I’ve been right in my prediction that the Fed would pause in June, and hike once or twice more before the end of the year.

I’ve also voiced my opinion that we will get a soft landing with no, or an extremely shallow and very short recession, with the important proviso that the Fed pauses its rate-hiking cycle, which it has already done. For the Fed this means the inflation rate is coming down. Remarkably, the Federal Reserve has raised interest rates high enough to reverse the inflation rate, without causing a severe downturn. And it’s done it in an extremely short amount of time.

Despite these facts, many believe a hard landing and a recession is coming. Daniel Lacalle, an influential economist, is one of them.

According to Lacalle, while the year is ending optimistically, with many investors expecting rate cuts and an economic soft landing, in fact a soft landing is a very rare event. “Since 1975, there have been nine rate hike cycles, and seven of them ended in a recession,” Lacalle writes.

One common misunderstanding is the concept of “landing”. According to Lacalle, even a soft landing is recessionary, because it is “a significant decline in the aggregate money supply, which entails lower credit and access to capital for families and businesses.”

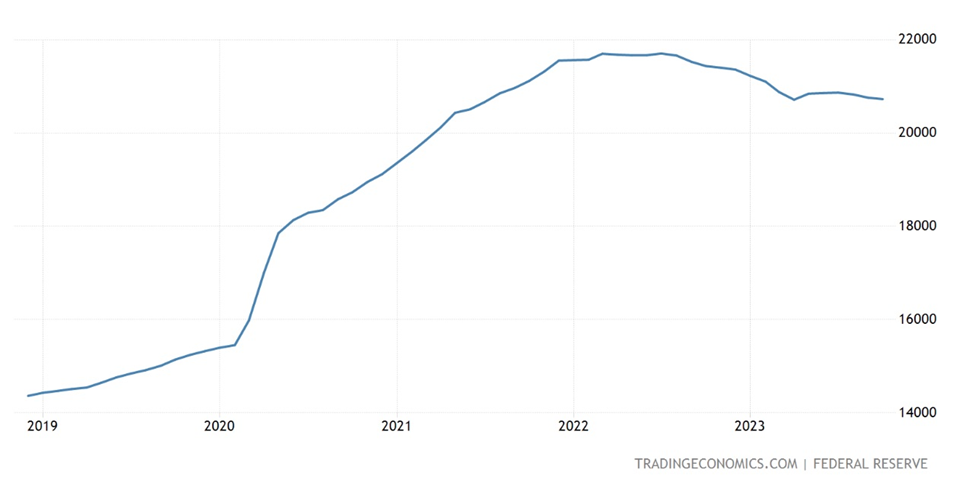

Arguably, this is what we see happening currently. M2 money supply in the United States fell roughly 4% year on year in September, while in the euro area the broad monetary aggregate M3 is shrinking too. The interest rates on mortgages, car loans and personal loans have all pushed higher, with the Fed’s overnight lending rate sitting at 5-5.5%.

“There is no other way to lower inflation, which the extraordinary and unnecessary increase in the money supply in 2020 caused,” says Lacalle, and he’s right.

2008 vs 2020

This brings up the question, why is there such high inflation now, compared to the financial crisis in 2008, when the Fed’s quantitative easing program (four rounds of it) injected trillions of dollars worth of liquidity into the financial system?

