Gold cracked $2,000 an ounce on Monday for the first time in a year, as metal traders reacted to Sunday’s news that a deal was reached for UBS to buy Credit Suisse.

10-year spot gold price. Source: goldprice.org

10-year spot gold price. Source: goldprice.org

But the USD$17 billion agreement failed to erase fears of a global banking crisis, with the precious metal rising as much as 1% despite regulators worldwide rushing to shore up market confidence over the weekend. The ongoing banking woes are also spurring bets that central banks may embark on a slower pace of monetary tightening (Bloomberg, March 20, 2023), which would be good for gold.

The Federal Open Market Committee of the US Federal Reserve meets this Tuesday and Wednesday to decide whether to continue raising short-term interest rates, lower them or leave them unchanged. The markets are pricing in another 0.25% increase.

Why isn’t gold higher?

Officials have raised rates at each of their last eight policy meetings spanning 12 months, as they try to lower inflation to their 2% target. However, the bank collapses and resulting market turbulence have added a complicating factor for the Fed as it debates its next move on inflation. (Wall Street Journal, March 15, 2023)

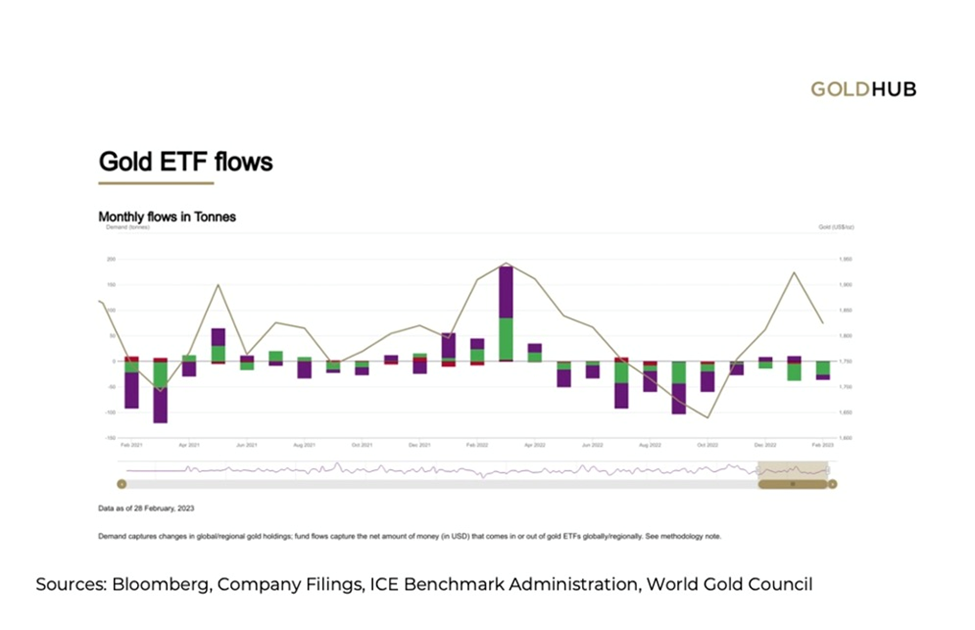

As for gold, it would be considerably higher if it wasn’t for ETF investors dumping the yellow metal.

A stronger dollar and rising bond yields (remember, gold pays neither a dividend not a yield, making the opportunity cost of holding gold higher during periods of high interest rates) led to a 5% decline in the gold price in February.

Last month, many investors of gold-backed ETFs decided to liquidate. According to the World Gold Council, gold ETFs lost $1.7 billion in February, marking a 10-month losing streak, the longest since January 2014.

Gold ETF assets under management (AUM) declined by 1% to $200 billion, WGC data showed. In tonnage terms, February’s decline saw global ETF holdings fall by 34 tonnes to 3,412t.

European funds drove outflows as the region’s central banks continued to deliver outsized rate hikes, while North American gold ETFs lost just over half a billion dollars, the first monthly outflow in 2023 after two consecutive months of inflows, the WGS said.

However as we observed in a previous article, the gold price continues to stay lofty, despite a high US dollar and elevated government bond yields. The dollar and gold normally move in opposite directions.

The answer, I believe, boils down to the demand for commodities being kept strong by governments, who are fueling inflation through hundreds of billions, in some cases trillions, of new spending, even as central banks tackle rising prices by hiking interest rates. The two are working at cross-purposes, and the loser is the consumer, being forced to pay both higher prices, and higher interest on loans/ mortgages.

