To many economists, saying we are going into an economic crash would be a prediction because over eighty percent of economists do not believe we are even in a recession right now, much less a total economic collapse. To me, on the other hand, saying we’re entering an economic collapse is not a prediction at all. It’s an observation. It’s what is happening all around us, and the hard part is figuring out why they can’t see it.

I know it’s hard to imagine so many economists could be living in the middle of a recession and not see it, much less something so much worse. It’s hard for me to imagine, too; but, as my last post reported …

72 percent of economists polled expect a recession to begin by the middle of next year including 19 percent of those who said the United States is already in a recession.

If I’m understanding how the data collectors are working those percentages, only 19% believe, as I do, that we are in a recession now. They’re included among the 72% of economists who believe we are either in a recession or one is coming as late as next year. Excluding that 19% who believe we’re already in a recession, leaves 53% who believe a recession is yet to come and another 28% outside the 72% who don’t even believe we’re heading into a recession down the road, much less that we are already in a great economic collapse.

However, I will not predict we are going to have an economic crash. I am here to say we’re already entering what I am calling “The Great Collapse” or have in the past called “The Epocalypse.” That’s because this recession and its accompanying stock-market crash are only parts of a much broader economic collapse — the bursting of the Everything Bubble, much of which I laid out in earlier Patron Posts. Now, I’m going to lay out the continuing developments for those events of the Great Collapse that I summarized in “An Apocalypse Upon Us: How much more can we take?” and make some more predictions along the way (which I’ll put in red to help them stand out) in this post for everyone.

Scorching inflation isn’t going away for a long time and will continue to kill the stock market and the economy

Before I go into more about those events and make any predictions about them, I need to followup on last year’s main prediction to show how this is developing. That prediction, which became the top story of 2021, was scorching hot inflation. I mention it because not everyone got to see that I took that prediction further in my last Patron Post in this series by stating unequivocally that the topping out of inflation and the appearances of recession everywhere would definitely not bring the relief from Fed tightening the stock market was believing those turns of events gave hope to. In fact, the Fed would realize inflation is going to remain so hot that the foolhardy narrative about a Fed Pivot would hit an abrupt dead end. So, just as many thought the rally had become so strong the bear market had ended, I wrote,

Stocks are at a particularly interesting inflection point. Many see the current rally and have been speculating the onset of recession means the Fed will pivot. I’ve said, “Nonsense.” The Fed will not pivot — not in time to save the stock market. This time is different. In past times, the Fed’s back was not up against the wall due to being pushed forward by inflation….

So, another prediction: the stock market tunnels to a new low before the end of the year and likely begins its longest drop of all, and the Fed does not pivot in time to save it.

“Economic Predictions for H2 2022, Part 3: Battle of the New Currency Competitors“

I didn’t even get to writing the next Patron Post in this prediction series because of intervening topics to write about before we saw all hopes of the pivot fall and the stock market fall with it. We, of course, have yet to see if the market hits a new low or if this becomes its longest drop in this bear market.

To put the seriousness of this inflation that appears to have topped out in perspective with what we experienced in the seventies, John Williams of Shadowstats says that, if inflation were measured by the same formulae used in the seventies, today’s inflation would be about 17%.

In the first post of this series, I laid what has already born out as follows: (It’s important to note so you see the cause-and-effect between all these events and have that basis for confidence in the rest of the predictions.)

Inflation will keep the Fed engaged in firefighting all year

Inflation remains the driving economic event that will dominate the economy, crush markets and bewilder the Fed and befuddle stock investors for the remainder of this year and into next year….

Investors are now beguiled by their belief in a Fed that had the liberty to stimulate the economy whenever it wanted to with nearly infinite money. They have not fully accepted the fact that the Fed no longer has that luxury, so they keep returning to peculiar belief that bad news is good news because it means the Fed will pivot and come to the rescue. It will not.

“Economic Predictions for H2 2022, Part 1: This is not Your Father’s Inflation“

You can see this has been a consistent theme in this series right from the start. At this point it’s become news that appears to have been accepted by nearly all financial writers that Papa Powell could not have made it more clear that the Fed is still on a crash course to kill inflation at any cost, and that is why the bear-market rally (the bull trap) is over and stocks are falling again with the knowledge this time that they do so without a safety net. In fact, over 2,100 CEOs are selling off their own stocks in their own company. Might they not know something the non-insider’s don’t? (Of course, they would never made insider trades…. Or would they?)

Anyway, the pivot’s past, the rally’s over:

The stock market’s summer rally was cut short last month as investors digested a reaffirmation of the Federal Reserve’s hawkish inflation-fighting stance…. But even after a roughly 9% drop in the S&P 500 since mid-August, Wilson says buyers should (still) beware.

