Saluti dalla Toscana! As indicated a week ago, our missive this time ’round is a brief read, but to the point; (our usual month-end graphics content shall instead be to-date in a week’s time).

Gold settled the abbreviated trading week Friday at 2674, -128 points below its All-Time High of 2802 (30 October). But price’s points volatility is well above normal: the average high-low weekly trading range across these past four is 132 points, such like average not seen since that ending 09 April 2020 as COVID unsettled the investing world.

Regardless of Gold’s recent careening about, the current weekly parabolic Short trend just completed its third week. And should price in this ensuing week not eclipse up through 2791 (i.e. +117 points above present price), such Short trend shall have completed a fourth consecutive week for the first time since that ending 25 August 2023. Here are Gold’s weekly bars and parabolic trends from a year ago-to-date:

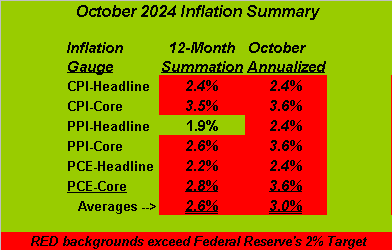

Also as anticipated in our prior missive, the Core Personal Consumption Expenditures Price Index would be this past week’s key metric. Such “Fed-favoured” inflation gauge registered for October at +0.3%, which annualized of course is +3.6%, thus exceeding the Federal Reserve’s preference for a +2.0% pace. And per our table for October’s inflation measures, the Core PCE’s actual 12-month summation of +2.8% too remains Fed-excessive, as does every cell in the graphic, save for the headline Producer Price Index:

Generally, Gold responds positively to Fed benevolence. And come the Open Market Committee’s next Policy Statement on 18 December, whilst ’tis not set in stone for a FedFunds rate cut, the conventional wisdom “assumption” shall look to another -25bp reduction. For after all, Fed policy tends — indeed is “expected” — to trend. And a Fed cut ought redound well for Gold, perhaps reversing the weekly parabolic trend from Short back to Long and further to a new All-Time High just in time for Christmas.

Further, the Economic Barometer remains rather steady through recent months. Were it instead to be rising, it might give pause for the Fed to — well — pause. Moreover, 33 metrics still are due for the Baro prior to the next Fed meeting in two-and-a-half weeks’ time. Alors, on verra. Here’s the Baro:

Thus in brief this week for Gold, our bottom line is to remain wary of price — at least technically — sporting some degree of confusion given the aforenoted volatility. To be sure, the weekly parabolic trend is Short, and by Gold’s page at the website, the 21-day linear regression trend is negative; however both Gold’s “BEGOS Market Value” and Market Magnet appear at present non-committal as to near-term direction. Yet to better one’s analytical perspective, by our Market Rhythms page, there are presently 11 for Gold which qualify to make that list, (as updated daily).

‘Course — fundamentally — priced today at 2674 versus the opening Scoreboard’s debasement valuation of 3778 reminds us that broadly: Gold is still ever so cheap!

Ciao!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro