The first two weeks of the year have been incredibly frustrating; however, if we just think about the fundamentals and driving forces pushing precious metal prices higher, one couldn’t be happier. First, we got a sizeable spending bill signed by Trump ($900B + $1.4T = $2.3T), which was very bullish but just two weeks later, Biden’s proposed a CV-19 relief package that is drastically higher, precisely $1.9T higher, which together with the Omnibus spending bill bring the total ($2.8T + $1.4T =$4.2T). A very significant amount of the CV-19 relief package will be incredibly inflationary and will drive the metals to record levels sooner rather than later.

If we’re all honest will ourselves, consumer prices have been surging, even though the C.P.I doesn’t indicate that. That’s because there are too many gimmicks that greatly distort the C.P.I. The measure of inflation has been disconnected from reality since the early ’90s. Nonetheless, I believe we will see the C.P.I read 2.5-3.0% before year-end, which really means it's running at 10-15%. This will continue in 2022 as monetary inflationary takes some time to show up in higher consumer prices. What no one in the MSM mentions inflation and that once it picks up, this isn’t like the 80’s, the FED has no way of fighting inflation. The economy can’t handle high, let alone moderate interest rates i.e., 4-5%.

$USAS, $AYA.TO, $CG.TO, $DPM.TO, $EQX, $GBR.V, $HL, $KNT.TO, $KL, $LUG.TO, $NFG.V, $OR, $OSK.TO, $RGLD, $ROXG.TO, $SAND, $SVM, $TGZ.TO, $TXG.TO, $VZLA.V, $WDO.TO

America’s Gold and Silver Corp: The company has finally achieved commercial production at Relief Canyon, which is several quarters late. The longer than expected timeline to production has caused the company to dilute shareholders, seen most recently through the announcement of an upsize of the previously announced bought deal financing to C$30m. Assuming Relief Canyon production and costs come within 10% of that outlined in the FS, it should undergo two market re-rates. The first in 2021 as cash flow explodes, relatively speaking, and again in 2022, the Galena Complex is projected to produce 1.8-2m oz. Ag, increasing thereafter.

Aya Gold & Silver: Reported record quarterly silver production of 408k oz. Ag in Q4. In Q4 2020, the company increased throughput to 566tpd or 81% of design capacity. Full-year 2020 production totaled 690k oz. Au.

Centerra Gold: Q4 gold production was 172k oz. Au including 90k oz. Au produced by the Kumtor mine, 42k oz. Au produced at Mt. Milligan and 39.4k oz. Au produced by the Oksut mine. Full-year 2020 production totaled 824k oz. Au (556k oz. Au from Kumtor, 161.9k oz. Au from Mt. Milligan, and 106k oz. Au from Oksut).

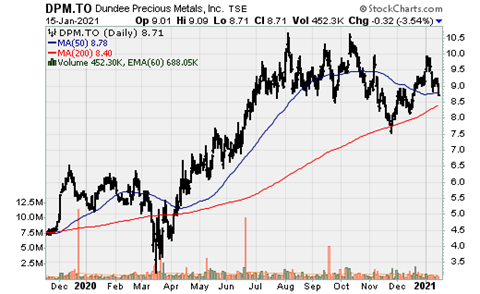

Dundee Precious Metals: Dundee achieved record production in 2020, with total gold production for the year at the high-end of the company’s 2020 guidance range. In Q4, the company sold 62.6k oz. Au, 7.8m lbs. Cu and 52.5kt of complex concentrated smelted at Tsumeb. For the full year 2020, the company sold 271k oz. Au, 33.4m lbs. Cu and 231.9kt of complex concentrate smelted.

Equinox Gold: Reported record quarterly in Q4 and a 90% increase in production vs. 2019. This was with its largest asset, Los Filos, operating for approx. 4 months out of the year due to the close of the Leagold acquisition, mandated suspension by the Mexican government, and an illegal mine blockade, which has since been resolved. Equinox's full-year production exceeded the high end of its revised guidance. 2021, 2022, and 2024 will see tremendous growth, with 2021 production 670-725k oz. Au, growing to approx. 1.25-1.35m oz. Au in 2024/25.