In a Tuesday research note, the CIO noted that his fire and ice moniker has “proven to be an effective way to describe the first half of this year,” and he expects that will continue to be the case through December.

Wilson believes the stock market is set to experience “fire and ice, Part 2” over the coming months after Fed Chair Jerome Powell’s comments at an annual central bank symposium in Jackson Hole, Wyo., last week.

Powell argued some “pain” may be required to get consumer prices under control over the next year, and economists noted that asset prices (including stock prices) will need to fall to achieve that goal.

In that first post of this series, I laid out all the reasons readers could be certain Powell would not pivot and the market would go the way it did as soon as it finally got its head set straight by Powell. More recently I noted that “some pain” is not what you experience when your plane makes a soft landing. So, please note that the soft landing is already off the table according to Powell.

I’m solidly in the same camp as Wilson and have been the entire time inflation was building from clear back when it was just building on the producer side of the economy, and Wilson’s side is this:

While some market pundits and investment advisers made the case that the stock rally was a buying opportunity over the summer, Wilson has contended it was nothing but a trap for investors all along.

His argument was, and is, based on the idea that inflation and the Fed’s attempts to combat it with interest rate hikes act as “fire” against stocks, significantly lowering their valuations. Rising interest rates raise the cost of borrowing for corporations as well, making it more difficult for them to invest in their future growth and turn a profit.

And at the same time, slowing economic growth, or “ice,” is pulling down consumer spending, and by extension corporate earning potential.

Translate that last part “recession.” And not just slowing economic growth, but slowing consumer spending due to prices rising higher and consumers becoming more conservative — a kind of slowing that will continue this winter as heating prices rise (bringing a rise in that component of GDP “growth” that is purely inflation playing through, not an increase in production) while that extra expense for consumers slows spending in many other categories where reduced spending results in an actual reduction in production.

In that first post in this series I said the market’s pivot point of view was ludicrous because the Fed had no choice but to fight inflation because …

the practical things that helped suppress inflation have suddenly vanished like a waterspout that is there and then retracts back into the sky and is gone [and] shortages mean excess money will be used to bid up prices as people and companies compete for the limited availability of things they need….

It all means there are many problems involved in even trying to resolve these shortages — left over trade wars with their tariffs, a world where nations now hate to trade with each other and where politicians would prefer to fight a war with sanctions than with direct involvement of their own militaries, supply chains that broke down due to the Covid lockdowns, and shortages of workers who said, “I’m never coming back.”

With all of that, this is a very complex inflation problem that could easily get much worse. And that is only part of why this inflation is not your father’s inflation, and why it is a greater battle than the Fed can handle….

“Economic Predictions for H2 2022, Part 1: This is not Your Father’s Inflation“

What you heard in Powell’s words and his tone is that the Fed now knows it has a serious battle before it. I had noted numerous pressures that would continue to keep inflation high and could drive it even higher after a bit of a dip and concluded, in terms of the market and its fantasy about the Powell Pivot….

…that is why you know the Fed is going to continue to take the inflation war seriously now that it sees inflation expectations starting to form and will lean on the side of fighting inflation versus the side of saving the stock market or preventing the economy from going into recession….

Having been so wrong about inflation in their public statements, I think it will be a long time before the Fed becomes complacent about inflation again as they see all those forces crowding against them. So, investors salivating for a quick pivot are highly likely to be wrong….The Fed is not going to throw a torch in the tinderbox the second it manages to suffocate the fire [by pivoting back to accommodative interest rates and QE].

It’s important to see all of that to understand where we are in the battle and how much lies ahead. In terms of where inflation goes from here, I said:

Inflation is probably near a peak — or, at least, won’t be rising as fast as it has been since the Fed is now strangling the limited life back out of the economy by raising the cost of financing and reducing the foundations of money supply. Inflation will likely now see ups and downs, rather than a straight climb up, given that the economy is clearly now back in a recession, and recessions create strong deflationary forces.

(See, I told you I’d let all readers know about this once it got to the point where it becomes vital to understanding where we are. Patrons, of course, got the heads up about all of this and all the reasons that would make it understandable and foreseeable before J. Powell came out and made it abundantly clear: NO PIVOT. He repeatedly stated the Fed will stay the course on fighting inflation “until the job is done.” all readers can, at least, now know it was foreseeable, in spite of how so many in the daft stock market and among economists did not see it coming in the slightest. And I hope that strengthens your ability to believe the rest of these predictions, as they will be helpful to you, even if they are of uglier times to come. After all, if you were heavily invested in the stock market, this not-so-cheery perspective would have been of great value, and it still is if your own understanding sees where this is going.)

