- US democrats and republicans continue their exuberant battle over who is the best steward of the nation’s fiat money system. Interestingly, a key question may be:

- Is this really a battle worth fighting?

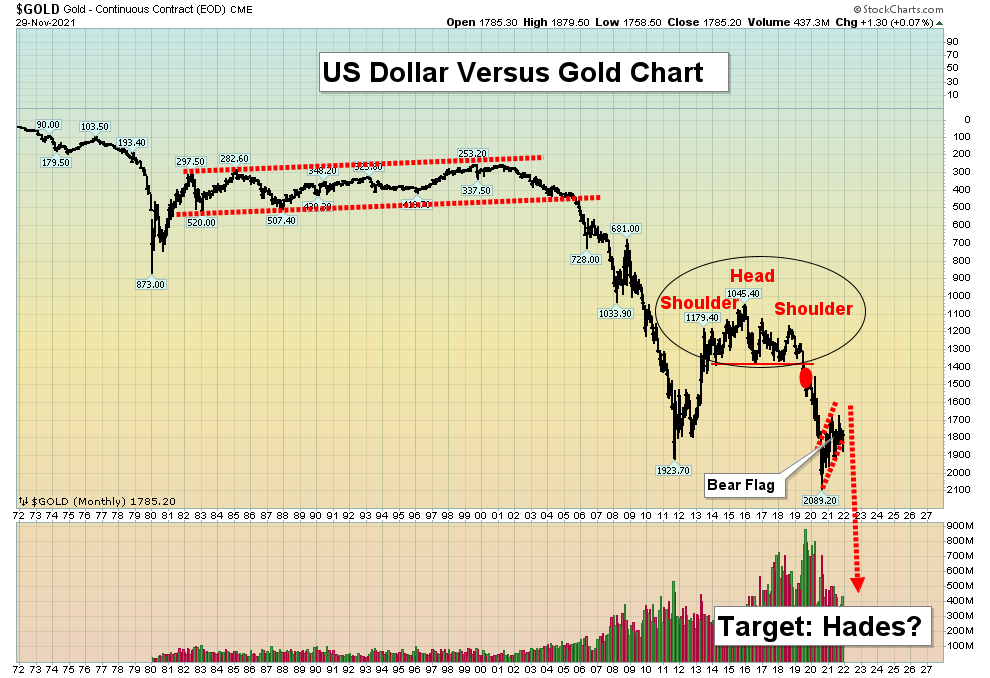

- Click to enlarge this horrifying US dollar versus gold chart.

- I’ll dare to suggest it’s time to for fiat enthusiasts to admit failure, embrace the gold money cake, and consider icing it with a small amount of crypto!

- Most governments have no savings, so a modest crisis like the financial crisis in 2008 or Corona in 2020 sees them attack citizen freedom with vicious FATCA goon squads and barbaric lockdowns.

- Horrifically, while this happens the central banks print trillions of dollars of handout money for the elite.

- What happens to a nation silly enough to live this kind of fiat-obsessed life and… what happens if there is a much bigger crisis?

- To view the likely and highly disturbing scenario, please click here now. Double-click to enlarge this stock market roadmap chart. I’ve talked about a potential 2021-2025 war cycle, and it could be dire.

- Looking at US history, the depression of the 1930’s was ended with the war cycle years of 1941-1945, which of course was World War Two.

- A stock and economic meltdown now could be “fixed” in a similar way. World War Two was the last war where the American government had any real success at all, but the nation was a gargantuan creditor at the time.

- Going into this war cycle as the world’s largest debtor is a situation best viewed as a harbinger of horror.

- Gold is clearly the asset of sanity in these disturbing times. Please click here now. Double-click to enlarge. Since issuing a sell-signal at round number $2000 in the summer of 2020, I’ve issued three significant buy alerts, with a focus on the miners.

- The November 2020, March 2021, and September 2021 buy alerts were all followed by powerful rallies in the mining stocks, but… what’s next for investors?

- The next major buy alert is going to come on a breakout above $2089 or a dip to $1566.

- Given that Chinese New Year approaches as India may launch a “price maker” bullion exchange, the odds favour the upside breakout, but either situation should be a big winner for mining stock investors.

- If gold trades at $1566-$1450, the ensuing rally is likely to produce “across the board gains” of 50%-100% for the miners in just a couple of months. If gold breaks out above $2089, the gains are likely to be even bigger, in the 100%-300% range, also in just a few months.

- Please click here now. Double-click to enlarge. In an inflationary environment, the South African miners have a history of leading, and that’s the case now.

- Stocks like Anglo, Goldfields, and Harmony are showcasing significant base patterns (and breakouts that are holding). This is a positive and largely unnoticed signpost for the entire gold and silver sector.

- Please click here now. I think the fiat enthusiasts of the world are going to learn that their money is a lot more transitory than the inflation they think they can get rid of with a couple of rate hikes.

- What about silver? I like silver here, especially the miners. On that note, please click here now. Double-click to enlarge this SIL daily chart. There’s a fabulous rounding bottom pattern in play and a January breakout to the upside looks like the most likely outcome.

- US elections in 2022 are likely to see the civil war cycle come to life in a bigger way. It could become physical war, especially if my stock market roadmap plays out as I’ve indicated.

- Please click here now. Double-click to enlarge this “Go big with gold!” chart. For 2022, a rally to the neckline looks to be the play.

- The year 2023 looks even better for gold, with America devolving into a state of “civil fiat war”, the stock market tumbling but the Fed hiking anyway as inflation surges, and gold on track for a beeline run to $3000.

- This will be happening while Asian jewellery markets recover magnificently, and money managers of the world engage in power buying of the mightiest miners!

Thanks!

Cheers

St