The link between commodities and inflation

US consumers are getting crushed by high-interest debt and inflation

There are two factors at play. The first, and easiest to explain, is why gold isn’t doing better during this period of high inflation. The economy is inflating at the same time as central bank banks are raising interest rates. Gold’s price appreciation is therefore limited by higher rates and bond yields. Why invest in gold, with offers neither interest nor a dividend, when you can get a decent return on a government bond, or just by stuffing a bunch of cash into a savings account that nowadays pays around 3%?

The second factor is a bit more complicated. Why is gold trading at $1,977, when a proxy for the buck, DXY, is at 103? In fact DXY has been over 100 since April 10, 2022, as the chart below shows.

Source: MarketWatch

Source: MarketWatch

Central bank buying

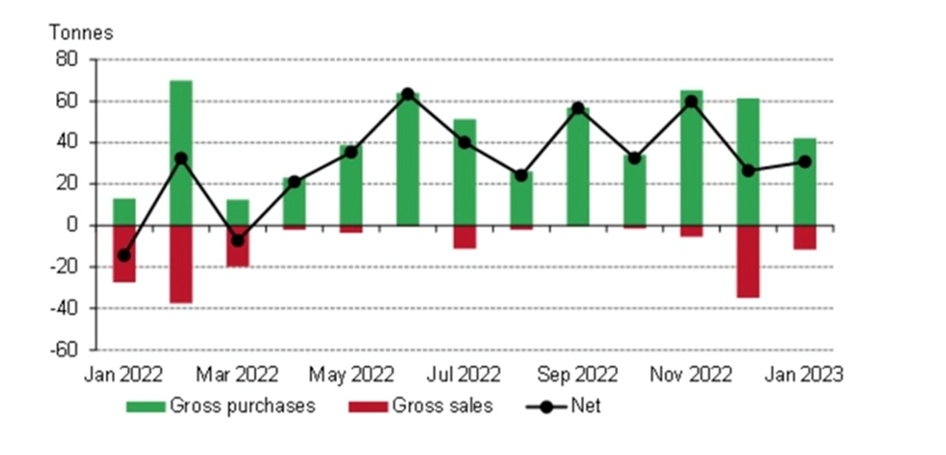

Central bank buying is one reason why gold has held its own over the past few months.

Central bank gold demand has reportedly seen a continuation from 2022’s record year of purchases, with CBs adding 31 tonnes to global gold reserves in January, the World Council said earlier this month.

Source: World Gold Council

Source: World Gold Council

The largest buyer was the Central Bank of Turkey, followed by the People’s Bank of China and Kazakhstan’s national bank.

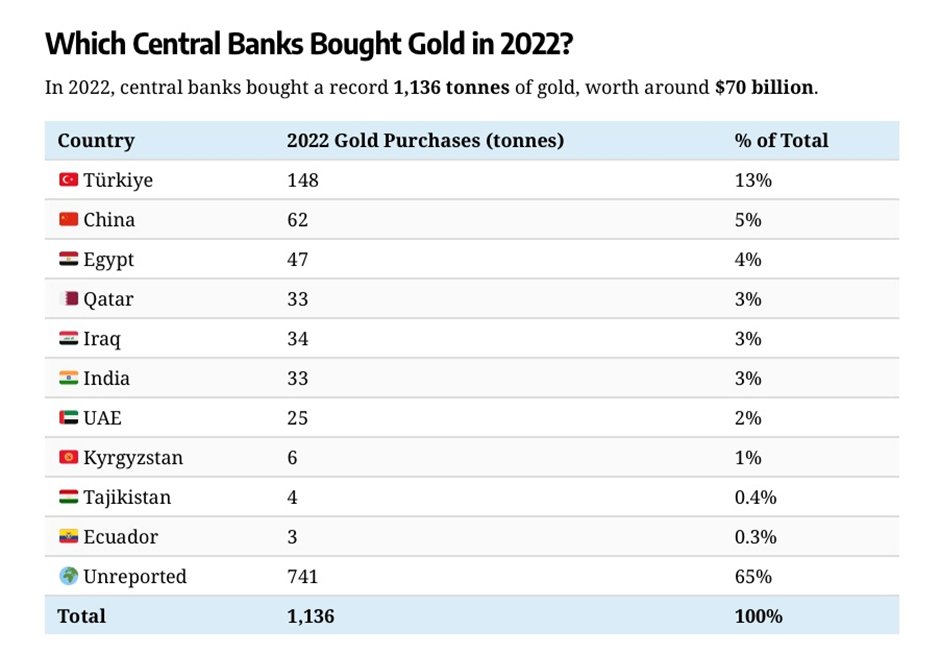

Source: Visual Capitalist

Source: Visual Capitalist

January’s central bank gold haul was 16% higher than December. The WGC sees the trend continuing throughout this year.

