Q2 2020 earnings results were in full swing throughput the week, some companies setting records in many categories such as production, revenue, cash flow, etc. and others missing by a wide margin (notably those in Mexico, Peru, and select other countries). Most companies were impacted to some degree by mine suspensions or CV19 protocols, preventing the them from operating at capacity. We finally got a long overdue correction in the gold and silver price, with gold down more than $115/oz. at one-point on Tuesday and silver selling off $4/oz. or about 14%. While we did see a sharp correction, it was very short-lived, which could mean the correction has only started. If this is the case, be sure to keep some dry powder, which is never a bad idea.

$AR.TO, $CXB.TO, $CDE, $EQX, $FSM, $GCM.TO, $GRSL.V, $IRV.CA, $JAG.TO, $KNT.V, $LUG.TO, $MGR.V, $MAG, $MMX, $NFG.V, $NEE.V, $OR, $PG.TO, $ROXG.TO, $SILV, $ELEF.TO, $VZLA.V, $WDO.TO, $WPM

Argonaut Gold: Announced Q2 operating and financial results as well as providing 2H guidance, which has changed since the acquisition of Alio Gold and its Nevada operations. In Q2 2020, Argonaut generated $11.8m in operating cash flow [before changes in non-cash working capital] and free cash flow after changes in non-cash working capital of $23m on production of of 31.5k AuEq oz.

The company has positioned itself to generate increasing free cash flow. 2H 2020 free cash flow guidance is for $41-$68m at $1,800/oz. gold and $49-$79m at $1,900/oz. gold. Argonaut was impacted by the mandated suspension of mining activities at its Mexican operations, partially negated by the reduction of heap leach pad inventory at minimal costs. Q2 2020 AISC fell significantly over the comparable period in 2019 and vs. Q1 2020. This likely had to do with, at least in part, the reduction in leach pad inventory, given the low costs and reduction in non-cash working capital.

Lastly, Argonaut continues to advance its next development project, Magino, and received approval of schedule 2 process from the Canadian federal government. Subsequent to quarter end, the company provided drill results from the Elbow zone, illustrating high-grade continuity below the proposed pit. While Argonaut definitely doesn’t have one of the more attractive group of producing assets, it has acquired or developed the right development projects to upgrade its portfolio over time, most notably Magino, Ana Paula, and Cerro Del Gallo to a lesser degree.

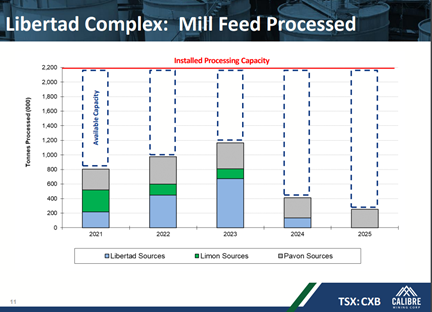

Calibre Mining: Reported Q2 operating and financial results which, as expected, was weak due to having both its mining operations suspended for 10 weeks of the quarter. Calibre also provided multi-year guidance at La Libertad and El Limon. At La Libertad, 2021-2023 guidance is for average annual production of 120k oz. Au @ AISC of $910/oz. This excludes drilling after 2018. Calibre will focus on near-mine and infill drill programs to both increase annual production [given material excess capacity at the mill of 1.5mtpa] and maintain higher production levels over a long period of time. Calibre has a very lucrative land package and coupled with the capable management team [much of the Newmarket team, which unlocked substantive value at Fosterville], should be able to execute and increase annual production at La Libertad upwards of 140-170k oz. p.a. at some point. Furthermore, later in the week, the company announced it would acquire the 70% interest in the Eastern Borosi project that it didn't already own, which provides another "spoke" to its hub-and-spoke strategy. The current resource at that deposit is 700k oz. Au (inferred) @ 4.90 g/t Au.

At El Limon, the company provided a multi-year forecast, with average annual production 50-70k oz. Au p.a. @ AISC between $900-$1,100/oz. This will last through 2023. The additional open-pit resources have the potential to extend the mine life through 2031 (assuming high resource conversion). Like La Libertad, there are also numerous exploration targets, which could augment production and/or extend the mine life. Calibre, when it repays B2Gold and is debt free, will quickly build a sizeable cash position, and will enable it engage in very aggressive brownfield and greenfield exploration. A tie-up between Calibre and Mako would make a lot of sense, further expanding the land package, increasing average annul production while putting downward pressure on costs.

