The gold miners’ stocks are enjoying a strong summer, recently surging to new bull highs. These upleg gains should continue mounting with gold’s autumn rally providing stiff tailwinds. Outsized Asian demand usually fuels seasonal gold gains into late September. Already large thanks to gold’s unique bullish backdrop, this year’s autumn rally has excellent potential to keep growing. Gold stocks will leverage its upside.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behaviors driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Gold stocks display strong seasonality because their price action amplifies that of their dominant primary driver, gold. Gold’s seasonality generally isn’t driven by supply fluctuations like grown commodities see, as its mined supply remains relatively steady year-round. Instead gold’s major seasonality is demand-driven, with global investment demand varying considerably depending on the time in the calendar year.

This gold seasonality is fueled by well-known income-cycle and cultural drivers of outsized gold demand from around the world. Starting in late summers, Asian farmers begin to reap their harvests. As they figure out how much surplus income was generated from all their hard work during the growing season, they wisely plow some of their savings into gold. Asian harvest is followed by India’s famous wedding season.

Indians believe getting married during their autumn festivals is auspicious, increasing the likelihood of long, successful, happy, and even lucky marriages. And Indian parents outfit their brides with beautiful and intricate 22-karat gold jewelry, which they buy in vast quantities. That’s not only for adornment on their wedding days, but these dowries secure brides’ financial independence within their husbands’ families.

So during its bull-market years, gold has tended to enjoy sizable-to-strong autumn rallies driven by these sequential episodes of outsized demand. Naturally the gold stocks follow gold higher, amplifying its gains due to their profits leverage to the gold price. Today gold stocks are once again back at their most-bullish seasonal juncture, the transition between the typically-drifting summer doldrums and big autumn rallies.

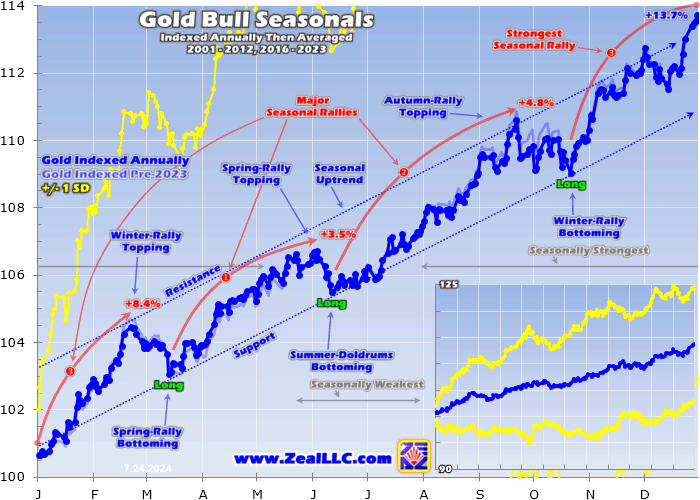

Since it is gold’s own demand-driven seasonality that fuels gold stocks’ seasonality, that’s logically the best place to start to understand what’s likely coming. This old research thread focuses on modern bull-market seasonality, as bull and bear price action are quite different. Gold enjoyed an epic 638.2% bull run from April 2001 to August 2011, fueling gold stocks skyrocketing 1,664.4% per their leading HUI index then!

Following that secular juggernaut, gold consolidated high before starting correcting into 2012. But the yellow metal didn’t enter formal bear territory down 20%+ until April 2013. That beast mauled gold on and off over several years, so 2013 to 2015 are excluded from these seasonal averages. Gold finally regained bull status powering 20%+ higher in March 2016, then its modest gains grew to 96.2% by August 2020.

Another high consolidation emerged after that, where gold avoided relapsing into a new bear despite a serious correction. Later the yellow metal started powering higher again, coming within 0.5% of a new nominal record in early March 2022 after Russia invaded Ukraine. So 2016 to 2021 definitely proved bull years too, with 2022 really looking like one early on. Then Fed officials panicked, unleashing market chaos.

