The gold miners’ stocks have rocketed higher this summer, smashing out of their usual summer-doldrums sideways grind. That atypical strength has been driven by gold steadily marching to major new secular highs, fueled by strong investment demand. This has carried gold stocks and the metal they mine back to their traditional strong season, which begins with robust autumn rallies usually accelerating in late summers.

Seasonality is the tendency for prices to exhibit recurring patterns at certain times during the calendar year. While seasonality doesn’t drive price action, it quantifies annually-repeating behavior driven by sentiment, technicals, and fundamentals. We humans are creatures of habit and herd, which naturally colors our trading decisions. The calendar year’s passage affects the timing and intensity of buying and selling.

Gold stocks exhibit strong seasonality because their price action mirrors that of their dominant primary driver, gold. Gold’s seasonality generally isn’t driven by supply fluctuations like grown commodities see, as its mined supply remains relatively steady year-round. Instead gold’s major seasonality is demand-driven, with global investment demand varying considerably depending on the time in the calendar year.

This gold seasonality is fueled by well-known income-cycle and cultural drivers of outsized gold demand from around the world. Starting in late summers, Asian farmers begin to reap their harvests. As they figure out how much surplus income was generated from all their hard work during the growing season, they wisely plow some of their savings into gold. Asian harvest is followed by India’s famous wedding season.

Indians believe getting married during their autumn festivals is auspicious, increasing the likelihood of long, successful, happy, and even lucky marriages. And Indian parents outfit their brides with beautiful and intricate 22-karat gold jewelry, which they buy in vast quantities. That’s not only for adornment on their wedding days, but these dowries secure brides’ financial independence within their husbands’ families.

So during its bull-market years, gold has usually tended to enjoy major autumn rallies driven by these sequential episodes of outsized demand. Naturally the gold stocks follow gold higher, amplifying its gains due to their profits leverage to the gold price. Today gold stocks are once again back at their most-bullish seasonal juncture, the transition between the typically-drifting summer doldrums and big autumn rallies.

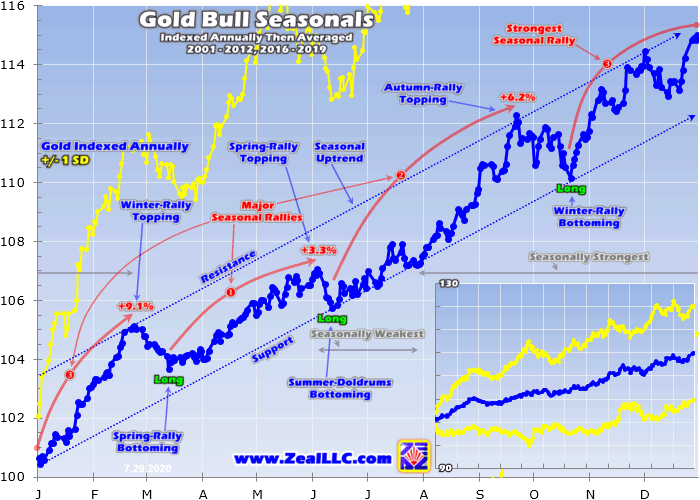

Since it is gold’s own demand-driven seasonality that fuels gold stocks’ seasonality, that’s logically the best place to start to understand what’s likely coming. Price action is very different between bull and bear years, and gold remains in a middle-aged bull market. After falling to a 6.1-year secular low in mid-December 2015 as the Fed kicked off its last rate-hike cycle, gold powered 29.9% higher over the next 6.7 months.

Crossing the +20% threshold in March 2016 confirmed a new bull market was underway. Gold corrected after that sharp initial upleg, but normal healthy selling was greatly exacerbated after Trump’s surprise election win. Investors fled gold to chase the taxphoria stock-market surge. Gold’s correction cascaded to serious proportions, hitting -17.3% in mid-December 2016. But that remained shy of a new bear’s -20%.

Gold rebounded sharply from those anomalous severe-correction lows, nearly fully recovering by early September 2017. But gold failed to break out to new bull-market highs, then and several times after. That left gold’s bull increasingly doubted, until June 2019. Then gold surged to a major decisive breakout confirming its bull remained alive and well! Its total gains grew to 87.3% over 4.6 years by late July 2020, still modest.

