest strong employment figures keep the Federal Reserve on track to raise interest rates by either 0.5 or 0.75 percentage point at its meeting later this month to combat high inflation.”

It’s always the same tune — the latest strong employment figures. Even an economist I enjoy reading who has been saying recession would arrive by this summer is giving the same reason for saying the economy is not, yet, in recession:

The US economy is in technical recession, though it’s debatable whether it is practically in recession given the relative strength in the labor market,

The illusion is strong, in spite of the fact that he notes numerous other signs that the economy is in recession and concludes,

Indeed the fixation on whether this is a ‘recession’ or not is probably misplaced in this garbled economic environment.

Garbled, indeed, and this Patron Post will finally reveal the cause of the garbling; but, first, I want to make sure you fully grasp the extent to which economists are almost all caught in the same garble, which leaves them tone deaf to recognizing that it is the the job numbers that are off pitch, not GDP. They just sing and huddle in their shuddering hull to the tune of Fed and feds, cacophonous inside the reality groaning against the ship’s splintering sides.

Even those who believe in the worst, still can’t fully understand the grumblings of recession they are stuck in; but they do believe, at least, that a terrible recession must surely be close for things to sound so bad. They can’t seem to avoid that much:

Worst is yet to come: Economist Stephen Roach says U.S. needs ‘miracle’ to avoid recession

Negative economic growth in the year’s first half may be a foreshock to a much deeper downturn that could last into 2024.

CNBC

Call it “negative economic growth,” but, whatever you do, don’t go as far as to call it a “recession.” Save the “R” word for things we might, by some miracle, still avoid. Don’t admit we’re already hung up in the Rocks of Recession. Never mind that “negative growth” is the exact definition of a recession if it lasts for “more than a few months,” and this has gone on already for half a year! I will, at least, give this ivy-league economist this much: he can sense from the rumblings that something wicked this way comes:

Stephen Roach, who served as chair of Morgan Stanley Asia, warns the U.S. needs a “miracle” to avoid a recession.

“We’ll definitely have a recession as the lagged impacts of this major monetary tightening start to kick in,” Roach told CNBC’s “Fast Money” on Monday.

And, yet, he misses it, too:

“They haven’t kicked in at all right now.”

So close and yet so far! And why can Roach not recognize the rocks we’re in? The standard labor-market tone-deafness:

Roach, a Yale University senior fellow and former Federal Reserve economist, suggests Fed Chair Jerome Powell has no choice but to take a Paul Volcker approach to tightening….

“Go back to the type of pain Paul Volcker had to impose on the U.S. economy to ring out inflation. He had to take the unemployment rate above 10%,” said Roach. “The only way we’re not going to get there is if the Fed under Jerome Powell sticks to his word, stays focused on discipline, and gets that real Federal funds rate into the restrictive zone. And, the restrictive zone is a long ways away from where we are right now.”

The Fed has a lot more tightening to do, says Roach, at least, affirming my endless reiterations that there would be “NO FED PIVOT.” He understands that part correctly; however, when we get to the reason he doesn’t think all this declining GDP is a recession … yet …

Despite the Fed’s sharp interest rate hike trajectory, the unemployment rate is at 3.5%. It matches the lowest level since 1969.…

“The fact that it hasn’t happened [unemployment hasn’t climbed] and the Fed has done a significant monetary tightening to date shows you how much work they have to do,” he noted. “The unemployment rate has got to go probably above 5%, hopefully not a whole lot higher than that. But it could go to 6%.”

Keep those numbers in mind. They are key. We’re actually already there, and I’ll explain why you don’t hear about it and why he doesn’t’ recognize it, nor do any of his colleagues or, for that matter, anyone I’m reading, even though he says that level of unemployment must happen to quell inflation, and why the Fed doesn’t recognized it at all; but first, let’s explore further just how prevailing this perception is.

Here’s another good economist — one I read all the time — who doesn’t believe we’re in a recession … again because the labor market doesn’t affirm it yet:

Recession Watch: This Labor Market is Not There Yet

In recent months, there have been many reports about layoffs, but most of those layoffs were small, a few hundred people here and a few hundred people there…. But they were a far cry from the mass layoffs of 15,000 or 20,000 people by company, the way they occurred one after the other in prior recessions….

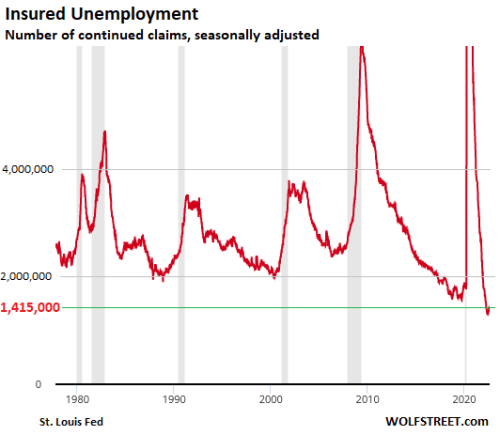

The number of people that continued to be on unemployment insurance after the initial claim – “insured unemployment” – dipped in the latest week by 19,000 to 1.415 million (seasonally adjusted), just a tad above the historic lows in May, and still near those historic lows, and far lower than during any other period. This shows how strong this labor market has been, starting in the second half last year – when “labor shortages” became a thing – through today:

In spite of what you see in that graph, I’ll maintain the position I’ve had all year, which is that the labor market is badly broken, not strong at all, and because of the unusual nature of the breakdown, the instruments of measurement are putting out misleading readings. Thus, the readings are as follows:

So we see that there has been a slight increase in unemployment claims [the minuscule uptick at the bottom], such as from layoffs, but they’re up from historic lows and are still historically low; and that insured unemployment is still right at historic lows.

What this tells us is that the labor market is still very strong; and that most people who are laid off are able to land a new job quickly, or already have a new job lined up before they leave their old job, and they either don’t stay on unemployment insurance long because they start working again, or never bother to file for unemployment insurance because they walked out from the old job into the new job.