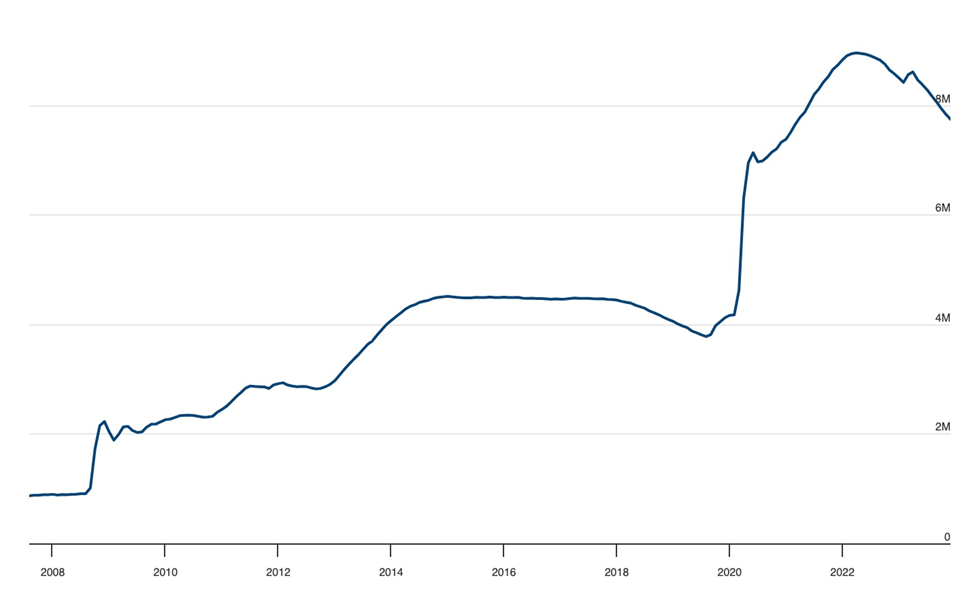

To fight the Great Recession, the Fed began “printing money” (actually they just added it on a computer screen, but the effect was the same). Between 2008 and mid-2014 the Fed increased their balance sheet from $800 billion to $4.5 trillion, thus helping to recapitalize banks that were in danger of going bankrupt, and restoring confidence in the economy.

But most of the new money never made its way into the economy; it stayed within the banks and much of it wasn’t even leant out. We therefore didn’t see any real inflation. In fact during this time inflation averaged about 1.6% a year, below the Fed’s 2% target.

Once the pandemic started in early 2020, the Federal Reserve resumed quantitative easing at a torrid pace, within weeks printing $3 trillion and again lowering interest rates to 0%.

The key difference between QE from 2008 to mid-2019, “quantifornication” I like to call it, and 2020, is that the Federal Reserve bought up US government debt (Treasuries) to fund a massive amount of government spending that got added to the national debt currently sitting at nearly $34T.

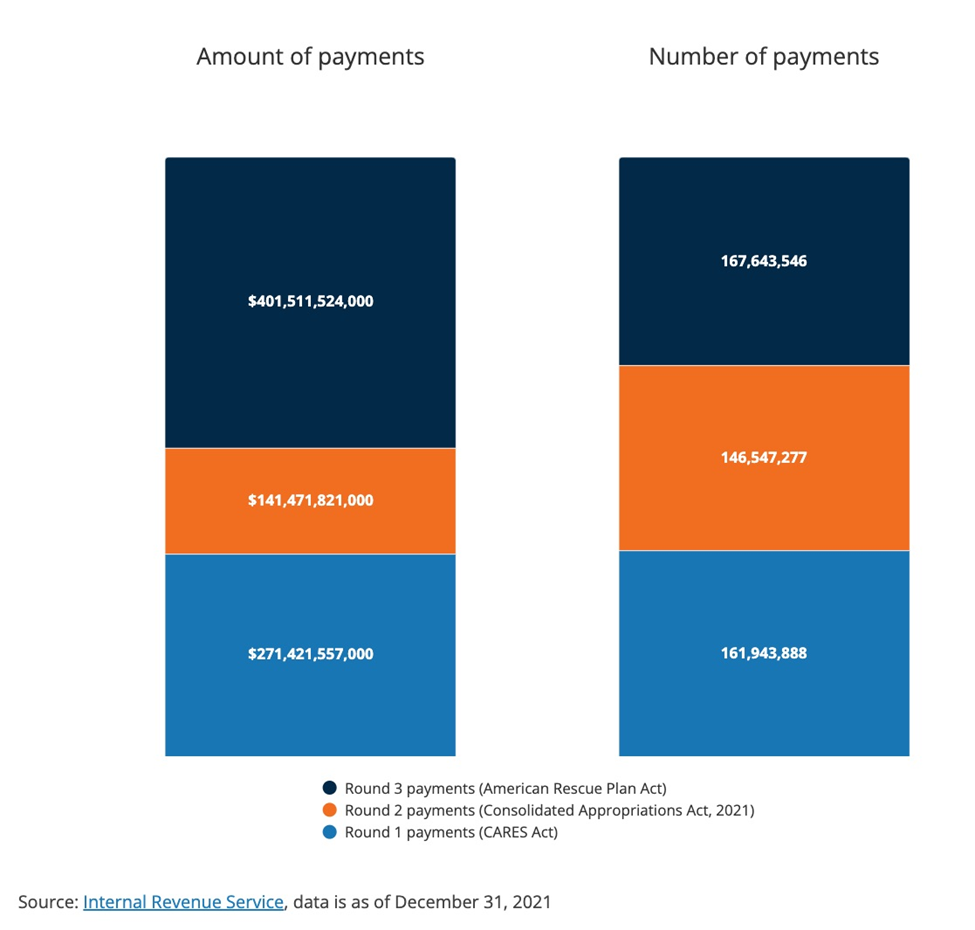

US politicians were willing to spend whatever it took to get the economy moving again and to maintain a bullish stock market. First there was the $2.2 trillion CARES Act passed by then-President Trump. It was followed in early 2021 by President Biden’s $1.9 trillion covid relief bill.