Gold’s last mighty bull market ran from April 2001 to August 2011, where it soared 638.2% higher! And while gold consolidated high in 2012, that was technically a bull year too since gold just slid 18.8% at worst from its bull-market peak. Gold didn’t enter formal bear-market territory until April 2013, thanks to the crazy stock-market levitation driven by extreme distortions from the Fed’s QE3 bond monetizations.

So the bull-market years for gold in modern history ran from 2001 to 2012, skipped the intervening bear-market years of 2013 to 2015, then resumed in 2016 to 2020. Thus these are the years most relevant to understanding gold’s typical seasonal performance throughout the calendar year. We’re interested in bull-market seasonality, because gold remains in its latest bull today and bear-market action is quite dissimilar.

Prevailing gold prices varied radically throughout these modern bull-market years, running between $257 when gold’s last secular bull was born to this week’s newest record high of $1969. All those long years with that great range of gold levels have to first be rendered in like-percentage terms in order to make them perfectly comparable. Only then can they be averaged together to distill out gold’s bull-market seasonality.

That’s accomplished by individually indexing each calendar year’s gold price action to its final close of the preceding year, which is recast at 100. Then all gold price action of the following year is calculated off that common indexed baseline, normalizing all years regardless of price levels. So gold trading at an indexed level of 105 simply means it has rallied 5% from the prior year’s close, while 95 shows it’s down 5%.

This chart averages the individually-indexed full-year gold performances in those bull-market years from 2001 to 2012 and 2016 to 2019. 2020 isn’t included yet since it remains a work in progress. This bull-market-seasonality methodology reveals that late summers are when gold’s long parade of big seasonal rallies really gets underway. That starts with the major autumn rally which is born in gold’s summer doldrums.

During these modern bull-market years, gold has enjoyed a strong and pronounced seasonal uptrend. From that prior-year-final-close 100 baseline, it has powered 15.0% higher on average by year-ends! These are major gains by any standard, especially averaged across 16 different years. While this chart is rendered in familiar calendar-year terms easiest for us to parse, gold’s seasonal years actually start in summers.

Gold tends to see its major summer-doldrums low in mid-June, the best seasonal buying opportunity of the year in precious metals. But then it usually spends the next 6 weeks into late July drifting sideways to modestly higher. On average gold slowly inches up 1.4% over that span, plodding middling gains often too inconsequential to register on investors’ radars. The first 2/3rds of gold’s summers are typically fairly dull.

But strong August action shatters that summer-doldrums malaise as gold’s major autumn rally picks up steam. Starting in late July, Asian-harvest gold buying really accelerates. While gold’s average gain in July between 2001 to 2012 and 2016 to 2019 was just +0.5%, in August that nearly quintuples to +2.3%! Surprisingly given gold’s weak summer reputation, August has proven its third best month seasonally.

Then September weighs in at fourth at 2.1% average gains in these modern bull-market years. And that is despite gold’s autumn rally topping in late September at 6.2% average gains. Of gold’s three major seasonal rallies, this +6.2% autumn one ranks in the middle between the powerful +9.1% winter rally and the comparatively-anemic +3.3% spring rally. Nearly 6/10ths of autumn-rally gains accrue by the end of August.

While getting deployed in precious-metals positions in mid-June ahead of gold’s troika of seasonal rallies is ideal, late July is normally the last chance to buy in relatively low. In typical summer-doldrums years where gold sentiment is apathetic, it takes a resolute contrarian bent to fight seasonal weakness and shift capital into the precious metals before the autumn rally. Gold’s huge counter-seasonal strength this year is unusual.

With their kids out of school, a sizable fraction of global traders take vacation time to enjoy summers. So gold investment demand usually withers in June and July. But that certainly hasn’t happened during this odd pandemic-scarred summer! The best daily proxy for global gold investment demand is the holdings of the dominant American GLD SPDR Gold Shares gold ETF, which I last explored in a mid-June essay.

Contrary to normal summer-doldrums behavior, in June GLD shares experienced such heavy differential buying that this ETF’s physical-gold-bullion holdings ballooned a large 5.0%! Rising GLD holdings show investment capital migrating into gold. GLD’s holdings climbed to major secular highs on 10 of June’s 22 trading days, helping push gold to major secular highs of its own on 5 of those. Investors really wanted gold.