“We see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023,” the report said. “The healthy January data we have so far gives us little reason, at this time at least, to deviate from this outlook.”

Last year, central banks purchased 1,136 tonnes — the most on record and a more than 150% increase from 2021. (Kitco News, March 2, 2023)

Nearly one-fifth of all the gold ever mined is held by central banks.

The gold price and gold miners

So gold is doing relatively well, in this strange macro environment of a high dollar, high interest rates, and high inflation — although it could be doing better. We now understand why it isn’t: massive ETF selling, and gold’s limited appeal versus high interest-bearing financial instruments such as government bonds.

In fact there may be another reason, and it’s related to a question that has been on my mind lately: Why aren’t gold stocks rising with the gold price, as they normally do? I’ll reveal the intriguing answer shortly, but first, some proof of the disparity between gold and gold equities.

The gold price hit an all-time high of $2,058 in the fall of 2020, based on the torrent of fiscal stimulus resulting from the coronavirus pandemic; quantitative easing; near zero interest rates; a low dollar; low bond yields; and general market fear of the then out-of-control virus.

The gold price chart above is reproduced below for easy comparison.

10-year spot gold price. Source: goldprice.org

10-year spot gold price. Source: goldprice.org

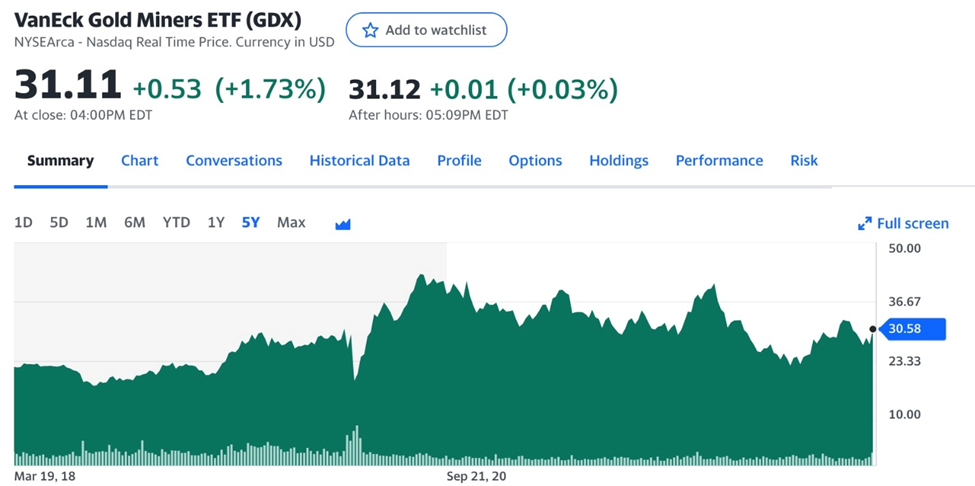

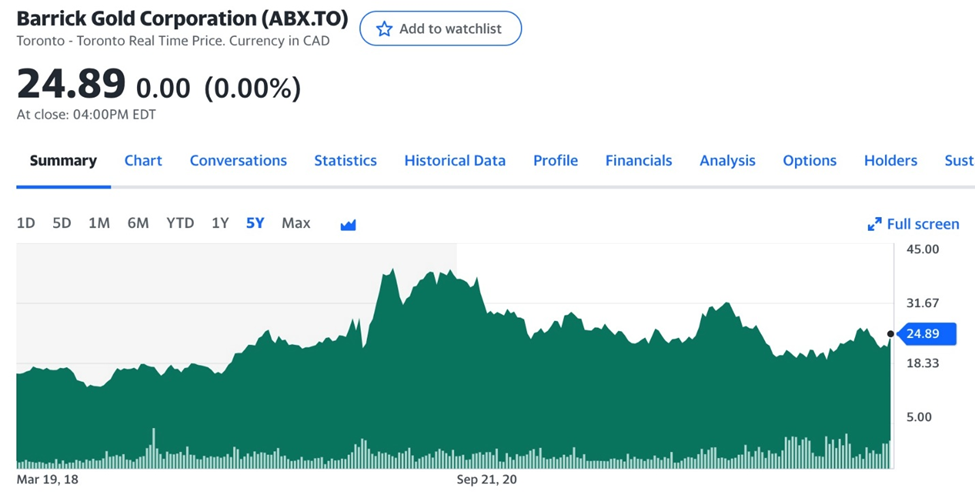

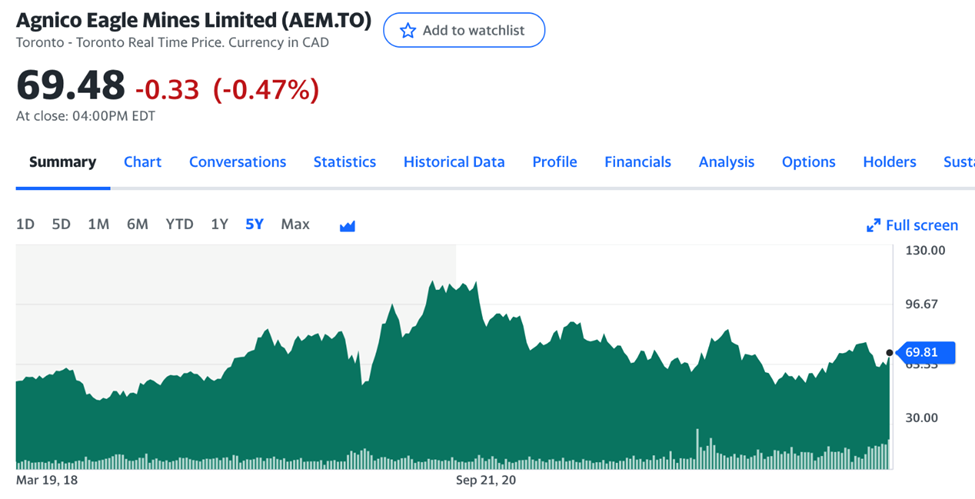

Now see the charts for GDX, the VanEck Gold Miners ETF that is a proxy for gold-mining and gold-streaming stocks; GDXJ, the VanEck Junior Gold Miners ETF that is a proxy for junior mining companies, although in reality there are more mid-tiers in the fund than small-cap juniors; and the stocks of three major mining firms: Barrick Gold, Newmont Mining and Agnico Eagle Mines Ltd.

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

Source: Yahoo Finance