My final conclusion, after providing a lot of bases for the conclusion, was,

[The Fed] won’t get inflation down by making interest higher, but only by destroying the economy trying.

Thus, the insiders who are not selling are jumping.

So, in short, stocks will fall a lot further before the end of the year.

It is likely to be a September to Remember, but not the the nice kind like this: (Might as well listen to something pleasant as you continue reading about the hard reality to come.)

Who knows whether October has a bigger surprise in store than what September is already delivering in tearing the rally back down, but I wouldn’t be surprised since the market’s deepest crashes seem to prefer October for reasons that remain mystically unknown. And “deep in December” the market might well be even deeper still.

The big thing about September and the following months is not just how inauspicious September and October are for stocks, but that, by the end of September, the Fed will double down on its pace for quantitative tightening. At that point, it will be burning through paper money like a blast furnace fueled on cash. You have only to think back to what happened during these months in 2018 when the Fed hit full-blast cash burn with its first attempted QT at a lower rate of burn than it plans now. Now it intends to do it when there is so much more wrong with the economy, forced into burning off cash by high inflation, which makes it hard to back off when things start to go wrong, as it had to do last time. It believes it can do this because it totally misunderstands today’s labor market, thinking it is proof the economy is strong and resilient, when it is proof of the exact opposite, as I explained in my last Patron Post.

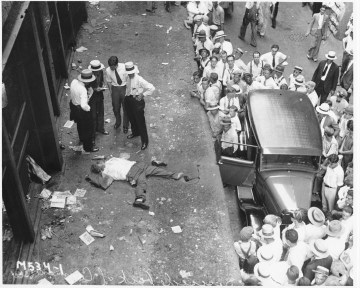

So, wrap up for a blisteringly cold winter … economically speaking. The pavement will be cold and hard for those execs who got where they are by shenanigans along the way … when the tide of money runs out like a tsunami and reveals more than these skinny-dippers wanted seen.

Expect more than the usual number of those kinds “revelations,” too, in this kind of climate where the dive from riches is off of a building to avoid dragging out longterm in courts.

Now, for those who want to find the whole series of predictions about the events I briefly summarized above, here are all the articles up to the present in this series about the Great Collapse we are entering: (The two that say “protected” were available to Patrons only.)

Protected: Economic Predictions for H2 2022, Part 1: This is not Your Father’s Inflation

Economic Predictions for H2 2022, Part 2: The Great Currency War for Global Dominance

Protected: Economic Predictions for H2 2022, Part 3: Battle of the New Currency Competitors

Economic Predictions for H2 2022, Part 4: Zombies in Bondage and Their Broken Banksters

Bond blowouts are billowing upward (and there’s a big reveal in this section for all readers)

The big bond blow-up that I laid out originally as part of this collapse clear back in March based on a Patron Post (that I will open up for everyone, at last, for free later in this post) is now emerging around us in those places where I said it would show up first and worst, making it time to finally reveal that to the general audience, too.

As noted then, “the bond-age is ending,” and now we are reading about the first serious cracks that are emerging as bond yields rise again to hit players already weakened by the earlier rise in yields.

In that late-March post, I noted it was time to …

get ready for all kinds of new fun in mortgage interest.

And we’ll get into how that has been playing out ever since then in the housing section further down this page.

Back then I noted,

the yield curve for bonds is now rapidly flattening as bond vigilantes seize the reins on the bond market that the Fed is releasing. That flattening presages a recession…. This time it is a delayed indicator because of how tightly the Fed held the reins on bond pricing,

The third great bond bear market was underway in “the sharpest plummet in decades” as yields rose and bond prices fell. Since then, as noted this month, the yield curve has now turned into one of the ugliest I’ve ever seen, and the bond market is breaking up along its weakest fault lines.

That’s why Tuesday’s Daily Doom reported the following actions now happening in the US bond market:

Junk-Loan Defaults Worry Wall Street Investors

Financial pain is spreading in the junk-loan market, showing how interest-rate increases are hurting debt-laden companies and worrying investors that a credit crunch looms as the economy slows….

Defaults on so-called leveraged loans hit $6 billion in August, the highest monthly total since October 2020, when pandemic shutdowns hobbled the US economy, according to Fitch Ratings. The figure represents a fraction of the sprawling loan market, which doubled over the past decade to about $1.5 trillion. But more defaults are coming, analysts say….

