Volatility continued this week as gold and silver consolidate. Early Thursday, Fed chairman Powell, essentially said that the U.S. would allow for considerably higher consumer price inflation rates for longer period of time. We will get consumer price inflation at some point in the near future but this time around the U.S. isn’t structurally sound enough to pull another Paul Volcker. These words from the chairman should have helped the metals, though this is more of the same from Powell of late, and might have already been priced in. Mining equities also continue to be very volatile, which has and should continue provide opportunities (for a bit longer at least).

It is important to understand, especially those investors who are newer to the sector that even if gold and silver prices drop a bit to say $1,800/oz and $23/oz., the mining equities will still go up as the implied old and silver prices in the valuations of many mining stocks are $1,675-$1,750/oz. and $20-$21/oz. I’m still of the belief that gold and silver prices could correct further, looking for gold to go as low as $1,825-$1,860/oz. and silver to $20-$22/oz. before we begin the next leg higher, although this would have to happen sooner rather than later just because there are so many potential catalysts for the precious metals. At this point, the biggest risk to the miners Is on the upside so it’s best that most are near fully invested (>75%).

For the second consecutive week, it was mostly a quiet week in mining. Given the much-improved equity markets, though still quite undervalued, there continues to be more equity raises, especially among juniors, just not to the degree in which we saw financings over the last three to four weeks.

$ARTG.V, $BRC.V, $CGC.V, $F.V, $KNT.V, $MKO.V, $MTA, $NAK, $NSR.TO, $SBB.TO, $SILV, $SLV.CN, $SKE.TO, $VZLA.V

Artemis Gold; Announced the closing of the acquisition of the Blackwater Project from New Gold. Artemis now holds a 100% interest in the project. The total purchase price for the project includes: I) An initial $140m payment (now paid); II) 7.407m common shares of the company at a deemed issue price of $2.70/share (which has been issued to New Gold); III) A $50m cash payment to be paid one year following the close of this deal; and IV) a secured 8%/4% gold stream with on-going per ounce payments equal to 35% of price quoted by the LMBA two days prior to delivery. The company also published a revised PFS for the project. Instead of incurring approx. $1.3-$1.4B of initial capital invesmtnet, the PFS envisions a smaller-scale startup, following by two expansions, such that Artemis needs to only incur $600m of initial cap-ex, followed by $425m for phase-II, and $400m for phase III. On-going cash flow generation will greatly reduce the financing needed to build the project and complete the expansion. Using an $1,800/oz. gold price, the NPV5 and IRR are significant at $3.05B and 42% and using a $2,050/oz. gold price deck, the NPV5 and IRR increase to $3.825B and 50%. Once the expansions are completed, this will be a 20mtpa operation.

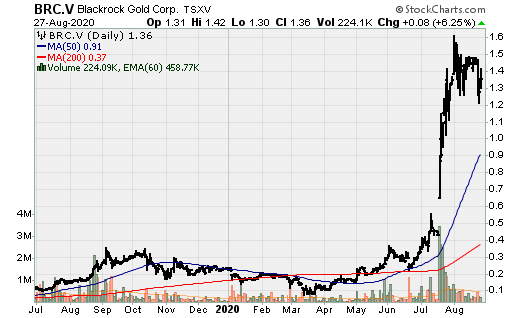

Blackrock Gold: Mobilizes second drill rig and expands initial drill program to 20k meters at the Tonopah West project.

Caldas Gold: The company both announced the term for its private placement offering of up to $90m of subscription receipts and closed the offering two days later, totaling $83m. Each subscription receipt will convert into one unit comprised of one senior secured gold-linked note in a principal amount of US$1,000 and 200 common share purchase warrants of the company. Each warrant will entitle the holder thereof to acquire one common share of the company, at a price of CA$2.75 per Warrant Share until July 29, 2025.

Fiore Gold: Reported its FY Q3 2020 operating and financial results. Q3 gold production was a record at 12.76k oz., the second successive quarter of record output. The company generated $10.5m in operating cash flow on revenue of $22m. The company boosted its cash balance to $17.3m, an increase of $8.2m relative to the previous quarter. The next potential catalysts for the company would be the advancement of its Gold Rock project. On May 19th, 2020, Fiore announced a 2m oz. M&I resource at its Golden Eagle project in Washington state.