Inflation was raging out of control thanks to their extreme money printing. In just 25.5 months following March 2020’s pandemic-lockdown stock panic, the Fed ballooned its balance sheet an absurd 115.6%! That effectively more than doubled the US monetary base in just a couple years, injecting $4,807b of new dollars to start chasing and bidding up the prices on goods and services. That fueled an inflation super-spike.

With big inflation running rampant, Fed officials frantically executed the most-extreme tightening cycle in this central bank’s history. They hiked their federal-funds rate an astounding 450 basis points in just 10.6 months, while also selling monetized bonds through quantitative tightening! That ignited a huge parabolic US-dollar spike, unleashing massive gold-futures selling slamming gold 20.9% lower into late September 2022.

That was technically a new bear market, albeit barely and driven by an extraordinary anomaly that was unsustainable. Indeed gold soon rebounded sharply, exiting 2022 with a trivial 0.3% full-year loss. Gold kept on powering higher, reentering bull territory up 20.2% in early February 2023! So I’m also classifying 2022 as a bull year for seasonality research. Gold’s modern bull years include 2001 to 2012 and 2016 to 2023.

Prevailing gold prices varied radically across these secular spans, running just $257 when gold’s epic 2000s bull was born to July 2024’s latest record high of $2,465. That vast range of gold levels spread over all those long years has to first be rendered in like-percentage terms in order to make them perfectly comparable with each other. Then they can be averaged together to distill out gold’s bull-market seasonality.

That’s accomplished by individually indexing each calendar year’s gold price action to its final close of the preceding year, which is recast at 100. Then all gold price action of the following year is calculated off that common indexed baseline, normalizing all years. So gold trading at 110 simply means it has rallied 10% off the prior year’s close. Gold’s previous seasonality before 2023 was added is shown in light blue.

If investors understood gold’s phenomenal performance in recent decades, it would be far more popular with allocations included in every portfolio. Through 20 of these last 23 years, gold has enjoyed fantastic average calendar-year gains of 13.7%! And the great majority of that came before the Fed recklessly more than doubled the US money supply. With inflation raging since, everyone should have 5% to 10% in gold.

Seasonally gold enjoys three distinct rallies occurring in autumn, winter, and spring. Their average gains from 2001 to 2012 and 2016 to 2023 clocked in at 4.8%, 8.4%, and 3.5%. These autumn rallies tended to start marching higher in mid-June, after gold’s summer-doldrums bottoming. Then they typically powered higher on balance until hitting the upper resistance of gold’s seasonal uptrend around late September.

2024’s autumn rally was born about a week ahead of schedule. On June 7th gold suffered a brutal 3.6% plunge to $2,286, its worst daily loss in fully 3.6 years! That was driven by China’s central bank breaking an 18-month streak of reporting monthly gold buying, and monthly US jobs printing at a four-standard-deviation upside surprise which was Fed-hawkish. Summer-doldrums selling was pulled forward and condensed.

Gold was down 1.8% month-to-date at that nadir, more than double its usual 0.7% mid-June loss. But as I explained in my first essay after that Jobs-Friday plunge, gold was still consolidating high. Since blasting to extremely-overbought levels in mid-April, gold had largely drifted between $2,300 to $2,400. Instead of correcting, gold merely pulled back on continuing buying from Chinese investors and central banks.

Despite that serious down day, gold had only fallen 5.7% from mid-May’s latest nominal record high. That was well shy of the 10%+ correction threshold. And gold would soon recover strongly from that forced summer-doldrums low. It bounced 1.6% into the end of June, exiting that month with a little 0.2% loss. That was right in line with June’s -0.1% seasonal average, despite gold’s considerable intra-month volatility.

While gold’s autumn rallies are usually birthed in mid-June, they really accelerate in July with nice 1.0% average gains. But this year’s performance is trouncing that, with gold rallying 3.2% month-to-date as of midweek! That exceptionally-strong mid-summer run included surging to $2,465, gold’s first new record since mid-May. The main driver was gold-futures speculators awakening from a summer-doldrums slumber.