One sign of concern—a flurry of reports published by investment banks after Fed Chairman Jerome Powell signaled on Aug. 26 his intent to keep rates high to suppress inflation. Wall Street firms sounding the alarm included Bank of America Corp., UBS Group AG and Morgan Stanley, which called the loans a “canary in the credit coal mine….”

That will trigger a wave of credit-rating downgrades and push average loan prices—currently 95 cents on the dollar—below 85 cents, a level breached only during the 2008 financial crisis and the depth of the Covid-19 pandemic….

Falling loan ratings and prices will make it harder for companies to borrow to fund growth or to repay their existing debts….

The slowdown is already hurting Wall Street banks that committed to loans earlier in the year—often backing takeovers by private-equity firms—and now need to sell the debt to investors….

You may remember I said one key dynamic in all of this would be what we now read in this story:

Forecasts for the loan market’s benchmark interest rate—the London interbank offered rate, or Libor—shot up in recent months as the Fed raised rates faster than expected to combat persistent inflation.…

The percentage of loans in default will likely rise to roughly 3.25% in mid-2023 from about 1% now, but it could go significantly higher, said Jeff Darfus, a credit analyst at the bank…. A Barclays’s model predicted could cause roughly 4.5% of the loans to be in default a year from now … and the elevated default rates could last two to three years, analysts say.

The actual default damage is likely to play out in slow motion because many of these loans won’t need to be rolled over for 1-3 years, but it’s important to note that it is all starting to happen, and the pace is building:

The trend i accelerating. Around twice as many loans received credit-rating downgrades as upgrades in the past three months, the highest multiple since October 2020, according to research by Bank of America. Downgraded companies included eye-care company Bausch & Lomb Corp. and Cream of Wheat maker B&G Foods Inc.

Faster damage of another kind in bonds, however, is likely to occur in bond funds if the transformation starts driving money out of bond funds well before the bonds mature and take the hit. Markets attempt to look forward, you know.

Bloomberg pounded the alarm button in The Daily Doom stories yesterday (Tuesday), too:

No Escape From Biggest Bond Loss in Decades as Fed Keeps Hiking

Investors who might be looking for the world’s biggest bond market to rally back soon from its worst losses in decades appear doomed to disappointment….

Swaps traders are pricing in a slightly better-than-even chance that the central bank will continue lifting its benchmark rate by three-quarters of a percentage point on Sept. 21 and tighten policy until it hits about 3.8%. That suggests more downside potential for bond prices because the 10-year Treasury yield has topped out at or above the Fed’s peak rate during previous monetary-policy tightening cycles. That yield is at about 3.19% now.

Inflation and Fed hawkishness have “bitten the markets,” said Kerrie Debbs, a certified financial planner at Main Street Financial Solutions. “And inflation is not going away in a couple of months. This reality bites.”

It’s going to bite a lot harder than they think because those top rates they are expecting are based on their misguided belief that the economy is still strong because the job’s market is hot, which was, I hope, thoroughly dispelled in my last Patron Post.

The Treasury market has lost over 10% in 2022, putting it on pace for its deepest annual loss and first back-to-back yearly declines since at least the early 1970s, according to a Bloomberg index. A rebound that started in mid-June, fueled by speculation a recession would result in rate cuts next year, has largely been erased as Fed Chair Jerome Powell emphasized that he is focused squarely on pulling down inflation. Two-year Treasury yields on Thursday hit 3.55%, the highest since 2007.

See how quickly things can change when markets get the delusions smacked out of their heads by the Fed? That’s why you want to know the delusions to begin with, which means knowing the basis for knowing the market’s sugar-plum hopes are delusions in both stock markets and bond markets.

At the same time, short-term real yields — or those adjusted for expected inflation — have risen, signaling a significant tightening of financial conditions.

It’s all coming down quickly because the delusions were grand, but …

The Friday labor report showing a slowdown in payroll growth allowed markets a “sigh of relief,” according to Rieder.

… they’re still delusional because they don’t understand how or why the labor market is broken. And continuing grand delusions mean lots of big breakage to come. That’s why I say understanding the labor market and the reasons for its failing is as key for the remainder of this year and next as inflation was last year for understanding the start of this year.

“You need to remain humble about your ability to forecast data and how rates will react,” said Wilensky, whose core bond funds remain underweight Treasuries. “The worst is over as the market is doing a more reasonable job of pricing in where rates should be. But the big question is what is going on with inflation?”

The bigger question is “What’s going on with labor?” Inflation is now clear. If you understand the labor market right now, however, you understand how even the Fed is delusional. This is one bad blind spot that you’ll need to understand in order to get your bearings about what is happening.

