Another treacherous week is in the books for 2021. Gold and silver prices have actually been acting rather well, though it seems like a bad year, but only because we had a robust rally into year-end in addition to the mining stocks acting very poorly in 2021.

Silver, in particular, looks rather strong. Gold is likely to remain in a wide trading range of $1,770-$1960/oz. until it breaks through the $1,960-$1,965/oz. convincingly on strong volume. The mining equities' price action has been absolutely awful, though hopefully, this change when the company's report Q4 and full-year 2020 results, if not earlier.

The fundamentals that drive precious metals have never been stronger, especially after Biden announced his intention to increase the stimulus bill [CV19 Relief + Omnibus] by an additional $1.9T. This is significant as it is highly inflationary. This is in addition to the stimulus package already passed by Trump.

$AXU, $AR.TO, $BTG, $EGO, $EQX, $AG, $FSM, $GATO, $GBR.V, $KTN.V, $LIO.V, $ORE.V, $ODV.V, $PAAS, $PVG, $ROXG.TO, $SSB.TO, $SAND, $SSRM,

Alexco Resources: The newest primary silver producer announced it has extended Bermingham (Its most important mine at this time) high-grade mineralization at depth. Highlights include:

- 8.76m @ 3,583 g/t Ag

- 1.64m @ 3,834 g/t Ag

- 3.5m @ 707 g/t Ag

- 5.3m @ 2,070 g/t Ag

- 6.12m @ 1,560 g/t Ag

- 1.30m @ 4,889 g/t Ag

- 7.46m @ 1,381 g/t Ag

Argonaut Gold: Though Argonaut gold's current operations are mediocre at best, the construction of Magino and the optimization and expansions will quickly change its portfolio's overall quality. Initially, Magino will produce an average of 150k oz. Au p.a.; however, including the underground component will likely allow Argonaut to increase annual production to 220-280k oz. Au. The week, the company also announced some excellent drill results from the South zone at Magino. Highlights include

- 10m @ 19 g/t Au

- 3.1m @ 47.1 g/t Au

- 3m @ 8.3 g/t Au

- 5m @ 4.1 g/t Au

- 6m @ 4.5 g/t Au

The South zone has been intersected in several drill holes extending from the border between the Island Gold mine and the Magino project westward over a strike length of 1.5KM and remains open at depth and to the west.

In Q4, Argonaut announced record quarterly production of 57k AuEq oz. and full-year 2020 production of 203k AuEq oz. 2021 guidance is for the production of 210-250k oz. Au @ AISC of $1,250-$1,350/oz. 2021 and 2022 will be transitional years for the company at it will be a period of high capital investment, with $180-$190m to be spent on the construction of Magino in 2021. Once the next leg up begins, Argonaut should benefit as it will see more significant margin expansion relative to its peer group and construction at Magino progresses.

B2Gold: Reported strong Q4 2020 gold production and record annual gold production. Q4 production totaled 270k oz. Au with full-year 2020 production of 1.04m oz. The company commissioned the Fekola mill expansion (7.5mtpa from 6mtpa); however, the mill can run above the new throughput rate, and an analysis is underway to determine the optimum throughput rate. In 2021, gold production is expected to be 970-1.03m oz. with AISC of $870-$890/oz. Costs will be higher in 2021 due to planned stripping activities and higher fuel and labor costs. Production will be weighted more heavily towards the 2H 2021. B2Gold also announced its 5-Yr gold production forecast of 950k oz. Au. This excludes a potential additional expansion at Fekola and any production from its Gramalote project, which should reach production mid-2H 2023.

El-Dorado Gold: The company announced the acquisition of QMX. This was a strategic acquisition as it expands the land package around its Lamaque mine in Canada. El-Dorado will acquire all of the outstanding shares of QMX for approx. C$132m. This deal serves to increase El-Dorado's landholding in the Abitibi Greenstone belt by 550%. It adds a pipeline of additional organic opportunities proximal to Lamaque, which can be exploited given the existing infrastructure. El-Dorado has already done an excellent job optimizing Lamque with plans for an expansion. I haven't been a fan of $EGO for many years given its past destruction of shareholder value; however, it has been making smart moves over the last couple of years.