Their overall positioning on both the long and short sides is published weekly in Commitments of Traders reports. For six CoT weeks from late May to early July, they sat on their hands. Their average CoT-week buying in gold-equivalent terms was just 3.2 metric tons, virtually nothing. But during the next two CoT weeks into mid-July, they rushed back in with a vengeance unleashing major buying of 49.2t and 89.2t!

Like usual I’ve been analyzing all that weekly gold-futures action and its implications for gold in depth in our popular subscription newsletters. There’s certainly a chance that frenzied buying pulled forward a big chunk of 2024’s autumn rally. If that’s the case, gold could continue consolidating high on balance mostly within recent months’ $2,300-to-$2,400 range. But this is also a great setup for these big seasonal gains to grow.

In seasonal-average terms, gold’s autumn rally tends to accelerate as it matures! Gold’s average returns in June, July, August, and September until cresting have run -0.1%, +1.0%, +1.6%, and +1.6%. Seasonal buying from Asian harvests and Indian wedding season really picks up in August and most of September. So despite its big summer-2024 gains so far, gold is heading into some of its stronger months of the year.

Where gold goes from here depends on who is buying and how aggressively. Normally speculators’ gold-futures trading and American stock investors’ gold-ETF-share buying dominate gold price trends. But the former have largely exhausted their likely capital firepower for buying after early July’s frenzy. And being heavily entranced by that long-in-the-tooth AI stock bubble, American stock investors have totally ignored gold.

But that could change fast, with either this bubble decisively bursting or gold rallying high enough for long enough to command investors’ attention. Interestingly both are underway. The flagship S&P 500 stock has fallen 4.2% over the past week or so, and the dominant gold ETFs are starting to see holdings builds revealing capital inflows. If American stock investors finally start returning, gold’s autumn rally will grow huge.

But even if they tarry, much of gold’s remarkable breakout to new nominal records since early March was fueled by atypical buyers. Chinese investors and central banks have taken control, doing big consistent buying that has driven gold much higher! While comprehensive gold fundamental data detailing that is only reported quarterly by the World Gold Council, there haven’t been any indications that buying has ceased.

So gold’s 2024 autumn rally has excellent potential to continue growing even after such hefty early gains. Some combination of gold-futures speculators, American stock investors, Chinese investors, and central banks buying could easily drive gold much higher. Buying tends to beget buying in markets, as traders love chasing winners. Gold’s 3.0% summer-to-date gains now rank as its sixth-best between 2001 to 2024!

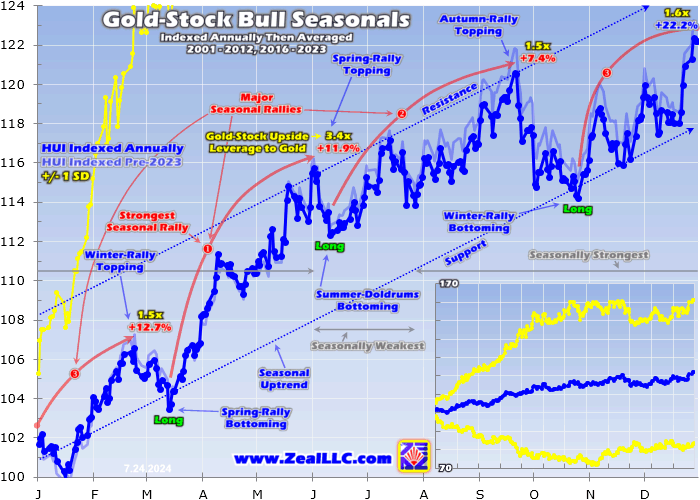

That’s very bullish for gold stocks, as their leading GDX ETF tends to amplify material gold moves by 2x to 3x. But only birthed in May 2006, GDX is too young for this long-term seasonal analysis. So instead the classic HUI gold-stock index is used, which is functionally interchangeable with GDX containing the same major gold miners. Gold stocks’ already-outsized autumn-rally gains are set to grow larger as gold runs.