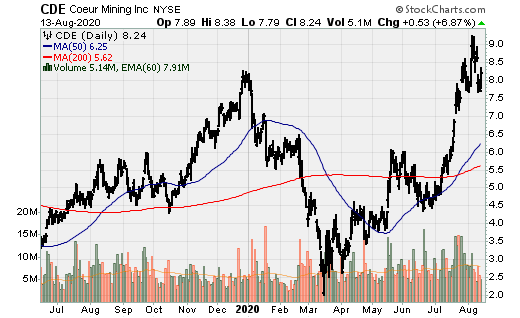

Coeur Mining: Q2 earnings was a non-event as Coeur's output was materially impacted [although it did generate $16.4m of operating cash flow. Its largest asset, Palmarejo was suspended for half the quarter. The 2H 2020 should be very robust as Palmarejo has ramped back up as well as continued strong performance from Kensington and Wharf. Coeur also received the necessary authorizations to advanced the expansion under plan of operations at Rochester. Construction is expected to begin soon. The company has hedged 50% of 2021 and 2020 gold production from Rochester. The company just released some highlights of exploration program whereby there are new, significant discoveries of oxide gold at Sterling and Crown in Nevada. Coeur also identified a meaningful, new, high-grade mineralization adjacent to the Rochester open-pit. There has also been exploration success at Kensington, Silvertip, and most notably at Palmarejo. Expansion drilling at Palmarejo north and east of the Independencia mine complex, highlighting the potential of additional growth in the future with continued drilling.

Equinox Gold: Reported very robust Q2 operating and financial results. The company produced 127k oz. Au @ AISC of $900/oz. despite its largest operation being suspended (Los Filos) for two out of three months (which was partially negated by the continued processing of leach pad solutions), as well at two Brazilian operations being suspended for shorter periods of time. Equinox generated $61m in operating cash flow before changes in non-cash working capital [and >$80m after accounting for changes in non-cash working capital]. This, however, is just the start. Beginning in Q4 of this year, Castle Mountain Phase I will contribute to production [albeit marginally ~ +45k oz. p.a.], as well as commencing construction at Santa Luz before year end [which has an approximate 10-month build-out period], which will add 100-105k oz. of annual production beginning in late 2021. Higher levels of production will also show up at Los Filos in the 2H 2021, increasing production by approx. 140-160k oz. Au beginning in 2022. These will be followed by in 2023/2024 by Castle Mountain Phase II (+200k oz. Au) and Aurizona underground (+65-70k oz.). It would be nice if Equinox made one more acquisition, diversifying into a 4th country, increasing the overall quality of the portfolio and divest the small scale, high cost Pilar mine. I’ve said this in previous issues; Gold-X Mining would add an excellent low-cost, long-lived, asset of scale in Guyana. Regardless, Equinox has an excellent growth profile, having one of the highest CAGR's over the next 4-5yrs. Not only will the company see production double, but all the projects that will come-online will put downward pressure on costs.

Fortuna Silver Mines: The company reported a loss during the quarter, which isn’t surprising given the 2-month suspension of mining operations in Mexico as well as Peru. Lindero is on track for the first gold pour before the end of the third quarter. In Q2, Fortuna produced 1.27m oz. Ag and 7.1k oz. Au with AISC at San Jose and Caylloma of $11.18/oz. and $15.81/oz. The company managed to be neutral regarding cash flow from operations, falling 86% to $3.4m, although it was actually lower if you exclude working capital adjustments, which should be done for natural resource companies.

Gran Colombia: Gold Production was lower relative to Q2 2019 at 48.23k oz. vs. 57.89k oz. Au as operations were impacted, though not horribly. April’s production from Segovia was weak due to the implementation of the CV19 quarantine and related protocols. Operations at Segovia returned to 95% of normal in the last two months of the quarter. Marmato, a smaller mine (operated by Caldas Gold), saw production fall off, achieving output of 62% relative to Q2 2019. 1H production now stands at 104.48k oz. Au, down from 118.49k oz. Au in the 1H 2019. 2020 production guidance was updated to 218-226k oz. Au for the FY 2020. AISC was noticeable higher in Q2 at 1,045/oz. vs $878/oz. in Q2 2019. The company generated operating cash flow of approx. $26m in Q2 2020, and its cash position remains solid at $87.7m, with the company also reducing the aggregate principal amount of gold notes outstanding to $41.3m.

GR Silver Mining: Reported near surface silver and gold mineralization in drill results from Plomosas. Highlights from this press release include 6.8m @ 191 g/t Ag, 1.9 g/t Au, 7.1% Pb and 3.4% Zn, 0.4m @ 1,560 g/t Ag, 0.5 g/t Au, 1.4% Pb and 1.1% Zn, and 12.6m @ 1.7 g/t Au, 17 g/t Ag and 0.70% Zn. This essentially indicates the presence of wide zones of mineralization as well as near surface polymetallic mineralization.