Seeing through the mist

Keep that last part in mind as we proceed. Yes, it does tell us they quit their job and never bothered to file for unemployment, BUT it will prove to be for another reason that has nothing to do with anything good like finding a better job. There is a reason we’ll come to as to why none of these people are even applying for unemployment, which no one (until now) has been thinking about — one truly insidious, very bad reason that no one wants to regard seriously because it is outside the normal scope of our experience and represents a chronic, long-term threat to the entire global economy.

Look hard into the spray, and you can make out the rocks that are the reason for the spray.

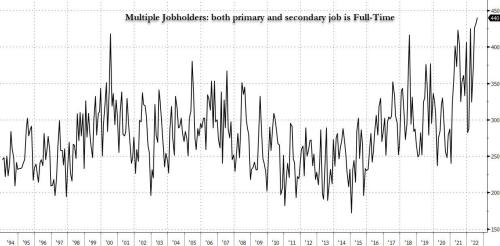

One sign that the quits are not due to a strong labor market and a strong economy is the fact that the number of people now holding TWO full-time jobs is soaring to record highs:

People do not typically hold two full-time jobs unless they have to in order to make ends meet. This also shows us that many of the people being counted as full-time employed may be getting counted twice because the measure of full-time employment doesn’t check to see if two jobs might be held by one person, who is likely holding the second job because that is what it takes to survive … maybe due to inflation, maybe due to a spouse being unemployed for reasons I’m coming to. It means total employment in terms of people employed is lower than graphs of total employment because they count jobs held, not individual people who hold the jobs.

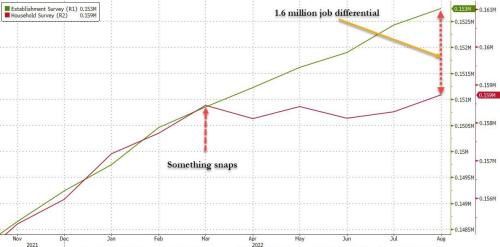

In fact we can see an enormous disparity has developed between two surveys covering the number of full-time employees that is likely due, at least in part, to how that double employment gets counted:

Says Zero Hedge,

So what’s going on here? The simple answer: Fewer people working, but more people working more than one job, a rotation which picked up in earnest some time in March and which has only been captured by the Household survey….

The BLS data engineers have been busy goalseeking the Establishment Survey (perhaps with the occasional nudge from the White House especially now that the economy is in a technical recession) to make it appear as if the economy is growing strongly.

Even ZH has to go and throw in the word “technical” as if we are not there yet just because the NBER hasn’t pronounced an official recession, but I doubt even the NBER’s economists will see through this illusion any better than all the august economists recounted above. The economy is not growing at all. It’s receding.

The wide gap between the surveys may also be due to the power of seasonal adjustments in the government’s reports (the Establishment Survey).

While the labor market is already cracking, it will take the BLS several months of veering away from reality before the government bureaucrats accept and admit what is truly taking place.

The illusion is strong. Strong enough to get the midterm election out of the way before the government breaks and possibly admits we’re in a recession. Awful and likely as holding the truth off for the sake of the elections is, it’s still not the insidious cause of this misleading employment information, but it may be a contributing factor. There is something deeper and more malign than standard election-year engineering that I’ll lay out now that you can see how pervasive the misguided belief is.

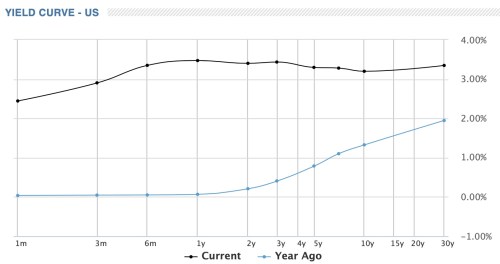

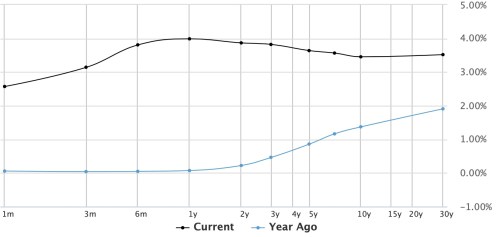

The Fed’s big deaf zone

Remember last year, I said the key to understanding the most important economic story of the year — high inflation and a dawning recession crashing the stock market — would be in realizing why the inversion of the yield curve — the Fed’s main recession warning indicator — would be slow to reveal its truth because it was not being allowed to price either inflation or a recession in? The key was to realize the Fed’s massive bond-buying inevitably resulted in total yield-curve control by the Fed because it naturally distributed its bond purchases across the full spectrum in a way that would make sure its buying did not distort the yield curve. The failure of that old-faithful signal to work correctly because of the Fed’s extraordinary measures was keeping people from seeing what was forming, including the inflation the curve would normally price in, which they, therefore, dismissed as “transitory.”

If the yield curve, under natural market forces, wanted to change to show us the bad that was coming, the Fed’s choice to maintain the curve by where it positioned its purchases in order not to distort the curve, would mean the Fed was actually forcing a distortion by not allowing it to distort. They merely thought their purchases were tending to distort the curve one way, so they needed to place their purchases to avoid that. In so doing, the Fed was forcing the yield curve to stay right where the Fed believed it should be. Because the Fed was the biggest whale in the bond pool, its purchases inevitably had that power based on where they were placed along the maturity spectrum. The Fed would naturally buy as many bonds at each inflection point in the curve as it had to in order to keep the curve in good form because it didn’t want to distort it. However, that was distorting it if the bond market really wanted to price in inflation or price in a recession.

The Fed’s interference in the bond market did not stop GDP from going right to showing a recession that began in the first quarter of the year, whether bond yields were free to price in a warning or not. This misled many economists into believing a recession was not forming because their main indicator — the yield curve — could not work. They could not think their way to seeing why it wouldn’t work, obvious as it was that the Fed’s massive bond buying HAD to be affecting the yield curve. This usually trustworthy gauge couldn’t show what it normally shows because the Fed was hosing up more treasuries than at any time in history.