Their outsized counter-seasonal demand hasn’t abated in July either. Month-to-date as of Wednesday, GLD’s holdings have surged an even-bigger 5.4% on GLD-share buying persistently outpacing gold’s own! Did this big summer investment rush pull forward some of gold’s autumn rally, or will demand still grow like usual in August and September pushing gold higher? Gold’s extreme overboughtness complicates this.

With COVID-19 and governments’ heavy-handed responses to it disrupting pretty much everything all over the world, summer 2020 is wildly unprecedented. Investors are flocking to gold via its ETFs led by GLD because of this crazy situation. They saw the stock markets collapse into a brutal panic on the draconian economic lockdowns, then saw central banks conjure up trillions of dollars to reverse that ugly selling.

In just over a month into late March, the flagship benchmark S&P 500 stock index plummeted 33.9% in a rare full-blown stock panic! That’s a 20%+ cratering in 2 weeks or less. Stock panics force investors to remember that market cycles still exist, stock markets rise and fall. Those traumatic events dramatically alter psychology for years after, elevating perceived risks for more serious downside. That’s great for gold.

After the prior stock panic in October 2008, gold soared 166.5% higher over the next 2.8 years. That was fueled by a massive 71.5% or 535.5 metric-ton GLD-holdings build! After suffering stock panics, investors flock back to gold for a long time to prudently diversify their stock-heavy portfolios. So even without this scary pandemic, gold investment demand will likely remain elevated for years in the wake of March’s panic.

Fed officials were terrified the extreme fear from COVID-19, governments’ lockdowns, and the plunging stock markets would spiral into a devastating depression. The US economy is overwhelmingly driven by consumer spending, so when Americans pull in their horns en masse economic contraction cascades into a vicious circle. To attempt to stave this off, the Fed ramped its money printing far beyond stratospheric.

From mid-March to mid-June, the Fed’s balance sheet skyrocketed up 66.3% or $2,857b! In only 3.0 months, it evoked enough new dollars to force their overall supply 2/3rds higher. That is radically unprecedented, as close to hyper-inflation as this 107-year-old central bank has ever dared tread. High inflation, relatively more money chasing relatively less goods and services, drives outsized gold investment.

The Fed’s $2.9t monetary deluge bought a massive 44.5% rebound rally in the S&P 500 by early June. But the elite American companies in this index aren’t earning anywhere near enough profits to justify such lofty Fed-goosed levels. At the end of June, the S&P 500 stocks averaged trailing-twelve-month price-to-earnings ratios of 27.8x. Weighted by market capitalizations, that ran 33.1x! Anything over 28x is a stock bubble.

And that was even before any disastrous Q2 earnings were reported, in the peak-lockdown quarter where economic activity collapsed. Lower profits will force prevailing valuations even higher into dangerous bubble territory. So investors are very justified in fearing more serious stock-market selling. As long as they do, gold investment demand will remain elevated. Stock markets need to reflect this COVID-19 world.

This unusual strong global investment demand should combine with typical strong Indian investment demand in this year’s autumn rally. Indian economic growth had stagnated even before this pandemic, and India’s COVID-19 cases have rocketed to the third-highest in the world despite low per-capita testing. The Indian rupee has fallen to record lows against the US dollar this year too, heightening inflation fears.

Thus rupee gold prices have soared to dazzling record highs! Indians are usually shrewd price-conscious gold buyers. But with COVID-19 spreading fast and more draconian lockdowns likely, moving capital into gold to protect from currency debasement should be a powerful motivator to step up investment demand. Way behind on their typical gold buying this year, stressed-out Indians should be anxious to stack more gold.

So 2020’s autumn gold rally has real potential to keep growing much larger than normal driven by unusually-strong gold investment demand. That is very bullish for gold stocks. The major miners of the leading GDX VanEck Vectors Gold Miners ETF tend to amplify material gold upside by 2x to 3x. And these higher-prevailing gold prices are dramatically boosting their earnings, fundamentally justifying big stock-price gains.

Gold miners won’t finish reporting their Q2 results until mid-August, but they will look awesome excluding COVID-19-lockdown disruptions. Over the past four quarters ending in Q1, the top 25 GDX gold miners reported average all-in-sustaining costs of $904 per ounce. AISCs don’t change much since mining costs are largely fixed regardless of gold levels. In Q2 gold averaged a high $1714, implying big sector profitability.