All of this pandemic-related spending dramatically increased the “M2” money supply, shown below.

M2 money stock. Source: Trading Economics

M2 money stock. Source: Trading Economics

From March 2020 to November 2021, the Fed more than doubled its balance sheet to $8.7 trillion. The central bank raised its monthly bond purchases to $120 billion in December 2020, saying that the pace would continue until there was “substantial further progress” in the economic recovery.

The Federal Reserve’s balance sheet. Source: US Federal Reserve

The Federal Reserve’s balance sheet. Source: US Federal Reserve

The federal government too demonstrated its willingness to “do anything” to get an economic recovery and that included sending stimulus checks to individual Americans.

According to Pandemic Oversight, more than 476 million payments totaling $814 billion in financial relief went to households impacted by the pandemic.

Source: IRS

Source: IRS

In 2008 regular people received no such payments, in fact the main recipients of US government generosity were the banks and large US corporations. According to MIT, the direct cost of the 2009 bailouts was $498 billion. Of this, the Treasury Department was authorized to buy up to $250 billion in bank shares, which it later sold for a profit, from among Troubled Asset Relief Program (TARP) assistance totaling $245.1 billion. Government capital fusions into Fannie Mae and Freddie Mac totaled $191.5 billion.

This also explains why financial crisis fiscal policy was not inflationary whereas 2020 fiscal policy was, and is — all the money or most of it in 2008-09 stayed within the banks or large corporations, and almost none of it made it into the economy. By contrast, in 2020-21 $814 billion was given directly to Americans. In the United States consumer spending accounts for roughly two-thirds of GDP. How have Americans spent that money? There’s no way of knowing for sure. Some socked it away in savings accounts, others used it to buy bitcoin and meme stocks, but a good portion spent it on goods and services, helping to drive the economic recovery as well as pushing inflation higher.

Lacalle has a more technical explanation for no inflation between 2008 and 2019. Quoting from Richard Burdekin’s paper ‘The US Money Explosion of 2020: Monetarism and Inflation’, he says “the key point is that the decline in the money multiplier largely offset the enormous increase in base money.”

In plain English, this means that the Fed gave the money to the banks which then held it in their reserves. They didn’t loan much of it out even though that was the intention. This also constrained the money supply and limited the velocity of money, which is the pace at which money changes hands throughout the financial system.

By contrast, in 2020 there was not a huge increase in bank reserve holdings. Between February and September 2020, Lacalle says the monetary base rose from $3.4 trillion to $4.8 trillion, while M2 money supply went from $15.4T to $18.6T, an increase of 20.7%.

“Since then, accumulated inflation in the United States has exceeded 20%, and rate hikes, added to a reduction of the balance sheet of the major central banks, have been the answer to containing the rise in prices.”

The Fed pause

The Fed is on pause. A wait-and-see approach – have they done enough to cool inflationary pressure, seems like, or do they need to raise, potentially twice more, to get inflation into their preferred Goldilocks zone?

If, as so many believe, we are in a recession, or will be shortly, it’ll be so shallow and brief it will be over long over before it’s even recognized as a recession in the middle of 2024.

We all need to remember, the Fed didn’t want to raise interest rates. That’s why it took so long for them to commit to a tightening program and there was all that talk about inflation being “transitory”.