Thus,

Credit Markets Are Way Underpricing Recession Risk, UBS Says

US corporate credit spreads were not adequately priced for Federal Reserve Chair Jerome Powell’s hawkish comments at Jackson Hole, and are significantly underpricing the risk of a recession, according to UBS Group AG strategists.

The bank is bearish on leveraged loans, in particular, and second quarter earnings results solidified that view….

Bloomberg via Yahoo!

Even bonds, which are supposed to be the wise market, are not so wise right now because everyone still believes this:

With labor markets too strong….

The crumbling of that delusion will really bring all markets tumbling down in a horrendous crash over time as the realization of the truth about labor builds:

The stock bubble, the bond bubble (along with its sub-bubble, the zombie corporation bubble), and the housing bubble are all major parts of the economy that central banks directly inflated with their profligate monetary whoring that will all deflate catastrophically when the hot air blown into their love dolls is taken away. These bubbles constitute the “Everything Bubble.”

“The Everything Bubble Bust Pt. 3: The Big Bond Blowup”

(To gain access now to that Patron Post, all you need to do is just click link above in order to read that whole Patron Post because I’ve removed the protection that makes it only accessible to Patrons. Having made it available to all Patrons as a gift, even at the $1 level months ago, I am now making it available to EVERYONE.

I am now making this description of a bond-market collapse my prediction for where the entire global bond market is going, now made public. You’ll see it’s aged quite well. (You’ll want to set aside some reading time, as there is a lot in my typically more in-depth Patron Posts.) This blowup is a supernova that takes out whatever remains of all bubbles around it. That also means the internal cascade takes a lot of time to build up before it finally blows up. Suffice it say, we see US bonds have returned to their bearish decline, meaning the biggest market in the global economy — bonds — is in deeper peril. For this year, expect to see the cracks widen and grow in number, but I don’t think we’ll see the big bust occurring in bond funds and elsewhere start to happen until next year. But, if you know what to expect in terms of where this ultimately is likely to go, the cracks will tell you what is starting to happen. As I essentially said in that original Patron Post, I expect it to play out slowly and then quickly and then cataclysmically.)

A consumer debt crisis is also starting to form in its infancy

We have already reached the level of stagflationary recession I’ve been writing about where, despite the intense recession denial by the higher-ups, the number of Americans taking out loans to buy groceries has doubled:

The “buy now, pay later” (BNPL) option that you often see on checkout screens when making an online purchase is more popular than ever before, thanks to the failing economy.

BNPL schemes from the likes of Zip, one of the biggest players in the short-term loan industry, have skyrocketed in popularity…. Zip says business is up 95 percent this year for people buying groceries, while restaurant bills are up a whopping 64 percent. Zip services major retailers such as Costco, DoorDash, Safeway and Starbucks.

You can’t do that kind of grocery buying for long before it catches up with you, and you aren’t able to buy groceries anymore. Those doing it are hoping inflation will end soon and times will get better. It won’t, and they won’t.

That doesn’t even include whatever is happening in grocery buying on credit cards, and about a third of BNPL users are already falling behind on payments, and 75% end up taking hits on their credit scores for overusing the system, if not for falling behind on payments. Providers of this kind of credit are not much better than payday loan sharks, so things get expensive quickly if you fall behind.

As with eating, so with shelter:

To make ends meet, people are turning to credit cards and loans, raiding savings, selling assets, and dipping into retirement funds…..

Americans added another $40.1 billion to their debt load in June alone…. Over the last year, credit card debt has exploded by 13%, the biggest increase in over 20 years.

Rather than being the corporate zombies I wrote about in my prognostication of the Great Collapse (or Everything Bubble Bust or the Epocalypse, whatever you want to call it), these are very ordinary human zombies — individual economic zombies who are only keeping themselves alive by the use of the credit (like the corporate zombies).

Global energy crisis

While the worst may be behind us, we may consider the high nineties for crude to be the new natural resting place when it used to be the old high. There will be times where it goes higher but probably not many spots where it goes lower. As long as the Ukraine war continues, the nineties will be the new mean low tide.

But it’s not all about the war and the price of crude. Energy companies are scoring massive increases in their profits. Clearly, they are raising prices by MORE than enough to simply offset their cost increases, or profits would not be rising. And Americans (and everyone in every country) are badly hiring because of their greed.

Nearly 20% of American are behind on their energy bills. Those, of course, are largely in hot southern states using lots of air conditioning right now at energy prices that are more scorching than the drought-based summer heat. Now, imagine what happens when the season flips, and the northern half of America turns to equally high energy consumption (or even higher) to HEAT their houses. There’s another 20% to be added from the northern-tier states when their turn comes.