The major gold miners of GDX could’ve earned $810 per ounce last quarter had lockdowns not briefly shuttered some operations. That would’ve made for astounding 84.5% year-over-year profits growth! Of course higher gold prices mean much-higher earnings in future quarters too. Soaring gold-mining profits are attractive anytime, but irresistible in bubble stock markets plagued by falling general corporate earnings.

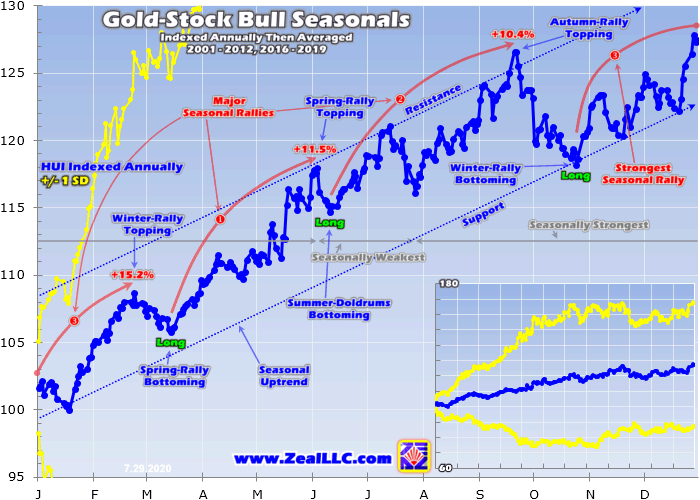

This next chart applies this same modern-gold-bull-year seasonality methodology to gold stocks. Since GDX was just born in May 2006, its price history is insufficient for longer-term studies. Thus the classic HUI gold-stock index is used instead. GDX and the HUI closely track each other, they are functionally interchangeable containing most of the same major gold stocks. Gold gains drive their autumn rally.

The major gold stocks have averaged a 10.4% autumn rally in 2001 to 2012 and 2016 to 2019. Like gold that starts grinding higher in mid-June, stalls to drift back down into late July, then greatly accelerates in August before topping in late September. Gold stocks’ autumn rally kicks off their strong season, which runs until early the following June. This contrarian sector’s overall seasonal uptrend is incredibly strong.

On average across these 16 gold-bull-market years, gold stocks have powered 27.4% higher! That is an extraordinary gain across such a long secular span. While gold stocks aren’t very popular outside of the usual contrarian circles, they certainly should be. With average annual gains at that scale, speculators and investors can double their capital in major gold stocks in less than 3 years! That’s hard to beat anywhere.

Yet out of gold stocks’ three major seasonal rallies that mirror gold’s, the autumn one is the most anemic. It is the smallest on average with those 10.4% HUI gains, compared to 15.2% in the subsequent winter rally and 11.5% in the later spring rally. Those run parallel to gold’s +6.2%, +9.1%, and +3.3% in its own autumn, winter, and spring rallies. Thus gold stocks’ autumn-rally upside leverage to gold has only run about 1.7x.

That’s worse than GDX’s average gold outperformance of 2x to 3x, but in line with the winter rally’s similar upside leverage of 1.7x. Gold stocks amplify gold’s gains the best in their spring rally, which clocks in way up at 3.5x. But their autumn rally is still well worth trading even with relatively-low upside leverage to gold on average. That is skewed low by weak autumn-rally years where gold and gold stocks fall sharply.

But in strong autumn-rally years where elevated gold investment demand pushes the yellow metal higher, gold stocks really amplify its gains. Last year was a great case in point. Between late May to early September 2019, roughly the autumn-rally span, GDX soared 51.6% on a 21.4% gold run! That made for good 2.4x upside leverage. When gold rallies strongly like this summer, gold stocks still really outperform.

