You would think the Fed wanted housing to become as overpriced as possible, having supported the market with $2.575 trillion in purchases of mortgaged back securities on its balance sheet to keep those securities flowing through with very low yields. That translated downward, of course, to very low mortgage rates, which the Fed sustained throughout the post-Covid years when housing prices were skyrocketing at their fastest rate to toward their highest prices ever, making housing unaffordable for just about everyone.

You would think they wanted to create and pop a housing bubble, having kept that acceleration up all the way to the second they pulled the plug on the market with interest hikes. Why else would you accelerate and accelerate without need and then slam on the brakes and aim for the curb unless you wanted to send someone’s head through the windshield?

It makes one think there are reasons behind the scene, since accelerating an inflamed housing market up to the moment of its intentional crash doesn’t make sense on the surface of things. Were there nameless hedge funds to save? Who was the Fed helping, or are their heads simply so full of tarantulas that, from a monetary or an economic standpoint, that this acceleration into a hard stop made sense to them?

Busting Banks 101

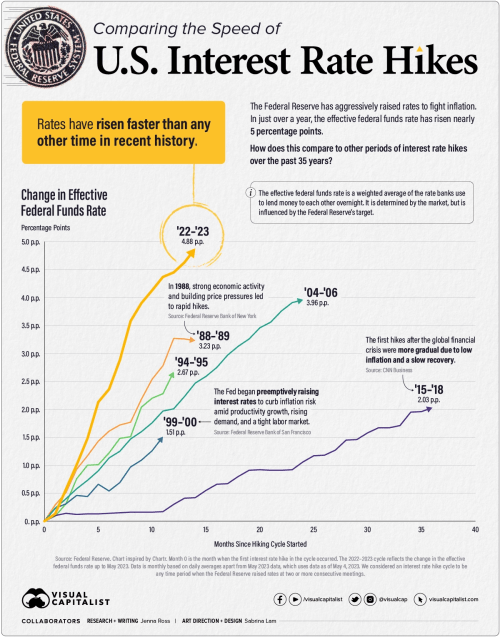

You’d also think the Fed wanted to bust some smaller banks. It could have done its required oversight and made sure that bank reserves were adequate by simply seeing how much of each banks reserves were tied up in Treasuries that the Fed knew it was about to crash with a long roll off of Treasuries from its the aforesaid balance sheet and a long period of the steepest interest-rate increases in history. It could have insisted several month before it started tighten the banks ready their reserves for what was coming. That would have been easy. I mean before they began this path:

When you know you are going to climb that yellow mountain, which the Fed began forecasting before each rate hike, then you do something to get all your little chicks in a row … unless you really don’t care about them.

You’d also think the Fed wanted to bust small banks when it deprived the little guys that are not “systemic” from infinite deposit insurance while assuring everyone listening that the biggest guys would be fully covered without limit because anyone who had not be recently lobotomized would have to know that such a proclamation would cause even more deposits to flee smaller banks in order to head for that free extra security. You had to know, so that must have been what the Fed wanted. Right?

That must be so that big banks like JPM can eat the little ones up for a cheap lunch because that is who they keep selling the little busted guys to — the banks that were already to fat to pop without blowing up the world.

It’s good to have friends with money presses

But, hey, at least the Fed has friends who have long been buying up a lot of America to keep the US stock market floating, such as the Swiss National Bank:

Yes, they own a lot of everything. Let us consider how they get the money for that: They create Swiss francs from the thin alpine air where the Swiss money grows. Then they buy Euros and translate them into Dollars. So far nobody’s raised a sweat. All this is done with a tab of a computer key. And then the SNB calls its friendly broker – I guess UBS – and buys the ears off of the US stock exchange. All of it with money that didn’t exist. That too, is something a little bit new.

It’s nice to have friends who have money … and a money printer so they can just buy up stocks to lift a friend’s market whenever they want and never worry about whether they lose it all because they can … (drum roll) just print more money. It’s been going on for years.

From A Havenstein Moment.

From A Havenstein Moment.