Great Bear Resources: The company reported continue high-grade intercepts at the LP fault. This news release provided 22 additional drill holes over 1.2km of strike length. New shallow, high-grade drill results between bedrock surface and approx. 150m meters depth include:

- 11m @ 16.56 g/t Au

- Including 3.10m @ 32.90 g/t Au

- 7.35m @ 20.24 g/t Au

- 4.65m @ 25.36 g/t Au

- 4.90m @ 18.45 g/t Au

- 5.00m @ 17.11 g/t Au

Hecla Mining: The company announced Q4 and full-year 2020 production. Hecla saw silver production increase 7%, reaching its second-highest production only too 2016 at 13.50m oz. Gold production fell 23% to 208.9k oz, due to lower output from the Nevada operations. The company continues to strengthen its balance sheet, ending the year with $131m in cash with its credit facility undrawn. Net Debt has decreased $75m (16%) over the last three quarters. Greens Creek was impressive with silver and gold production of 10.5m oz. and 48.5k oz. While San Sebastian is no longer in production (producing 1m oz. Ag in 2020), it will be made up for in 2021 by higher production from Lucky Friday, estimated at 3m oz. Ag (from 2m oz.) and increase until production of 4.5-5m oz. is achieved in a few years.

K92 Mining: The company achieved record annual and quarterly production, with 29.82k AuEq oz., produced in Q4. Full-year 2020 production totaled 98.87k AuEq oz. (95k oz. Au, 1.85m lbs. Cu and 36k oz. Ag).

Kirkland Lake Gold: The only senior producer with operations solely in Tier-I mining jurisdictions reported a robust Q4 and full-year 2020 production results. Q4 output totaled 369k oz. Au, a 32% increase vs. the comparable period in 2019. All three of its cornerstone assets had the highest production levels of 2020. For the full year 2020, production was 1.37m oz. Au, a 41% increase vs. 2019 and in-line with full-year guidance of 1.35-1.4m oz. Kirkland Lake, which has the lowest cost structure amongst senior producers, returned $847.6m to shareholders in 2020 (dividends + share buybacks). The company bought back 18.926m shares during 2020 and 20m shares if you include the first week of 2021. Kirkland Lake increased its dividend twice during the year, first doubling it in Q1 and increasing it 50% in Q4. Kirkland continues to have one of, if not the most pristine balance sheet of all senior producers with no debt and $848m of cash. This would be almost $1.7B had the company not paid any dividends or bought back any shares. Heading into 2021, there will be a dramatic fall-off in production at Fosterville by approx. 120-150k oz. Au and 150-200k oz. Au in 2022. However, higher output at Macassa and Detour Lake will offset those losses. On the cost side, costs will go up at Fosterville, but this will be offset by lower costs at Macassa and Detour Lake.

Lundin Gold: The company reported Q4 and 2020 production of 96.83k oz. Au and 242.4k oz. Au. Commercial production was declared on March 1, 2020, at Fruta Del Norte.

New Found Gold: Announced partial results from four diamond drill holes recently completed at the Keats Zone and six initial drill holes at the Little-Powerline zone. Highlights include:

- 10.4m @ 22.5 g/t Au (Keats)

- 15.9m @ 31.4 g/t Au (Keats)

- 18.2m @ 10 g/t Au (Keats)

- Including 7.7m @ 20.70 g/t Au

- 8.9m @ 5.90 g/t Au (Keats)

- 9.6m @ 2.61 g/t Au (Little-Powerline)

- Including 2.30m @ 7.75 g/t Au

- 2m @ 253 g/t Ag

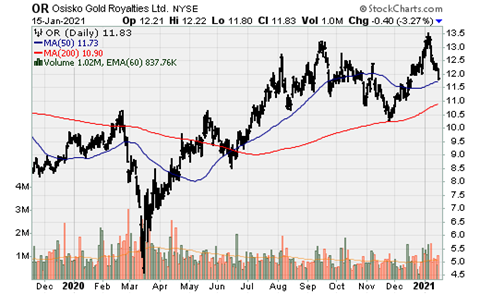

Osisko Gold Royalties: The company announced Q4 and 2020 attributable AuEq production and updates on select royalties and streams. In Q4, Osisko received 18.8k AuEq oz., bringing full-year gold equivalent production to 66.1k oz. Actual attributable production in Q4 was 20.50k AuEq oz. but 1.75k oz. was from the Renard diamond stream, the proceeds of which were reinvested through a bridge loan with the operator of the mine (this will be the case until 1H 2022).