Equinox Gold: Announced very encouraging drill results from Piaba underground and Genipapo targets at Aurizona. The 2020 Piaba underground delivered great results, which illustrate this will be a larger project in terms of output and mine life. 96% of the drill holes intersected mineralization. Following the close of the Premier Gold acquisition, Equinox will have three cornerstone assets (producing and development) in Los Filos (Mexico), Castle Mountain (U.S.), and Hardrock (Canada). Aurizona has the potential to become its fourth cornerstone asset. Growth will develop an underground component that showed robust economics in the PEA; however, the underground component will likely be larger than that envisioned in the PEA. Highlights from this press release include:

- 24m @ 5.56 g/t Au (Piaba U/G)

- Including 11m @ 9.85 g/t Au

- 1.0m @ 96.8 g/t Au (Piaba U/G)

- 11m @ 4.18 g/t Au (Piaba U/G)

- 11m @ 6.15 g/t Au (Piaba U/G)

- 6m @ 8.24 g/t Au (Piaba U/G)

- 15m @ 3.43 g/t Au (Piaba U/G)

- 11m @ 4.42 g/t Au (Piaba U/G)

- 37m @ 4.35 g/t Au (Piaba U/G)

- Including 10m @ 7.16 g/t Au

- 6m @ 9.10 g/t Au (Piaba U/G)

- 25m @ 1.43 g/t Au (Genipapo O/P)

- 90m @ 1.41 g/t Au (Genipapo O/P)

- 19m @ 3.15 g/t Au (Genipapo O/P)

- 20m @ 1.10 g/t Au (Genipapo O/P)

- 5m @ 17.7 g/t Au (Genipapo O/P)

- 17m @ 1.63 g/t Au (Genipapo O/P)

First Majestic Silver: The company produced 3.5m oz. Ag and 26k oz. Au in Q4 2020. FY 2020 production totaled 11.6m oz. Ag and 100k oz. Au. San Dimas saw its highest quarterly silver production since First Majestic acquired it in May 2018 and La Encantada produced 1.1m oz. Ag in Q4, the highest quarterly silver production since Q2 2013. 2021 guidance is for silver production of 12.5-13.9m oz. Ag and 100-112k oz. Au or 20.6-22.9m AgEq oz. The increase is based on higher throughput and silver grades at San Dimas following Mexico’s two-month national shutdown in 2020. San Dimas is projected to produce 7.1-8m oz. Ag in 2021 and 72-80k oz. Au. Companywide AISC is estimated at $14.81-$15.99/oz. Growth over the next several years will be fueled by Ermitano (beginning in early 2022, which will displace an initial 40-50% of the Santa Elena mill feed), La Parilla, La Guitarra, and potentially Del-Toro, depending on exploration success.

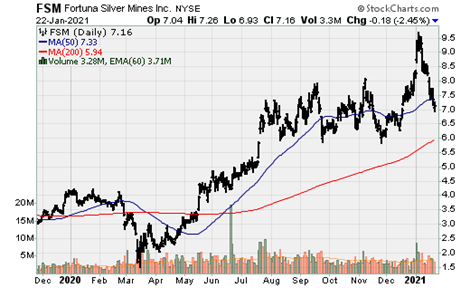

Fortuna Silver: The company reported 2020 full-year production of 11.3m AgEq oz. and issued 2021 guidance. For the full year 2020, Fortuna produced 7.13m oz. Ag and 55k oz. Au. This was lower than it would otherwise be given mandated government shutdowns in Mexico and Peru due to CV-19. 2021 will see a big jump in cash flows due to Lindero, which should cause cash flows to more than double. The San Jose mine will continue its trend of lower silver production (5.8-6.5m oz.), and hopefully, it can maintain those production levels assuming exploration success. The company has been acquiring land around the current operations at San Jose, so it does seem likely.

Gatos Silver: Before year-end, the CLG mine achieved throughput levels of 2,324tpd (2,500tpd initial design capacity). The company would have achieved design throughput if it weren't for the two-month mandated suspension during the year. By the end of 2020, the mine achieved just under 16k meters of development. In 2020, the CLG mine produced 4.2m oz. Ag, 34.2m lbs. Zn, 27.4m lbs. Pb and 4.9k oz. Au. Gatos is expected to exercise its rights to increase its interest from 51.50% to 70% around the end of January. In Q1, Gatos will begin a 5,400m exploration program on its wholly-owned Santa Valeria project. Over-time this could increase average annual output as it is 100% owned and is geologically comparable to the CLG mine.