Major gold stocks have averaged outstanding 22.2% gains during 20 of these last 23 years! With a great track record like that, it blows my mind that this high-potential contrarian sector isn’t more widely followed by traders. Everyone who likes multiplying their wealth should keep an eye on gold stocks and maintain some reasonable portfolio allocation like 15% to 20%. Gold stocks are ultimately leveraged plays on gold.

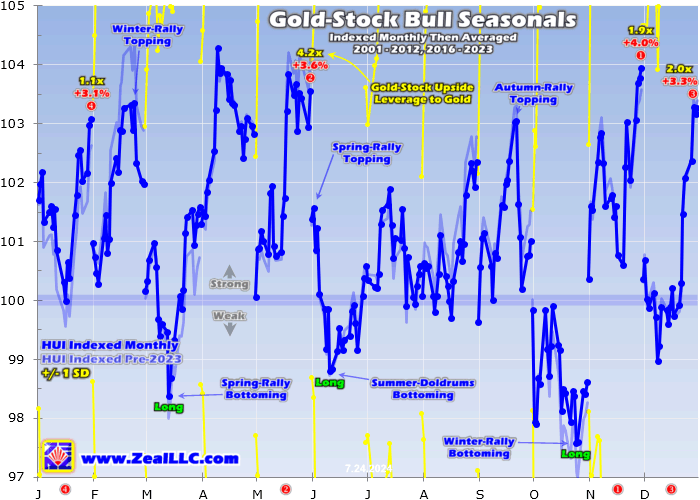

So following and amplifying their metal, they too have enjoyed three distinct autumn, winter, and spring seasonal rallies. Their average gains during those spans ran 7.4%, 12.7%, and 11.9%, leveraging gold’s seasonal rallies by 1.5x, 1.5x, and 3.4x. Traditionally gold stocks’ autumn rally has proven their weakest, but this year is shaping up much differently. This sector’s summer-doldrums low is also carved in mid-June.

That came right on schedule in 2024, but four trading days after gold’s Jobs-Friday plunge. GDX fell to $33.15 on close, down 6.1% summer-to-date. That was much worse than their 1.2% MTD average loss in early June, really hammering sentiment! But as I analyzed in an essay then, gold stocks were reloading. I warned “this may prove the last chance to buy relatively low for awhile” with gold’s autumn rally nearing.

While this sector ground sideways into early July, gold stocks resumed surging with their metal on that big gold-futures buying. By mid-July GDX had soared 15.8% MTD, amplifying gold’s parallel rally by 2.6x! This leading gold-miner ETF decisively broke out to a major new bull-market high of $39.28, GDX’s best level in 2.2 years. Gold stocks were enjoying their fourth-best summer performance from 2001 to 2024!

And as long as gold’s autumn rally continues powering higher on balance, gold stocks’ outsized gains ought to keep mounting. Like their metal, gold stocks’ autumn rally accelerates as it matures. The longer and higher GDX surges, the more traders rush to chase its gains. In June, July, August, and September MTD into the autumn-rally topping, the HUI averaged increasing 0.4%, 0.6%, 2.3%, and 3.0% gains!

Summer 2024 so far has proven volatile, with GDX falling 3.9% in June before soaring 9.7% MTD in July! The major gold stocks are already up 5.4% this summer with its best couple months still coming. This last chart uses a similar methodology to slice gold-stock seasonals into calendar months. This reveals how strong August and September are compared to June and July, which is a bullish omen for this sector.

Gold stocks’ autumn-rally upside potential depends on how the metal that drives their profits fares. And gold’s near-term outlook remains quite bullish, mainly since American stock investors still haven’t started chasing this upleg yet. From early October to mid-July, gold soared a mighty 35.5% higher! This is its first upleg achieving new record-high streaks since a pair both peaking in 2020, which are really important.