Thus, I argued that, as quickly as the Fed tapered its bond buying, the yield curve would start to invest to what it had not been allowed to show, and it certainly did exactly that — becoming one of the wackiest, most distorted yield curves I’ve ever seen. Here it is with the curve at the bottom from a year ago being the relatively normal kind of pattern the Fed’s bond buying was maintaining back then, and the top (present) “curve” being highly indicative of a recession, albeit late to the game because treasuries couldn’t recurve until the Fed stopped its massive interference in the treasury market. Look at the huge difference the whale made, getting out of the pool:

[And here is an update added to show how much more inverted with the front end humping up above the far end it has become as I make this post now available to everyone just two weeks later:]

The original key last year was to understand Fed & Co. were all blinded by the yield curve being controlled by the Fed’s belief it was merely avoiding distorting the curve when the curve actually wanted to distort to price in inflation long ago … so that the inversion arrived late at the party. That is now one seriously ugly yield curve because it’s making up for lost time, and it began to show up as quickly as the Fed started backing away from buying additional treasuries, as I promised it would. It has become even more distorted now that the Fed is rolling off its treasury holdings, [which will move up to full-pitch this week.]

Now, however, we have a new broken gauge distorting the Fed’s perception and all the economists who follow along with the Fed. This time it is not something they are doing to themselves. It is something governments did to the entire world with their lockdowns and that Covid or the vaccines or both have done that we are slow to understand, but it is finally being grasped in all of its horror.

The labor market is another major gauge the Fed relies heavily on for assessing whether we are in recession, and it has become the Fed’s deaf zone this year. Last year the Fed’s blind spot was that inflation was transitory. This year the Fed is deaf because it thinks labor is not transitory — that it hasn’t changed for the worse yet. The Fed doesn’t hear the crying of the unemployed because it doesn’t know where to look for them. Almost no one does because they are not in the statistics. And the Fed is wrong! Dead wrong!

Powell badly misunderstands the current job market, and I can finally explain why. While I’ve said all year that the labor gauge is the measure that is off, not GDP, I couldn’t figure out just why it was off. Up to now, I’ve merely pointed out that the labor market clearly could not supply labor, and that has to mean the market is broken because that is its only job, but I couldn’t answer why it couldn’t supply labor.

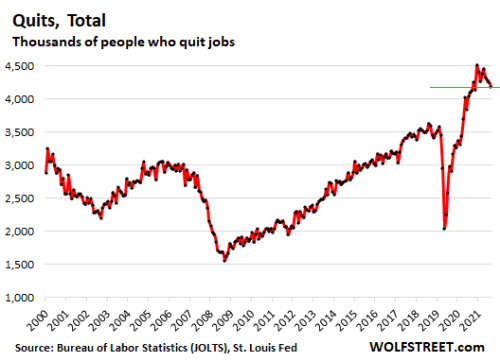

One thing that should have been logically self-evident, hasn’t been to many: The shortage of employees is a problem, not a strength. Labor is not tight because demand is making the economy so strong that labor can’t keep up — the sign of a strong economy. Rather, for some unclear reason, a large percentage of the people who became unemployed due to the Covid lockdowns, stepped out of the labor force for good. They never came back. People started calling this “The Great Resignation” as they puzzled over its cause. Everyone ventured reasons as to why it might be happening, including me, but no one was really sure, including me, why so many people had left the force.

The following graph shows where employment broke and the level to which it is has now recovered, according to “The Establishment Survey.” As you can see it is up to the same level at which it broke. However, the red dotted line is the trend line along which employment growth had generally followed population growth. While we’ve recovered to where employment was before Covid, you can see we are far from catching back up with the population/employment growth trend:

And here is “The Household Survey” of the same employment trends — the survey that is less subject to political manipulation via smoothening seasonal adjustments:

Based on these surveys, we are about 4-5-million below the longterm trend still. The big question on everyone’s mind has been “What is the Great Resignation about? Where have these people gone?”

What you’re about to see in the next section is that the Fed’s misunderstanding of what is happening here in labor is resulting in a huge miscalculation by the Fed about how strong the economy is, which will result in policy errors as bad as the Fed’s refusal to see inflation last year.

The job market is far from being as healthy as most economists believe because it is simply UNABLE to supply normally adequate labor, and we now have news I’ll lay out that finally explains what is causing the Great Resignation and why that cause means the labor market will remain chronically disabled and, therefore, underproductive. “Underproductive” means we have more months of declining GDP to come.

If you’re inclined to doubt the big boys can all be soooo wrong on something so important to where they can — all in unison — miss seeing it when it is right in front of their faces — and to think no little David could possibly challenge that which Goliath scoffs at — just think back to last year, and remember how the Fed claimed for months that inflation was transitory and everyone followed along while yours truly kept assuring you it was not. The Fed’s blind spot resulted in a great miscalculation by the Fed on how long it could continue low interest and could keep expanding the foundation for money supply, causing inflation to fly completely out of control. We all realize that now, including the Fed most of all with pie on its face. We are now watching a similar miscalculation unfold.

The Fed admits it finds the labor market mysterious at present. Its failure to understand that we are already in recession means it will not stop its tightening until the economy is deep in recession, just as being wrong about transitory inflation meant it would not start its tightening to curb inflation until inflation was already wildly out of control because the Fed didn’t’ believe in the inflation that was all around it any more than it now appears to believe in the recession it is standing in (just as Fed Chair Bernanke failed to recognize in the past). It wrongly thought that inflation would go away on its own. It even apparently thought the economy continued to need its support, in spite of the strong jobs market, because it certainly kept printing money and low interest policy going far too long.