Canadian Malartic: Operations are steady at the CM open-pit. Given the exploration success at East Gouldie, Odyssey, and East Malartic zones, the JV operator announced it would publish a PEA for a future underground operation in Q1 2021 with a target production rate of 15-20ktpd by 2029 [400-450k oz. of production]. The company expects underground production to begin as early as 2023. There is also the possibility for additional open-pit discoveries. Over-time, as some of Osisko’s other sizeable assets (Horne 5, Mantos Blancos, Cariboo, Back Forty] come online, CM will no longer be the company's anchor asset; rather, there will be four to five cornerstone assets.

Mantos Blancos: Mantos Copper continues construction of the sulphide concentrator, which is expected to increase throughput from 4.3mtpa to 7.3mtpa by Q4 2021, and extend the mine life to 2035. Once completed, this will increase Osisko’s attributable silver production to 1.2m oz. p.a. from Mantos Blancos.

Cariboo & San Antonio: Two growth drivers for the company over the next three years will increase attributable production in 2021. Small scale production at Bonanza Ledge will begin soon [+3k oz. Au]. Full construction activities are expected to commence in 1H 2022, with production slated to reached in 2023 of approx. 210-220k oz. Au (or +10.5k AuEq oz. attributable). At San Antonio, there is near-term production potential from a gold stockpile beginning in 2021. Osisko Development is targeting an initial production of 50-70k oz. Au annually (+7.5-10.5k oz. Au attributable). Osisko Development believes San Antonio is scalable with considerable exploration upside, which could mean additional upside for Osisko Gold Royalties).

Horne 5: Falco is advancing permitting work at Horne 5 in Quebec. This could be a nice addition to Osisko Development. This is the largest medium-long term growth driver for the company, which will increase attributable production by 1.6-1.75m oz. Ag.

There are numerous near and medium-term growth drivers for the company. Please read our full report @ Goldseeker.com.

Osisko Mining: The high-grade drill intercepts are never-ending. This week the company reported the following high-grade intercepts (highlights):

- 2.20m @ 344 g/t Au

- 2.60m @ 114 g/t Au

- 2.0m @ 90.20 g/t Au

- 2.20m @ 74.2 g/t Au

- 7m @ 26.7 g/t Au

Osisko Mining also announced a C$60m bought deal private placement of flow-through shares. The company's share structure is getting rather sloppy but understandable given the massive exploration programs at Windfall undertaken over the last several years. Hopefully, this is the last or almost the last equity raise before the start of construction at Windfall, which hopefully will be financed by at least 65% debt. The Osisko Group of companies has made shareholders a lot of money over the years, which won't be an exception. At some point, the company will do something like a 5:1 reverse split.

Royal Gold: Royal provided an update regarding its fiscal 2021 second quarter. Royal Gold sold 57.5k oz. AuEq (44.5k oz. Au, 461k oz. Ag, and 1,800 tons of copper). In the calendar year 2021, Royal Gold’s production growth will be rather muted in 2021 on a normalized basis; due to the mandated suspension of assets in various countries in 2020 due to CV-19, there will be growth, i.e., Penasquito. There will be more growth in 2022 driven by the Khoemacau silver stream, which is expected to reach initial production in Q3 2021, ramping up in Q4. Another growth driver will be from its various Cortez royalties operated by Nevada Gold Mines (Barrick + Newmont).

