The committee that normally stands behind J. Powell rushed to clear all the bodies off of Main Street by sending out three of their Fedheads to undermine everything Powell said when an attack of internal head lice caused him to go mad this week. This they did after Marshal Powell slaughtered all their allies. (See "Marshal Powell Shot All the Bond Vigilantes Dead!” for part one of this Old-West tale of incompetence and mischief if you missed the first half of this story.)

The first to speak was the Fed’s John Williams, who was quick to say that Powell was a liar. Well, of course, he didn’t put it that way or he’d be shot, too; he just talked about the things that Powell had indicated the Fed would do and said there is almost no chance that will ever happen.

Williams is one of the big Fedhead cheeses. He governs the Fed’s most significant local branch, known commonly as the “New York Fed.” Contrary to Powell and contrary to what the FOMC, which sets Fed monetary policy, showed in their internal assessment (called the “Fed’s dot plot”) about where interest rates would be set next year, Williams said rate cuts are not even a topic of discussion at the moment for the central bank. Apparently, the voting members of the FOMC were just daydreaming at the whiskey bar when they filled out their opinion cards of where interest rates would go in ’24.

Williams actually used the language Powell had used to unleash the bond vigilantes in the first place when Powell said there was not even a chance the Fed would be thinking about cutting interest rates in 2024. After Powell’s subsequent proclamation of likely rate cuts out of the blue this week, Williams said,

We aren’t really talking about rate cuts right now. We’re very focused on the question in front of us, which as chair Powell said… is, have we gotten monetary policy to sufficiently restrictive stance in order to ensure the inflation comes back down to 2%? That’s the question in front of us.

Apparently, the Fed is practicing opposite-speak where they attempt wean stock investors away from listing to everything the Fed says as the basis for their investing and teach them to start to think for themselves by telling them two completely opposing narratives and then making them decide for themselves where real policy will fall between those poles.

As a result, some of the steam did come out of market’s face-ripping, record-setting rally, closing almost flat for the day on Friday, but still at record highs all the same, thanks to vigilante assassin Powell, the mad Marshall who deputized major bond investors to do the Fed’s dirty work and then killed them all before they finished the job when he thought in his lousy delirium he was done needing them.

According to Williams, the real discussion at that FOMC meeting was about are we tight enough yet or do we need to do more, not about how soon should we start cutting interest rates. He explained it this way:

One thing we’ve learned even over the past year is that the data can move and in surprising ways, we need to be ready to move to tighten the policy further, if the progress of inflation were to stall or reverse…. We just got to make sure that … inflation is coming back to 2% on a sustained basis.

Powell had just set off on a different mission to make sure things loosen up with his mere speech, even before the Fed takes action, as who could not have predicted the effect of his speech?

The stock market will have to find a way to brush all of the counter-talk off as the committee members rein in Marshal Powell’s words in order to keep the shine on its rosy new rally. To make it harder to brush off their counter-talk, the Fed committee members trotted out another talking head to try to save some of the tightness that the Fed had accomplished over many months and that Powell said a month ago would now do the Fed’s work without the Fed needing to tighten more.

So, the Fed’s Bostic walked through the saloon’s revolving door and tamped down the enthusiasm Powell had lit on fire with his pivot breakdown, which indicated four rate cuts in 2024, as follows:

“I’m not really feeling that this is an imminent thing,” Bostic was quoted by Reuters as saying.

“Policymakers still need ‘several months’ to see enough data and gain confidence that inflation will continue to fall.”

The third Fedhead sounded more timid, as if Powell might have been drawing a beed on him from the bar window as he spoke in order to keep him in line:

“We should be prepared to raise rates if we stop getting good news and it looks like we're not on path to get down to" the Fed's target, Goolsbee said.

"But also if we see inflation going down more than we expected, we should be prepared to recognize whether that level of restrictiveness that we're at now, which is clearly restrictive, whether that's appropriate and whether we should loosen" policy.

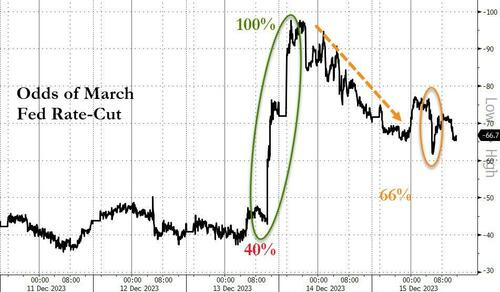

The threesome did take some of the heat out of the irrational stock market’s flaming jamboree, knocking anticipated rate cuts down by a third:

They also took gold’s post-Powell rally down about 40% and sent the dollar back up. They even decapitated a massive short squeeze that was amplifying the climb in stocks. Clearly, the market was, again, overly anxious to accept the pivot narrative, especially when it was dripped from the Fed chair’s own lips.

Another one of Powell’s accomplishments coming out of the FOMC meeting was to drive that reverse repo facility to its largest drawdown over three days since the banking crisis last spring. That means the banks started rushing for some cash. That’s got to be a good thing, right? It means banks are moving cash they had parked for interest with the Fed to get it off of their own reserve balances during QE, now back into their own reserves, ready for deployment.

It is interesting to watch Powell reel around in brain fever, massacring much of the tightness that Fed had carefully created in financial markets then see Team Fed swing into frantic action to counter their lost leader and try to get the tightness back in place … all in three day’s time! It must be like first learning of your father’s Alzheimer’s at the board meeting of your family company where he is CEO as he sets the place on fire.

Now we have to worry about how Papa Powell might misfire next.