It may be the Fed doesn’t even believe its own tune. It could be that they have to sing the tune because they now HAVE to fight inflation because it is their legal mandate to do so, and they took it way out of control. People, like Liz Warren, would feel great peril if they believed the Fed was tightening the economy when the economy is already sinking into recession. So, it’s possible the Fed knows we are in recession but must itself time by convincing everyone there is no recession in order to create space for its tightening.

Thus, Senator Warren feels the recession, so she fears the Fed’s tightening, even as she sings along with the “no recession yet” tune for the sake of her fellow Democrats who know the electorate usually throws out whoever is in power during the time when we sink into recession. She’s either a fool who is oblivious to the obvious, as so many seem to be, yet feels the recession, so she is worried about it; or she’s knowingly trying to maintain Democrat denial about the recession because it’s hard for the incumbent party in power to get re-elected in an election year when the economy is falling into recession. Thus, no Democrat can admit the obvious truth or perhaps none or willing to look hard through the mist to see what they fear to see.

I’m inclined to think she is one of the many tools who believes the delusion for the simple reason that plenty of Republicans seem to be singing along with the “no recession yet” tune, too, as do almost all economists, as noted by ZH, because they all believe and parrot whatever the Fed tells them. Let’s not forget Warren helped create the inflation during the Covidcrisis by pushing the Fed to fuel the economy and by pushing her government colleagues to distribute free money to the masses, whom they forced into totally unproductive unemployment. That gives her plenty of built-in denial toward believing she helped cause the problem with her own policy pressure for lockdowns and money printing.

The fundamental fact is today’s consumer price inflation fiasco is a direct result of Washington’s spending policies. The coronavirus hysteria provided the perfect excuse to spew printing press money into the economy. Warren was one of the greatest advocates.

The Fed, for its part, merely obliged the wishes of Congress. It created credit from thin air and loaned it to the Treasury in the form of Treasury note purchases.

The Treasury then obliged the wishes of Congress…. It used the money that was borrowed from the Fed to fund stimmy checks, PPP, and generous federal unemployment payments. This was all to meet the legislative demands of Warren and the other knaves in Congress.

They all sang along in unison back then, and they all continued to sing along and marched bent over backwards into the same boat all of this year, claiming no recession when we are obviously in one.

Their actions were highly destructive. And now we all must live in the discombobulated world they made.

So, now let’s get down to the cause of the Great Resignation and our present foundering shipwreck on the rocks to which it blinded us.

The cause of the Great Resignation tells us why unemployment figures are grossly in error, and the error is NOT transitory

In short, unemployment figures will continue to look much better than they are for a long time (even when they start to look bad) because we have a unique unemployment situation that is not counted in traditional measures.

There have been many suggested explanations as to why labor never fully recovered from the pandemic shutdowns, and I’m sure they all play a roll; but until now no single reason stood out as being the prime suspect. Some of the reasons people gave were …

- folks decided they didn’t need to have two people working, and it was better for the kids for one parent to stay home;

- they resigned from the employee side of labor and production and went into business for themselves so they could keep working from home;

- they made so much money off of stocks that they didn’t need to go back to work;

- they were only a few years from retirement anyway, so they took early Social Security benefits and called it quits;

- their old company closed down for good, and the jobs that reopened are nowhere near where they live nor matching what they are skilled in; and so on.

All of those are fitting explanations, but a much larger explanation has just emerged; and, unlike some of the above, it may not ever go away. It may be a permanent injury to the workforce, leaving us less productive for years to come.

Here it is: The Brookings Institute has revealed that hundreds of thousands (who got Covid) are not returning to their jobs because they died:

By far most survived [COVID]. But hundreds of thousands did not. American deaths now number well over 1 million.

But that’s only the smallest part of it. Obviously the million who died are gone for good, but most of them were already retired. So, they may not make up a large part of the recently unemployed. However …

Sometimes the original symptoms, sometimes frightening new ones, not only lingered after the acute phase, but were of increased morbidity.

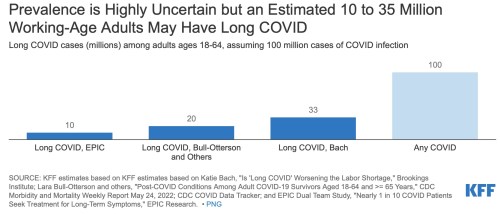

Now two-and-a-half years after the onset of the pandemic, there may be more than 20 million Americans who are still suffering from what is currently known as “long COVID” – a less acute version but one ultimately as debilitating.

Twenty-million! Many of those did not return to work, and we’ll see that the number who did not form a shadow group, in that they are not shown in unemployment figures at all and are exactly right in size to fill the gap in the graphs above between where employment has recovered to and where it would have been, had the pandemic not interrupted the normal flow.

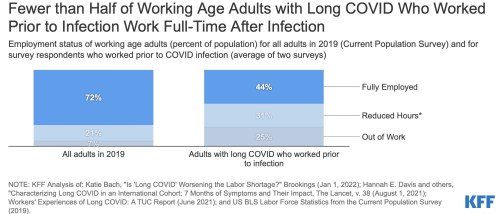

Twenty-million is about two-thirds of the entire portion of the labor force that was forced into layoffs for the Great Lockdown of 2020. Many of those have limped back to work but may be underperforming due to the fatigue they are experiencing, causing domestic production to decline as an unrecognized new reality. Firing those who underperform and replacing them in this new reality of severe labor shortages is no ready solution either because of the labor shortage and is almost unthinkable to some employers, scratching to find more labor.

The number that did NOT return to work due to “long Covid” is shocking:

Some pessimistic analyses suggest well over 4 million once-active Americans are now disabled from this often-ignored pandemic and out of the workforce.

That shadow group is enough to account for the entire number of people who never reported back for work — the gap in the graphs above – as result of the disabling effects of long Covid.

Perhaps 10-30% of those originally infected with COVID-19 have some lingering symptoms six months to a year after the initial infection. And they are quite physically sick, desperate to get well, and certainly not crazy.