K92 Mining: The company continues to do what it has been so successful at doing over the last 2+ years, announcing additional high-grade drill results, this time inclusive of the first hole from most southerly drill cuddy. Highlights include:

- 5.06m @ 49.8 g/t AuEq and 19.15m @ 15 g/t AuEq

- 4.21m @ 133.8 g/t AuEq

- 4.57m @ 10.21 g/t AuEq

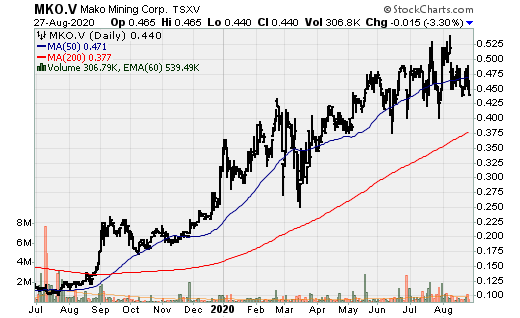

Mako Mining: Received the permit amendment to process up to 1ktpd at the San Albino gold project in Nicaragua. This will essentially allow the company to double production from the start, and makes it far easier to generate material cash flow. Average annual production will be close 80k oz. Au p.a. @ AISC of just $395/oz. There is still exploration potential in and around San Albino but on its other exploration property as well. Mako and Calibre will be the two leading Nicaraguan gold companies, both with excellent exploration potential. Mako also has one of the highest grades for an open-pit globally at 8.02 g/t AuEq.

Metalla Royalty & Streaming: Announced results for its FY 2020 and provided select asset updates. During the year ended May 31st, 2020 and the period after (just under 3-months) the company;

- Acquired a 2.0% NSR on the La Fortuna deposit (The Cantarito Claim) and other exploration grounds, which form part of the NuevaUnion project in Chile (JV b/t Newmont & Teck Resources). The project as a whole is one of the largest undeveloped Cu-Au-Mo projects in the world.

- Acquire Idaho Resources Corp for $2m. With the acquisition, Metalla now holds a gross-overriding royalty (GOR) of 0.50% on Nevada Gold Mine’s (JV b/t Newmont & Barrick) Anglo-Zeke claim block in Nevada, located on trend to the southeast of the Cortez operations and Goldrush project. Further, included in the deal is a 1.5% GOR covering NuLegacy Gold Corp’s Red Hill project in Eureka County, Nevada, which is contiguous to the southeast of the Anglo/Zeke claims.

- Acquired a 3.0% NSR on St. Barbara’s Fifteen Mile Stream gold project on the Plenty deposit and Seloam Brook prospect.

- Acquired a 1.0% NSR on the operating Wharf Mine (Coeur Mining)

- Entered into an agreement with NuEnergy Gas Ltd to acquire an existing 2.50% NSR royalty on the northern and southern portions of Kirkland Lake Gold’s Fosterville mine.

Metalla continues to successfully position itself for exceptional longer-term growth, most of which won’t be realized until the next cycle, simply because the royalties on many of these projects are many years away from production or construction.

Metalla also provided some other asset updates. The COSE and Joaquin royalties will begin contributing higher revenue in the 2H of the year. These royalties started to pay out this year, however, because of the suspension of mining operations and related protocols due to CV19, production was light in the 1H 2020. Further, both mines being primarily silver; prices having more than doubled since the low’s in March, should cause attributable revenue to increase much more than it otherwise would have. After decades of successful mining operations, CBH Resources LTD, the operator of the Endeavour Mine suspended operations in late-2019 and placed it into care and maintenance. The focus is for a potential future mining in the recent discovery of the Deep Zone Lode at depth and potential open-pit that was initially outlined in a historic study completed in 2007. Given that silver prices have risen by a material degree, this could lead to CBH resuming operations more quickly than would otherwise be the case.

Metalla also provided asset updates for its New Luika silver stream (15%), Santa Gertrudis (2.0% NSR), Fifteen Mile Stream (1% NSR on the Hudson, Egerton-Maclean, 149 and the majority of the Plenty deposit and a 3% NSR on the remainder of the Plenty and Seloam Brook), El Realito (2.0% NSR), Hoyle Pond Extension (2.0% NSR), Wasamac (1.50% NSR subject to a 0.50% buyback for $7.5m), Beaufor Mine (1.0% NSR commencing after 100k oz. Au have been produced), San Luis (1% NSR), Zaruma (1.50% NSR), NuevaUnion (2.0% gold only NSR on a portion of the project), among others. Aside from the royalties on Fifteen Mile Stream and New Luika silver stream, the other assets mentioned herein range from exploration to advanced development.

Nomad Royalties: Announced two pieces of exciting news for the mid-sized royalty and streaming company [comparable vs. Maverix Metals, but not the “big 5”, and substantially larger relative to the likes of Ely Gold Royalties, Metalla, Vox etc.). Nomad announced it would acquire Coral Gold for nearly $46m. Through this acquisition, Nomad will add a sliding-scale 1.0-2.25% NSR royalty on Nevada Gold Mines’ Robertson property, which forms part of the greater Cortez & Pipeline mining complex. The scale of the royalty is gold price dependent and using a $1,940/oz. gold price, the applicable royalty rate is currently 2.0%. The Robertson development project has a historical Inferred resource estimate (2012) of 2.7m oz. Ag. There are minimum advance royalty payments totaling $0.5m/years for 10-years commencing in 2025.