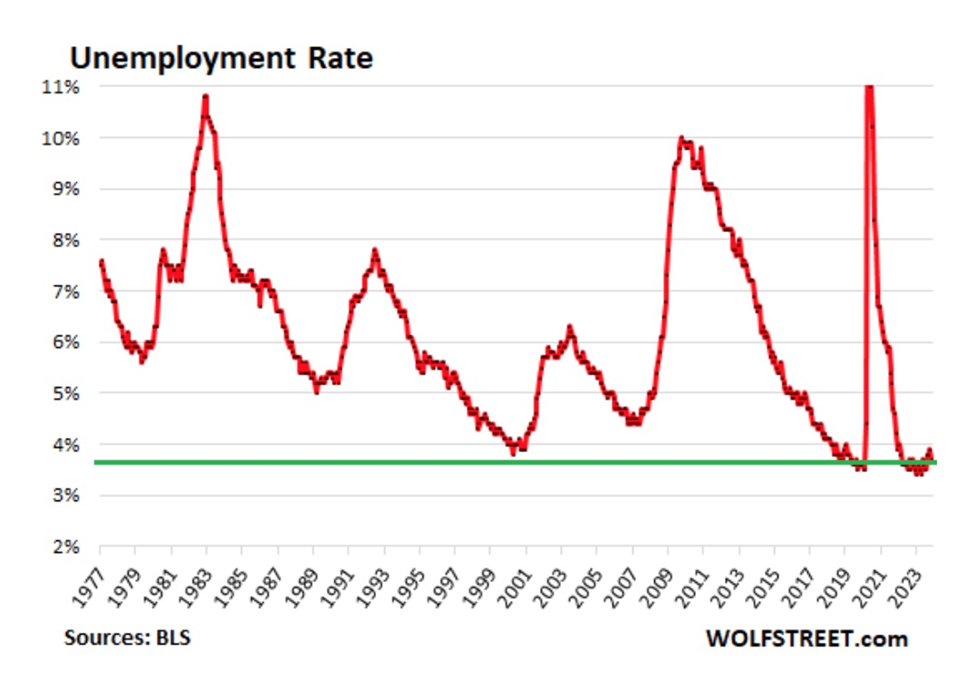

When they did, they hiked with a vengeance, putting interest rates higher 11 times in under two years, knowing that historically, this is the best way to engineer a soft versus a hard landing.

Now the Fed is waiting to see how much damage the rate increases have done to the economy.

The lag effect

We know that money supply growth has been negative for the past year. Year to date, the decline is -4.5%. In fact, it’s the first decline in money supply since the 1930s.

This should have a negative effect on the economy, but according to Lacalle, the reason it’s not, “is because the amount of liquidity injected in 2020–21 was so enormous that there is a lag effect as savings are consumed, and the accumulated money growth effect keeps credit conditions relatively loose.”

In effect what he’s saying is that things are going to get much harder for the American consumer, as they run out of savings, loans will be renewed at higher rates, and credit generally will be harder to get.

This is another reason the Fed is on pause; they’re waiting for the lag effect make its way through the economy. In my view there are three potential outcomes: number one, the Fed sees the economy running too hot, with inflation still too high, and decides to bump up rates once, maybe twice more. Number two, the Fed does nothing and keeps waiting for more information on which to make a decision. Number three, the economy takes a major turn for the worse, and the Fed thinks it has to lower rates, say 25 basis points, just to inject some optimism and heat the economy back up.

(Wolf Street asks why the Fed would “pivot” to multiple rate cuts starting in the first quarter of 2024, with the labor market booming. Average hourly earnings grew for the third month in a row, rising at an annualized 5% in November. Moreover, services inflation is still running hot, at 4.6% according to the PCE price index and 5.5% according to CPI. To see how historically low the unemployment rate is, view the chart below over the past 40 years.)

In Lacalle’s view, the problem is that inflation remains elevated. The CPI rose 3.2% in October, with core CPI (excluding food and energy) hitting 4%. But here’s something interesting. Due to the continued decline in the money supply, Lacalle says inflation should already be below 2%.

“Government spending and massive consumption of newly created units of currency are keeping inflation above where it should be,” he writes.

“If next year we see rate cuts and money supply growth, accumulated inflation from 2019 will likely surpass 23%, when it stands at 20.3% in the latest figure.”

Ouch. If you think that won’t have a major impact on the average American’s spending habits, you haven’t been paying attention.

Let’s take a closer look at increased government spending. Lacalle maintains that inflation would be coming down faster if it weren’t for the fact that, “fiscal policy, for the first time in decades, is moving in the opposite direction of monetary policy. And this is likely to create significant problems in the future.”

We first pointed out this clash between the federal government and the Federal Reserve back in 2018, when Trump was president. The Fed at the time was raising interest rates, to the disappointment of Trump who wanted to keep them low.

Consider: As the Fed pursues a tight monetary policy, unwinding its balance sheet and raising interest rates, the Treasury is printing money that the federal government keeps spending to fulfill its many promises. The Biden administration’s three signature pieces of legislation — the Inflation Reduction Act, the Bipartisan Infrastructure Law and the CHIPS and Science Act — are costing trillions.

Remember too, that most of this promised money has yet to be spent.

Unsurprisingly, inflation has added a huge chunk to construction project costs, which has also meant delays. An Economist article notes that the biggest component of the infrastructure package was a 50% increase in funding for highways to $350B over five years. But highway construction costs soared by more than 50% from the end of 2020 to the start of 2023, in effect wiping out the extra funding.

Another problem is “Buy America” rules requiring builders to source materials at home, along with touchy-feely requirements to promote racial equality, fair wages, and environmental sustainability.