I know first-hand what that feels like. Decades ago I got Chronic Fatigue Syndrome, which was thought to have come from a virus, but no one was able to identify the virus. Others thought it was due to chemical exposures. One thing was clear, it was due, at least in part, to the immune system having become over-activated, not shutting down when it should and, thus, burning itself out. Today, doctors are saying long Covid looks a lot like Chronic Fatigue Syndrome or its sister illness Fibromyalgia, and they may all be, in fact, just varying presentations of the same kind of immunological damage from a virus that somehow disabled the immune system’s ability to turn itself off when the job was done, so their bodies keep fighting the disease after its gone, tearing themselves down. After all, part of what the immune system does to fight diseases is turns the body into a hostile environment with temperature changes, histamines, etc, which isn’t great of us either. The plan is that the disease dies before we do, and then the system resets to normal.

With CFS, the fatigue I felt was truly disabling at times. It’s not, as many miscast the disease, that a person feels just a little lethargic or becomes lazy. I WANTED to return to work. At 33 years old, I still had my full career ahead of me, and I hated to look lazy because I was raised with a strong work ethic. However, many days the lethargy was so deep that my legs felt like they were made of concrete. I could barely drag them along with me to cross the room. I got exhausted easily, and I had a sore throat that lasted for months, and my muscles would burn and tighten with built-up lactic acid for several days after doing a mere half hour’s work, like they used to do for just one day after I did a huge workout at the gym.

The “brain fog,” as people called it back then, was so bad that sometimes I would encounter people I had known for years, and I could not figure out what their names were. Sometimes the fog was so thick I couldn’t even figure out what to say or how to say it. It came and went and came again and was deeply embarrassing.

My immune system became so dysfunctional, after years of outstanding health, that it seemed all I had to do was look at someone with a cold, and I’d come down with a cold in less than the normal incubation time. If someone sneezed across the room, it seemed I caught the cold by the next day, and it lasted for three months and developed into bronchitis or pneumonia. That susceptibility to illness continued for a couple of decades!

My legs would sometimes go numb, and I’d experience nerve pain, and I developed a heart murmur from a prolapsing mitral valve that I have to this day, which is often symptomatic of some kind of myocardial heart infection. It took years for me to climb out of those symptoms, and all of them remain to some degree with varying intensities to this day. I would not be surprised, at this point, if the unknown virus that was expected back then was some earlier from of Covid, say Covid 12 or some form that was less clearly identified because …

That is all exactly what people with long Covid are going through today:

While we know the nature of the virus well by now, no one fathoms what causes long COVID’s overwhelming fatigue, flu-like symptoms, neuralgic impairment, cardiac and pulmonary damage, and an array of eerie problems from extended loss of taste and smell to vertigo, neuropathy, and “brain fog.”

“Post-viral fatigue” has long been known to doctors. Many who get the flu or other viruses like mononucleosis sometimes take weeks or even months to recover after the initial acute symptoms retire.

But no one knows why long COVID often seems to last far longer and with more disability.

The only difference in the symptoms listed here from CFS or fibromyalgia is the change in sense of taste or smell, but one would expect a new kind of Covid or a different virus as the cause of the damage would have some variation in its expression. It’s not much. It is also possible that vaccines or other medications taken to battle Covid are causing problems as side effects:

Is [long Covid’s] persistence due to one theory that SARS-CoV-2 is a uniquely insidious, engineered virus? Or do vaccines and antivirals only help to curb infection, while possibly encouraging more unpredictable mutations?

Or do they cause side effects where the cure is worse than the disease?

And it is not just the lazy or the unhealthy who suffer these extreme changes to their bodies:

Who gets long COVID, and why and how is, to paraphrase Winston Churchill, “a riddle, wrapped in a mystery, inside an enigma.”

Those who nearly die from acute COVID-19 can descend into long COVID. But then again so can those with minimal or few initial acute symptoms.

The obese with comorbidities are prone to long COVID, but triathletes and marathon runners are, too….

Those with down-regulated and impaired immune systems fight long COVID. But then again so do those with up-regulated and prior robust immunity, as well as people with severe allergies.

Some of the people who get long Covid are the healthiest, most active, and most ambitious athletes on earth. People made the same claims that is it just laziness with respect to CFS and Fibromyalgia, too, when they were first recognized. Many of the people who came down with these long-term inexplicable illnesses had been highly active people, as I had been. They were ambitious people who felt like they had been kneecapped early in life with no idea what hit them.

Back when I got CFS, many thought it was a basket-case diagnosis and chalked it up to being psychosomatic. Some still do. I participated in a long-term University of Washington study run by a psychiatrist who became one of the leading authorities on CFS, and her study revealed that CFS did not have any kind of profile that matched up to psychosomatic illnesses or clinical depression.

And so it is with long Covid:

Since early 2020, no one has deciphered the cause, although numerous Nobel Prizes await anyone who unlocks its mysteries.

The questions being asked today are the same as were asked back then with CFS and Fibromyalgia:

Does a weakened but not vanquished SARS-CoV-2 virus hide out and linger, causing an unending immune response that sickens patients?

Or does COVID-19 so weaken some long-haulers to the degree that old viruses, long in remission, suddenly flare up again, sickening the host with an unending case, of say, mononucleosis?…

Is there something unique to the nature of COVID-19 that damages the vital on-and-off buttons of the immune system, causing the body to become stuck in overdrive, as it needlessly sends out its own poisons against itself?

All the exact same questions with the preferred explanation by doctors back when I got CFS being that the immune system was permanently broken by the battle it went through and was causing most, if not all, of the enduring problems because a broken immune system often results in autoimmune disorders where the body starts battling itself as the immune system loses some of its ability to discern between what is YOU and what is an invader.

Thirty years later, I’m a lot better than I was, but I still experience a lot of the symptoms, just with a lot less severity. And that was how my specialist told me, based on her research and experience with many patients, the illness was likely to go. If I got better, as she believed I was on track to do, it would by a long gradual climb uphill, lasting well over a decade.