In a separate transaction, announced the same day, Nomad Royalty will acquire a small cash flowing royalty on the producing Moss Gold Mine in Arizona. Nomad announced it would acquire a private royalty company [Valkyrie Royalty] that owns a small NSR royalty on the Moss mine for $7.6m. The royalty consists of a 0.50-3.0% NSR on all metals produced from specific claims within the property as follows:

- A 1.0% NSR on certain patented lode claims with no other royalty within the property.

- A 0.50% overriding NSR on all production within the property derived from certain patented load claims with other royalty interests.

- A 3.0% NSR on any and all production derived from 63 unpatented lode claims within the property and on public lands within 1 mile of the property’s outside perimeter of the present claim’s boundary.

This is a smaller royalty as even if material is being mined from the 3% NSR grounds, attributable production will only be approx. 1.8k AuEq oz.

Northern Dynasty: There was a report that the Trump administration will block the Pebble project. The company denied this but that didn’t stop the stock price from taking a big hit, followed by a partial recovery. The road toward a construction decision has been long and it looks as though it will be a while longer, if it ever does get the go-ahead.

Sabina Gold & Silver: Provided an update regarding its Back-River Gold project. Since the 2015 FS study, the project has changed considerably and has achieved key milestones. The company continues to move the project closer to a construction decision. It is fully permitted for construction and operations with basic engineering completed and advancement of detailed engineering. Sabina has also discovered a large new mineralized zone at Nuvuyak, identifying and drilling a higher-grade corridor of mineralization within the Umwelt underground resource and extension of the Llama gold structure by over 500m down plunge from the current resource.

The company is currently trying to put together a financing package, comprised of debt and equity. Following the 2015 FS, the gold price in CAD’s has increased from C$1,438/oz. to C$2,560/oz.

There are on-going internal studies to maximize the NPV of the project as new, higher-grade discoveries have been made since the 2015 FS, so the company is revisiting mine sequencing to significantly impact the production profile, notable in the earlier years of production. Sabina will release an updated FS in Q1, 2020. Given the increase in resources, new higher-grade discoveries, and on-going infill drilling (in addition to higher gold prices), the economics of the project should be very robust. If the company can make this project even larger, i.e. average annual output of 250k+ oz. Au, this will be a world class development project given its scale, cost, jurisdiction, and potential mine life.

Silvercrest Metals: Announced the acquisition of the El Picacho property near Las Chispas. The purchase price is minimal at $1.6m as this could serve as a future satellite deposit or stand-alone project. This property isn’t new to the company as it looked into acquiring it back in 2016 [following the first iteration of Silvercrest]. The company expects to start an exploration program at the property before year end.

Silver Dollar Resources: The company reported 2m in drill core of 1,778 g/t AgEq from the La Joya silver project in Durango Mexico. Originally, this was the Silvercrest Mine’s asset [1st iteration], which was then absorbed by First Majestic following the takeover of Silvercrest Mines. Silver Dollar has been granted an exclusive option to acquire up to a 100% interest in La Joya (Ag-Cu-Au). The following drill results from the phase III drilling program, completed by Silvercrest in Q1 2014, were not previously reported but obtained through the file-sharing arrangement with First Majestic. This drill program hit mineralization in 15 of 17 holes. This was a larger, low-grade resource with presence of higher-grade mineralized areas. There is also near-surface mineralization outcropping. Assay highlights from drill core sample include the following (in addition to the highlight hole previously mentioned):

- 5.15m @ 180 g/t AgEq

- 12.3m @ 204 g/t AgEq

- 0.95m @ 463 g/t AgEq

- 1.2m @ 500 g/t AgEq

- 6.1m @ 382 g/t AgEq

- 1.4m @ 464 g/t AgEq

- 11.65m @ 202 g/t AgEq

Skeena Resources: Eskay Creek continues to get more exciting as Skeena announced a new discovery of deep mineralization in lower mudstones (which lies beneath the historically mined contact mudstone sequences). The highlight intercept was 35.42m @ 25 g/t Au. The company also released 21A zone infill drilling highlights: 34m @ 5.9 g/t Au, 35.4m @ 21.9 g/t Au, and 36.5m @ 6.5 g/t Au.

Vizsla Resources: Announced a third new discovery with the company’s first step-out drill results along the Napoleon vein corridor at the Panuco silver-gold project. The drill highlight from this press release is 2.5m @ 689 g/t Ag, 3.76 g/t Au, and 0.88% Pb + Zn. This was part of three drill holes at The Papayo Zone, with assays pending for the other two holes.

Vox Royalty: The company acquired a producing royalty over South America’s largest diamond mine, Brauna. Vox will acquire a 0.50% gross sales royalty in exchange for C$330k [C$165k cash and C$165k in stock]. Osisko Gold Royalties also owns a royalty interest in Brauna, a 1% gross revenue royalty.