Irving Resources: Hits more high-grade veins at the Omui mine site, which is part of its 100% owned Omu gold project, Hokkaido, Japan. Assays from the first holes Irving has completed at its Nanko target, confirm the presence of multiple gold-silver veins. Highlights from this press release include:

- 2m @ 12.59 g/t Au + 91 g/t Ag

- 14.50m @ 2.90 g/t Au + 29.5 g/t Ag

- 1.76m @ 8.15 g/t Au + 147 g/t Ag

- 14.24m @ 3.55 g/t Au + 69 g/t Ag

- 1.72m @ 21.65 g/t Au + 538 g/t Ag

In my view, Irving is one of the more exciting exploration stage companies out there.

Jaguar Mining: the BOD declared a dividend of C$0.08/share on a post consolidation basis as Jaguar intends to undertake a 10:1 reverse split. This likely means an up-listing to one of the major U.S. exchanges later this year, if not 2021. Post consolidation, the number of shares outstanding will be approx. 72.35m.

K92 Mining: Reported strong Q2 2020 financial results, in which multiple records were set; production, revenue, cash flow, and cash position. The company produced 26.85k oz. AuEq [25.76k oz. Au, 531,406 lbs. Cu, and 10.87k oz. Ag]. K92 saw record tonnage of 49.31k tons treated, a 30% increase over the comparable period in 2019. Cash costs and AISC remained low at $596/oz. and $678/oz. Au. During the quarter, the company sold 27.15k oz. Au, 566k lbs. Cu and 11.73k oz. Ag. Revenue totaled $48m, a 105% increase vs. Q2 2019. Operating cash flow [prior to working capital adjustments] was $30.3m. Further, the balance sheet continued to strengthen with its cash position increasing $13.1m to $34.7m while paying down $4.2m in debt. The Phase II expansion commissioning and twin incline development are both underway while exploration activity increased considerably. Also, during the quarter, in addition to the Phase III PEA being published [outlining a potential tier-1 asset with average annual output once completed of 315k AuEq oz. with AISC sub $400/oz. Au], K92 reported an updated resource estimate for Kora with M&I resources of 1.1m oz. @ 10.45 g/t AuEq and Inferred resource of 3.7m oz. Au @ 9.01 g/t AuEq.

Lundin Gold: Reported Q2 results, which were significantly impacted due to the mandated suspension of Fruta Del Norte for much of the quarter. Still, the company recognized revenue of $50m on the sale of 30.9k oz. Au at an average realized price of $1,680/oz. Cash costs and AISC were $876/oz. and $952/oz. Lundin incurred suspension costs of $29.3m. The company saw its cash position fall as a result of $21.7m in development costs and cash flow used from operations of $4.8m but this was offset by the proceeds of a $41.4m bought deal equity financing. The company reported a working capital deficit of $7.2m (and cash position of $74.2m), which is primarily due to the reclassification of long-term debt to current debt [that which comes due over the next 12-months]. With the resumption of operations in early July, Lundin Gold should report a far more robust Q3 and even better Q4. Lastly, the company is evaluating increasing mine and mill throughput, which could and likely will be implemented in 2021. Newcrest remains a committed shareholder and it wouldn't be surprising to see Newcrest make a take-over bid for the company at some point.

Magna Gold: The current price of the company’s stock represents deep value if the management team (which has significant experience with this asset – San Francisco) can execute its objectives. Aside from this, the company entered into an option agreement with a private party to acquired a 100% undivided interest in the Los Muertos silver-gold project in Sonora, Mexico. It is 30km southeast and on-trend with Argonaut’s La Colorada mine.

Maverix Metals: Reported Q2 2020 financial and operating results, in which it set multiple records including revenue and operating cash flow. The company had attributable production of 6.4k oz. AuEq from which it generated revenue of $11m and cash flow of $8.5m. The company also received $15.6m in cash proceeds from the Pan-American Silver warrant exercise.

Regarding its royalty portfolio, its 100% silver stream on Northern Vertex’s Moss mine set a monthly record in July of 4.7k oz. AuEq (including 37.17k oz. Ag), the fourth consecutive increase in monthly production. This should translate into marginally higher attributable production for Maverix as the Moss mine in now operating at or above design levels. Maverix’s royalty on the Florida Canyon mine saw its value increase as a new life of mine plan was announced, which saw the mine life increase to 9.5-year, producing an average of 77k oz. p.a.