It’s not hard, therefore, to forecast a massive increase in the number of people in America and all around the world who fall badly behind on their energy bills, resulting in their own individual financial crises.

Housing is at it again … as is commercial real estate

Home sellers are already dropping prices. Usually there are many months between a decline in sales and the lowering of prices as most seller would rather wait out a sale for a few months (something at one time normal) than lower the value of their prized asset. However, even Seattle, which was one of the last cities to see price drops in 2008 and which declined much less than most parts of the nation, is seeing falling home prices already.

1 in 5 home sellers are now dropping their asking price as the housing market cools….

The median listing price in August dropped to $435,000 from $449,000 in July. The average home sold for less than its list price for the first time in more than 17 months during the four-week period ended Aug. 28, according to Redfin.

Home sellers are getting nervous, as the once-hot housing market cools fast….

The supply of homes for sale is also rising fast, up nearly 27% from a year ago, even as fewer sellers decide to list.

In other words, inventories are up because houses are not selling, not because more people are listing.

Pending sales in July, which represent signed contracts on existing homes and which are the most recent sales data available, were nearly 20% lower than July 2021.

And wait until the normal post-Labor-Day slowdown starts to show up in the data.

Whether or not that turns into the kind of systemic housing calamity we saw in mortgage-backed securities and banks, it’s already shaping up like a personal crisis for renters whose rates have to rise to keep up with the cost of the buildings they are renting in as those work their way into the rental market. 3.8 million Americans believe they may be evicted from their homes as quickly as the next couple of months:

The median rent in the US eclipsed $2,000 per month in June for the first time ever. It’s another symptom of rampant inflation burning through the US economy….

On a yearly basis, shelter costs have spiked by 5.7%, according to government numbers. And the CPI drastically understates the cost of housing. Actual rents have increased more than 15% in the last 12 months, according to data compiled by Zillow.

The author of the article, Michael Maharrey, does not appear to parse out the fact that a 15% rise in advertised rental rates does not factor in the much greater number of existing rents that are still on leases with set rates. However, that has no bearing on the following number:

With rents skyrocketing, households representing 8.5 million people are behind on their rent, according to the Census Bureau. Of those, 3.8 million say they are somewhat or very likely to be evicted within the next two months.

That is due in large part to the end of rental forbearance now catching up with people who didn’t pay rent for all the months of the Covidcrisis. One more of those provisions that will eventually catch up with people.

According to Yahoo Finance, “The combination of soaring inflation, the end of most eviction moratoriums and rental assistance payments and an extremely low vacancy rate has pushed rents up — and many renters out.”

Besides owing back rent for those months of forbearance, 11% of renters have seen rate increases of $250/mo. or more. To make things worse, these renters are being squeezed in by moving walls on both sides:

The Fed’s efforts to stem inflation are adding to the pain. With mortgage rates rising, renters who were hoping to buy homes have been priced out of the market.

Eviction levels are already rising. According to Princeton University’s Eviction Lab, evictions were 52% above average in Tampa, 90% above average in Houston, and 94% above average in Minneapolis-St. Paul this month.

This is yet another sign that the economy isn’t as strong as the powers that be would like you to believe.

Despite the fact that private sector economic activity has dropped to the lowest levels since early in the COVID lockdowns, the housing market is tanking, and the economy has charted two straight [quarters] of negative GDP growth, the mainstream keeps pointing to the strong labor market. But if the labor market is so strong, why are so many people facing eviction?

I laid out a full revelation to why the labor market is nothing like it looks in my last Patron Post if you’re asking the same thing. It’s a big blind spot for the Fed — so big that, all by itself, it guarantees a crash landing for the economy as we can now ascertain that, not only is Powell attempt to land his 747 economy inverted, but he’s flying blind.

My prediction for the housing market is, as with my prediction on bonds, not likely anything cataclysmic this year, but it appears to be building into another possible crisis. So, this is a “watch” for now, more than a prediction. Do expect, though, to see the stress cracks increase as the year marches on to its close.

Plague and a pox upon us

If you think the Covidcrisis is ending, you’re overly optimistic. Covid may just be taking a breather, but our central planners at Disease Central are not resting. A story that I posted in The Daily Doom yesterday said,

The best vaccines contain a piece of the spike, or genetic data about the spike, either of which can spur an immune response. Not to be outdone, the virus has been mutating—with many of the changes occurring on that same spike.

But other parts of the virus are changing, too. Now, for the first time, a team of scientists has scrutinized these changes—and voiced a warning.