The law included more than 100 new competitive grant programs, which require new application systems and new compliance procedures. Some state and local officials are not even bothering to apply for funding.

America’s separation of powers between the federal government and the states has also thrown a wrench into infrastructure improvements:

There is a substitution effect as the arrival of federal money allows states to step aside and spend less on construction. A recent wave of tax cuts by states has been made possible in part by the gusher of federal cash.

Getting permits is yet another obstacle, familiar to those in mining.

The federal government keeps spending money and the Treasury keeps printing it, to cover the deficits which keep mounting. Around $13 trillion in government debt is expected to roll over next year, at much higher rates, meaning more money-printing is on the way.

Gold blip

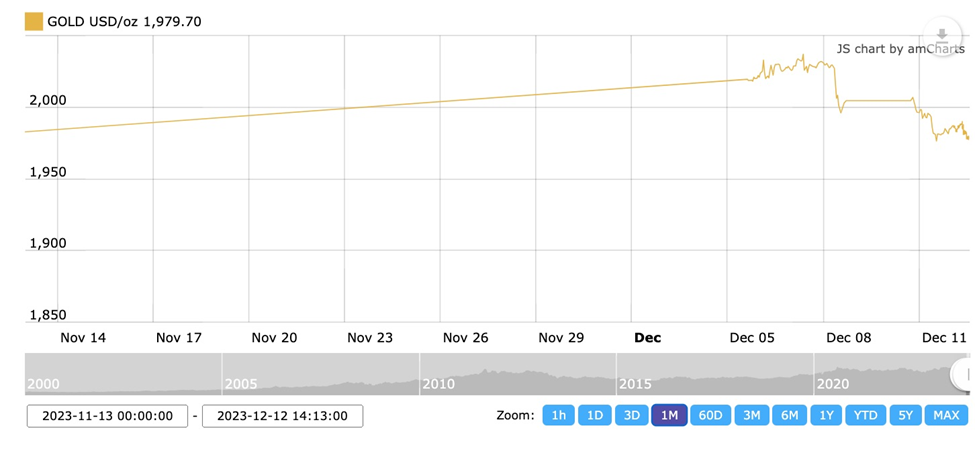

Getting back to the idea of a soft landing, many investors earlier this month placed a bet on bullion when they figured the Fed was planning to lower interest rates in 2024. Spot gold hit a new record-high $2,100 an ounce on Dec. 3. However, as we argued in Gold not yet, copper will retest $4, gold is not going much higher until the dollar starts weakening (the US dollar index DXY is still well above 100), and we have negative real rates. With inflation currently at 3.1% and the yield on the US 10-year Treasury at 4.2%, real rates are currently +1.1%.

The gold price as of this writing is $1979.80, 6% lower than the $2,100 record set on Dec. 3.

One-month spot gold. Source: Kitco

One-month spot gold. Source: Kitco

The direction of a weakening dollar is clear, with the Federal pausing its tightening cycle after a series of interest rate hikes. But we’re not there yet. If and when he Fed cuts rates in 2024, it will weigh on both US Treasury yields and the greenback — both positives for gold.

Another point is we’re not within the “gold to the moon” camp of people who think gold is going to $5,000. How negative would real interest rates have to get for a gold price that high? It would almost certainly mean an entire collapse of the global monetary system. Not something we’d want to see or a world we’d want to live in.