So, with these …

4 million once-active Americans [who] are now disabled from this often-ignored pandemic and out of the workforce….

The 4-million are the worst among those who have long Covid. They match the residual labor shortfall perfectly, and we cannot expect they will re-enter the workforce anytime soon. Because we haven’t come to grips with this new reality, we are not recognizing that the labor force has been damaged, which means we certainly do not see how extensive the damage is. This new report by the Brookings Institute affirms my belief that the severe shortage in labor has nothing to do with a strong economy. In fact, to the exact opposite of the usual meaning, the tight labor force due to a lack of workers is why the economy is declining. We do not have a surplus of jobs; we have a death of workers, and those who have gone missing are uncounted for reasons I’ll lay out. That labor shortage is also contributing to all other shortages because the same problem exists all over the world.

The tightness in labor is not due AT ALL to a strong economy but, in the US, to 4-million people — almost exactly the number that have not, at this point, returned to work after the Covid lockdowns — being weakened and disabled. That is 4-million fewer productive people in the economy who still consume as much as they always did but produce next to nothing. That means shortages will endure for years to come … or until automation can make up the the shortfall because there is no evidence these people are getting better anytime soon.

Do more vaccines help or worsen long COVID?

We don’t know for sure, and that’s not me asking the question. Vaccines tax the immune system, and several studies have shown the new mRNA vaccines may tax it in ways that it is unaccustomed to and that are more damaging than was let on. One informal study of people conducted by a large support organization for CFS with over 3,000 of its own CFS-diagnosed members participating, showed that nearly 30% of those diagnosed with CFS reported major setbacks in their CFS symptoms right after being vaccinated with any one of the mRNA vaccines with many of them saying the setbacks did not resolve. So, it is not likely the vaccines are going to resolve this problem. They may actually be making it worse.

Now we come to the crux of the study for the purposes of this article:

Long COVID may be one of many reasons why in a recession, labor paradoxically still remains scarce. Millions likely stay home in utter disbelief that they are still battling long COVID. Others isolate in deadly fear of getting either the acute or chronic form of the illness.

Not just in disbelief, but in feeling too sick and worn down to drag themselves back to work … in some cases to even drag themselves to a standing position, as many people with CFS were bed-ridden for well over a year and never did get to where they could return to any significant amounts of activity. I was told I was one of the “lighter” cases, one of the ones who was likely to get better in a decade or two … and I did … mostly … over the course of three decades.

The social costs to America of this hidden pandemic in lost wages and productivity, family and work disruption, and expensive medical care are unknown.

But they are likely enormous, still growing – and mostly ignored.

This is a huge area where the Fed is entirely deaf to the crashing breakers all around them. So, when the Powell parade of backward-bending yoga yokels tell you that the extreme shortage of labor is proof the economy is strong so don’t don your lifejackets, just remember the shortages exist because 4-million of those who never returned to work are not out because they’re doing so well that they don’t need to work; they’re out because they’re still too ill from the after-effects of Covid and perhaps the medical treatments for Covid to be able to go back to work.

Far from strong, THE LABOR MARKET IS SICK! It is UNABLE to supply the labor that businesses need, so production has been throttled way back in many places of work, and services are reduced in other businesses. Menus are made skinnier at restaurants. In some places, hours of service are cut back. The economy is less productive (lower GDP is the definition of a recession) because there are, at least, 4-million fewer able-bodied workers.

Last year, Powell’s big blind spot was his transitory belief, which caused him to wait too long to turn off the extra fuel, leading to crippling levels of inflation. We saw all of that hit long before Putin’s War in Ukraine began. This year his tune that “the labor market is strong” is sung by one who is tone deaf. As with inflation back then, nearly everyone is singing along now because they can’t get their heads around the fact that, sure, labor can be tight because demand is high due to expanding production so there just aren’t enough people to fill all the open jobs; BUT labor can also become tight because people are becoming sick and leaving the force for good; and NONE of those people are eligible for unemployment SO NONE OF THOSE PEOPLE ARE EVEN COUNTED AS BEING UNEMPLOYED.

And there you have the mystery solved. That is the second critical aspect in understanding why the Fed is so deaf to the crashing waves and the cries of recession from the general passengers. The only people who join the unemployment count are those who join the unemployment-benefits roll. You cannot get unemployment benefits for being sick. You cannot get them for quitting your job. You have to be activity looking for work to be on the unemployment roll, and those who quit due to illness are certainly not looking for work.

Sick people need not even apply for unemployment. They won’t get it. They know that. These are the millions of people who invisibly fell out of the employment world because they did NOT fall into the unemployment count. They are are a shadow group that lives in the employment gap of the graphs above.

Moreover, this explains why the open jobs numbers don’t align with the labor shortage. With a rapidly shrinking labor force due to crippling disease, there are no longer enough people to fill open jobs. So, the jobs remain open. Some get taken off the job market for a month as employers figure out how to restructure and what to do, and then get re-listed where they will simply appear as “new job openings,” but they’re the same old jobs being rerun. In other words, there is a lot of churn right now as companies struggle to tread water inside the foundering ship, which has nothing to do with a strong market for jobs, but everything to do with a labor market that has a gaping hole on the labor supply side that is no longer capable of floating the work force needed to maintain old levels of production and service.

The irony here is that what Powell & Co. see as strength is actually disabling damage, and that means Team Fed will seriously overshoot its economic tightening. Belief that tight labor means the economy is strong is causing them to look at obviously falling GDP and simply write it off as an anomaly for which the Fed has proffered NO explanation. The Fed simply can’t explain the dynamics within its old models because it’s never faced anything like this.