Always serving the too-big-to fail and crushing the little guy

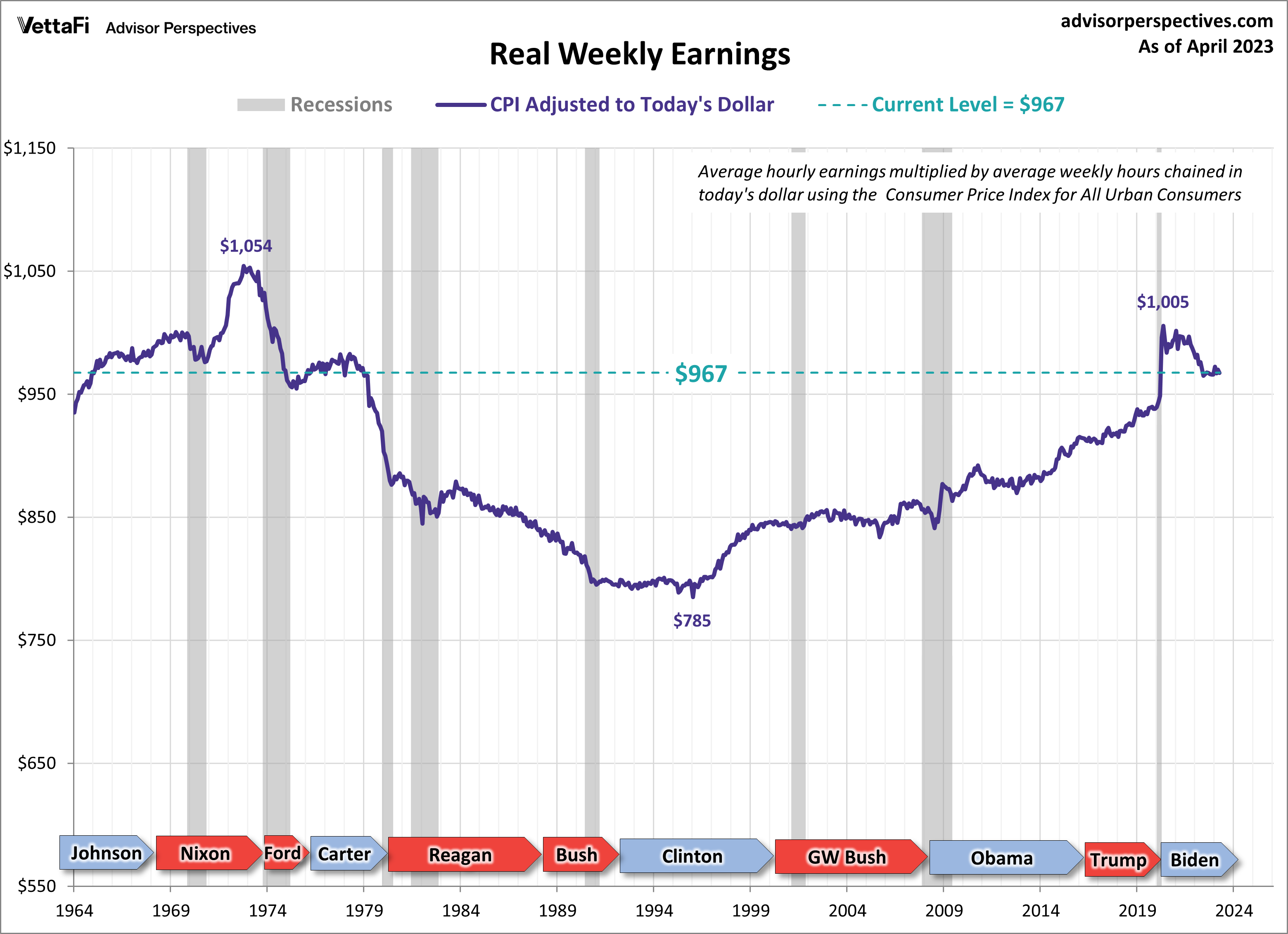

Remember the friendly Fed from back in Gramma Yellen’s day when she routinely told us that the Fed wanted to get wages up for the average person so that the economy was more equitable and that the Fed could not understand why their economic stimulus was only raising the incomes of the wealthy? It was such a mystery as to what giving all the trillions you printed with your money press to big banks would only make the wealthy wealthier.