GDX is essentially flat, with its high point in February, 2020. A lot of mining executives say the ETF has been propped up by gold streaming and royalty companies, over the past 15 years creating an investment alternative to mining companies.

GDXJ shows a similar pattern, and the charts for Barrick Gold, Newmont and Agnico Eagle Mines are not dissimilar. Gold market analyst Adam Hamilton recently commented on GDXJ, writing that in late January,

GDXJ had blasted 57.4% higher in 4.0 months on a parallel young gold upleg surging 20.2%! But waxing short-term overbought, gold was then crushed by several unusual events I analyzed in depth in recent essays. They included a dovish surprise from the European Central Bank, a US-jobs record seasonal adjustment, and gold-futures reports going dark.

So this dominant mid-tier benchmark was bludgeoned 21.2% lower into early March. That gutted bullish sentiment, leaving gold stocks really out of favor. But they’ve just resumed surging on the extraordinary market events of this past week. With the Fed’s most-extreme tightening cycle ever now spawning full-blown crises of confidence in larger banks, traders are remembering gold’s legendary safe-haven status.

Maybe. The climb on Monday to $2,000 certainly suggests some haven demand at play. But it doesn’t explain why, at the end of the trading day, two of the above equities were down and one was flat.

It’s also a mystery why their stock prices are substantially lower now, than before covid. For example Agnico Eagle’s stock on Monday was trading around CAD$69, but it was at $83 in August, 2019. Barrick is trading at about $24, close to where it stood months before the pandemic.

The reason may be due to investors feeling more confident in the ability of the central banks to stave off economic crises, such as the global credit crunch that followed the collapse of Lehman Brothers in 2008.

According to this view, the effects of stimulus haven’t provided the same kick for either gold or mining companies as they did over a decade ago. From 2008 to 2011, during the financial crisis, gold rose 174%, from USD$692 an ounce to $1,896. During covid, gold could only manage a 39.5% gain between March and August 2020, when its ascent to $2,054 broke a record.