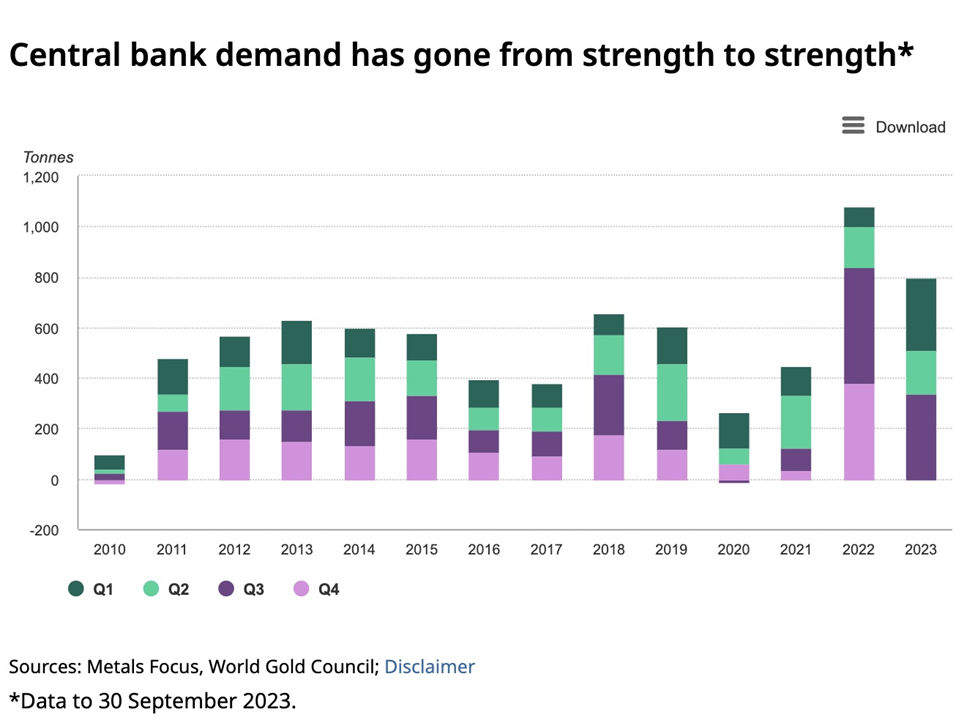

Central bank gold buying

Considering the additional risk to currency destruction that 2024 brings, it is not surprising to see central banks loading up on the precious metal. Lacalle notes that central banks have reached a record figure of purchases of gold in the first three quarters of 2023, surpassing the 800-tonne level. This record figure of gold purchases by central banks, a 14% increase from the 2022 level, reflects the need to strengthen and diversify their reserve base, reducing the exposure to sovereign debt, which has created net losses in the past two years, and increasing the holdings of an asset, gold, that guarantees stability and rising purchasing power over time.

According to the World Gold Council, central banks bought 337 tonnes in the third quarter, which is the second-highest Q3 on record.

Source: World Gold Council

Source: World Gold Council

Gold ETF sales slow

In another positive trend for gold, the flow of metal out of gold-backed exchange traded funds (ETFs), slowed considerably in November. North American funds saw gold flow in rather than out for the first time in five months, recording a 10.4-ton increase. Nine tons moved out of ETFs globally, which were valued at $212 billion as of Dec. 1.

Monetary debasement & De-dollarization

On the other hand, things are certainly moving in the direction of monetary basement. Daniel Lacalle says “the massive destruction of the purchasing power of the currency continues,” with “gold now the only real defense against the loss of the purchasing power of fiat currencies.”

Some may say that bitcoin is an inflation-fighting alternative to gold, but Lacalle isn’t one of them, and neither are we. That’s because “bitcoin, stocks, and bonds are all directly correlated with the expectations of a larger money supply and lower rates, but none of them are effective ways to offset the constant and inevitable destruction of currencies.”

Over the past few years, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

Dollar collapse will happen ‘gradually, then suddenly’

As Reuters noted in a story on May 25, Rivalry with China, fallout from Russia’s war in Ukraine and wrangling once again in Washington over the U.S. debt ceiling have put the dollar’s status as the world’s dominant currency under fresh scrutiny.

One of the most telling signs of de-dollarization is the decline of the dollar’s share of official foreign exchange reserves. The main reason this is happening, is central banks diversifying to other currencies, following Russia’s invasion of Ukraine. When the United States punished Russia by freezing half of its $640 billion in gold and FX reserves, other countries thought “the same thing could happen to them”. Among the countries re-thinking their foreign exchange composition, are Saudi Arabia, China, India and Turkey.

Furthermore, commodity-producing countries have started conducting trade in currencies other than the greenback. For example, India has started purchasing Russian oil in UAE dirham and roubles, China paid for $88 billion worth of Russian oil, coal and metal in its home currency, the yuan, and Chinese state-owned oil company CNOOC and France’s TotalEnergies in March completed their first yuan-settled LNG trade.

According to the Bank of International Settlements, the yuan’s share of global forex transactions went from almost nothing 15 years ago to 7%.

The Daily Bell notes that, as the yuan’s influence increases, other countries will start holding more of it, to trade with China, meaning less demand for dollars.

President Emmanuel Macron is urging Europe to become independent from US foreign policy and to rely less on the dollar. Despite being one of American’s oldest allies, France, as mentioned, completed its first liquefied natural gas trade settled in yuan.

Before that, China bought LNG from the UAE using its own currency.

Most importantly, Saudi Arabia is reportedly open to breaking the petrodollar and to sell oil in yuan. According to the Wall Street Journal,

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

Malaysia, meanwhile, struck a deal with India to trade in the rupee and its Prime Minister has proposed an “Asian Monetary Fund” to reduce dependence on the US dollar, The Daily Bell states.