Roxgold: 2020 production (+133.9k oz. Au) exceeded guidance (120-130k oz. Au) and provided its outlook for 2021. The company generated $47m in operating cash flow and $19.90m in free cash flow. More importantly, the company has commenced early works at Seguela to enable a ramp-up to full construction activities later in the year. Seguela is a high-grade, high-return project with a short buildout period (production expected before year-end 2022). Seguela will likely surprise on the upside through exploration and potentially higher annual output. Nonetheless, production will increase by approx. 100%-125% when online and optimized. This is a perfect asset to build before beginning construction at Boussoura, a larger, more capital-intensive project. To date, Roxgold has identified over 9 vein sets over 4 vein corridors with high-grade results, i.e., 4.8m @ 27 g/t Au.

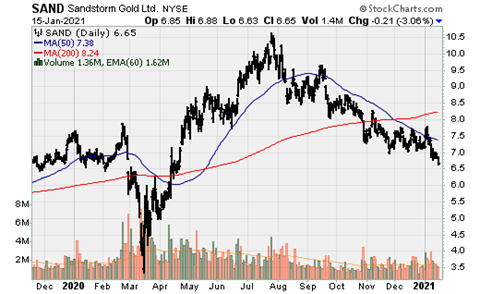

Sandstorm Gold Royalties: Announced record revenue in 2020 on the back of higher gold prices. The company sold 52.2k AuEq oz. (attributable) in 2020, generating revenue of $93m. The company sold approx. 15.8k AuEq oz. in Q4. Sandstorm's stock price has been punished much more so than its peer group, and rightly so, as its output will fall over the next couple of years. New streams and royalties will come-online, but large assets such as its Santa Elena gold stream will see 40-50% lower production as Ermitano displaces approx. 40% of the mill feed beginning in 2H 2021, and the Karma fixed gold deliveries will soon reach the threshold and turn into a small stream. It has a lot of liquidity, so hopefully, it will complete one larger sized deal or two or moderately sized deals.

Silvercorp: The company produced 1.7m oz. Ag + base metals in Q3 of its Fiscal 2021. The company remains on track to produce 6.2-6.5m oz. Ag plus significant byproduct credits for its fiscal 2021. Silvercorp is another company needing to engage in M&A to find growth projects, and the company hasn't had any for the last 5 or so years.

Teranga Gold: The company reported its highest quarterly production in company history and a 40% increase in annual gold production. Teranga reported production of 119k oz. Au in Q4 and 404k oz. Au for the full year 2020. The 40% increase in production was driven by Wahgnion (+175k oz. Au), destroying the initial 2020 guidance of 130-140k oz. Au. Growth was also driven by achieving commercial production at Massawa (combined with Sabodala), which saw record quarterly production of 79k oz. Au in Q4. Production growth will continue in 2021, driven by higher output at Sabodala-Massawa, more than offsetting lower output at Wahgnion. Endeavour’s acquisition of the company should be completed before the end of Q1 2021, creating a top-10 global producer. To read our full report on the Pro-Forma Endeavour Mining, please visit Goldseeker.com.

Torex Gold: The company provided its outlook for 2021. Following gold production of 430k oz. Au in 2020, production is expected to increase to 430-470k oz. Au in 2021 at lower cash costs and AISC. Costs will remain elevated as in years past as the company continues to invest in the Muckahi system, Media Luna (its next project), expanded development and exploration of the ELG underground, and a scoping study for a layback within the El Limon open-pit.

Vizsla Resources: The company reported results from two new holes at the Tajitos vein zone at the Panuco Ag-Au project. Highlights include:

- 13.50m @ 536 g/t Ag and 4.35 g/t Au

- 7.55m @ 946.8 g/t Ag and 7.68 g/t Au

- Including 1.5m @ 1,870 g/t Ag and 15 g/t Au

Wesdome Gold Mines: Announced Q4 and full-year 2020 production results and provided 2021 guidance. Q4 production totaled 20k oz. Au, bringing full-year output to 90.3k oz. Au, which met the lower end of 2020 guidance. During the year, the company had exploration success at both Eagle River and Kiena. Wesdome published the preliminary economics assessment results for Kiena, and the results of the pre-feasibility study are expected to be published this quarter. While Wesdome’s valuation is significantly higher relative to its peer group and larger, more diversified mid-tier producers, it is warranted to an extent given its producing mines are located in Canada and its development project, Kiena. Kiena is scalable, so there is likely some upside priced in above that outlined in the PEA.