Great Bear Resources: The company announced financing at the beginning of the week, which was then upsized to C$70m later in the week. $GBR's stock price has held up well considering how weak the mining equities have been over the last several months. Great Bear will issue 3.225m flow-through shares @ $18.60/share, and an additional 784k common (non-flow-through) shares @ $12.75/share. This financing will fund considerable exploration for what is clearly becoming a tier-I asset as it has more than C$100m in cash. This should fund exploration through 2023 and allow the company to issue a maiden MRE. It is only a matter of time until the company is acquired.

Kootenay Silver: Reported the final 17 core drill holes from its Phase II drill program (9,114m over 43 holes) at its Columba high-grade silver project. Highlights include:

- 10.1m @ 152 g/t Ag

- 3.1m @ 325 g/t Ag

- 3.78m @ 170 g/t Ag

- 94m @ 40 g/t Ag

- 9.05m @ 179 g/t Ag

- 9m @ 691 g/t Ag

- 2.45m @ 208 g/t Ag

- 11.15m @ 415 g/t Ag

- 3m @ 314 g/t Ag

- 9m @ 154 g/t Ag

Lion One Metals: Reported deep and shallow high-grade mineralization at Tuvatu. Two high grade lodes were intersected: 2.24m @ 13.31 g/t Au, 3.47m @ 20.71 g/t Au (including 0.23m @ 294 g/t Au).

Orezone Gold: Announced a financing package for the construction of Bombore into production. The financing is for a combined $182m. It comprises $96m in senior debt, $35m convertible note facility, and $51m in equity financing. The first production remains on track for Q3-2022. Once in production, Bombore has excellent economics with an average annual production of 134k oz. Au over the first 10yrs (13yr initial mine life) @ AISC of $672/oz. There is a fair amount of optionality at the project, with the potential to run the oxide plant at 5.2mta while at the same time running the sulphide circuit at 2.2mtpa. Once the sulphide circuit is commissioned, the oxide feed will be reduced to 3.0mtpa, so there is potential to run both at full capacity in addition to the sulphide circuit being expandable to 4.0mtpa. While the reserve base is 1.8m oz. Au, there is an additional 3.3m oz. in M&I resources. The deposit is open at depth with significant M&I tons of higher grade sulphide below existing reserve pits. Orezone is also trading at a steep discount to NAV of under 0.40x.

Osisko Development: The newly created company announced its cash position and outlook at its three projects. Following the recent financing, the company has C$200m in cash and C$125m in marketable securities. The company is kicking off a 2-yr drill program at Cariboo (90k meters of resource conversion drilling by Q3 2021 to support the feasibility study). It commenced the development of mineralized material from Bonanza Ledge 2, and stockpiling has been initiated at the mill. First gold production is targeted in Q1 2021. Osisko Development completed the engineering and permitting to process the gold stockpile via heap leaching at its San Antonio project in Mexico.

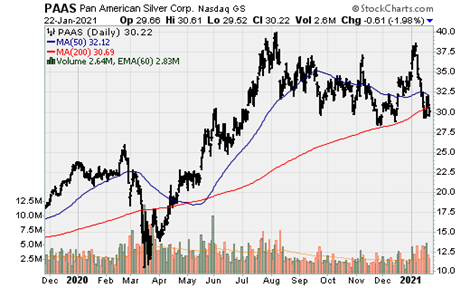

Pan-American Silver: Announced 2020 production results and issued 2021 guidance. 2020 saw many operations suspended for various amounts of time. Pan-American produced 17.3m oz. Ag and 522k oz. Au in 2020. Further, La Colorada, the company's highest quality silver asset (aside from Escobal, which isn't producing), was impacted by an inability to access high-grade ore due to the CV-19 related delay in completing an underground ventilation raise and the loss of a ventilation raise in late Q4 2020.

2021 guidance is for silver production of 22.5-24m oz. Ag and 566-613k oz. Au. 2021 will be impacted by restricted mining rates at La Colorada during the first half of the year due to the replacement of ventilation infrastructure. AISC will be elevated in 2021, due in part to CV-19 restrictions. The company expects the restrictions to decline throughout the year. In other words, performance in the 2H of 2021 should be better relative to the first half.

Pretium Resources: Reported Q4 production of 88.3k oz. Au, bringing the full-year total to 347k oz. Pretium also repaid $160m in debt and ended 2020 with a cash balance of $174.80m. 2021 guidance is for the production of 325-365k oz. Au with all-in sustaining costs (AISC) of $1,060-$1,090/oz.