Adding credence to the notion that US dollar hegemony has peaked, Bloomberg macro strategist Simon White argues that hegemony is not about the dollar’s value, rather, it’s about the dollar’s place in the global financial system. His article carried by Zero Hedge presents four charts proving that dollar dominance is starting to be challenged.

Finally, an article on Dollar Collapse notes that three events happened within a a short time to bolster de-dollarization. They are:

The COVID-19 pandemic, which led to lockdowns and stimulus, “blew the “first three D’s” of the gold bull thesis — debasements, deficits and debt — to even more absurd proportions.

The weaponization of the financial system toward foreign adversaries, mentioned above, changed the calculus of holding USD foreign reserves.

US “exoribitant privilege” became more conspicuous and overt.

“Now, “de-dollarization” isn’t some unthinkable scenario, it’s a thing,” writes Mark Jeftovic. “The BRICs are already planning an alternative system and we’re seeing more transactions that were previously settled exclusively in USD, being settled in alternative currencies — including gold.

The latest example is Zambia, with Business Insider reporting the Bank of China’s office in Zambia is pushing the yuan to be used in more trades with Africa’s second largest copper producer and its neighbors.

And this just in: China is again dumping US dollars in global currency markets to protect the yuan. Watcher.Guru reports Chinese state-run banks offloaded greenbacks in the spot foreign exchange markets on Dec. 4-6, after ratings agency Moody’s cut China’s outlook to negative.

There is even an idea, sounded out by The Guardian, that it is time to make Russia pay for its war in Ukraine by confiscating the $300 billion in Russian central bank assets currently frozen by Western states!

If this happens, it will be a major catalyst for de-dollarization. Every developing country will immediately stop using the dollar because they realize that their dollar holdings could be frozen and sold at the whim of the US Congress.

Buying dead flowers

Institutional investors tend to prefer investments that are thought to contain the potential for growth, growth = sprouts. An investment has to produce a growing revenue stream – if it doesn’t grow it doesn’t compound. Silver and gold are rejected as investments because they don’t produce sprouts, meaning the steady income and systematic growth so sought after by institutional investors just isn’t there.

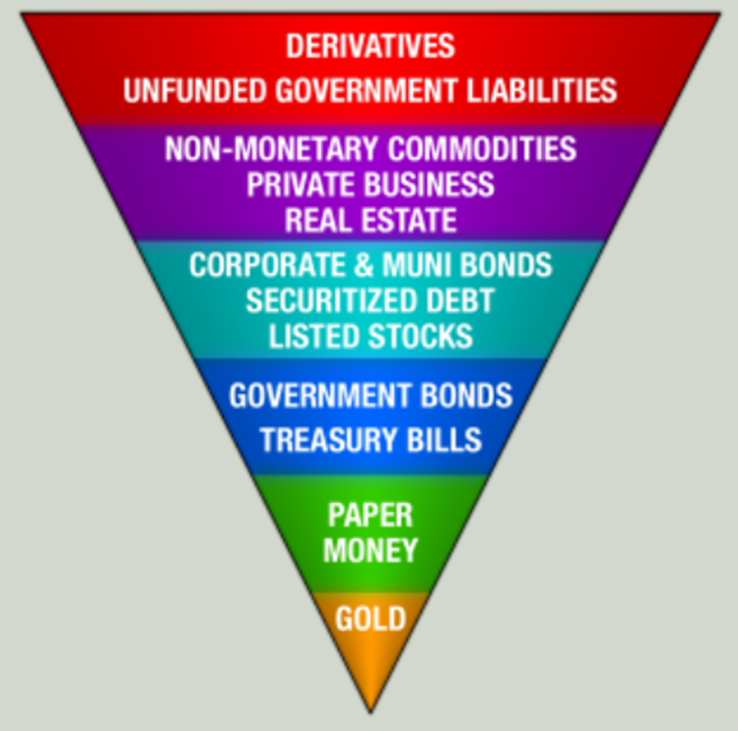

John Exter was an American economist and a member of the Board of Governors of the United States Federal Reserve System. Exter is known for creating Exter’s Pyramid – useful for visualizing the organization of asset classes in terms of risk and size.

When the credit system is expanding most money flows to the top of the pyramid – the increasingly speculative and illiquid investments. When the credit system comes under pressure and debt cannot be repaid, the items at the top of the pyramid get sold and money flows towards the bottom.

“In order to make use of it though, we must first make the distinction between real wealth and claims on wealth. Real wealth is represented by actual items that people want or need. This can be food, land, natural resources, buildings, factories etc. Financial assets, shown as layers in the pyramid, represent claims on real wealth. In a fully developed financial system, in good perceived standing, there is a high ratio of claims on wealth to actual underlying real wealth. In this environment the average buying power of the financial assets is lower. This can best be observed by looking at the purchasing power at the bottom of the pyramid. Gold is at a minimum here. It is competing with all of the other claims on wealth for a relatively constant amount of underlying real assets.