They fuel a powerful self-feeding record-momentum dynamic. The higher gold rallies, the more traders want to buy in. The more they buy, the higher gold rallies. When that forges into nominal-record territory like in this current upleg, financial-media coverage increases. New records drive more-frequent and more-bullish reporting on gold, which builds awareness attracting in more speculators and investors to chase it.

Astoundingly during today’s gold upleg, American stock investors have been net sellers. During its exact span, the combined holdings of the world-dominant GLD and IAU gold ETFs actually fell 4.5% or 57.2t! It is wildly unprecedented in this modern gold-ETF era for any gold upleg to grow massive without American stock investors driving it. This time around Chinese investors and central banks usurped that primary role.

But American stock investors are still likely to return, especially as that distracting AI stock bubble bursts. Gold’s last two monster uplegs achieving new-record streaks peaked at 42.7% and 40.0% gains in 2020. Huge American-stock-investor demand fueled them, with GLD+IAU holdings soaring 30.4% or 314.2t in the first and skyrocketing 35.3% or 460.5t in the second! Today’s upleg could go from -50t to +400t or more.

While still anomalously low, differential GLD+IAU-share buying is picking up. Their combined holdings have climbed 1.3% or 15.6t MTD in July, their strongest build in this upleg. So American stock investors are nibbling, and could easily start migrating back in a bigger way in August and September. In addition to further gold rallying likely, gold stocks have their own bullish factors supporting a bigger autumn rally.

First the gold miners are likely to soon report their fattest quarterly profits on record in the next several weeks! I wrote a whole essay in late June with the underlying analysis, which was published when GDX was still under $34. Mainly thanks to record-shattering gold prices, gold miners’ huge earnings growth will surprise most fund investors. That should motivate plenty to start allocating more capital to gold stocks.

Second gold stocks remain undervalued relative to gold, and likely to not only keep mean reverting but overshoot. My essay last week explored this. Gold stocks suffered an extreme valuation anomaly back in late February, hitting stock-panic lows. After such extremes, prices tend to not only return to averages but overshoot proportionally in the opposite direction! This dynamic portends much-higher gold-stock prices.

While seasonals are interesting, they are peripheral drivers acting like tailwinds or headwinds for gold and its miners’ stocks. Their trends are mostly driven by sentiment, technicals, and fundamentals. But when seasonals align with these primary drivers, trends are strengthened. While seasonals alone can’t be relied upon, they can definitely bolster existing bullish conditions. That’s the case in 2024’s autumn rally.

While long ignored, gold stocks have generated fortunes for contrarian traders. Our newsletter trading books are currently full of great fundamentally-superior smaller mid-tiers and juniors, which outperform majors substantially. Midweek our unrealized gains in today’s upleg are already as high as +87.0%! In Zeal’s quarter-century history, all 1,510 newsletter stock trades realized averaged +15.6% annualized gains.

Successful trading demands always staying informed on markets, to understand opportunities as they arise. We can help! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

Our holistic integrated contrarian approach has proven very successful, and you can reap the benefits for only $10 an issue. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential.

The bottom line is gold and its miners’ stocks are enjoying much-stronger autumn rallies than normal this year. Big gold-futures buying already propelled gold to a new record high in July, and seasonal strength tends to accelerate in August and September. With American stock investors still ignoring gold’s mighty upleg, it has excellent potential to continue growing in coming months as they inevitably start chasing gold.

Meanwhile the Chinese investors and central banks who fueled gold’s big upleg gains are likely to keep buying. And with the gold miners about to report amazing record quarterly results, their stocks remain undervalued relative to gold. They are mean reverting and will likely proportionally overshoot to the high side. Add seasonal-autumn-rally tailwinds into this mix, and gold and gold stocks ought to keep powering higher.

Adam Hamilton, CPA