It’s possible the virus is accumulating non-spike mutations in an attempt to gain some advantage over our collective immunity…. These new mutations might not make the virus more infectious the way spike mutations do, but they could be associated with longer infections.

If this trend continues—and there’s no reason to believe it won’t….

“Yet Another Curveball in the COVID Mutation Nightmare“

Enough said on that. They go from there to pushing for more new vaccines, which the government will likely try to foist on everyone again. The vaccines can actually make things worse:

As the spike evolves, the virus gets better and better at grabbing onto our cells despite the presence of antibodies. That’s one reason why the vaccines have been getting somewhat less effective, and we’re seeing more and more breakthrough cases in vaccinated people. And it should come as no surprise that one of the leading contenders for the next dominant subvariant … features a particularly worrying mutation on the spike called R346T….. Non-spike mutations are becoming a bigger factor, too.

With these very narrow-approach vaccines, it is almost like we are training the virus how to improve itself because our immune systems learn from the vaccine only how to attack one very limited part of the virus, making it easier for the viruses to find a workaround.

Currently the dominant subvariant, doesn’t just have mutations along its spike—it features changes all across its structure.

Nice.

Of course, to figure out what is going on and how to make new vaccines against the new permutations, mad scientists — doing more of the kind of thing Wuhan did —

cloned SARS-CoV-2 then started deleting the spike proteins and testing the resulting “deletion viruses” on mice, assessing how contagious the viruses were and how severe the infections were.

Great. More experimentation on making the virus worse in order to test what will happen as we perhaps create what will happen next.

At least, the new forms of disease will come from cute little mice getting loose this time, not hideous flying rats (bats).

The spike mutations make the virus steadily more contagious. “Mutations in [the] spike have been identified in every major variant that then out-competes the previous variant,” Frieman explained.

Meanwhile, the non-spike mutations appear to prolong infection. This in turn gives the pathogen more time to mutate inside a particular person, and also spread to other people….

Frieman said his goal is to scrutinize these non-spike mutations in order to “figure out what they do, how they do it [and] why they make the virus better at being a virus.” “Then we can use that information to make drugs,” including new antiviral therapies and vaccine formulations.

Beautiful!

Humans creating their own apocalypse. As we continue down that path, I expect worse forms of the virus to form and more vaccine pressures to occur. When, I don’t know. It may depend on when it breaks out of a lab … again. Or it may just emerge everywhere as it learns its own mutations under the half-cloak of vaccines that create incomplete immune responses in people, making those people repositories for the virus to reform itself.

That’s always how I figured judgement (even if its God’s judgment) would play out upon the earth — normal human foolishness and sometimes all-out greed or human evil burning itself out. Evil contains the seeds of its own destruction. It creates its own conflagration … in hell and on earth.

Alas, so quickly are we helping the virus in its permutations that …

our pharmaceutical research-and-development processes might be too slow.

Now we’re going to need Operation Super-duper Warp Speed.

I also expect we’ll find more problems as side effects from all these new-tech vaccines being pushed on people than we do from the viruses. Covid, monkeypox and quarantines here and there around the world will continue to be with us, perhaps even, again, due to the experimentation done to test vaccine approaches against new man-made plagues because we learned nothing due the past two-plus years of denial.

Vaccine complications will continue to become more apparent this hear and next in the data to the extent we can pry it out of the government’s hands, and China will continue to self-destruct for awhile longer under its Zero-Covid policy of entire city lockdowns, which are so extreme that people are forced to remain locked inside their buildings even during large earthquakes as another story in The Daily Doom reported yesterday. (See: “Outcry as Chinese lockdown traps residents during earthquake“)

Eventually some large building fire in which everyone is locked in and gets roasted will put an end to this extreme Chinese austerity, or they’ll see a peasant revolt. Horrible, but it is where locking people inside of a building from the outside to force lockdowns is likely to eventually wind up. I mean, look how the guards responded even in an earthquake out of fear of going against the government.

Meanwhile, China’s continued deconstruction of its economy through lockdowns and its housing crisis will deepen the global recession into all-out depression before we are done with it, since China is the center of so very many supply chains that will take a couple of years to rebuild in other places. Expect to see all of this continue build through the remainder of the year.

Social unrest

You cannot continue to crush people forever with the kinds of austere measures we’ve seen in times that are worsened greatly by governmental and banking decisions that have been made all along the way and not wind up without great social unrest and violence.

There is already a move in the UK to go on an energy strike and refuse to pay bills entirely if rates are allowed to rise higher in October. Social unrest already showed up in Czech Republic over high energy costs. As energy corporations seek to price gouge and profiteer as described above, exploiting the times to pocket bigger profits and not merely cover their actual increases in costs, then expect a great deal more unrest.

