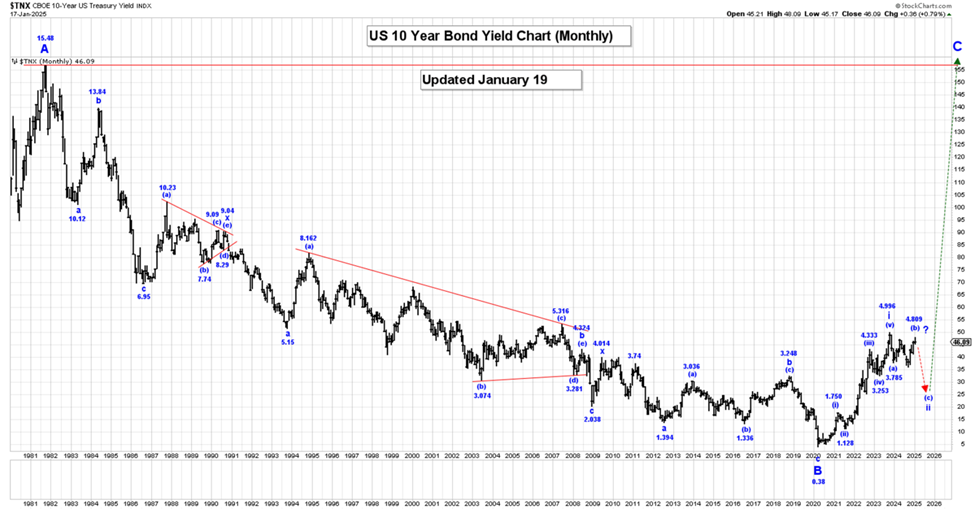

US Rates Update

The US 10-year Bond Yield has completed wave i at the 5.021% high and we are correcting that 5-wave impulsive sequence within wave ii, which has the following retracement levels:

50% = 2.698%.

61.8% = 2.155%.

We are working on the assumption that wave ii has become a flat-type correction, as shown on our chart above.

On our Long-Term Monthly Chart all of wave A ended at the 15.83 high in 1981 and since that high was made, we have fallen in a triple 3 wave correction within wave B that ended at the 0.38% level.

We have now started to rally higher in a multi-year wave C rally that will eventually see rates reach at least the 15.83% high again!

Trading Recommendation: Go short, risking to 5.50%.

Active Positions: Short risking to 5.50%!

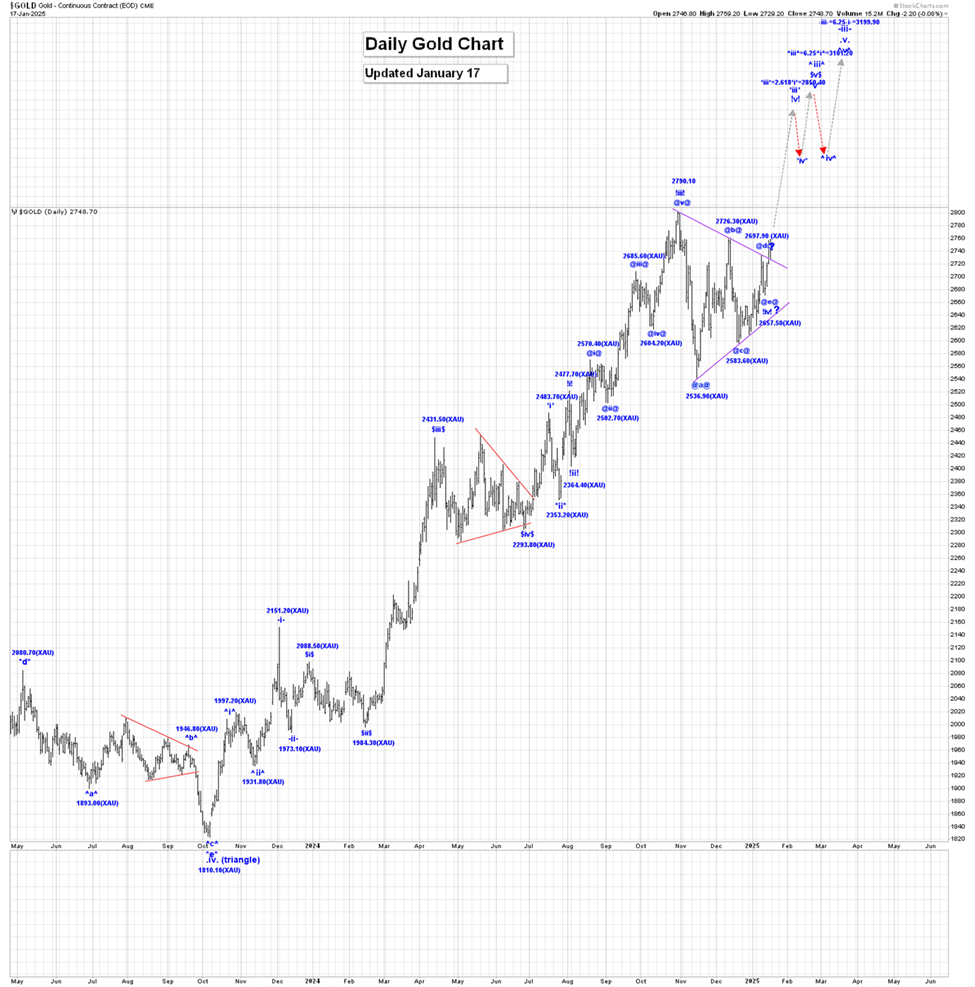

Gold Market Update

We continue to rally in wave .v. of -iii-. Within wave .v., we completed wave ^i^ of *i* at the 1997.20 high and all of wave ^ii^ at the 1931.80. We continue to rally in wave ^iii^, which has a projected endpoint of:

^iii^ = 6.25^i^ = 3101.20!

We are now moving lower in wave $iv$ which appears to have become a bullish triangle, although it may now be complete at the 2656.70 low.

If that is the case, then we are starting to thrust sharply higher in wave $v$. The other option is that this wave $iv$ bullish triangle is going to expand and extend, before it ends.

Our current projected endpoint for the end of wave -iii- is:

-iii- = 6.25-i- = 3199.90!

Trading Recommendation: Go long gold. Use puts as stops.

Active Positions: Long gold, with puts as our stops!

Thank-you!

Captain Ewave & Crew