Roxgold: The West-Africa focused junior producer continues to release very encouraging news flow, primarily from its high-grade development project Seguela. The drill results from the newest high-grade deposit, Koula, at Seguela, have been excellent. Highlights from this news release include:

- 14m @ 42.90 g/t Au

- 11m @ 46.20 g/t Au

- 18m @ 22.10 g/t Au

- 16m @ 21.30 g/t Au

- 24m @ 8.6 g/t Au

- 21m @ 9.2 g/t Au

Roxgold is one of the more interesting junior producers, given its stable cash flow, which will more than double in 2023.

Sabina Gold & Silver: Reported an updated MRE for its Back River Gold Project, Nunavut, Canada. Gold resources (M&I) now total 6.32m oz. Au @ 5.88 g/t and an additional 2.86m oz. Au (Inferred) @ 6.44 g/t. This will be incorporated into the updated feasibility study, which is expected to be published later this quarter. The updated MRE saw an increase in M&I resources by 988k oz. (18.50%) and 1.005m oz. Au in Inferred resources (54.3%).

Sandstorm Gold Royalties: The company provided an asset update. Sandstorm Gold hold's a 0.90% NSR on Lundin Gold's Fruta Del Norte project. Lundin will undertake a 20% mill expansion, which is expected to be complete before year-end 2021. 2021 production guidance is estimated at 380-420k oz. Au or 3.4-3.8k attributable oz. Sandstorm also highlighted the Equinox exploration results at Aurizona as it has a 3-5% sliding-scale NSR royalty (3% at a gold price under $1,500/oz., 4% at a gold price between $1,500-$2,000/oz. and a 5% NSR when the gold price is above $2,000/oz.). Aurizona will see higher average annual output over the medium-term over a longer mine life. Sandstorm Gold Royalties has a 4.205 copper stream on Lundin Mining's Chapada mine. Lundin Mining resumed full production rates In December, which will positively impact Sandstorm Gold Royalties in Q1 and augmented by higher copper prices. Lastly, Endeavour Mining released its 5-year production estimates at Hounde and Ity CIL. Sandstorm owns a 2.0% NSR on the Hounde mine, which will provide average annual attributable production of 5k oz. Au (2021-2025). Endeavour’s goal is to maintain production of 250k oz. Au for the next 10-years.

SSR Mining: The company achieved its 2020 full-year production guidance and provided 20201 production and cost guidance. For the full year 2020, the company's four operating assets produced approx. 711k AuEq oz., with 220k AuEq oz. coming in Q4. In 2021, SSR mining expects to produce 720-800k AuEq oz. @ AISC of $1,050-$1,110/oz. 2020 was a transformational year for the company as it completed Alacer Gold's acquisition, giving the company a clear anchor asset, Copler. The company's objective is to sustain 700-800k AuEq oz. over the next 5-Yrs. This is a bit disappointing as it has a massive silver project in La Pitarilla, which would produce approx when in production. 15m oz. Ag p.a. during the first 18yrs. It is capital intensive ($750m) but would provide the company with a large, long-lived cornerstone asset. Silver prices will have to rise to upwards of $35/oz. to generate an IRR of 15-20%.

The focus at Copler in 2021 will be the construction of a flotation circuit with an expected ramp-up beginning mid-year, exploration and development of Ardich with the first production targeted in 2023, and exploration at C2, focusing on an expandable development plan. At Marigold, the focus will be on cost reduction and other improvement initiatives, oxide exploration targeting higher grades and conversion at Mackay, Valmy, New Millennium, and other areas, and sulfide exploration. The focus of Seabee will be increasing mining rates to exploit excess capacity, gap hanging wall resource conversion, and Seabee and Fisher exploration and resource development.

Production at Copler will be weighted towards the second half of 2021 due to the commissioning and ramp-up of the flotation circuit within the sulfide plant. If not for Copler, companywide AISC would be significantly higher, driven by high-costs at Marigold (AISC of $1,250-$1,290/oz.), projected to have AISC of $760-$810/oz. lastly, silver production at Puna is expected to be 6.0-7.0m oz. @ AISC of $16.00-$17.50/oz. Higher AISC will result from higher sustaining capital costs, which are expected to total $19m.