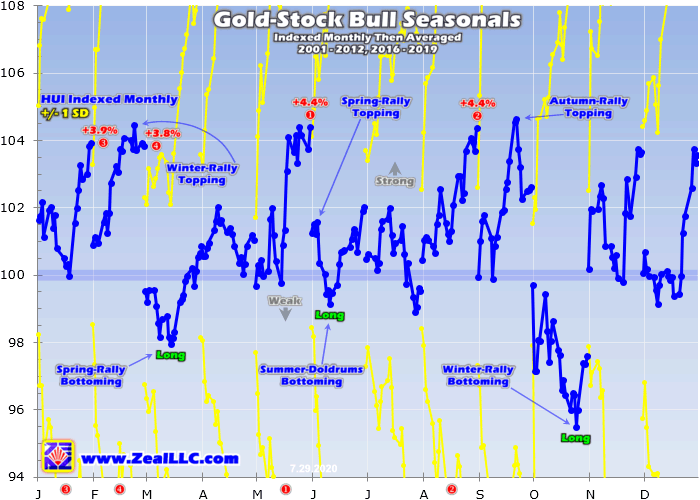

So if gold investment demand remains strong as it ought to this August and September, the gold stocks should see much-bigger autumn-rally gains than usual. August has proven gold stocks’ second-best month of the year seasonally, enjoying excellent average 4.4% gains. September is no slouch either averaging +2.6%. These months combined are major gold stocks’ third-strongest 2-month seasonal span.

That is more apparent in this final chart that slices gold-stock seasonals into calendar months. Each is indexed to 100 at the previous month’s final close, then all like months’ indexes are averaged together. These same modern-gold-bull years of 2001 to 2012 and 2016 to 2019 are included. The next couple months are usually an important time to be fully deployed in gold stocks in order to ride their autumn rally.

Gold-stock seasonals are certainly very favorable in these next couple months. Late summers heading into August before gold’s and gold stocks’ autumn rallies usually take off offer an excellent seasonal buying opportunity. While not quite as good as the earlier summer-doldrums lows, late summers are just before gold stocks transition into their seasonally-strong autumns, winters, and springs. Those enjoy major gains.

That being said, seasonality reveals mere tendencies. The primary drivers of gold and its miners’ stocks are sentiment, technicals, and fundamentals. Seasonality reflects how these average out across calendar years over long spans, but they can easily override seasonals in any given year. But this year’s autumn-rally setup still looks quite bullish because it is so wildly unprecedented. We’ve never seen anything like it.

As long as gold investment demand remains strong pushing this metal higher, the gold stocks will follow it up amplifying its gains. Heading into autumn 2020 it’s hard to imagine investors forsaking gold. We just had a rare stock panic, which galvanizes gold investment demand for years. The frantic Fed did all but hyperinflate to dig stock markets out, blasting the dollar supply 2/3rds higher forcing stocks into bubble territory.

And overlaying that big heap of gold bullishness, we are plagued with a raging pandemic still worsening. Its economic impact from both fear and government actions has been devastating already, and remains far from over. Wall Street’s V-shaped economic recovery is a euphoric fantasy, with a long drawn-out U-shaped one being far more likely. Gold investment demand shouldn’t flag given these extraordinary risks.

But technically gold has blasted vertically to extremely-overbought levels in recent weeks, complicating its autumn-rally outlook. After gold soared too far too fast historically, pullbacks or corrections soon followed. Excessive euphoric gains pull forward too much near-future buying, exhausting gold’s near-term upside potential. Yet with markets so radically unprecedented now, gold may be able to resist that usual reckoning.

At Zeal we started aggressively buying and recommending fundamentally-superior gold and silver miners in our weekly and monthly subscription newsletters back in mid-March right after the stock-panic lows. We layered into many new positions before recent overboughtness, with unrealized gains already growing as big as +234%! Our trading books are full of fundamentally-thriving gold and silver miners that are still running.

To profitably trade high-potential gold stocks, you need to stay informed about the broader market cycles that drive gold. Our newsletters are a great way, easy to read and affordable. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today and take advantage of our 20%-off sale! If overbought gold doesn’t correct, our many winning trades should well outperform GDX in gold stocks’ autumn rally.

The bottom line is gold and gold stocks are entering their strong season, starting with their autumn rally mostly in August and September. That is normally fueled by Asian seasonal gold demand ramping back up. But all this year’s pandemic craziness has also unleashed strong sustained investment buying from around the world. These big capital inflows should make for supercharged gold and gold-stock autumn rallies.

Investors have been flocking to gold and its miners this summer because they are rightfully very worried. No one knows how terrible COVID-19’s economic impact will ultimately prove. And the Fed’s radically-extreme monetary inflation has spawned bubble-valued stock markets. Prudently diversifying portfolios with gold may have never been more important. That trend could fuel one heck of an autumn rally this year.