This despite the level of fiscal stimulus being far greater than during the Great Recession. According to McKinsey & Co., governments globally spent $10 trillion on covid-19 relief programs, triple what was used during the financial crisis. And that was as of June, 2020. Trillions more have been spent since, including Biden’s $1.9T American Rescue Plan. The United States and Japan were the top two covid spenders, according to the Washington Post.

Pumping trillions of dollars into the global economy should be reflected in a much higher gold price, and healthy returns on share equity, because gold miners are getting more for their gold than previously. Instead, the gold mining companies have underperformed both the gold price and the broader stock market.

“It’s kind of like the Rodney Dangerfield phase, where everybody’s saying, ‘I get no respect’,” a 2022 article quotes Jason Neal, a veteran mining investment banker.

“The whole reason for holding a gold equity is largely gone because of governments covering every crisis,” said Andrew Kaip, a former top gold analyst at BMO Financial Group.

”Go back to the (2008-09) financial crisis: we didn’t know if quantitative easing was going to work, the global outlook was very uncertain,” he added. “This time around, everybody knows what the outcome is … we know they’re going to save our asses.”

Of course there are other reasons for gold stocks’ underperformance. I’d suggest three. One is the popularity of technology stocks like Alphabet and Microsoft. Before the tech sector crashed last year, investors between 2020 and 2022 preferred technology over the insurance that gold companies could theoretically provide.

Another relates to the direct stimulus (“stimmy”) payments that every American household received. Many younger recipients, the likes of those on Robinhood, used the extra money to open a trading account and learn how to trade stocks. Some of this money poured into gold equities, hence the bump gold stocks enjoyed in 2020.

Now that that stimulus money has been spent, trading platforms aren’t seeing nearly the amount of traffic, as investors young and old hunker down, afraid of losing money on stocks amid a recession year.

The third reason is that many gold investors have “aged out” of the game. These folks have seen gold bull markets come and go, they’ve made their 5, 10, 20-baggers but in retirement, they no longer have the risk tolerance needed for resource investing.

Put it all together, and it’s easy to see why gold companies just aren’t receiving the kind of investor interest they have previously. But that doesn’t mean there isn’t a future for junior resource companies, particularly those with excellent projects in safe jurisdictions.

According to Hamilton, the gold market analyst, With gold still far from reflecting the Fed’s still-doubled US money supply since March 2020’s pandemic-lockdown stock panic, speculators and investors should be aggressively upping their gold-stock portfolio allocations. With mid-tiers and juniors still trading at deeply-undervalued levels, traders should be paying attention to their fundamentals and looking to buy low.

Conclusion

Hamilton also says the biggest gold-stock gains during major gold up-legs accrue in the mid-tiers and juniors. I agree 100%.

Investing early in the development cycle of the right gold junior, one that has an excellent project in a safe jurisdiction led by experienced management with the ability to raise money, can reap huge rewards — 5, 10, even 20 times your money isn’t uncommon.

Kitco columnist David Erfle agrees that, despite the gold price outperforming the stock market since early Q4 2022, “mining stocks remain deeply discounted when compared to U.S. stocks as investors are under-invested in the precious metals complex.” Erfle suggests part of the problem is the lack of institutional investment, which “has yet to begin moving into the beaten down and left for dead precious metals space.” Still, he is bullish on gold stocks in 2023, stating that “With the sector now overbought, this is a good time to accumulate long-term holdings in quality juniors on weakness.”

Remember, the stock prices of these companies typically rise and fall with the gold price.

According to Sprott, a top investor in the bullion industry, if ongoing turmoil in the banking sector persists and global central banks downshift their interest-rate hiking cycle (we’ll know Wednesday what the Fed decides), gold prices could surpass the record set in August 2020.

“I certainly think we’re on our way to new highs,” Sprott’s Chief Executive Officer Whitney George said in a recent Bloomberg interview. After a market downturn, “the minute liquidity is restored back into the global market, gold seems to be always be the first thing to recover, and then often hits new highs.”

Consider that gold surpassed $2,000 this week with the failure of three banks. What will happen to gold if more banks go down? A banking contagion leading to a global recession is now a significant threat.

Or if one of four hot spots in 2023 — the war in Ukraine, Iran protests, US-China trade relations, and North Korea — flares up? Historically, precious metals- focused juniors offer the best leverage to rising gold and silver prices.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.