No wonder these rich people are investing heavily in plans to get out of the country if necessary as reported in another article in Tuesday’s Daily Doom: “Rich Dems Worried About Trump Are Buying Second Citizenships.” They may be worried about more than Trump. Some of them, who are profiteering, are likely worried about the pitch-forks of the torch-bearing masses that will be coming their way in the great conflagration of greed.

You combine impoverishing greed with record levels of profiteering, and you have a sure formula for social unrest. Without a doubt, we’ll see a lot more unrest with a higher pitch of violence around the world in the winter as these pressure build.

The rich better run. Well, those particular ones. Fortunately for them, they are among the few who can still afford to fuel their flight to safety (in their private jets to their underground bunker mansions … as described in yet another article in Tuesday’s Daily Doom (See: “Super-rich ‘preppers’ planning for apocalypse….”) You see, I haven’t been kidding about not wanting to miss the focused news in this new offspring of The Great Recession Blog. It really does collect the stories that become the basis for my own writing, and you might as well be first to read them, as it takes me a couple of days to write about them.)

Enflamed politics

For those same reasons, I think it is likely we’re going to see that social unrest break out in an ugly election year in the US. (But I think everyone is anticipating that.)

To give you some idea of how bad this election year is likely to become, here are three more articles I listed Tuesday in The Daily Doom: (And, no, I am really not listing the articles just to push that new publication. This is why I created it in the first place — to gather the most significant news about the collapse.)

“A hyperpolarized, deeply fragile 2022 election: Democrats’ energy over Roe blunts GOP advantage“

“Video: MSNBC Declares ALL Republicans “EVIL” And A “Threat To Democray”; Pundit Says ‘We Are At War‘”

Tracking these kinds of stories is how I figure out what the trends are and whether they are intensifying in a way that looks like they’ll break out worse in the future.

It is looking highly likely that this will be, not just a supercharged election year in the US, but a violent election year. That, after all, was just in one day’s news, and the trend seems to be building stronger. I’ll have to track it more to become clear on whether it is likely to become violent; but so far, it seems likely this year could result in more of the strains the Pentagon already fears:

“Past Pentagon leaders warn of strains on civilian-military relations“

But I’m not just talking in the US. The news is filled with this kind of tension and outbreaks of civil unrest all around the world that are rapidly increasing in number and intensifying.

So, I am certain we are in for the winter of our global discontent.

Black swans can’t be scarce in times like these

When you are going through times with so much pressure built up all around the world, you are likely to experience more than the usual number of black-swan events, by which people mean those dark events that seem to swoop down out of nowhere. You cannot know what they will be, or they wouldn’t be “black swans;” but you can know that a badly fractured environment creates a lot more likelihood such things will happen. So, it’s like meteorologists predicting more hurricanes when the major weather systems appear set up for it.

Things fractured and crumbling unbeknownst to everyone suddenly give way in catastrophic structural failure somewhere that “nobody saw coming,” except there is always someone or some group who can see it coming (the people who are in the center of it and trying their best in many cases to hide what is about to break because of their own responsibility or likely losses).

Without being able to know what they will be, it is a fairly safe bet in this environment that we are going to see some Laymen moments come up out of all of this as major corporations crack under the weight of all that is happening and that starts to cascade through the economy in many of the areas above.

With that, I think I’ve shared with all enough free predictions to give a clear sense of where this is going, so I’ll save the rest for my final Patron Post in this series. Those categories yet to be covered are likely to be….

- War and sanctions

- Shortages

- Food shortages and famines

- Dollar v Russia & Chinese competition for reserve currency

- Heat waves, widespread, droughts, brownouts, blackouts, and burnouts

- Globalism’s great schism

An update on my last article about the key revelation for the year ahead

As a further update, my last Patron Post, which included no predictions, laid out how badly skewed and misleading unemployment numbers were and why they are so far from being what the Fed believes. I’ll now add to what was said there to report that John Williams of shadowstats.com says that, if honest numbers were used, the actual rate of unemployment would be over 24 percent.

For those who know wahere I went with the unemployment/jobs situation and the Fed’s view, that real figure, if Williams is right (or even a figure half that great), gives you sense of just how dangerously the Fed is flying blind.

Furthermore, about half of US companies already say they will be laying off workers in the next year. (See: “The Layoff Tsunami Has Begun.”)

So, the hairline fractures in the jobs market are showing up and will become widening gaps and much greater in number with increasing speed. The cost of this miscalculation by the Fed will be great.

Liked it? Take a second to support David Haggith on Patreon!