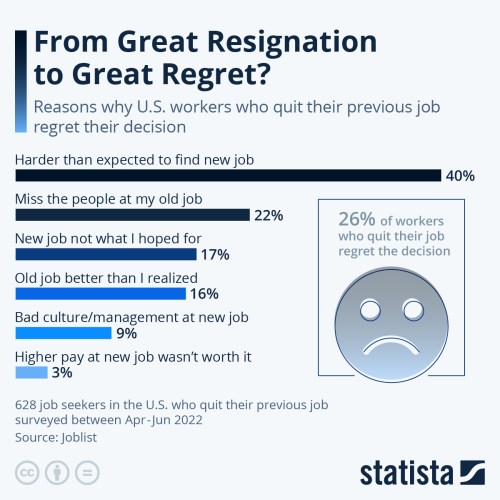

So, when you consider statistics from polls like the following, consider one additional thing:

That poll is from Joblist, and it states that it is polling only a group of people who are “job seekers.” The people who are too sick to work are not visiting job-listing sites, and they certainly are not seeking a job. They would gladly have stayed with their old job, and they quit (or were fired for not returning) because they got Covid, their sick leave ran out, and then never felt well enough again to return to work. This is only a poll of the people who ARE returning to work. The long-Covid folk remain as gray ghosts who are unseen — neither among the crowd that is back in the job market nor in the crowd that is counted on unemployment rolls.

Even with chronic illness keeping such an extraordinary number of people from returning to work who cannot be added to unemployment counts, the overall unemployment number is rising, even as “new” jobs are being listed (or relisted). August payrolls came in with 315,000 new employees on payroll, but unemployment rose. Unemployment rolls rose from a 3.5% unemployment rate to 3.7% in just one month while the total number of unemployed people rose by 344,000 (more than the number of newly employed people) to a total of 6,000,000; BUT that number, remember, does not count people who quit or were fired due to longterm disability from long Covid. That means unemployment is now rising, but it would be about 60% higher if all the long-Covid people who didn’t return to work were collecting unemployment. We’d be at an unemployment rate that did rise to 6% — not a number the Fed considers healthy.

Note that is exactly the figure I highlighted in the economist quotes above that one would expect unemployment to be at IF we are already in a recession!

The number of people returning to the labor force last month was 800,000 people. That’s a big return. Those are likely from among the people mentioned in the first list of explanations for the Great Resignation — the ones who were out for some reason other than being chronically ill who are now seeing their nouveau stock wealth vanish or their stimulus money long dried up or the luxury of having one parent remain at home fade as inflation makes that impossible. It doesn’t likely include any from the 4-million or so long-Covid list of gray ghosts because they aren’t able to return to work. Apparently the “new jobs” could not absorb the 800,000 people who did return to the labor market, so the unemployment actually count rose anyway.

Here is another graph of what the recovery in the labor-force participation rate looks like two years after the Covid crash. This one is based on percentages of the labor force that are participating in employment:

Only 62.4% of the labor force is participating.

The labor force participation rate is an estimate of an economy’s active workforce. The formula is the number of people ages 16 and older who are employed or actively seeking employment, divided by the total non-institutionalized, civilian working-age population…. The labor force participation rate indicates the percentage of all people of working age who are employed or are actively seeking work.

The Brooking Institute states the facts clearly:

Since the depths of the COVID-19 pandemic through today, news about labor shortages and missing workers has dominated headlines. The question everyone still seems to be asking is: Why?…

Around 16 million working-age Americans (those aged 18 to 65) have long Covid today.

Of those, 2 to 4 million are out of work due to long Covid.….

These impacts stand to worsen over time.

That is the range between the most conservative and most pessimistic estimates of those who are no longer participating in the labor force due to long Covid.

The Brookings report gives a thorough explanation of all that goes into deriving those numbers; so, if you want the math, I’ll let you go directly to the source. Suffice it to say, 2-4 million people with long Covid who have not returned to work is enough to fully account for the gap in the labor force participation rate. And most of these now appear to be people who will not be coming back to work for years if ever.

It is too early to have comprehensive data or a clear picture of employment outcomes but there are reports that claims associated with long COVID are rising for disability insurance, workers compensation, and group health insurance….

An important question for the future is whether federal disability programs will count long COVID as a disability. The Office of Civil Rights within the U.S. Department of Health and Human Services determined that long COVID can be a disability under the Americans with Disabilities Act if an individual assessment determines that it substantially limits one or more major life activities. Despite the recognition that long COVID can be a disability, to qualify for federal programs, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), applicants must be unable to work and have health conditions that last for at least one year or result in death. At this point, it is unclear how many people with long COVID will qualify for disability benefits under this definition.

As you can see, disability claims can take a long time to become approved, and clearly those collecting the data are telling us it is not clear yet just how bad the picture is. In fact, the regulations and rulings covering whether or not long Covid will be allowed to be considered under federal disability insurance are still being worked out, too. At the very quickest, it takes a full year for those with long Covid to be declared on disability rolls.

You can be sure this is also still processing its way through private disability insurance as they wait to see what the government will determine in order to know if they have to pay out. More importantly, many workers do not have private disability insurance, and workers compensation and group health do not cover loss of employment income. They are merely data from which one might be able to infer who is not working due to Covid just as Brookings is doing. So, these gray ghosts of the employment world remain lost in a murky sea as this new reality is sorted out.

We have not “a strong labor market,” but a longterm disabled workforce! In fact, it is hard to imagine what scale of longterm burden will fall all of society for the costs of all of this. We may be seeing the initial stages of the greatest economic breakdown in our lifetimes if it doesn’t turn around.

A crippled labor force assures lower GDP for some time to come, and future Fed stimulus will do nothing to put those people who cannot work back to work. Moreover, if Fed stimulus provides for their welfare in the face of less productivity due to fewer available workers, it will drive prices up rapidly in a continuing environment of shortages due to many members of society being unproductive through no fault of their own. For all we know, it is even due to the vaccines that were forced on them, as the Brookings’ study avers vaccines may be making the situation worse.

So, don’t kid yourself about the “no recession yet” part of the current narrative. We are in a recession the Fed cannot fix, and it could be the worst we’ve ever seen if what is starting to emerge in health statistics bears out for the longer term.