New Found Gold: Completed its IPO on August 11th. New Found Gold is highlighted by excellent leadership as well as ownership as its largest investors (Pre-IPO) were Palisade Gold (33%) Novo Resources (11%), Eric Sprott (18%), Rob McEwen (7%), management and other insiders (4%). The company has two key projects, Queensway and Lucky Strike. New Found Gold completed the largest ever consolidation within the Central Newfoundland gold belt. There is district scale exploration potential and given Quinton Hennigh is a director, there is a higher probability of exploration success.

Northern Vertex: Northern Vertex reported high-grade intercepts at high-grade Ruth vein, adjacent to open-pit at its Moss Project:

- 15.2m @ 9.11 g/t Au and 86 g/t Ag

- Including 6.1m @ 21.8 g/t Au and 211 g/t Ag

- 1.5m @ 69 g/t Au and 716 g/t Ag

- 3m @ 3.73 g/t Au and 22.85 g/t Ag

The emerging discovery at West Oatman:

- 53.3m @ 0.81 g/t Au and 14.7 g/t Ag

The intercepts at the Ruth vein are exceptionally high-grade relative to the reserve and resource grades. There is potential for the unification of the west and center pits and expansion of the center pit to the south to incorporate the former producing, high-grade Ruth vein. The West extension show solid continuity to the current resource with sporadic higher-grade intercepts along a strike length of more than 1.2km.

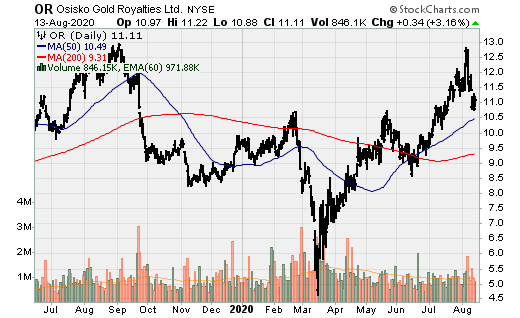

Osisko Gold Royalties: The company beefed up some of its royalties; those acquired from Teck Resources in Q4 2015. Osisko entered into an agreement to acquire the 15% ownership of Canadian precious metals royalties held by Caisse de depot et placement du Quebec (“Caisse”) for total consideration of C$12.5m. The portfolio consists of 28 royalties on properties located in Canada, including royalties on Alamos Gold’s Island Gold mine (which will see production increase approx. 50% post-expansion) and Eldorado Gold’s Lamaque mine (which will also undergo an expansion). This was yet another high-return investment albeit small for Osisko Gold Royalties. The last two years have seen the company consummate royalty deals with much more attractive returns relative to its royalty peer group. The only downside to this is that moves such as this don't really move the needle. It would be nice to Osisko invest $100-$250m over the next 9-12 months, adding a cornerstone asset or two.

Osisko Gold Royalties has been trading at a steep discount to its peer group and at a much lower NAV and cash flow multiple relative to the entire royalty and streaming niche [even those which are producing with production less than 1/10th of Osisko's. The company has embedded growth (bought and paid for) to see annual attributable production grow to 130-140k AuEq oz. I believe think Osisko would get a re-rate sooner rather than later as it will resume growth in 2022, primarily from a potential restart of the Renard mine, the expansion at Mantos Blancos, increased production at Canadian Malartic [which may begin 2020/2023] from the underground component, which has the potential to be very significant once optimized, and a full year of production from Victoria Gold’s Eagle mine (in 2021). It is also likely Osisko continues to build up its portfolio and likely will announced another material investment over the next 12 or so months.

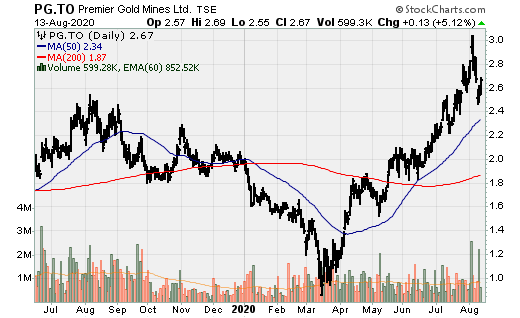

Premier Gold: Announced it will acquire the Getchell project in Nevada from Waterton Global Resource Management. It will acquire from Waterton, all of the outstanding membership interests of Osgood Mining company, which is the owner of the project for consideration consisting of $50m in cash and common stock, plus contingent value rights and warrants. Waterton will also receive purchase warrants amounting to 12.76m common shares, with an exercise price of C$3.67/warrant, for a period of 36 months. Waterton is entitled to receive and additional $5m upon the announcement of a positive production decision, and another $5m upon production of the first ounce of gold. This will become one of Premier’s core assets in Nevada.