I do recall her lip service to that concern, but I cannot say that I ever paid any attention to it. Now, when inflation is here, they sure seem bent on taking inflation down to keep the wage price spiral from making things worse. They seem to be good at making sure the little guy fells the hit the hardest as they almost appear aim for job losses, though they claim that is not their objective.

We actually did see a slow gain in inflation-adjusted wages over past decades, which eventually got us back to where we were in the Nixon days before the Fed was given more power over the economy with the abandonment of the gold standard:

Fortunately, they are getting that back under control, and just in time since earnings have been down this past quarter for stockholders. So, that’s a plus … if you’re a stockholder … to know wage costs will come down so you can maintain your margins. It’s nice to have friends with a money printer.

Replaying bubble history

You would think the Fed would have known that years and years of near-zero interest would lure investors into loans for cheap money to invest that would be impossible to keep paying when funded by bonds or other methods that have to be rolled over now at more than five times the origination cost. Notice, I said, “YOU would think,” not the Fed. That major change in interest is compounded, of course, by falling rents:

The commercial real estate bubble is going to be serious when it bursts, and it is already collapsing. Office space is not in great demand with the result that many office buildings are half empty. When the time comes for renewing loans for financing projects, there are going to be multiple bankruptcies. This sector of the economy is going to suffer. Investors should try to get out of commercial real estate funds while the getting is still good.

You would think the Fed might have seen that as a potential commercial real-estate (and therefore future banking) catastrophe. It almost seems they don’t see it still! Since the rest of us can see it coming, a major real-estate crash must be part of the plan, but for some reason the Fed doesn’t want to let us know it’s coming, even though it is inevitable with lower rents, fewer tenants and higher refi rates. It’s just math. I guess the Fed just doesn’t see it.

Oddly, this is awfully similar to the real-estate crash they appeared to have engineered back in 2008, which they also didn’t see, only focusing more on commercial real estate this time. I guess that is just part of the rinse-and-repeat plan with a twist, as I wrote about in Downtime, a book about the present collapse that was simple to write because I just copied what I wrote about the last collapse!

Either the Fed is a slower learner than the rest of us, having learned nothing since 2008 and seeing none of the sureties in this collapse that the rest of us can see, or breaking things badly is just part of the plan. Maybe their heads are full of butterflies … or vampire bats from hell. Hard to say. If I were to give them the benefit of every doubt and be more than generous in spirit, I’d say they are just terribly dumb! But many would say that is being far too kind. I certainly won’t waste time arguing on the Fed’s behalf!

See: “They can’t be this stupid.”

Apparently they can. They have a knack.

And, if they didn’t want bubbles, they wouldn’t blow them.

Still free to criticize until tomorrow

OK, but, at least, we can complain about it, free from concerns of censorship now that Elon Musk owns Twitter and has made the World Economic Forum’s Chair of the “Taskforce on the Future of Work” Twitter’s new CEO. Right? She was also on the WEF’s steering committee for “Media, Entertainment and Culture,” a group that sought solutions to stop the spreading of misinformation online.

The key to failing and winning is to fail big

Always remember, the key to assured success is that you simply need to become too big to fail … and have a friend with a money printer. If either the Dems or the Repubs wanted to actually regulate banking back in the days of Dodd-Frank, they would have simply put Glass-Steagall back in place, saving themselves a lot of time with a tried-and-true regulation, and they would have broken up the nation’s largest banks like they did Ma Bell; but solving the problem of too big to fail that they keep grumbling about as if they cared and of corrupt banks was clearly never really the agenda was it? If it were, they wouldn’t keep making the biggest ones bigger.

But, hey, if we didn’t keep the major bank CEOs in place as billionaires, how would our credit cards keep working when we need them just to pay the light bill due to Fedflation?

Now, getting back to those MBS and that Fed balance sheet that is full of them and that helped create all this inflation, in the end, Fedonomics is just math and can be graphed like this:

Is balance sheet reduction the Fed’s Gordian knot?

Is balance sheet reduction the Fed’s Gordian knot?

Sure, this book may just be a rerun, but so is the future:

If you value this writing, please take a second to support David Haggith on Patreon!