Says, Brookings,

THE ECONOMIC BURDEN OF LOST WAGES IS APPROACHING $200 BILLION A YEAR—AND LIKELY TO RISE…

Harvard University economist David Cutler arrived at a nearly identical number using a different methodology. His study cited research that 12% to 17% of COVID-19 patients are still experiencing three or more symptoms 12 weeks after onset, and that the labor force reduction among those with significant impairment is 70%. Using COVID-19 case counts and labor force participation rates, Cutler estimated that 3.5 million people are out of work due to long Covid, for a five-year lost wage cost of $1 trillion, or around $200 billion per year.

Critically, this number does not represent the full economic burden of long Covid, because it does not include impacts such as the lower productivity of people working while ill, the significant health care costs patients incur, or the lost productivity of caretakers. Cutler estimated that medical care and lost quality of life related to long Covid cost an additional $544 billion each year.

Far from being the sign of a strong economy, this labor situation is likely to be the cause of a permanently crippled economy. All of that also goes a long way to explain why so many people are holding two full-time jobs. They have to make up for a sick spouse who is eligible for no benefits, though the spouse cannot work. At the same time, the spouse carrying two jobs is overworked even more by having to provide some caregiving.

Labor’s contribution to the recession, not its exception from the recession, due to so much disability, doesn’t end until these people recover. The Fed cannot do a darn thing about it, and maybe that is why it is whistling past the graveyard, trying to pretend the recession has not begun; or maybe it is just that Cutler’s explanation for why the labor market is short is just emerging; but it confirms that the labor market is broken, which is what I’ve been claiming for months, though I couldn’t point out the cause.

We need to dump the “strong labor” tune everyone is singing as “not helpful” in the least, just like the Fed’s and Treasury’s “transitory” narrative was “not helpful” but was actually harmful by keeping the Fed and the government from understanding what they needed to understand last year.

If long Covid patients don’t begin recovering at greater rates, the economic burden will continue to rise. To give a sense of the magnitude: If the long Covid population increases by just 10% each year, in 10 years, the annual cost of lost wages will be half a trillion dollars.

Following Occam’s Razor, this is the most succinct explanation I can see for explaining why this is the “weirdest labor market ever” as many, even the Fed, are calling it. It IS the weirdest labor market ever, and long-Covid disabilities go all the way necessary to explaining its shortcomings. It is not a labor market that cannot keep up with demand because the economy is so strong. It can’t keep up because it is disabled and even dying. It’s just hard for people to wrap their heads around that kind of damage.

In such an environment, you can expect the number of layoffs will NOT be as significant as they would be during equal economic declines at other times because employers are already short on employees, so they will seek ways to move their limited human resources out of divisions they are closing into positions long held unfilled. They have a lot more incentive to try to promote more from within or retrain from within by offering those they would normally lay off other positions within the company that they have to been unable to fill for months. With such severe shortages in available labor, don’t expect layoffs to stack up like they usually do in a recession, even as entire divisions get shut down.

In the past, recessionary periods were preceded by unemployment claims rising past the 350,000 mark

While certainly true, that is less likely to be the case when employers are downsizing in one department while other areas of their business have long-unfilled positions due to the people who never came back to work because of long Covid. Thus, the weirdness in which we see the number of continuing open jobs is rising, even as unemployment is rising.

Job openings in July, not seasonally adjusted, jumped to the second highest ever, to 12.09 million openings, just behind the record in April, up by 482,000 openings year-over-year and up by 4.45 million openings, or by 61%, from July 2019.

Not all job openings happen due to expansion. Whenever someone quits a job due to disability that results in a job opening, too. So, expanding job openings CAN mean expanding quits due to disability as the list of people with long Covid IS still growing.

While the number of “quits” is slowing a little as Covid has been slowing, it’s still up 15% from a year ago. Hopefully, with Covid not seeming to be as bad as it was a year ago, the number of additional quits will continue to slow. Quits in better times are evidence of job-hopping that reflects a strong labor market, but long Covid provides a viable explanation in present times for the high quits rate. We because none of us have experienced a pandemic this severe in our lifetimes (which would include any disabling effects the vaccines or other medications might have had, another factor still being sorted out).

Thus, what was seen in the following graph by many economists as evidence of a strong job market (as it would be in normal times) may have been nothing other than the mark of an increasingly disabled labor force:

That people are quitting due to disability puts an altogether different spin on the image!

Somehow, you have to account for where those 2-4 MILLION people who quit and never returned to work due to long Covid fit into all the statistics. Don’t leave them as gray ghosts. They’re real people — real former employees — who have faded silently out of the workforce but are most certainly buried beneath statistics that are not designed to account for actual unemployment (v. statistical unemployment) due to mass chronic illness.

As Wolf Richter says of recent new hires,

These are not all new jobs that have been filled, far from it. Many of these “hires” filled jobs that were left behind when workers quit to work somewhere else as part of the massive churn in the labor force.

I would simply point out it is an assumption they quit to work somewhere else because that is the normal assumption, but I believe they quit due to disability, whether Social Security has ever rated them as legally disabled or not, a designation they may not have even tried for if they are still hoping to get better so they can return to work but are just finding that “getting better” is evading them longer than they ever believed it would? (And a designation that takes a year to achieve even in more understandable times.)

The “churn” may be Covid, insidiously chewing away at the soft underbelly of the labor scow in ways that we are unaccustomed to seeing or accounting for. So, as the Fed and feds keep singing their siren song about how “there is no recession yet,” bear in mind that over and over again they base that almost entirely on the “strong labor market,” and it looks like they are seriously wrong in their understanding about that. That means the recession already seen in half a year of declining GDP will actually become far more chronic than they imagine for the very reason they think recession is not happening at all! It will turn out not to be “transitory,” once again. In fact, their deafness to the roar of the waves around them is likely to cause them to make it worse, just like they did with inflation last year.

Rest assured, I won’t be singing their tune.

Liked it? Take a second to support David Haggith on Patreon!