Roxgold: Produced 32.8k oz. Au during Q2 at an average grade of 8.2 g/t Au, bringing the 1H 2020 production total to 65.19k oz. Au. The company also reported record quarterly throughput of 1.4ktpd for a total of 127.3k tons, which exceeded nameplate capacity by 300tpd (1.1ktpd). The company sold 36.28k oz. Au in Q2, generating revenue of $62.1m. Roxgold also generated record cash flow of $33.3m and free cash flow of $9.3m. During the quarter, the company released the results of the PEA for the Seguela gold project, which has an after-tax NPV5 and IRR of $268m and 66% @ $1,450/oz. Au, increasing to $548m and 121% at $2,000/oz. Au.

SIlverCrest Metals: The company owns Las Chispas, which is arguably has the most attractive silver project nearing a production decision. It is highlighted by exceptionally high silver and gold grades. The feasibility study (FS) is due out later in the year. The FS will look at upsizing the plant vs. that contemplated in the PEA of 1.25ktpd and likely end up somewhere between 1.5-2ktpd. Part of the decision will be based on the reserve and resource base.

Following the cut-off for drill results included in the PEA, Silvercrest has done nothing but continue to report additional excellent drill results, both infill and exploration. It has also made several new discoveries and hit the best intercepts [grade x thickness] on the project multiple times over the last year. This success continued today with the announcement of a new record drill hole; 1.7m @ 26,004 g/t Ag & 635 g/t Au or 73,595 g/t AgEq. The press release contained a total of 48 holes for a total of 124 holes drilled at Babi Vista. Most of the holes, although not very thick, were of high-grade silver and gold.

Silver Elephant: Announced some exciting results from its diamond infill drilling project from its Pulacayo project, Bolivia. Highlights include: 102m @ 145 g/t Ag, 1.05% Pb and 2.56% Zn, 5m @ 1,565 g/t Ag, 8.25% Pb and 3.85% Zn, 17m @ 274 g/t Ag, 1.13% Zn and 0.33% Pb, 66.7m @ 112 g/t Ag, 0.46% Pb and 1.13% Zn.

Vizsla Resources: Announced a new discovery with the company’s first drill results (2 holes) from the San Carlos mine on the Animas vein corridor at the Panuco silver-gold project. Drill highlights include: 1.5m @ 821 g/t Ag and 5.08 g/t Au within 6.75m @ 231 g/t Ah and 2.19 g/t Au.

Wesdome: Reported strong Q2 results from its two operations despite reduced operations at Eagle River complex. Company-wide production totaled 25.14k oz. Au, a 12.1% increase over Q2 2019. Wesdome generated operating cash flow of $30.2m and free cash flow of $17.7m, increasing its cash position to $66.7m at the end of Q2. Cash costs and AISC were $637/oz. and $879/oz. Wesdome resumed drilling activities on May 11th at Kiena, which is focused on resource conversion and some exploration drilling outside of the most recent resource estimate. It is expected the company will make a construction decision shortly following the completion of the pre-feasibility study in the 1H 2021. Kiena, as outlined in the PEA is low-cost, exceptionally high-return project. The PEA outlined a project with initial capital investment of $35m, producing on average 86k oz. Au annually (over an initial 8-year mine life) with cash costs and AISC of $374/oz and $515/oz. Using a gold price deck of $1,532/oz. yields an after-tax NPV5 and IRR of US$315m and 102%. Using a long-term gold price deck of $1,900/oz. yields and after-tax NPV5 of US$435m.

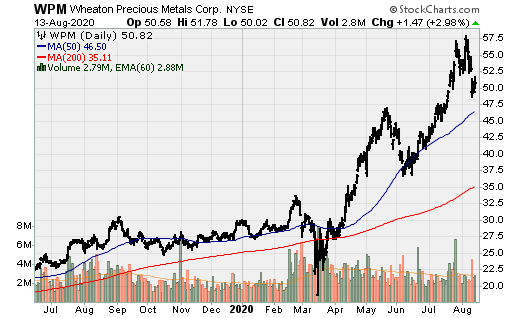

Wheaton Precious Metals: Many of the companies key streaming assets were impacted by the mandated shutdowns arising from CV19 protocols in Q2 2020 at least regarding attributable production (not sales). The company generated $151m in operating cash flow, on the back of higher gold prices. The company reduced its net debt by $80m, resulting in a net debt position of $509m, although the company does own securities worth in excess of $200m. Wheaton will see an impact in Q3 as the amount of gold and silver produced but not delivered decreased in Q2 (hence why sales were well above production levels), which will likely reverse in Q3.