According to Exter’s theory of money, when economies get into trouble through the accumulation of too much debt, the levels of the pyramid disappear in order from highest to lowest. As the pyramid contracts downward, the remaining layers represent a proportionally higher claim on the real underlying wealth. In other words their value increases. Using gold as our reference point, it’s relative purchasing power increases as the pyramid contracts. Gold finds itself in a secular bull market.

In the extreme hypothetical case where all other asset classes are destroyed, including the currency itself, only gold remains. In this case the holders of gold compete with no other financial assets for claims on the underlying wealth. This scenario represents the ultimate clearing of the economy. All currency denominated debts have been wiped clean.

If a market economy remains in place then the pyramid begins to expand and grow again. The wealth claims represented in gold will be deployed as investments and a new currency will emerge that garners the faith of those who use it. As this new economy grows and expands, the previous instruments of credit and financing will appear again. Layer upon layer are added back to the pyramid.

From the perspective of gold, its relative purchasing power decreases as it competes with these new financial assets for claims on the underlying real wealth. Gold is in a secular bear market as the newest levels of the pyramid are in their growth phase. This model provides a useful intuitive understanding of the alternating secular bull and bear markets of commodities vs. equities.” Trace Mayer, The Paper Empire

Conclusion

De-dollarization is one reason for central banks to own gold but the bigger rationale for gold purchases is the destruction of fiat currencies.

Lacalle writes that

“Gold is now the only real defense against the loss of the purchasing power of fiat currencies. Considering that central banks are looking to impose their own digital currencies, gold proves again that it is an essential asset in a portfolio where investors try to escape the collapse of money as we know it.

“The problem in 2024 is that soft landings are rare, that monetary contraction and rate hikes will show their true impact with the typical lag of twelve to fourteen months since the last hike, and that the federal government’s fiscal policy will continue to drive deficits and debt higher, which means consuming more newly created units of currency and debasing our salaries and savings. If the threat of central bank digital currencies is confirmed, gold will prove again its quality as a reserve of value and means of payment, but it is also likely to show that it is one of the few assets that protects investors in a recession.”

Indeed, fiat currencies are being destroyed because of reckless money-printing by governments and this is the reason to own gold.

Ascent of central bank digital currencies bodes well for gold

You don’t purchase gold to take advantage of short-term price fluctuations in the market, you buy it because it will always gain in value compared to paper money.

Over time, gold is a store of value because it is not subject to the inflationary pressures fiat currencies are. Since 1913, when the Federal Reserve was created, the US dollar has lost 96% of its value.

The extraordinary value of gold versus dollars is easily grasped by conducting a little thought experiment. Let’s say you were 18 years old in 1971, and just beginning your working life. In five years time you make some smart investments and manage to bank $100,000. At age 23 you have a decision to make: Is it better to plug that money into a retirement savings plan, or buy $100,000 worth of gold, which in 1976 is trading at $125/oz? You decide to buy gold.

Historical spot gold price. Source: Goldprice.org

Historical spot gold price. Source: Goldprice.org

Fast forward 47 years. You are now 70 years old and ready to retire. In 2023, gold is worth $2,000 an ounce — 16 times what you bought it for in 1976! The gold bars and coins just sat there in a safe, not earning interest. The 800 ounces you bought at $125/oz ($100,000) are now worth $1.6 million. This retirement nest egg would easily see you through to the ripe old age of 85, and that’s by withdrawing $106,000 a year. Live more modestly, and you could live to 100. Or leave a bunch of money to your kids, grandchildren, or charity.

Remember, this is in addition to whatever you managed to save, perhaps in addition to a company or government worker pension. We aren’t even counting what you’d receive from government pension plans.

Compare this to what would have happened if you’d have just stuck to a regular pension plan. You might get to live on $1,500-$2,000 a month, plus some extra savings if you were fiscally prudent and lucky.

There are multiple reasons to trade gold — US dollar movements, geopolitical tensions, ETF outflows, central bank buying, negative real rates, etc., but only one reason to own it: maintaining your purchasing power against dollar (or other currency) losses incurred by inflation.

We can only guess what the Federal Reserve is going to do next year. We hope the Fed gets it right and we have a soft landing, but we don’t know for sure. What we do know is that all currencies are weak, they’re not “real money”, and that every portfolio should have a proportion of physical gold.